Guardian Metal Resources PLC Announces Option to Acquire Tempiute Tungsten Project Signed

Guardian Metal Resources (GMTLF) has signed a Definitive Exploration Lease and Option to Purchase Agreement with Hinkinite Resources for the Tempiute Tungsten Project in Nevada, located 240 km north of Las Vegas. The agreement includes:

- Initial payment of US$50,000 and 150,000 ordinary shares to Hinkinite

- Recurring US$25,000 payments every six months until option exercise

- Requirement to establish a mineral resource within 3 years

- Bonus payment of US$100,000 per 3,100 tons of WO3 metal (up to US$2M)

- 1.5% NSR royalty upon option exercise, with 50% buyback option for US$1M

The former producing tungsten mine comes with existing infrastructure and lies within patented mining claims. The company plans a site visit in February to commence groundwork shortly after, aligning with U.S. efforts to reshore critical metals production.

Guardian Metal Resources (GMTLF) ha firmato un Contratto Definitivo di Esplorazione e Opzione di Acquisto con Hinkinite Resources per il Progetto Tungsteno Tempiute in Nevada, situato a 240 km a nord di Las Vegas. L'accordo include:

- Pagamento iniziale di 50.000 USD e 150.000 azioni ordinarie a Hinkinite

- Pagamenti ricorrenti di 25.000 USD ogni sei mesi fino all'esercizio dell'opzione

- Obbligo di stabilire una risorsa minerale entro 3 anni

- Pagamento bonus di 100.000 USD per ogni 3.100 tonnellate di metallo WO3 (fino a 2 milioni di USD)

- Royalty NSR dell'1,5% all'esercizio dell'opzione, con opzione di riacquisto del 50% per 1 milione di USD

La precedente miniera di tungsteno in produzione comprende infrastrutture esistenti ed è situata all'interno di rivendicazioni minerarie patentate. L'azienda prevede una visita al sito a febbraio per avviare i lavori, allineandosi agli sforzi statunitensi per riportare la produzione di metalli critici nel paese.

Guardian Metal Resources (GMTLF) ha firmado un Contrato Definitivo de Arrendamiento de Exploración y Opción de Compra con Hinkinite Resources para el Proyecto de Tungsteno Tempiute en Nevada, ubicado a 240 km al norte de Las Vegas. El acuerdo incluye:

- Pago inicial de 50.000 USD y 150.000 acciones ordinarias a Hinkinite

- Pagos recurrentes de 25.000 USD cada seis meses hasta el ejercicio de la opción

- Requisito de establecer un recurso mineral dentro de 3 años

- Pago adicional de 100.000 USD por cada 3.100 toneladas de metal WO3 (hasta 2 millones de USD)

- Regalía NSR del 1,5% al ejercer la opción, con opción de recompra del 50% por 1 millón de USD

La antigua mina de tungsteno en producción cuenta con infraestructura existente y se encuentra dentro de reivindicaciones mineras patentadas. La compañía planea una visita al sitio en febrero para comenzar los trabajos poco después, alineándose con los esfuerzos de EE. UU. para reubicar la producción de metales críticos.

Guardian Metal Resources (GMTLF)는 네바다주 라스베이거스에서 북쪽으로 240km 떨어진 곳에 위치한 템피우트 텅스텐 프로젝트에 대해 Hinkinite Resources와 최종 탐사 임대 및 구매 옵션 계약을 체결했습니다. 계약 내용은 다음과 같습니다:

- Hinkinite에 대한 초기 지급금 50,000 USD 및 150,000 일반주

- 옵션 행사 전까지 매 6개월마다 25,000 USD 지급

- 3년 이내에 광물 자원을 설정할 의무

- WO3 금속 3,100톤당 100,000 USD의 보너스 지급(최대 200만 USD)

- 옵션 행사 시 1.5% NSR 로열티, 100만 USD에 대한 50% 재매입 옵션

이전 생산된 텅스텐 광산은 기존 인프라를 갖추고 있으며 특허 받은 광산 청구 내에 위치합니다. 회사는 2월에 현장 방문을 계획하여, 이후 신속히 기초 작업을 시작할 예정이며, 이는 미국의 주요 금속 생산을 국내로 유턴하려는 노력에 부합합니다.

Guardian Metal Resources (GMTLF) a signé un Contrat Définitif de Bail d'Exploration et d'Option d'Achat avec Hinkinite Resources pour le Projet de Tungstène Tempiute au Nevada, situé à 240 km au nord de Las Vegas. L'accord comprend :

- Paiement initial de 50 000 USD et 150 000 actions ordinaires à Hinkinite

- Paiements récurrents de 25 000 USD tous les six mois jusqu'à l'exercice de l'option

- Obligation d'établir une ressource minérale dans un délai de 3 ans

- Paiement bonus de 100 000 USD par tranche de 3 100 tonnes de métal WO3 (jusqu'à 2 millions USD)

- Redevance NSR de 1,5 % lors de l'exercice de l'option, avec option de rachat de 50 % pour 1 million USD

L'ancienne mine de tungstène en production possède des infrastructures existantes et se situe dans des revendications minières brevetées. La société prévoit une visite sur site en février pour commencer les travaux peu après, en accord avec les efforts des États-Unis pour relocaliser la production de métaux critiques.

Guardian Metal Resources (GMTLF) hat einen endgültigen Explorationspacht- und Kaufoptionsvertrag mit Hinkinite Resources für das Tempiute Tungsten Project in Nevada unterzeichnet, das 240 km nördlich von Las Vegas liegt. Der Vertrag umfasst:

- Erstauszahlung von 50.000 USD und 150.000 Stammaktien an Hinkinite

- Wiederkehrende Zahlungen von 25.000 USD alle sechs Monate bis zur Ausübung der Option

- Verpflichtung zur Etablierung einer Mineralressource innerhalb von 3 Jahren

- Bonuszahlung von 100.000 USD pro 3.100 Tonnen WO3-Metall (bis zu 2 Millionen USD)

- 1,5% NSR-Royalty bei Ausübung der Option, mit 50% Rückkaufoption für 1 Million USD

Die frühere tungstenproduzierende Mine verfügt über vorhandene Infrastruktur und befindet sich innerhalb patentierter Bergbauansprüche. Das Unternehmen plant einen Standortbesuch im Februar, um kurze Zeit später mit den Arbeiten zu beginnen und sich damit an den Bemühungen der USA zur Rückverlagerung der Produktion kritischer Metalle auszurichten.

- Project includes existing infrastructure and patented mining claims

- Historical production record demonstrates proven tungsten resources

- Strategic alignment with U.S. government initiatives for domestic critical metals

- Flexible payment structure with option to pay up to 50% of bonus in shares

- Required US$50,000 immediate cash payment plus ongoing US$25,000 semi-annual payments

- Mandatory resource establishment within 3 years or agreement termination

- Potential bonus payments up to US$2M upon resource establishment

- 1.5% NSR royalty obligation upon project acquisition

Option to Acquire Former Producing Tempiute Tungsten Project Signed

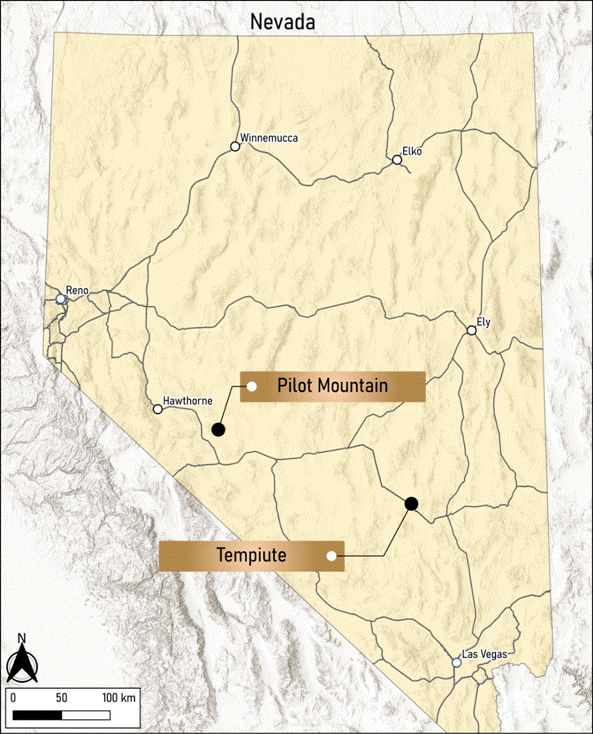

LONDON, UNITED KINGDOM / ACCESS Newswire / January 27, 2025 / Guardian Metal Resources plc (LON:GMET)(OTCQX:GMTLF), a strategic development and mineral exploration company focused in Nevada, USA, is pleased to announce that it has completed the required due diligence and now signed the Definitive Exploration Lease and Option to Purchase Agreement ("Definitive" or the "Agreement") with Hinkinite Resources LLC ("Hinkinite" or the "Optionor") for the Tempiute Tungsten Project ("Tempiute" or the "Project"). Tempiute, also formerly known as the Emerson Tungsten Mine, is located in south-central Nevada less than 240 km north of Las Vegas in Lincoln County.

Highlights:

Signing of the Agreement marks a significant step forward for Guardian Metal in its mission to lead reshoring efforts for critical metals in the U.S., specifically tungsten, aligning with U.S. president Donald Trump's plan of 'Unleashing American Energy'.

Tempiute, a historical tungsten producer as recently as the late 1980s, boasts extensive in-place infrastructure and lies almost entirely within patented (private) mining claims, providing a robust foundation for rapid redevelopment.

The Company's Chairman, CEO, select advisers and members of Guardian Metal's engineering team will be completing a site visit to Tempiute in the second week of February with a goal of immediately aligning on next key steps to advance the Project with groundwork expected to commence shortly thereafter.

Oliver Friesen, CEO of Guardian Metal, commented:

"We are very pleased to have finalised the Agreement allowing for a

"Tempiute has been a domestic U.S. tungsten producer during multiple periods over the last 100 years, and we strongly believe, given the significant tailwinds across the U.S. critical metals space, that it can under Guardian's guidance once again supply U.S. consumers with tungsten that has been mined in America."

Further Details:

Hinkinite is a privately owned and operated Utah-based company focused on the prospecting and development of precious, base-metal and industrial material deposits as well as on revitalising historic mining operations located throughout the western United States.

A Letter of Intent to acquire the Project was signed on 31 October 2024 the details of which are outlined in the below:

Following this, a due diligence update was provided on 18 December 2024 the details of which are outlined in the below:

Commercial Terms:

As the definitive agreement (the "Definitive" or "Definitive Agreement") to acquire the Option has now been signed, a cash payment of US

$50,000 will be made to Hinkinite along with the issue to Hinkinite of 150,000 ordinary shares in Guardian Metal ("Consideration Shares") within the coming days.Until such time as the Option is exercised or the Definitive Agreement is terminated, Guardian Metal will pay Hinkinite a cash payment of US

$25,000 at the end of each six-month period following the date of the Definitive Agreement.In order to exercise the Option, Guardian Metal will be required, (i) within three (3) years of the date of the Definitive Agreement, to establish on the Property a "mineral resource" of tungsten trioxide (WO3) with a minimum cut off grade of

0.4% , prepared in accordance with either the CIM Definition Standards on Mineral Resources and Mineral Reserves adopted by CIM Council, as amended, or the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the "Maiden Resource"), and (ii) within five (5) business days of the announcement of the Maiden Resource to pay Hinkinite a bonus of US$100,000 for each 3,100 tons (WO3 metal) of such Maiden Resource (the "Bonus Payment"), equal to US$1,000,000 for a 31,000 ton (WO3 metal) Maiden Resource, up to a maximum Bonus Payment of US$2,000,000. Guardian Metal may, in its sole discretion, satisfy up to50% of the Bonus Payment by issuing to Hinkinite ordinary shares in Guardian Metal at a deemed price per share equal to the volume weighted average trading price of Guardian Metal's ordinary shares on the London Stock Exchange for the last ten (10) trading days ("10-day VWAP") calculated as of the date of the announcement of the Maiden Resource, converted from pounds sterling to United States dollars using the Bank of England daily spot exchange rate as of the date of the announcement. In the event that Guardian Metal does not establish a Maiden Resource and make the Bonus Payment within three (3) years of the date of the Definitive Agreement, the Definitive Agreement will terminate and Hinkinite will retain a100% interest in the Property.Upon Guardian Metal having established a Maiden Resource and payment of the Bonus Payment, Guardian Metal will be deemed to have acquired a

100% interest in the Project. Hinkinite will retain a limited license to explore for and mine industrial minerals, such as sand, gravel and limestone, on the Property at its own cost and risk, subject to Guardian Metal's prior and superior right to explore for, develop and mine other minerals on the Project.Upon exercise of the Option, Guardian Metal will grant Hinkinite a production royalty equal to

1.5% of the net smelter returns from all mineral production from the Project (the "NSR Royalty"). Guardian Metal may, at any time after the grant of the NSR Royalty, repurchase50% of the NSR Royalty for a one time payment of US$1,000,000 b y Guardian Metal to Hinkinite, payable at the option of Guardian Metal in cash or in Guardian Metal ordinary shares at a deemed price per share equal to the 10-Day VWAP converted from pounds sterling to United States dollars using the Bank of England daily spot exchange rate calculated as of the date that Guardian Metal provides notice to Hinkinite of its election to repurchase. The balance of the NSR Royalty after repurchase will be0.75% of the net smelter returns from all mineral production on the Project.

Media

Application will be made for the 150,000 Consideration Shares to be admitted to trading on AIM which is expected to occur on or around 30 January 2025 ("Admission"). The Consideration Shares will rank pari passu in all respects with the ordinary shares of the Company currently traded on AIM.

Following Admission of the Consideration Shares and of the 931,873 Warrant Shares issued and announced on 24 January 2025, the Company's issued share capital will comprise 126,422,687 ordinary shares of 1p each. This number will represent the total voting rights in the Company and may be used by shareholders as the denominator for the calculation by which they can determine if they are required to notify their interest in, or a change to their interest in, the Company under the Financial Conduct Authority's Disclosure and Transparency Rules.

This announcement contains inside information for the purposes of Article 7 of EU Regulation 596/2014 (which forms part of domestic UK law pursuant to the European Union (Withdrawal) Act 2018). The Directors of the Company are responsible for the contents of this announcement.

Forward Looking Statements

This announcement contains forward-looking statements relating to expected or anticipated future events and anticipated results that are forward-looking in nature and, as a result, are subject to certain risks and uncertainties, such as general economic, market and business conditions, competition for qualified staff, the regulatory process and actions, technical issues, new legislation, uncertainties resulting from potential delays or changes in plans, uncertainties resulting from working in a new political jurisdiction, uncertainties regarding the results of exploration, uncertainties regarding the timing and granting of prospecting rights, uncertainties regarding the timing and granting of regulatory and other third party consents and approvals, uncertainties regarding the Company's or any third party's ability to execute and implement future plans, and the occurrence of unexpected events.

Actual results achieved may vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors.

For further information visit www.Guardianmetalresources.com or contact the following:

Guardian Metal Resources plc Oliver Friesen (CEO) | Tel:+44 (0) 20 7583 8304 |

Cairn Financial Advisers LLP Nominated Adviser Sandy Jamieson/Jo Turner/Louise O'Driscoll | Tel: +44 20 7213 0880 |

Shard Capital Partners LLP Lead Broker Damon Heath/Erik Woolgar | Tel: +44 (0) 20 7186 9000 |

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

SOURCE: Guardian Metal Resources PLC

View the original press release on ACCESS Newswire

FAQ

What are the key terms of GMTLF's Tempiute Tungsten Project acquisition?

Where is the Tempiute Tungsten Project located?

What is the royalty structure for GMTLF's Tempiute project?

When will GMTLF begin work at the Tempiute Tungsten Project?