Idaho Champion Gold Completes 2021 Exploration Program at Champagne Gold Project

Idaho Champion Gold Mines has successfully completed its 2021 exploration program at the Champagne Gold Project, located in Idaho. The program included 10 diamond core holes totaling 3,432 metres, focused on the St. Louis-Reliance Corridor's induced polarization (IP) anomaly. Additional IP lines were established, extending coverage by 7,800 metres. CEO Jonathan Buick expressed optimism regarding the mineralization encountered, suggesting potential for high-grade mineralization and a deeper porphyry system. Analytical results are anticipated soon, which could enhance the company's growth prospects.

- Completion of 10 diamond core holes totaling 3,432 metres.

- Expansion of IP coverage by an additional 7,800 metres.

- Encouraging mineralization observed indicating potential high-grade veins.

- Possibility of discovering a deeper porphyry copper system.

- None.

TORONTO, ON / ACCESSWIRE / October 25, 2021 / Idaho Champion Gold Mines Canada Inc. (CSE:ITKO; OTCQB:GLDRF; FSE:1QB1) ("Idaho Champion" or the "Company") is pleased to announce the completion of the 2021 exploration program at its

2021 Champagne Exploration Highlights

- Focused on testing the large, induced polarization (IP) anomaly comprising the prospective St. Louis-Reliance Corridor with a series of drill "fences" (Figure 1) (See press release dated September 14, 2021).

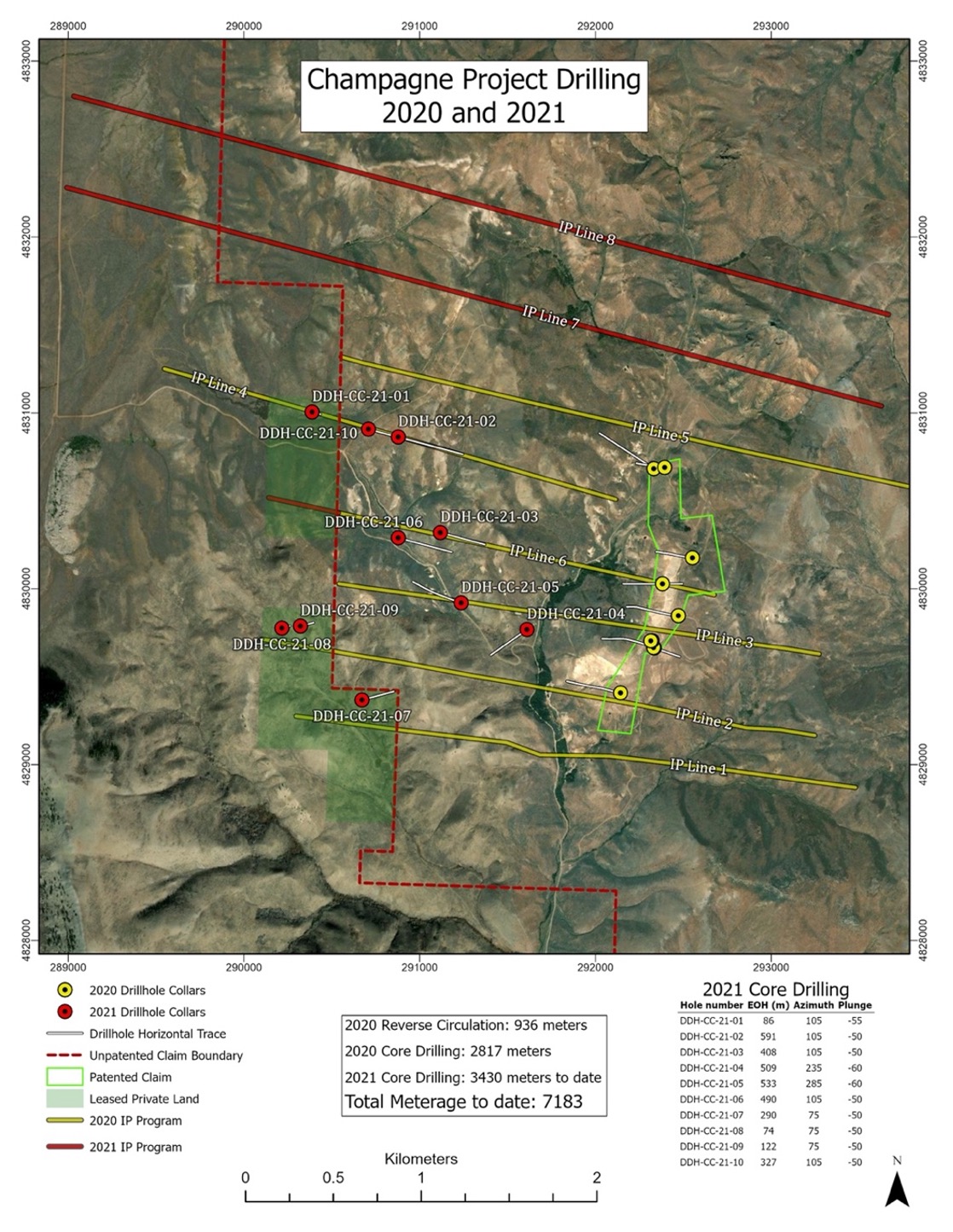

- Completed ten (10) diamond core holes totaling 3,432 metres - located along IP lines -3, -4 and -6.

- Expanded IP coverage by an additional 7,800 line metres in two lines over the northern extent of the St. Louis- Reliance Corridor.

Jonathan Buick, Idaho Champion's CEO, commented, "The large scale of the IP anomaly discovered in 2020 warranted a rigorous drilling test, so we completed several drill fences across the shallower targets reported earlier this year. As we recently announced, the extent of alteration, sulfide mineralization, and veining is encouraging. We encountered disseminated and vein hosted sulfide minerals that indicate depth continuity to the mineral system. We are confident that the results from this drill program will improve our understanding of the zonation within this large geophysical anomaly and mineral system. The potential for both high-grade veins and porphyry style mineralization at Champagne is an excellent foundation for the continued growth of Idaho Champion."

Drilling Program

On July 7, 2021, Idaho Champion commenced a core drilling program designed to test the large IP anomaly identified during the 2020 exploration program northwest of the Mine Hill mineralization (See press release dated February 2, 2021). The program was recently completed, including 3,432 metres in ten (10) holes. Three reconnaissance drill holes are located in the newly defined Western Corridor and are positioned on IP Lines -1 and -2. Seven holes are located within the St. Louis-Reliance Corridor on IP lines -3, -4 and -6 (Figure 1). Core processing (logging and sampling) is almost completed; the final hole, DDH-CC-21-10, is currently being logged and sampled. The Company expects to receive the first of the analytical results in the very near term.

2021 Induced Polarization Program

The Company completed two new IP lines north of the 2020 survey (lines 7 and 8) totaling 7,800 metres (Figure 1). These new lines extend the survey coverage over the St. Louis-Reliance Corridor IP anomaly by an additional 1,000 metres of strike length to the north.

Figure 1: Summary of IP and Drilling at Champagne Project

Target Review and 2021 Exploration Strategy for Champagne

The principal targets at the Champagne Project are the roots to the polymetallic sulfosalt-sulfide vein system and gold-silver vuggy silica/breccia bodies historically exploited at Mine Hill. Geologic mapping at Mine Hill found that the veins could be traced at the surface for distances ranging from 500 to 1,200 metres, totaling approximately four kilometers of cumulative prospective strike length.

Historic mining on the property by Bema Gold in the 1990s focused on gold-silver-bearing vuggy silica breccia bodies and clusters of veins covering an area of approximately 1,200 by 700 metres on Mine Hill. It is the interpretation of the Idaho Champion team based on its chemistry, alteration, and textural features that the Gold Hill mineralization is the upper-most part of a high-sulfidation system related to a porphyry copper intrusion at depth.

Core drilling and IP surveys carried out in 2020 revealed that the vein system and breccia bodies at Mine Hill had been sheared off at shallow depth along a flat-lying detachment fault and displaced a considerable distance in an eastward direction. Hence, the downward extent of the vein system and breccia bodies remains intact and concealed beneath cover rock overlying the detachment fault. The roots of the vein and breccia system may have significant depth extent, including possible bonanza grades so the depth extent of that system a worthwhile target to pursue. The 2020 IP survey defined a large IP anomaly west of Mine Hill and extending for 2,000 metres north-south and having widths up to 1,000 metres. The geophysical anomaly appears to have considerable depth extent (>800 metres).

While the northern and southern portions of the IP anomaly are concealed beneath 150 to 300 metres of cover rock, the central segment, which is approximately 1,200 metres long, is uplifted bringing the IP anomaly close to surface. The Idaho Champion team believes that the characteristics of the central portion of the IP anomaly fit well with the signature expected from the targeted sulfide-rich veins and breccias. A porphyry copper system at depth is an attractive target, but the associated veins and breccias overlying a porphyry system may host very attractive grades of polymetallic mineralization.

Reports from the historic mines in the Mine Hill area indicated bonanza grades for precious and base metals in several of the productive veins, including:

- The central vein cluster at Mine Hill with 2-

3% copper and 12 oz/ton silver; - An outer vein containing

4% lead,7% zinc, 2 to 3 oz/ton silver, and 0.03 oz/ton gold; and - Another vein west of Mine Hill carried ore grades of

8% lead, 5 -10% zinc, and 12 to 18 oz/ton silver with minor gold credits.

The Company cautions that the information from historic reports about past-producing mines at Champagne is not likely to be indicative of mineralization on Idaho Champion's property. The historic data is provided only for context and as an illustration of the prospectivity of the property. There can be no assurance that this type of mineralization still occurs on the proper, and if mineralization does occur, that it will be of sufficient quantity or grade to result in an economic extraction scenario. The Company has not yet conducted sufficient exploration to ascertain if a mineral resource is present on the property.

About the Champagne Project

The Champagne Mine was operated by Bema Gold as a heap leach operation on an epithermal gold-silver system that occurs in volcanic rocks. Bema Gold drilled 72 shallow reverse circulation holes on the project, which complement drilling and trenching from other previous operators. The property has had no deep drilling or significant modern exploration since the mine closure in early 1992.

The Champagne Deposit contains epigenetic style gold and silver mineralization that occurs in strongly altered Tertiary volcanic tuffs and flows of acid to intermediate composition.

Champagne has a near surface cap of gold-silver mineralization emplaced by deep-seated structures that acted as conduits for precious metal rich hydrothermal fluids. Higher grade zones in the Champagne Deposit appear to be related to such feeder zones.

Qualified Person

The technical information in this press release has been reviewed and approved by Peter Karelse P.Geo., a consultant to the Company, who is a Qualified Person as defined by NI 43-101. Mr. Karelse has more than 30 years of experience in exploration and development.

About Idaho Champion Gold Mines Inc.

Idaho Champion is a discovery-focused gold exploration company that is committed to advancing its

ON BEHALF OF THE BOARD

"Jonathan Buick"

Jonathan Buick, President and CEO

For further information, please visit the Company's SEDAR profile at www.sedar.com or the Company's corporate website at www.idahochamp.com.

For further information please contact:

Nicholas Konkin, Marketing and Communications

Phone: (416) 567- 9087

Email: nkonkin@idahochamp.com

THIS PRESS RELEASE DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES IN ANY JURISDICTION, NOR SHALL THERE BE ANY OFFER, SALE, OR SOLICITATION OF SECURITIES IN ANY STATE IN THE UNITED STATES IN WHICH SUCH OFFER, SALE, OR SOLICITATION WOULD BE UNLAWFUL.

Cautionary Statements

Neither the Canadian Securities Exchange nor its regulation services provider has reviewed or accepted responsibility for the adequacy or accuracy of this press release This press release may include forward-looking information within the meaning of Canadian securities legislation, concerning the business of the Company. Forward-looking information is based on certain key expectations and assumptions made by the management of the Company, including suggested strike extension. Although the Company believes that the expectations and assumptions on which such forward-looking information is based on are reasonable, undue reliance should not be placed on the forward-looking information because the Company can give no assurance that they will prove to be correct. Forward-looking statements contained in this press release are made as of the date of this press release. The Company disclaims any intent or obligation to update publicly any forward-looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws.

SOURCE: Idaho Champion Gold Mines Canada Inc.

View source version on accesswire.com:

https://www.accesswire.com/669422/Idaho-Champion-Gold-Completes-2021-Exploration-Program-at-Champagne-Gold-Project

FAQ

What were the results of the 2021 exploration program at the Champagne Gold Project?

What are the expected outcomes from the Champagne Gold Project's recent drilling?

How much additional IP coverage was established during the 2021 exploration?

When can investors expect the results from the Champagne exploration drilling?