GoGold Announces New Discovery at Casados in Los Ricos North Including 2,740 g/t AgEq over 1.3m Contained Within 56.5m of 171 g/t AgEq

GoGold Resources has announced significant drilling results from the Casados deposit in its Los Ricos North project, revealing two new mineralized veins. The initial 9 diamond drill holes showed that Casados Vein 1 is mineralized over widths exceeding 20 meters, with some intervals reaching up to 56.5 meters at 171 g/t silver equivalent. The discovery is expected to contribute to a significant Mineral Resource Estimate in 2021. The company plans to continue drilling to further explore these promising finds.

- Discovery of multiple mineralized veins at Casados, significantly wider than historical mining suggests.

- Strong mineralization demonstrated with intervals exceeding 20m and up to 56.5m at an average of 171 g/t AgEq.

- Potential for a significant Mineral Resource Estimate at Los Ricos North in 2021.

- Drilling encountered technical difficulties in hole LRGCS-20-009, affecting results.

Insights

Analyzing...

Shares Outstanding: 265,450,634

Trading Symbols: TSX: GGD

OTCQX: GLGDF

HALIFAX, NS, Feb. 17, 2021 /PRNewswire/ - GoGold Resources Inc. (TSX: GGD) (OTCQX: GLGDF) ("GoGold", "the Company") is pleased to release the results of the initial 9 diamond drill holes from the Casados deposit in the Los Ricos North project. These are the first holes ever drilled in what represents a new discovery at Casados. Although there was limited historical mining that averaged 1.5m in width on one of the veins (Casados – Vein 1), the discovery is that the Casados Vein 1 is strongly mineralized over widths exceeding 20m. There is an additional discovery of a second fully intact vein (Casados – Vein 2) in the footwall that exceeds 20m in width with grades as good or exceeding Vein 1. In some instances, these two veins combine into one with widths up to 56.5m of 171 g/t silver equivalent ("AgEq").

"Casados, like El Orito, is the second major epithermal silver and gold discovery our exploration team has made since we began working on the Los Ricos North property only 8 months ago," said Brad Langille, President and CEO. "These discoveries, along with the resource drilling at El Favor and La Trini, we believe will be paramount to the team defining a significant Mineral Resource Estimate at Los Ricos North in 2021. This additional discovery at Casados continues to strengthen our belief that Los Ricos North is a very large mineralized system."

Next Steps

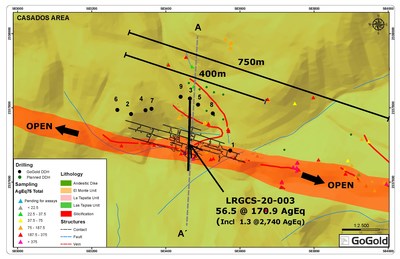

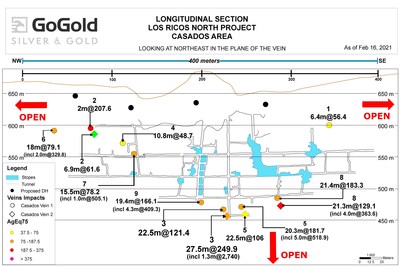

- Up dip drilling to test Vein 1 and Vein 2 to surface (Figures 3 and 4)

- Additional shallow drilling to follow wide zones of silicification and veining mapped along strike to the East (Figure 2)

- Drilling at depth, as other ore shoots in district are known to extend as deep as 850m (Figure 4)

Table 1: Drill Hole Intersections

Hole ID | Area | From | To | Length1 | Au | Ag | AuEq2 | AgEq2 |

(m) | (m) | (m) | (g/t) | (g/t) | (g/t) | (g/t) | ||

LRGCS-20-001 | Casados – Vein 1 | 26.0 | 32.4 | 6.4 | 0.19 | 42.3 | 0.75 | 56.4 |

including | 26.0 | 27.0 | 1.0 | 0.64 | 151.9 | 2.67 | 200.1 | |

LRGCS-20-002 | Casados – Vein 1 | 103.0 | 105.0 | 2.0 | 0.32 | 183.7 | 2.77 | 207.6 |

Casados – Vein 2 | 121.5 | 128.5 | 6.9 | 0.24 | 44.0 | 0.82 | 61.6 | |

including | 121.5 | 123.0 | 1.5 | 0.58 | 111.1 | 2.07 | 154.9 | |

including | 127.8 | 128.5 | 0.6 | 1.12 | 205.5 | 3.86 | 289.8 | |

LRGCS-20-003 | Casados – Multi3 | 133.5 | 191.5 | 56.5 | 0.37 | 143.6 | 2.28 | 170.9 |

Casados – Vein 14 | 133.5 | 157.0 | 22.5 | 0.32 | 97.3 | 1.62 | 121.4 | |

including4 | 138.3 | 144.7 | 4.9 | 1.05 | 307.5 | 5.15 | 386.3 | |

Casados – Vein 2 | 164.0 | 191.5 | 27.5 | 0.48 | 214.1 | 3.33 | 249.9 | |

including | 186.5 | 187.8 | 1.3 | 4.67 | 2,390.4 | 36.54 | 2,740.4 | |

LRGCS-20-004 | Casados – Vein 15 | 100.2 | 114.5 | 10.8 | 0.15 | 37.8 | 0.65 | 48.7 |

including | 109.7 | 112.5 | 2.8 | 0.27 | 91.2 | 1.48 | 111.3 | |

LRGCS-20-005 | Casados – Multi3 | 123.1 | 183.0 | 59.9 | 0.30 | 84.3 | 1.43 | 106.9 |

Casados – Vein 3 | 0.0 | 4.5 | 4.5 | 0.32 | 134.3 | 2.12 | 158.7 | |

including | 2.5 | 4.5 | 2.0 | 0.68 | 284.1 | 4.47 | 335.3 | |

Casados – Vein 1 | 123.1 | 143.4 | 20.3 | 0.51 | 143.2 | 2.42 | 181.7 | |

including | 124.0 | 129.0 | 5.0 | 1.48 | 408.0 | 6.92 | 518.9 | |

Casados – Vein 2 | 160.5 | 183.0 | 22.5 | 0.29 | 84.1 | 1.41 | 106.0 | |

including | 170.8 | 174.0 | 3.2 | 0.97 | 253.5 | 4.35 | 326.6 | |

LRGCS-20-006 | Casados – Vein 1 | 90.0 | 108.0 | 18.0 | 0.17 | 66.3 | 1.05 | 79.1 |

including | 101.0 | 108.0 | 7.0 | 0.30 | 133.0 | 2.08 | 155.7 | |

including | 102.0 | 104.0 | 2.0 | 0.67 | 279.4 | 4.40 | 329.8 | |

LRGCS-20-007 | Casados – Vein 16 | 103.5 | 122.0 | 15.5 | 0.19 | 63.9 | 1.04 | 78.2 |

including | 112.5 | 113.5 | 1.0 | 0.94 | 434.4 | 6.73 | 505.1 | |

LRGCS-20-008 | Casados – Vein 3 | 81.4 | 83.4 | 2.0 | 0.24 | 71.3 | 1.19 | 89.6 |

Casados – Multi3,7 | 99.2 | 155.0 | 53.3 | 0.40 | 98.9 | 1.72 | 129.1 | |

Casados – Vein 17 | 103.5 | 127.4 | 21.4 | 0.63 | 136.1 | 2.44 | 183.3 | |

including | 112.5 | 118.3 | 5.8 | 1.02 | 212.1 | 3.85 | 288.7 | |

Casados – Vein 2 | 133.7 | 155.0 | 21.3 | 0.34 | 103.8 | 1.72 | 129.1 | |

including | 139.0 | 147.2 | 8.2 | 0.68 | 210.8 | 3.49 | 261.5 | |

including | 139.0 | 143.0 | 4.0 | 0.96 | 291.9 | 4.85 | 363.6 | |

LRGCS-20-009 | Casados – Vein 18 | 158.0 | 177.3 | 19.3 | 0.42 | 134.6 | 2.22 | 166.1 |

including | 170.1 | 174.4 | 4.3 | 1.01 | 333.2 | 5.46 | 409.3 |

1. | Not true width | 6. | Excludes 3.0m of historically mined void |

2. | AqEq converted using a silver to gold ratio of 75:1. | 7. | Excludes 2.5m of historically mined void |

3. | Includes multiple veins. | 8. | Drilling did not continue through to Vein 2 in hole |

4. | Excludes 1.5m of historically mined void | LRGCS-20-009 due to technical difficulties. | |

5. | Excludes 3.5m of historically mined void | ||

The Discovery

At the turn of the last century, small scale underground mining followed a rich 1 to 2 metre wide portion of the Casados 1 vein for a distance of approximately 400m along strike and down dip for 160m. Production was limited to several stopes. A longitudinal map of the workings produced in 1921 displays the assay results for 1,679 samples averaging 422 g/t silver and 2.57 g/t gold. No cross-cuts were developed in the old workings so there was no knowledge of the true width of the mineralization in the Casados Vein 1 or the presence of the Casados Vein 2 until discovered by this drilling program. GoGold's drilling has identified the wider with of Casados Vein 1 and the discovery of the wide zone in Casados Vein 2.

The Casados Vein strikes nearly E-W, dips 45o to the north and is hosted in andesitic tuffs and is exposed on surface for about 400 metres along strike. In the 7 metres of old stope that is above the water level at the Casados mine, the vein shows as a zone of quartz stringers about a meter wide, but at other places it is more than 2 metres wide. A zone of silicification up to 50 metres wide envelopes the vein and this resistant outcrop forms a steep ridge along the strike of the vein, particularly on the north or hanging wall side.

Discussion of Drill Hole Results

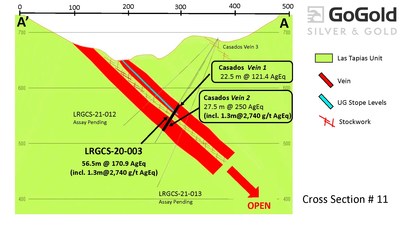

Drill hole LRGCS-20-003 intersected 58.0 metres of quartz veins, veinlets and silicification from 133.5 to 191.5m. The hole passed through a 1.5m wide void related to historical underground workings in the Casados Vein and then discovered a second zone of quartz veins and stringers in the footwall below the workings. The overall zone averages 171 g/t AgEq, consisting of 144 g/t silver and 0.37 g/t gold over 56.5m excluding the 1.5m void.

The hole intersected the Casados Vein 1 from 133.5 to 157.0m and averaged 121 g/t AgEq comprised of 97 g/t silver and 0.32 g/t gold over a core length of 22.5m, excluding a 1.5m historically mined void. The interval also includes 4.9m of 386 g/t AgEq. The second vein, Casados Vein 2, was intersected from 164.0 to 191.5m, for 27.5m of 250 g/t AgEq, consisting of 214 g/t silver and 0.48 g/t gold. This intercept included 1.3m of 2,740 g/t AgEq, which was made up of 2,390 g/t silver and 4.67 g/t gold.

Drill hole LRGCS-20-008 intersected multiple veins from 99.2 to 155.0m for 53.3m of 129 g/t AgEq, consisting of 99 g/t silver and 0.40 g/t gold. The intersect excluded a 2.5m void from historical mining. The first vein, Casados Vein 1, was intersected from 103.5 to 127.4m and averaged 183 g/t AgEq, comprised of 136 g/t silver and 0.63 g/t gold over 21.4m, which included 5.8m of 289 g/t AgEq. Casados Vein 2 was intersected from 133.7 to 155.0m and averaged 289 g/t AgEq, consisting of 104 g/t silver and 0.34 g/t gold over 21.3m. This intercept included 8.2m of 262 g/t AgEq, which was made up of 211 g/t silver and 0.68 g/t gold.

Drill hole LRGCS-20-005 intersected multiple veins from 123.1 to 183.0m for 59.9m of 107 g/t AgEq, consisting of 84 g/t silver and 0.30 g/t gold. Casados Vein 1 intersected 20.3m of 182 g/t AgEq, including 5.0m of 519 g/t AgEq. Casados Vein 2 intersected 22.5m of 106 g/t AgEq, including 3.2m of 327 g/t AgEq. The hole also intersected a third vein, Casados Vein 3, at surface for 4.5m of 159 g/t AgEq.

Drill hole LRGCS-20-009 intersected Casados Vein 1 from 158.0 to 177.3m and averaged 166 g/t AgEq, comprised of 135 g/t silver and 0.42 g/t gold over 19.3m. The intercept included 4.3m of 409 g/t AgEq. The drill encountered technical difficulties and was unable to continue through to Vein 2.

Table 2: Drill Hole Locations

Hole ID | Easting | Northing | Elevation | Azimuth | Dip | Length |

LRGCS-20-001 | 583574 | 2337685 | 668.1 | 207 | -60 | 111.0 |

LRGCS-20-002 | 583306 | 2337783 | 725.4 | 180 | -60 | 183.0 |

LRGCS-20-003 | 583465 | 2337825 | 687.8 | 180 | -60 | 219.0 |

LRGCS-20-004 | 583345 | 2337794 | 714.6 | 180 | -60 | 171.5 |

LRGCS-20-005 | 583487 | 2337809 | 678.9 | 180 | -60 | 214.5 |

LRGCS-20-006 | 583269 | 2337795 | 715.5 | 180 | -60 | 166.5 |

LRGCS-20-007 | 583361 | 2337798 | 710.1 | 180 | -60 | 163.5 |

LRGCS-20-008 | 583527 | 2337785 | 673.0 | 180 | -60 | 168.0 |

LRGCS-20-009 | 583440 | 2337830 | 670.0 | 180 | -60 | 181.5 |

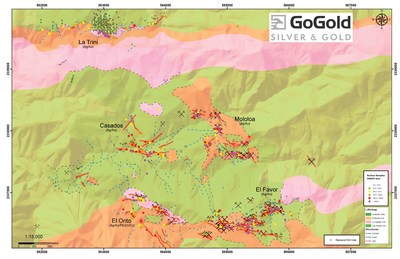

Figure 1: Plan View – La Trini to El Favor Area of Los Ricos North

Figure 2: Plan View – Casados Deposit

Figure 3: Cross Section – Casados Hole LRGCS-20-0003

Figure 4: Long Section – Casados Deposit

VRIFY Slide Deck and 3D Presentation

VRIFY is a platform being used by companies to communicate with investors using 360° virtual tours of remote mining assets, 3D models and interactive presentations. VRIFY can be accessed by website and with the VRIFY iOS and Android apps.

Access the GoGold Company Profile on VRIFY at: https://vrify.com

The VRIFY Slide Deck and 3D Presentation for GoGold can be viewed at: https://vrify.com/explore/decks/9404 and on the Company's website at: www.gogoldresources.com.

Los Ricos District Exploration Projects

The Company's two exploration projects at its Los Ricos property are in Jalisco state, Mexico. The Los Ricos South Project began in March 2019 and includes the 'Main' area, which is focused on drilling around a number of historical mines including El Abra, El Troce, San Juan, and Rascadero, as well as the Cerro Colorado, Las Lamas and East Vein targets. An initial resource on the Los Ricos South project was announced on July 29, 2020 and indicated a Measured & Indicated Mineral Resource of 63.7 million ounces AgEq grading 199 g/t AgEq contained in 10.0 million tonnes, and an Inferred Resource of 19.9 million ounces AgEq grading 190 g/t AgEq contained in 3.3 million tonnes. An initial PEA on the project was announced on January 20, 2021 indicating an NPV

The Los Ricos North Project was launched in March 2020 and includes drilling at the El Favor, La Trini, and El Orito targets. During 2020, GoGold's exploration team identified over 100 targets on the Los Ricos North properties, demonstrating the significant exploration potential. The Company plans to drill 10 of these targets as part of its 2021 drilling program which is planned to exceed 100,000 metres of drilling and will be one of the largest in Mexico.

Procedure, Quality Assurance / Quality Control and Data Verification

The diamond drill core (HQ size) is geologically logged, photographed and marked for sampling. When the sample lengths are determined, the full core is sawn with a diamond blade core saw with one half of the core being bagged and tagged for assay. The remaining half portion is returned to the core trays for storage and/or for metallurgical test work.

The sealed and tagged sample bags are transported to the ActLabs facility in Zacatecas, Mexico. ActLabs crushes the samples and prepares 200-300 gram pulp samples with ninety percent passing Tyler 150 mesh (106μm). The pulps are assayed for gold using a 50-gram charge by fire assay (Code 1A2-50) and over limits greater than 10 grams per tonne are re-assayed using a gravimetric finish (Code 1A3-50). Silver and multi-element analysis is completed using total digestion (Code 1F2 Total Digestion ICP). Over limits greater than 100 grams per tonne silver are re-assayed using a gravimetric finish (Code 8-Ag FA-GRAV Ag).

Quality assurance and quality control ("QA/QC") procedures monitor the chain-of-custody of the samples and includes the systematic insertion and monitoring of appropriate reference materials (certified standards, blanks and duplicates) into the sample strings. The results of the assaying of the QA/QC material included in each batch are tracked to ensure the integrity of the assay data. All results stated in this announcement have passed GoGold's QA/QC protocols.

Mr. David Duncan, P. Geo. is the qualified person as defined by National Instrument 43-101 and is responsible for the technical information of this release.

About GoGold Resources

GoGold Resources (TSX: GGD) is a Canadian-based silver and gold producer focused on operating, developing, exploring and acquiring high quality projects in Mexico. The Company operates the Parral Tailings mine in the state of Chihuahua and has the Los Ricos South and Los Ricos North exploration projects in the state of Jalisco. Headquartered in Halifax, NS, GoGold is building a portfolio of low cost, high margin projects. For more information visit gogoldresources.com.

CAUTIONARY STATEMENT:

The securities described herein have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws, and may not be offered or sold within the United States or to, or for the benefit of, U.S. persons (as defined in Regulation S under the U.S. Securities Act) except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities laws or pursuant to exemptions therefrom. This release does not constitute an offer to sell or a solicitation of an offer to buy of any of GoGold's securities in the United States.

This news release may contain "forward-looking information" as defined in applicable Canadian securities legislation. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding the Los Ricos South and North projects, and future plans and objectives of GoGold, including the intention to undertake further exploration at Los Ricos North, and the prospect of further discoveries there, constitute forward looking information that involve various risks and uncertainties. Forward-looking information is based on a number of factors and assumptions which have been used to develop such information but which may prove to be incorrect, including, but not limited to, assumptions in connection with the continuance of GoGold and its subsidiaries as a going concern, general economic and market conditions, mineral prices, the accuracy of mineral resource estimates, and the performance of the Parral project. There can be no assurance that such information will prove to be accurate and actual results and future events could differ materially from those anticipated in such forward-looking information.

Important factors that could cause actual results to differ materially from GoGold's expectations include exploration and development risks associated with GoGold's projects, the failure to establish estimated mineral resources or mineral reserves, volatility of commodity prices, variations of recovery rates, and global economic conditions. For additional information with respect to risk factors applicable to GoGold, reference should be made to GoGold's continuous disclosure materials filed from time to time with securities regulators, including, but not limited to, GoGold's Annual Information Form. The forward-looking information contained in this release is made as of the date of this release.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/gogold-announces-new-discovery-at-casados-in-los-ricos-north-including-2-740-gt-ageq-over-1-3m-contained-within-56-5m-of-171-gt-ageq-301229540.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/gogold-announces-new-discovery-at-casados-in-los-ricos-north-including-2-740-gt-ageq-over-1-3m-contained-within-56-5m-of-171-gt-ageq-301229540.html

SOURCE GoGold Resources Inc.