Gold Hunter Completes the Consolidation of Large Gold District

Gold Hunter has completed the acquisition of an option to earn a 100% interest in the Great Northern and Viking Projects in Newfoundland and Labrador. This agreement was initially made with Magna Terra on May 28th, 2024, and amended on June 10th, 2024.

To secure the option, Gold Hunter issued 7,042,253 shares at $0.142 per share and made a $300,000 cash payment to Magna Terra. The option expires on June 10th, 2026, with the next payment deadline on June 10th, 2025, requiring $2,750,000 in shares and a $450,000 cash payment.

Additionally, Gold Hunter acquired 195 mineral claims and completed the purchase of Long Range Exploration , issuing 9,000,000 shares and a $50,000 cash payment.

- Completion of option acquisition for Great Northern and Viking Projects.

- Issuance of 7,042,253 shares at $0.142 per share.

- Cash payment of $300,000 to Magna Terra.

- Acquisition of 195 additional mineral claims.

- Purchase of Long Range Exploration

- Issued 9,000,000 shares and $50,000 cash payment for Long Range.

- Future requirement to issue $2,750,000 in shares by June 10, 2025.

- Future requirement to make a $450,000 cash payment by June 10, 2025.

- Outstanding expenses of Long Range require full $50,000 cash payment.

VANCOUVER, BC / ACCESSWIRE / June 11, 2024 / GOLD HUNTER RESOURCES INC. (CSE:HUNT)(OTC PINK:GHREF) (the "Company" or "Gold Hunter"), a Canadian exploration company focused on the acquisition, exploration, and development of precious & base metal projects, is pleased to announce that it has completed the acquisition of an option (the "Option") to earn a

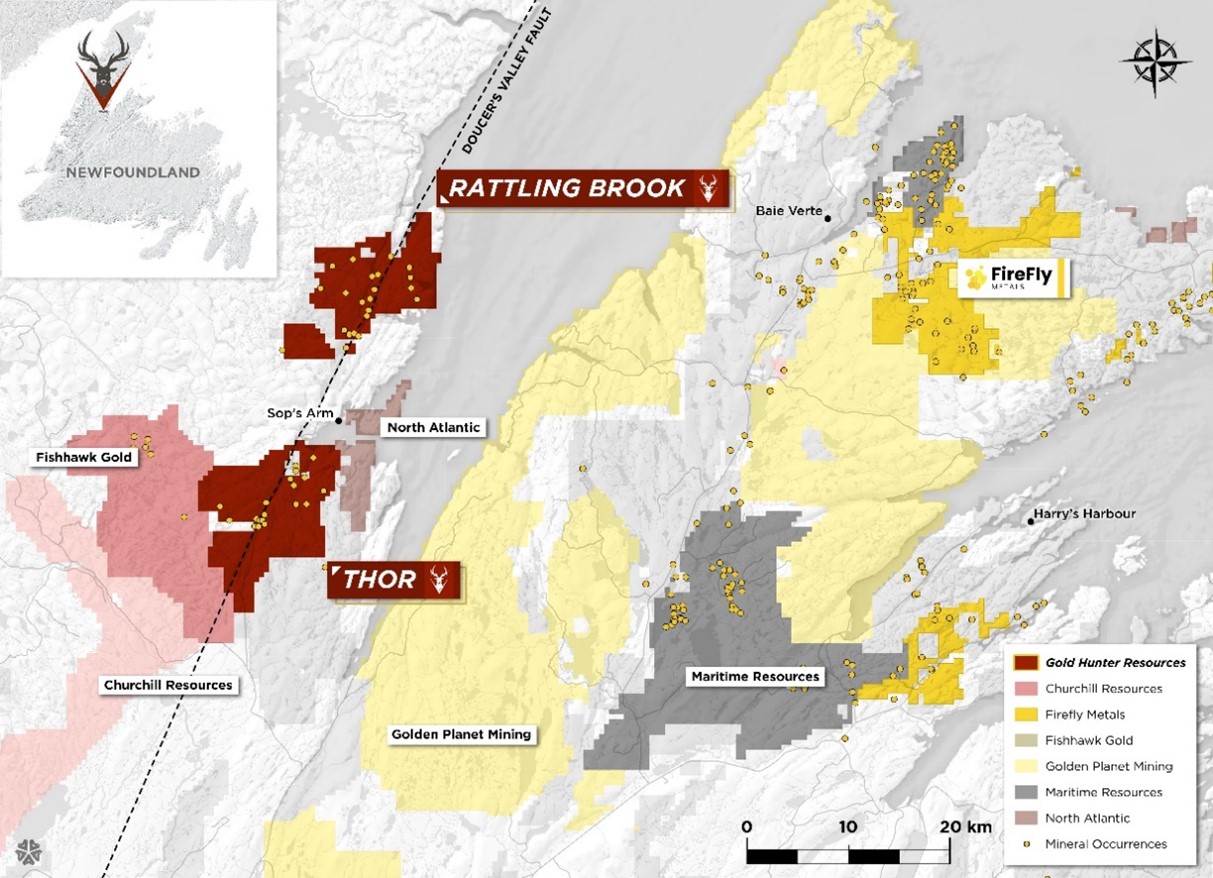

MAP: Gold Hunter's Consolidated Gold District, Including Magna Terra's Great Northern & Viking Projects and Additional Land Packages

Pursuant to the Option Agreement, Gold Hunter acquired the Option by issuing 7,042,253 common shares (each, a "Share") in the capital of the Company at a deemed price per Share of

Concurrently with acquiring the Option, Gold Hunter is excited to announce that it has completed the previously announced acquisition of 195 additional mineral claims surrounding and adjoining the Projects through a series of mineral property purchase agreements (collectively, the "Property Purchase Agreements") with four different vendors, being Sorrento Resources Ltd. (CSE: SRS | OTCQB: SRSLF), Neal Blackmore, Stephen Keats, and Darrin Hicks. For full particulars regarding each of the property purchase agreements, please refer to Gold Hunter's news release dated May 29th, 2024.

Gold Hunter is also pleased to announce that it has completed the acquisition of Long Range Exploration Corporation ("Long Range") pursuant to a share purchase agreement (the "SPA") dated May 29th, 2024, whereby Gold Hunter has acquired all of the issued and outstanding common shares of Long Range (the "Long Range Shares") from the shareholders (the "Long Range Shareholders") of Long Range, such that Long Range is now a wholly-owned subsidiary of Gold Hunter. As consideration for acquiring the Long Range Shares, Gold Hunter issued 9,000,000 Shares to the Long Range Shareholders, distributed on a pro-rata basis based on the number of Long Range Shares held by each Long Range Shareholder, and a cash payment of

About the Great Northern and Viking Projects

The Great Northern and Viking Projects are located near the communities of Sops Arm, Pollard's Point, and Jackson's Arm, Newfoundland and Labrador.

The Projects are centered along a 30 km section of the Doucers Valley Fault, a known geological control and host to several gold occurrences, including the Thor and Rattling Brook Deposits. Additional known gold mineralization on the Projects includes the Incinerator, Furnace, Jacksons Arm, Viking, Kramer, Viking North, and Little Davis Pond mineralized trends. This proven gold environment with the Thor Deposit Mineral Resource and numerous untested gold trends occurs over a cumulative 30+ km strike length. Gold mineralization is hosted within a variety of rock types that include Precambrian or Ordovician granites to granodiorites, as well as younger volcanic and sedimentary rocks, typically along splays off the Doucers Valley Fault. Alteration consists of mesothermal style quartz ± iron carbonate ± sulfide veins and stockworks with 2 to

Finder's Fee

Pursuant to a Finder's Fee Agreement between Gold Hunter and Kluane Capital FZCO executed on June 10, 2024, Gold Hunter paid a finder's fee of 1,824,225 Shares and

Appointment of Darrell Brown and Lew Lawrick to Gold Hunter's Board of Directors

In furtherance of the strategic partnerships created by the Option Agreement and the SPA, Gold Hunter is pleased to announce the appointments of Darrell Brown and Lew Lawrick to the board of directors (the "Board") of the Company.

About Darrell Brown

Darrell Brown was the President and CEO of Long Range prior to its acquisition by Gold Hunter. He is a professional engineer (APEGA) with over 30 years of experience in the resource sector in Canada and South America. He has been responsible for project management, exploration, drilling, regulatory compliance, negotiations, and operations. Mr. Brown is the principal of Metal-Ox Ventures Inc. and has previously served as a director and senior officer for four publicly traded companies.

He was formerly VP Operations of Lightning Energy Ltd., a junior oil and gas company that grew from 0 to 6,000 BOE/D, before being acquired two years after its startup in 2005. Mr. Brown also served as Director and VP Operations for Drilcorp Energy Ltd., a junior oil and gas producer that tripled its production before being acquired a year later in 2006.

About Lew Lawrick

Lew Lawrick currently serves as the President and CEO of Magna Terra, as well as the Managing Director of Thorsen-Fordyce Merchant Capital Inc., a private Toronto based merchant bank focused principally on the mineral industry. Mr. Lawrick is the Founder of Signal Gold Inc. (formerly Anaconda Mining Inc.). He served as President & CEO of Anaconda until 2010 and has served as an officer and/or director of several other private and public mining and mineral exploration companies, including Volta Resources Inc. (TSX), Franconia Minerals Corporation (TSX), Brionor Resources Inc. (formerly Normabec Mining Resources Ltd.) (TSX-V), and Serengeti Resources Inc. (TSX-V). Mr. Lawrick holds a Bachelor of Commerce degree (BCOM) from the University of Calgary.

"Magna Terra is very pleased to finalize this transaction with Gold Hunter. We believe that the Great Northern Project has the potential to be an exceptional gold exploration project in a jurisdiction well supported by infrastructure and accessible year-round. With over 30 km of strike potential identified to date, and numerous first-priority drill targets hosted in a geological domain that is known to host gold deposits, there is potential for additional gold discoveries. We will continue to be involved with the development and execution of the technical exploration programs along with the Gold Hunter team; and as significant shareholders, we are very excited to see this project move forward with pace for the benefit of both Gold Hunter and Magna Terra stakeholders." - Lew Lawrick, President & CEO, Magna Terra Minerals Inc.

"We are thrilled to welcome both Lew and Darrell to our team, along with their partners and extended team. Their wealth of experience and expertise, particularly with Magna Terra's expansive time spent in the province, will be invaluable as we move forward. Again, we believe consolidation is key to expand known mineralized areas and Gold Hunter has seized an opportunity to control a district that we believe is underdeveloped and underexplored. We are already working alongside our expanded team to amalgamate the districts data, which includes additional high-priority drill targets outside of the Great Northern & Viking project area. I would like to extend our gratitude to everyone who has supported and contributed to this key positioning, the Great Northern Project. We look forward to exploring and developing the district," stated Sean Kingsley, President and CEO of Gold Hunter.

The Company also announced that Mr. Richard Macey has resigned from the Board after having served as a Director of the Company since 2019. The team would like to thank Mr. Macey for his service and contributions to the Board.

Early Warning Disclosure

Immediately prior to the completion of the acquisition of the Option, Magna Terra did not hold any securities in Gold Hunter.

Pursuant to the Option Agreement, Magna Terra acquired ownership and control of 7,042,253 Shares, representing approximately

An early warning report will be filed by Magna Terra with applicable Canadian securities regulatory authorities. To obtain a copy of the related early warning report, please contact Lew Lawrick (647-478-5307; info@magnaterraminerals.com). The head office of Magna Terra is located at 20 Adelaide St. East, Suite 401, Toronto, Ontario M5C 2T6.

Qualified Person

This news release has been reviewed and approved by Rory Kutluoglu, B.Sc., P.Geo., a "Qualified Person", under National Instrument 43-101 - Standard for Disclosure for Mineral Projects.

About Gold Hunter Resources Inc.

Gold Hunter Resources Inc. is a Canadian-based exploration company dedicated to the acquisition, exploration, and development of precious & base metal projects. With a focus on high-quality assets in premier mining jurisdictions, Gold Hunter Resources aims to build a robust portfolio of projects to drive shareholder value.

About Magna Terra Minerals Inc.

Magna Terra Minerals Inc. is a precious metals focused exploration company, headquartered in Toronto, Canada. Magna Terra owns two district-scale, resource stage gold exploration projects in the top-tier mining jurisdictions of New Brunswick and Newfoundland and Labrador. Further, the Company maintains a significant exploration portfolio in the province of Santa Cruz, Argentina which includes its Boleadora Project being advanced by Newmont Corp. under an option to purchase agreement; a precious metals discovery on its Luna Roja Project proximal to Cerrado Gold's operating Don Nicholas Project, as well as several additional district scale drill ready projects available for purchase or option/joint venture.

On Behalf of the Board of Directors,

GOLD HUNTER RESOURCES INC.

"Sean A. Kingsley"

President, CEO, and Director

Email: info@goldhunterresources.com

Phone: +1 604-440-8474

www.goldhunterresources.com

Forward-Looking Statements

This news release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends", "believes" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" or "occur". This information and these statements, referred to herein as "forward‐looking statements", are not historical facts, are made as of the date of this news release and include without limitation, statements regarding discussions of future plans, estimates and forecasts and statements as to management's expectations and intentions with respect to, among other things: the expected benefits of the various transactions contemplated herein; the exercise of the Option, including the payment of the next share issuance and cash payment; and the future potential of the minerals claims acquired pursuant to the transactions contemplated herein.

In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation the assumption that the Company will be able: to receive expected benefits and achieve anticipated integration post-transaction; exercise the Option in full; and continue exploring the Projects and surrounding minerals claims acquired pursuant to the transactions contemplated herein.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws.

Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Magna Terra Minerals Inc.

View the original press release on accesswire.com