Genco Shipping & Trading Highlights Strong Results and 19th Consecutive Quarterly Dividend in Letter to Shareholders

Genco Shipping & Trading has mailed a letter to shareholders emphasizing the importance of voting for their nominees at the upcoming 2024 Annual Meeting. The company reported strong quarterly results, including a $0.42 per share dividend, marking the 19th consecutive quarterly dividend. Genco has reduced its debt by 62% since 2021 and is actively renewing its fleet. Despite a proxy battle initiated by George Economou, Genco's board, supported by ISS, recommends shareholders vote against Economou’s nominee and proposal. The board argues that Economou's suggestions do not enhance long-term shareholder value.

- Authorized a $0.42 per share dividend for Q1 2024, marking the 19th consecutive quarterly dividend.

- Returned $5.575 per share in total dividends since 2021, nearly 25% of the stock price.

- Reduced debt by 62% since 2021.

- Continued renewing the fleet by selling three older Capesize vessels.

- Ranked #1 in the annual Webber Research ESG Scorecard for three consecutive years.

- Potential increase in net debt and cash flow breakeven rate if share buyback or tender offer suggestions are implemented.

- Proxy fight initiated by George Economou, who has sold over half his Genco shares since April.

- Board concluded Economou's nominee, Robert Pons, would not add value due to lack of relevant experience.

Successfully Executing on its Comprehensive Value Strategy

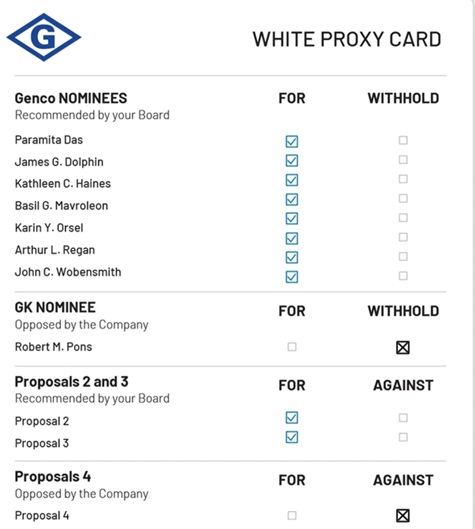

Reminds Shareholders to Vote “FOR” Genco’s Nominees on the WHITE Proxy Card

NEW YORK, May 14, 2024 (GLOBE NEWSWIRE) -- Genco Shipping & Trading Limited (NYSE: GNK) (“Genco” or the “Company”), the largest U.S. headquartered drybulk shipowner focused on the global transportation of commodities, today mailed a letter to shareholders in connection with the Company’s 2024 Annual Meeting of Shareholders (the “Annual Meeting”), scheduled to be held on May 23, 2024. Shareholders of record as of March 28, 2024 will be entitled to vote at the meeting. The letter and information about how to vote at the meeting is available at www.VoteForGenco.com.

The full text of the letter follows:

Dear Genco shareholders,

The Annual Meeting is approaching quickly, and we need your vote “FOR” the re-election of each of Genco’s nominees to help realize the upside potential of your Genco investment.

Vote FOR Genco’s Comprehensive Value Strategy

Our Board and management team are successfully executing on our clear strategy in which Genco is capturing opportunities today and positioning the business to generate growth and shareholder returns through drybulk market cycles. Our recent quarterly earnings results reflect the progress we are making:

- Compelling dividends: Our Board authorized a

$0.42 per share dividend for the first quarter of 2024, a quarter-over-quarter increase and the 19th consecutive quarterly dividend payment the Company has made. Since 2021, we have returned$5.57 5 per share in total or nearly25% of our stock price.1 - Reducing debt: We further reduced our debt during the quarter and have lowered our debt by

62% since 2021. We are continuing to reduce our cash flow breakeven rate to the lowest in our U.S.-listed drybulk peer group.2 - Investing in growth and fleet renewal: We continued taking steps to renew the fleet, closing on the sales of three older Capesize vessels scheduled for special surveys in 2024.

As we execute our strategic initiatives, we are committed to maintaining our industry-leading corporate governance practices which have us ranked #1 in the annual Webber Research ESG Scorecard three years in a row.3 Genco’s directors are also highly qualified, active and engaged business leaders, all of whom we believe bring the right balance of skills and experience in areas relevant to our business.

You can learn more about our Comprehensive Value Strategy and our Board of Directors at www.VoteForGenco.com.

The Choice Between the Genco Board and George Economou and his Nominee is Clear

George Economou is continuing his proxy fight against Genco and has nominated Robert Pons as a director candidate for our Board. Nonetheless, Economou has reported selling over half his Genco shares since the beginning of April.4

Consistent with our commitment to strong corporate governance, our Board and management team have engaged with Economou over the last several months. With the assistance of its advisors, our Board thoroughly reviewed his suggestions for the Company of a share buyback or a tender offer. Our Board concluded these suggestions are not in the best interest of Genco or our shareholders. Our Board considered that detailed analyses did not establish that the suggestions would enhance long-term share price performance, implementing these suggestions could materially hinder our value proposition by increasing our net debt and cashflow breakeven rate while reducing market capitalization and liquidity, and purchasing new vessels instead could create more long-term value and optionality.

Our Board also reviewed Pons and firmly believes he would not be additive to our already strong, focused and experienced Board. Following an interview of Pons, the Board concluded he has no experience in shipping, commodities, cyclical businesses or other industries relevant to Genco’s business.

But don’t just take it from us. We encourage you to follow the recommendation of leading independent proxy advisory firm Institutional Shareholder Services (“ISS”) which has recommended that Genco shareholders vote “FOR” Genco’s director nominees, “WITHHOLD” on George Economou’s nominee, Robert Pons, and “AGAINST” his shareholder proposal.

In its report ISS highlighted the Company’s progress to deliver value for all Genco shareholders and shared that:5

- “The dissident has since provided limited disclosure regarding his effort to unseat the company's chairman. As the dissident has failed to articulate a compelling case for change, shareholders are recommended to WITHHOLD votes for dissident nominee Robert Pons.”

- “Economou filed an amended Schedule 13D on May 2, which seems to reflect an increasing selling of shares since late April.”

You can read more about Economou and Pons and why our Board strongly recommends Genco shareholders vote WITHHOLD on Pons on the WHITE proxy card at www.VoteForGenco.com.

Your Vote Matters: Vote Today FOR Genco’s Nominees

“A vote FOR the management director nominees is warranted.” – ISS Report, May 8, 2024

Every vote counts, regardless of how many shares you own. We encourage Genco shareholders to vote “FOR” the re-election of Genco’s nominees and against Economou's nominee by voting “WITHHOLD” on Pons and “AGAINST” Economou’s shareholder proposal on the WHITE proxy card.

We appreciate the support of ALL Genco shareholders, as we continue to take concrete steps to deliver on our Comprehensive Value Strategy to drive long-term sustainable value.

Sincerely, on behalf of the entire Board and management team,

| James G. Dolphin Chairman of the Board | John C. Wobensmith Chief Executive Officer |

Vote Today

By Phone / Online / By Signing and Returning your Proxy

Learn more at www.VoteForGenco.com

| If you have any questions or require any assistance with voting your shares, please call or email Genco’s proxy solicitor: MacKenzie Partners, Inc. Toll Free: 800-322-2885 Email: proxy@mackenziepartners.com |

About Genco Shipping & Trading Limited

Genco Shipping & Trading Limited is a U.S. based drybulk ship owning company focused on the seaborne transportation of commodities globally. We provide a full-service logistics solution to our customers utilizing our in-house commercial operating platform, as we transport key cargoes such as iron ore, grain, steel products, bauxite, cement, nickel ore among other commodities along worldwide shipping routes. Our wholly owned high quality, modern fleet of dry cargo vessels consists of the larger Capesize (major bulk) and the medium-sized Ultramax and Supramax vessels (minor bulk) enabling us to carry a wide range of cargoes. We make capital expenditures from time to time in connection with vessel acquisitions. As of May 14, 2024, Genco Shipping & Trading Limited’s fleet consists of 16 Capesize, 15 Ultramax and 12 Supramax vessels with an aggregate capacity of approximately 4,490,000 dwt and an average age of 11.8 years.

"Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995

This release contains certain forward-looking statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements use words such as “expect,” “intend,” “plan,” “believe,” and other words and terms of similar meaning in connection with a discussion of potential future events, circumstances or future operating or financial performance. These forward-looking statements are based on management’s current expectations and observations. For a discussion of factors that could cause results to differ, please see the Company's filings with the Securities and Exchange Commission, including, without limitation, the Company’s Annual Report on form 10-K for the year ended December 31, 2023, and the Company's reports on Form 10-Q and Form 8-K subsequently filed with the SEC. We do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Additional Information and Where to Find It

On April 16, 2024, Genco filed with the SEC a definitive proxy statement on Schedule 14A (the “Definitive Proxy Statement”), containing a form of WHITE proxy card, with respect to its solicitation of proxies for Genco’s 2024 Annual Meeting of Shareholders. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED BY GENCO AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT ANY SOLICITATION. Investors and security holders may obtain copies of these documents and other documents filed with the SEC by Genco free of charge through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by Genco are also available free of charge by accessing Genco’s website at www.gencoshipping.com.

Participants

Genco, its directors and certain of its executive officers will be participants in the solicitation of proxies from shareholders in respect of the 2024 Annual Meeting of Shareholders, including John C. Wobensmith (Chief Executive Officer and President), Peter Allen (Chief Financial Officer), Joseph Adamo (Chief Accounting Officer), Jesper Christensen (Chief Commercial Officer), and Genco’s directors other than Mr. Wobensmith, namely James G. Dolphin, Paramita Das, Kathleen C. Haines, Basil G. Mavroleon, Karin Y. Orsel, and Arthur L. Regan. Investors and security holders may obtain more detailed information regarding the Company’s directors and executive officers, including a description of their direct or indirect interests, by security holdings or otherwise, under the captions “Management,” “Executive Compensation,” and “Security Ownership of Certain Beneficial Owners and Management” in Genco’s Definitive Proxy Statement. To the extent holdings of such participants in Genco’s securities changed since the amounts described in the Definitive Proxy Statement, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC. These documents are available free of charge as described above.

MEDIA/INVESTOR CONTACT:

Peter Allen

Chief Financial Officer

Genco Shipping & Trading Limited

(646) 443-8550

Aaron Palash / Carleigh Roesler / Jenna Shinderman

Joele Frank, Wilkinson Brimmer Katcher

(212) 355-4449

1 Genco share price as of May 13, 2024.

2 See https://assets.website-files.com/66194b028d2943b401e9ea9f/663ba9007d5fffa5879f52c2_Analysis%20Information.pdf for a list of these U.S.-listed drybulk companies.

3 Based on the Webber Research 2023, 2022 and 2021 ESG scorecard.

4 See Amendment No. 3 to Economou’s Schedule 13D at https://www.sec.gov/Archives/edgar/data/1326200/000110465924056575/tm2413438d1_sc13da.htm and Exhibit 99.2 to such filing at https://www.sec.gov/Archives/edgar/data/1326200/000110465924056575/tm2413438d1_ex99-2.htm. Such filing indicates that after the March 28, 2024 record date for our 2024 Annual Meeting of Shareholders, Economou sold 697,432 common shares. In a notice provided to Genco pursuant to its by-laws on May 13, 2024, he disclosed selling an additional 525,503 common shares. The total such shares sold represent over

5 Permission to use quotes neither sought nor received.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/65d98cdf-838c-4c89-9fc7-3b33ff72afa3