Genius Group Adopts Bitcoin Treasury Reserve Strategy

Genius Group (NYSE American: GNS) has announced a new 'Bitcoin-first' strategy, committing to hold 90% or more of its reserves in Bitcoin. The company plans to utilize its $150 million ATM facility to acquire an initial $120 million in Bitcoin as its primary treasury reserve asset. The strategy includes launching a Web3 Wealth Renaissance education series and enabling Bitcoin payments on their Edtech platform. The company reports $23 million in audited annual revenue for 2023 and total assets of $43 million, while currently facing a market capitalization of $12 million. Genius Group has pending litigation against alleged market manipulators, with estimated damages over $250 million.

Genius Group (NYSE American: GNS) ha annunciato una nuova strategia 'Bitcoin-first', impegnandosi a detenere il 90% o più delle sue riserve in Bitcoin. L'azienda prevede di utilizzare il suo sportello automatico da 150 milioni di dollari per acquisire inizialmente 120 milioni di dollari in Bitcoin come principale asset di riserva. La strategia include il lancio di una serie di educazione Web3 Wealth Renaissance e la possibilità di effettuare pagamenti in Bitcoin sulla loro piattaforma Edtech. L'azienda riporta un fatturato annuale verificato di 23 milioni di dollari per il 2023 e attivi totali di 43 milioni di dollari, mentre attualmente affronta una capitalizzazione di mercato di 12 milioni di dollari. Genius Group ha contenziosi in corso contro presunti manipolatori di mercato, con danni stimati superiori a 250 milioni di dollari.

Genius Group (NYSE American: GNS) ha anunciado una nueva estrategia 'Bitcoin-first', comprometiéndose a mantener el 90% o más de sus reservas en Bitcoin. La empresa planea utilizar su instalación de cajeros automáticos de 150 millones de dólares para adquirir inicialmente 120 millones de dólares en Bitcoin como su principal activo de reserva. La estrategia incluye el lanzamiento de una serie de educación Web3 Wealth Renaissance y la habilitación de pagos en Bitcoin en su plataforma Edtech. La empresa reporta 23 millones de dólares en ingresos auditados anuales para 2023 y un total de activos de 43 millones de dólares, mientras que actualmente enfrenta una capitalización de mercado de 12 millones de dólares. Genius Group tiene litigios pendientes contra supuestos manipuladores del mercado, con daños estimados en más de 250 millones de dólares.

지니어스 그룹 (NYSE American: GNS)는 '비트코인 우선' 전략을 발표하며, 90% 이상의 자산을 비트코인으로 보유하기로 약속했습니다. 이 회사는 1억 5천만 달러 규모의 ATM 시설을 활용하여 비트코인으로 초기 1억 2천만 달러를 확보할 계획입니다. 이 전략에는 Web3 자산 르네상스 교육 시리즈를 시작하고 Edtech 플랫폼에서 비트코인 결제를 활성화하는 내용이 포함되어 있습니다. 이 회사는 2023년에 감사된 연간 수입이 2천 3백만 달러이고, 총 자산이 4천 3백만 달러라고 보고하며, 현재 시장 시가총액은 1천 2백만 달러입니다. 지니어스 그룹은 주장되는 시장 조작자들에 대해 pending litigation을 진행 중이며, 피해액은 2억 5천만 달러 이상으로 추산되고 있습니다.

Genius Group (NYSE American: GNS) a annoncé une nouvelle stratégie 'Bitcoin-first', s'engageant à détenir 90 % ou plus de ses réserves en Bitcoin. L'entreprise prévoit d'utiliser sa facilité de distributeurs automatiques de 150 millions de dollars pour acquérir initialement 120 millions de dollars en Bitcoin comme actif de réserve principal. La stratégie comprend le lancement d'une série de formation Web3 Wealth Renaissance et la possibilité d'effectuer des paiements en Bitcoin sur leur plateforme Edtech. L'entreprise rapporte 23 millions de dollars de revenus annuels audités pour 2023 et des actifs totaux de 43 millions de dollars, tout en faisant face à une capitalisation boursière actuelle de 12 millions de dollars. Genius Group a des litiges en cours contre des manipulateurs de marché présumés, avec des dommages estimés à plus de 250 millions de dollars.

Genius Group (NYSE American: GNS) hat eine neue 'Bitcoin-first'-Strategie angekündigt, die vorsieht, 90 % oder mehr seiner Reserven in Bitcoin zu halten. Das Unternehmen plant, seine 150 Millionen Dollar umfassende Geldautomateneinrichtung zu nutzen, um zunächst 120 Millionen Dollar in Bitcoin als primäres Reservevermögen zu erwerben. Die Strategie umfasst die Einführung einer Bildungsreihe zur Web3 Wealth Renaissance und die Ermöglichung von Bitcoin-Zahlungen auf ihrer Edtech-Plattform. Das Unternehmen meldet für 2023 einen geprüften Jahresumsatz von 23 Millionen Dollar und eine Gesamtaktiva von 43 Millionen Dollar, während es derzeit mit einer Marktkapitalisierung von 12 Millionen Dollar konfrontiert ist. Genius Group hat anhängige Klagen gegen angebliche Marktmanipulatoren, wobei die geschätzten Schäden über 250 Millionen Dollar betragen.

- Plans to acquire $120 million in Bitcoin using existing ATM facility

- Reported $23 million in annual revenue for 2023

- Total assets of $43 million

- Strategic expansion into blockchain technology and cryptocurrency education

- 0% capital gains tax advantage due to Singapore incorporation

- Current market capitalization of only $12 million, significantly below reported assets

- Share price dropped to under $0.60

- Ongoing legal battle against market manipulators

Insights

The adoption of a Bitcoin-first treasury strategy by Genius Group represents a significant shift in corporate treasury management. With plans to allocate

This strategic pivot goes beyond mere Bitcoin investment, incorporating blockchain technology into their core business model. The integration of Bitcoin payments into their Edtech platform and the launch of Web3 education series indicates a comprehensive approach to blockchain adoption. However, the timing of this announcement, coupled with their ongoing market manipulation litigation and depressed stock price, suggests this could be a tactical move to regain market confidence. The addition of blockchain experts to the board adds credibility, but the

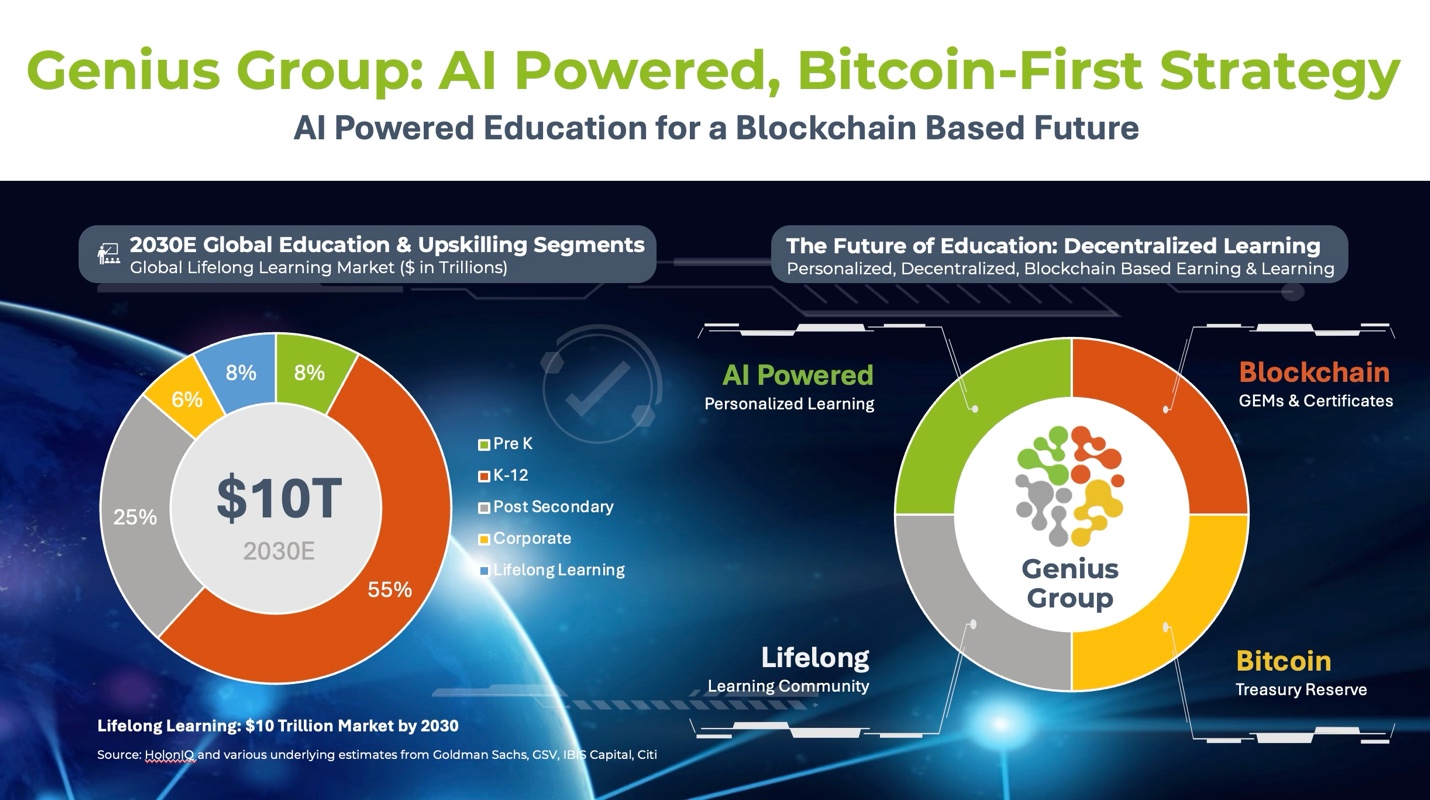

SINGAPORE, Nov. 12, 2024 (GLOBE NEWSWIRE) -- Genius Group Limited (NYSE American: GNS) (“Genius Group” or the “Company”), a leading AI-powered education and acceleration group, today announced that its Board has adopted a global “Bitcoin-first” strategy with Bitcoin to be the primary treasury reserve asset. The Board’s adoption of this new policy follows the recent restructuring of its Board to include experts in Blockchain and Web3 technologies.

The Company’s Board of Directors have approved the following Bitcoin-first strategy:

- To commit

90% or more of our current and future reserves to be held in Bitcoin - Commence utilizing our

$150 million ATM1to acquire an initial target of$120 million in Bitcoin, to be held for the long term as its primary treasury reserve asset - Launch our Web3 Wealth Renaissance education series for students to accelerate their understanding of Bitcoin, Cryptocurrency and Blockchain with Genius Group’s AI-powered guides.

- Enable Bitcoin payments globally on the Company’s Edtech platform.

Thomas Power, Genius Group Director and previously Board Director at Team Blockchain and the Blockchain Industry Compliance and Regulation Association (BICRA), said “Genius Group is focused on educating students for the exponential technologies of the future. We see Bitcoin as being the primary store of value that will power these exponential technologies. The compelling case that we believe Michael Saylor and Microstrategy have made for public companies to invest in Bitcoin as their primary treasury reserve asset is one that we fully endorse.”

“We believe with our Bitcoin-first strategy, we will be among the first NYSE American listed companies to fully embrace Microstrategy’s Bitcoin strategy, for the benefit of our shareholders.”

Ian Putter, Genius Group Director and previously Head of Blockchain Domain at Standard Bank and founder of the Blockchain Research Institute Africa, a think tank that collaborated with research institutes across the globe to identify blockchain use-cases relevant to Africa, said “Genius Group has an approved

Roger Hamilton, Genius Group’s CEO, said “Genius Group has been in a two-year public battle against market manipulators, in which it has seen its share price drop to under

“The Company has pending litigation against alleged market manipulators, led by Wes Christian, with alleged damages estimated at over

“We believe a new type of future-focused, AI-driven, blockchain-based public listed companies can bridge the divide for investors between the current, centralized and regulated world of NYSE, NASDAQ and other stock markets with the future promise of decentralized, exponential economies. Genius Group’s unique position of already educating for the future gives us an opportunity to bring a layer of added value through education, where we prepare the next generation for a world in which how they earn and learn are dramatically different.”

Genius Group will be holding a GeniusLIVE podcast featuring Roger Hamilton, Thomas Power and Ian Putter which will go into detail on Genius Group’s AI-powered, Bitcoin-first plan at 9am ET on Tuesday, 19 November 2024. To register, visit https://www.geniusgroup.ai/

About Genius Group

Genius Group (NYSE: GNS) is a leading provider of AI powered, digital-first education and acceleration solutions for the future of work. Genius Group serves 5.4 million users in over 100 countries through its Genius City model and online digital marketplace of AI training, AI tools and AI talent. It provides personalized, entrepreneurial AI pathways combining human talent with AI skills and AI solutions at the individual, enterprise and government level. To learn more, please visit www.geniusgroup.net.

For more information, please visit https://www.geniusgroup.net/

Forward-Looking Statements

Statements made in this press release include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the use of words such as “may,” “will”, “plan,” “should,” “expect,” “anticipate,” “estimate,” “continue,” or comparable terminology. Such forward-looking statements are inherently subject to certain risks, trends and uncertainties, many of which the Company cannot predict with accuracy and some of which the Company might not even anticipate and involve factors that may cause actual results to differ materially from those projected or suggested. Readers are cautioned not to place undue reliance on these forward-looking statements and are advised to consider the factors listed above together with the additional factors under the heading “Risk Factors” in the Company's Annual Reports on Form 20-F, as may be supplemented or amended by the Company's Reports of a Foreign Private Issuer on Form 6-K. The Company assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events, new information or otherwise. No information in this press release should be construed as any indication whatsoever of the Company’s future revenues, results of operations, or stock price.

Contacts

MZ Group - MZ North America

(949) 259-4987

GNS@mzgroup.us

www.mzgroup.us

1 Availability under the Form F-3 “shelf” is subject to limitations under Instruction 1.B.6. of Form F-3 until the Company reaches a market capitalization of