Generation Mining – Targets Copper in Two Phased Exploration Program including Drilling and AI

- None.

- None.

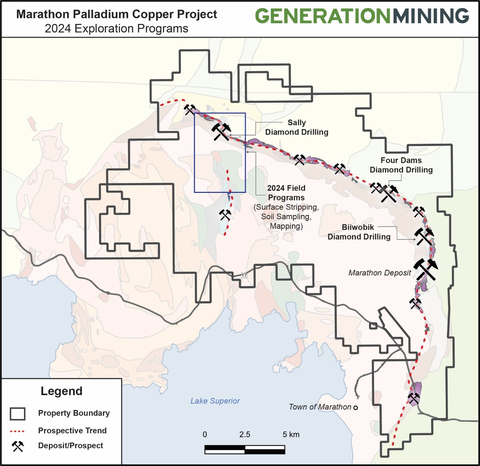

Figure 1 – Map of Marathon Palladium project showing locations of 2024 exploration programs. (Graphic: Business Wire)

The drill and crew have mobilized to site and drilling has commenced. The aim of the first hole at Biiwobik is to better define the extent of the Powerline and Chonolith domains which will aid in determining the potential to expand the Marathon Palladium-Copper deposit or develop a fourth pit increasing the life of the mine beyond 13.5 years.

The winter phase of the program will comprise approximately 3,000 metres and is designed to potentially extend the northern Marathon Pit, targeting an area adjacent to the north pit and extending 400 metres to the north. Highlights from the 2021 drill program (see news release dated September 2, 2021) include drill intercepts* of 46 metres grading

The summer phase of the program will comprise approximately 2,000 metres of exploration drilling at the Four Dams prospect and 1,000 metres at the Sally deposit.

The Four Dams prospect (Figure 3) hosts an approximately 250-metre-wide by 60-metre-thick ultramafic pipe which contains abundant higher density minerals such as olivine and apatite along with semi-massive to massive sulphides occurring at its base. The concentration of these higher density minerals as well as massive sulphides is interpreted to be the result of gravity driven accumulation of heavier minerals which often leads to the pooling of larger massive sulphide bodies at depth. A combination of down-dip drilling and borehole electromagnetic surveying will be used to vector towards these bodies. The last drill program targeting the main Four Dams pipe occurred between 2005-2006 with results including

A second target will be drilled approximately 275 metres southeast of the main pipe, where three holes drilled between 2013 and 2017 encountered similar rock units that make up the main Four Dams pipe, with the best results being

Drilling at the Sally Deposit (Figure 4) will utilize a helicopter portable drill rig and consist of a single hole totalling approximately 1000 metres. This hole will follow up on the successful drill program carried out by Gen Mining in 2019 (see news release dated December 17, 2019). A subsequent borehole electromagnetic survey at the end of 2019 and magnetotelluric survey in 2020 both indicate the presence of a large untested conductor just below the 2019 intercept. This conductor occurs along the same geological horizon which hosts extremely high-grade outcrop samples with grades up to

Additional surficial field programs are planned at Sally as well as the region between the Sally and Geordie deposits, where mapping and sampling by past operators has indicated the potential for economic copper mineralization (Figure 1).

The company has also engaged ALS Goldspot to carry out a 2D prospectivity analysis of the Company’s entire exploration land package. This project is the culmination of over four years of data compilation by Gen Mining and will include over 60 years of exploration data from various past operators. Gen Mining will work closely with Goldspot’s team of geologists, geophysicists and geochemists to prepare the data for analysis using their proprietary artificial intelligence (AI) and machine learning technology. Results from this program will help to guide exploration programs in 2024 and beyond. Pending results, a 3D analysis will be carried out following the 2024 drill program to better define prospective targets at depth.

Gen Mining’s CEO Jamie Levy stated, “We are excited to follow up on the positive drill results from the summer 2021 program to better understand our land package and its potential to contain copper rich deposits.”

* drill intercepts lengths approximate true widths

*Metal prices of

About Generation Mining Limited

Gen Mining’s focus is the development of the Marathon Project, a large undeveloped palladium-copper deposit in

The Feasibility Study Update estimated a Net Present Value (using a

The Marathon Property covers a land package of approximately 22,000 hectares, or 220 square kilometres. Gen Mining owns a

Qualified Person

The scientific and technical content of this news release was reviewed, verified, and approved by Drew Anwyll, P.Eng., M.Eng, Chief Operating Officer of the Company, and a Qualified Person as defined by Canadian Securities Administrators’ National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Forward-Looking Information

This news release contains certain forward-looking information and forward-looking statements, as defined in applicable securities laws (collectively referred to herein as "forward-looking statements"). Forward-looking statements reflect current expectations or beliefs regarding future events or the Company’s future performance. All statements other than statements of historical fact are forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "continues", "forecasts", "projects”, “predicts”, “intends”, “anticipates”, “targets” or “believes”, or variations of, or the negatives of, such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “should”, “might” or “will” be taken, occur or be achieved, including statements relating to the final location and depth of drill holes, surveys and targets; the life of mine; mineral production estimates; payback period; and financial returns from the Marathon Project.

Although the Company believes that the expectations expressed in such statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the statements. There are certain factors that could cause actual results to differ materially from those in the forward-looking information. These include the timing for a construction decision; the progress of development at the Marathon Project, including progress of project expenditures and contracting processes, the Company’s plans and expectations with respect to liquidity management, continued availability of capital and financing, the future price of palladium and other commodities, permitting timelines, exchange rates and currency fluctuations, increases in costs, requirements for additional capital, and the Company’s decisions with respect to capital allocation, and the impact of COVID-19, inflation, global supply chain disruptions, global conflicts, including the wars in

Forward-looking statements are based on a number of assumptions which may prove to be incorrect, including, but not limited to, assumptions relating to: the availability of financing for the Company’s operations; operating and capital costs; results of operations; the mine development and production schedule and related costs; the supply and demand for, and the level and volatility of commodity prices; timing of the receipt of regulatory and governmental approvals for development projects and other operations; the accuracy of Mineral Reserve and Mineral Resource Estimates, production estimates and capital and operating cost estimates; and general business and economic conditions.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking information. For more information on the Company, investors are encouraged to review the Company’s public filings on SEDAR+ at www.sedarplus.ca. The Company disclaims any intention or obligation to update or revise any forward- looking information, whether as a result of new information, future events or otherwise, other than as required by law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240307808472/en/

Jamie Levy

President and Chief Executive Officer

(416) 640-2934 (O)

(416) 567-2440 (M)

jlevy@genmining.com

Source: Generation Mining Limited