Genworth 17th Annual Cost of Care Survey: COVID-19 Exacerbates Already Rising Long Term Care Costs; Care Providers Foresee Additional Rate Hikes in 2021

RICHMOND, Va., Dec. 2, 2020 /PRNewswire/ -- Despite the efforts of long term care providers to absorb many of the costs associated with COVID-19 as they put their own lives at risk to care for their clients, long term care costs increased substantially this year, particularly for assisted living facilities and in-home care, according to Genworth's 17th annual Cost of Care Survey.

To explore Cost of Care data by city, state or zip code, find trend charts and access lists of states ranked in order of care costs, visit www.genworth.com/costofcare.

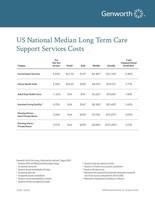

Over the course of a single year, the cost of care increased as follows:

- Assisted living facility rates increased by

6.15% to an annual national median cost of$51,600 per year. - Homemaker services, which includes assistance with "hands-off" tasks such as cooking, cleaning and running errands, has increased

4.44% to an annual median cost of$53,768 1, followed closely by the cost of a home health aide, which includes "hands-on" personal assistance with activities such as bathing, dressing and eating, which has increased4.35% to an annual median cost of$54,912 .2 - The national median cost of a semi-private room in a skilled nursing facility rose to

$93,075 , an increase of3.24% , while the cost of a private room in a nursing home increased3.57% to$105,850 .

Why Rates Are On the Rise

In a supplemental study to better understand why costs are rising, Genworth researchers conducted follow-up online discussions with owners and senior administrators of 79 long term care providers across the country. Participants spoke with pride about the selflessness and resiliency of their staffs as they stepped up to meet the challenge of caring for their clients amid the risks posed by COVID-19, and they outlined the market dynamics that are forcing them to increase the cost of care they are providing under these extraordinary circumstances.

"They told us that the same factors responsible for the continuing increase in long term care costs in recent years – a shortage of workers in the face of increasing demand for care, higher mandated minimum wages, higher recruiting and retention costs, and an increase in the cost of doing business, including regulatory, licensing and employee certification costs -- were made even worse by the pandemic," said Gordon Saunders, senior brand marketing manager at Genworth who manages the Cost of Care Survey.

"Providers have been competing with higher-paying, less-demanding jobs for years, but with COVID-19, they told us it has become much more difficult to recruit and retain care professionals because of factors such as concerns about exposure to COVID-19 and parents needing to stay home with school-age children," Saunders said.

As a result, providers have had to raise wages – in some cases, offering hazard pay of up to 50 percent more for workers caring for COVID-19-sickened clients – and increase spending for training on new safety procedures, testing, purchase of personal protective equipment (PPE) and cleaning supplies, and benefits, such as free child care to attract and retain staff. Although many providers contacted by Genworth said they were trying to absorb these new costs, more than half (62 percent) predicted that they would eventually be forced to raise rates in the next six months with 43 percent saying those increases would top five percent or more.

Bright Spots For Home Care

In subsequent, separate conversations with CEOs of two national home care companies, the executives acknowledged that while COVID-19 has created serious challenges for the industry, the pandemic has also produced a few bright spots, namely, the recognition that home care is an equally valued part of the healthcare delivery system, and the acceleration of technology that has made their services better and safer.

"The pandemic has shined a bright spotlight on the value of home care," said Jeff Huber, CEO of Home Instead Senior Care, based in Omaha. "We can increase the capacity of the healthcare delivery system. The hospital of the future looks a lot like your living room. As a part of a value-based care package, we can reduce costs, admissions, readmissions, and overall usage of the healthcare system. And, we can keep clients safer and improve the quality of life for the whole family by keeping sons and daughters in the workforce while we care for their parents."

He said the pandemic has also accelerated adoption of technology that allows his company to onboard and train new caregivers and continue to train them remotely. Home Instead Senior Care also is bringing digital capabilities into the home that connect care professionals with their clients and families, which effectively extends the care team and enables the company to quickly attend to any issues that arise in the home.

Seth Sternberg, CEO of Honor, one of the largest owned and operated home care companies in the U.S., has seen average hours of home care increase from 35 to 45 hours per week among his clients during the pandemic, driven by more acute needs, fear of contracting COVID-19 in a communal care setting, and everyday tasks becoming riskier than they used to, such as shopping for groceries.

He said his company has invested in new infection prevention protocols, as well as technology that allows it to quickly backfill care professionals who may not be able to come to work, mitigating the challenges of reduced availability of care professionals. Honor has built out additional COVID-19 response programs, including investment in PPE, training and additional paid time off for caregivers.

"The COVID-19 pandemic has underscored the need for technology to help enhance safety and reliability in home care," he said. "This year we added new protocols into our technology platform specifically to meet those needs. Some of the additional features include pre- and post-visit wellness checks, replacement staffing tools and contact tracing. These enhancements added significant upfront costs, but they are worth doing because they have enabled more older adults to live independently at home – and will keep people safer well beyond the end of the pandemic."

Genworth's Cost of Care Planning Resources

"COVID-19 has also underscored the need to plan ahead for long term care, considering both where we want to receive care as well as how we will pay for it," Saunders said. "Our purpose as a company is to help people prepare for the challenges of growing older so that they can continue to live their lives on their own terms. We provide our annual Cost of Care Survey and award-winning interactive website to arm individuals and their families with the education and tools that can empower them to make those important plans, well before they need it."

In addition to the Cost of Care calculator, Genworth's website contains long term care planning tools, practical information on topics such as understanding Medicare and Medicaid, conversation starters, impairment simulations, options for financing long term care, and videos of real families sharing their long term care stories.

- To access 17-year Cost of Care trend charts, click here.

- To access tables ranking states from the highest to lowest cost in each care category, click here.

About Genworth's 17th Annual Cost of Care Survey

Genworth's annual Cost of Care Survey, one of the most comprehensive studies of its kind, contacted nearly 60,000 long term care providers nationwide to complete almost 15,000 surveys for nursing homes, assisted living facilities, adult day health facilities and home care providers during July and August, 2020. The survey includes 435 regions based on the Metropolitan Statistical Areas, defined by the Office of Management and Budget. CareScout®, part of the Genworth Financial family of companies, has conducted the survey since 2004. Located in Waltham, Massachusetts, CareScout has specialized in helping families find long term care providers nationwide since 1997.

About Genworth Financial

Genworth Financial, Inc. (NYSE: GNW) is a Fortune 500 insurance holding company committed to helping families achieve the dream of homeownership and address the financial challenges of aging through its leadership positions in mortgage insurance and long term care insurance. Headquartered in Richmond, Virginia, Genworth traces its roots back to 1871 and became a public company in 2004. For more information, visit genworth.com.

From time to time, Genworth releases important information via postings on its corporate website. Accordingly, investors and other interested parties are encouraged to enroll to receive automatic email alerts and Really Simple Syndication (RSS) feeds regarding new postings. Enrollment information is found under the "Investors" section of genworth.com. From time to time, Genworth's publicly traded subsidiary, Genworth Mortgage Insurance Australia Limited, separately releases financial and other information about their operations. This information can be found at http://www.genworth.com.au.

______________________________

1 Based on 44 hours per week for 52 weeks

2 Based on 44 hours per week for 52 weeks

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/genworth-17th-annual-cost-of-care-survey--covid-19-exacerbates-already-rising-long-term-care-costs-care-providers-foresee-additional-rate-hikes-in-2021-301183279.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/genworth-17th-annual-cost-of-care-survey--covid-19-exacerbates-already-rising-long-term-care-costs-care-providers-foresee-additional-rate-hikes-in-2021-301183279.html

SOURCE Genworth Financial, Inc.