Generation Mining Provides Update on 2024 Summer Exploration Program

Generation Mining (TSX:GENM, OTCQB: GENMF) has provided an update on its 2024 summer exploration program at the Marathon Property in northwestern Ontario. The program includes:

- Completion of ALS Goldspot AI analysis, identifying 46 untested exploration targets, including 6 high priority locations

- Diamond drilling at Sally Deposit, Four Dams Prospect, and Biiwobik Prospect

- Significant results include:

- Sally: 48m at 1.52 g/t PdEq, including 6.0m at 3.42 g/t PdEq

- Four Dams: 74m of mineralized ultramafic rock grading 0.22% CuEq

- Biiwobik: 50.0m at 0.58% CuEq, including 10.0m at 1.50% CuEq

The company is continuing field work, including surface stripping, mapping, and soil sampling over priority targets.

Generation Mining (TSX:GENM, OTCQB: GENMF) ha fornito un aggiornamento sul suo programma di esplorazione estiva 2024 presso la Marathon Property nel nord-ovest dell'Ontario. Il programma include:

- Completamento dell'analisi ALS Goldspot AI, identificando 46 obiettivi di esplorazione non testati, inclusi 6 luoghi ad alta priorità

- Trivellazione a diamante presso il Sally Deposit, il Four Dams Prospect e il Biiwobik Prospect

- I risultati significativi includono:

- Sally: 48m a 1.52 g/t PdEq, inclusi 6.0m a 3.42 g/t PdEq

- Four Dams: 74m di roccia ultramafica mineralizzata con un grado dello 0.22% CuEq

- Biiwobik: 50.0m a 0.58% CuEq, inclusi 10.0m a 1.50% CuEq

L'azienda sta continuando il lavoro sul campo, inclusi scavi superficiali, mappatura e campionamento del suolo sui target prioritari.

Generation Mining (TSX:GENM, OTCQB: GENMF) ha proporcionado una actualización sobre su programa de exploración de verano 2024 en la propiedad Marathon en el noroeste de Ontario. El programa incluye:

- Finalización del análisis de ALS Goldspot AI, identificando 46 objetivos de exploración no probados, incluidos 6 lugares de alta prioridad

- Perforación de diamante en el Sally Deposit, Four Dams Prospect y Biiwobik Prospect

- Los resultados significativos incluyen:

- Sally: 48m a 1.52 g/t PdEq, incluyendo 6.0m a 3.42 g/t PdEq

- Four Dams: 74m de roca ultramáfica mineralizada con un grado de 0.22% CuEq

- Biiwobik: 50.0m a 0.58% CuEq, incluyendo 10.0m a 1.50% CuEq

La empresa continúa el trabajo de campo, incluidos el desmonte superficial, la cartografía y el muestreo de suelos en los objetivos prioritarios.

Generation Mining (TSX:GENM, OTCQB: GENMF)는 온타리오 북서부의 Marathon Property에서 2024년 여름 탐사 프로그램에 대한 업데이트를 제공했습니다. 프로그램은 다음과 같습니다:

- ALS Goldspot AI 분석 완료, 46개의 미탐사 탐사 목표를 식별하고 6개의 고우선순위 위치 포함

- 다이아몬드 시추 Sally Deposit, Four Dams Prospect 및 Biiwobik Prospect에서 진행

- 주요 결과는 다음과 같습니다:

- Sally: 48m에서 1.52 g/t PdEq, 6.0m에서 3.42 g/t PdEq 포함

- Four Dams: 0.22% CuEq 등급의 광물화된 초마그네사이트 암석 74m

- Biiwobik: 0.58% CuEq에서 50.0m, 10.0m에서 1.50% CuEq 포함

회사는 우선 목표에 대한 표면 제거, 매핑 및 토양 샘플링을 포함한 현장 작업을 계속하고 있습니다.

Generation Mining (TSX:GENM, OTCQB: GENMF) a fourni une mise à jour sur son programme d'exploration estivale 2024 sur la propriété Marathon dans le nord-ouest de l'Ontario. Le programme comprend :

- Achèvement de l'analyse ALS Goldspot AI, identifiant 46 cibles d'exploration non testées, dont 6 emplacements prioritaires

- Forages au diamant au Sally Deposit, au Four Dams Prospect et au Biiwobik Prospect

- Les résultats significatifs comprennent :

- Sally : 48m à 1.52 g/t PdEq, dont 6.0m à 3.42 g/t PdEq

- Four Dams : 74m de roche ultramafique minéralisée avec une teneur de 0.22% CuEq

- Biiwobik : 50.0m à 0.58% CuEq, dont 10.0m à 1.50% CuEq

La société poursuit les travaux de terrain, y compris le déblaiement de surface, la cartographie et l'échantillonnage du sol sur les cibles prioritaires.

Generation Mining (TSX:GENM, OTCQB: GENMF) hat ein Update zu seinem Sommerexplorationsprogramm 2024 auf dem Marathon-Gelände im Nordwesten Ontarios gegeben. Das Programm beinhaltet:

- Abschluss der ALS Goldspot AI-Analyse, die 46 ungetestete Explorationsziele identifiziert, darunter 6 wichtige Standorte

- Diamantbohrungen am Sally Deposit, Four Dams Prospect und Biiwobik Prospect

- Wesentliche Ergebnisse umfassen:

- Sally: 48m bei 1.52 g/t PdEq, einschließlich 6.0m bei 3.42 g/t PdEq

- Four Dams: 74m mineralisierter ultramafischer Gestein mit 0.22% CuEq Gehalt

- Biiwobik: 50.0m bei 0.58% CuEq, einschließlich 10.0m bei 1.50% CuEq

Das Unternehmen führt weiterhin Feldarbeiten durch, darunter Oberflächenabtragung, Kartierung und Bodensampling in priorisierten Zielgebieten.

- AI analysis identified 46 new exploration targets, including 6 high priority locations

- Sally Deposit drilling encountered wide mineralization 275m outside the current deposit, indicating expansion potential

- Four Dams drilling confirmed mineralization related to MT anomaly, representing a significant step out from the current prospect

- Biiwobik drilling yielded multiple mineralized intervals, including 0.58% CuEq over 50.0 metres

- Some drill holes at Four Dams (FD-24-045 and FD-24-047) did not encounter significant mineralization

- One drill hole at Biiwobik (MB-24-060) did not encounter significant mineralization

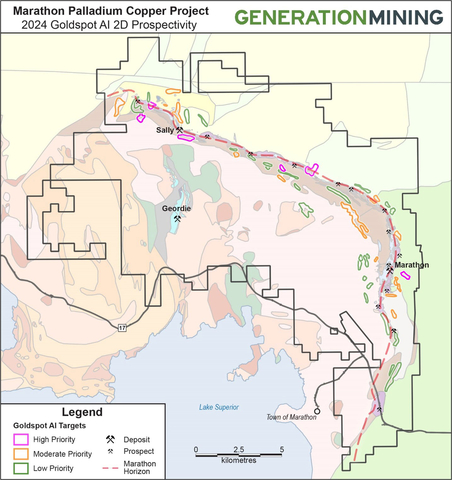

Figure 1: Map showing the 46 priority exploration targets identified by Goldspot during the 2024 2D Prospectivity analysis. Red dashed line shows the approximate location of the main Marathon Horizon along the outer limb of the Coldwell Complex (Graphic: Business Wire)

Jamie Levy, President and CEO commented, “We are very excited to get the first phase of the Goldspot AI process completed on the Marathon Property. The historic site data is now in one place and with the AI-tools being used to assess the exploration and structural data, we have identified 6 new high priority targets that have not previously been drilled and have seen only minimal ground exploration. The AI analysis and recent drilling results should lead to some very interesting future exploration potential.”

Goldspot 2D Prospectivity Analysis

Between March and June 2024, the company engaged ALS Goldspot to review and analyse over 60 years of historic surface exploration data using their AI driven integrated targeting technique. Targets were identified by comparing overlapping geophysical and geochemical signatures to those of known mineralization on the property. The exercise resulted in a total of 46 untested exploration targets, including 6 high priority and 14 moderate priority locations. The higher priority targets were selected based on a range of criteria, such as their similarities to other known deposits and prospects, upside size potential and relatively low density of surface prospecting data which represent some of the best areas for new discoveries on the property. These results will be used to guide several surface stripping and mapping programs being initiated in the coming months. A map of the identified exploration targets can be found in Figure 1.

Diamond Drilling

The diamond drilling portion of the 2024 exploration program has also been completed on the Marathon Property, including the Sally Deposit, Four Dams Prospect and Biiwobik Prospect.

Sally Deposit

Drilling at Sally consisted of a single drillhole targeting a large Magnetotelluric (MT) anomaly down dip from the Sally Deposit.

Drilling was completed to 954 m and encountered a wide interval of mineralization approximately 275m outside the currently defined deposit, highlighting the exceptional expansion potential at Sally. Highlights from this zone include 48 metres at 1.52 g/t PdEq (0.74 g/t Pd,

Table 1: 2024 Sally Drilling Location and Orientation

HoleID |

Total Depth |

CollarAzi |

Colar Dip |

Easting UTM NAD83 |

Northing UTM NAD83 |

Elevation |

SL-24-079 |

954 |

348 |

-61 |

537677 |

5412219 |

531 |

Table 2: 2024 Sally Drilling Results

HoleID |

From |

To |

Length1 |

Cu (%) |

Pd (g/t) |

Pt (g/t) |

Au (g/t) |

Ag (g/t) |

CuEq (%)2 |

PdEq (g/t)3 |

SL-24-079 |

730 |

754 |

24 |

0.29 |

0.02 |

0.02 |

0.02 |

0.88 |

0.35 |

0.50 |

and |

764 |

768 |

4 |

0.08 |

0.81 |

0.92 |

0.02 |

0.30 |

1.11 |

1.63 |

and |

798 |

846 |

48 |

0.18 |

0.74 |

0.46 |

0.13 |

0.94 |

1.04 |

1.52 |

including |

806 |

812 |

6 |

0.03 |

1.91 |

1.35 |

0.39 |

0.23 |

2.34 |

3.42 |

1. All lengths are in metres. Interval lengths of interceptions are assumed to be approximate to true width.

2. The Copper Equivalent (“CuEq”) calculation expressed in % is calculated as the sum of the theoretical in situ value of the constituent metals (Au + Pt + Pd + Cu + Ag) in one tonne sampled divided by the value of one percent of copper in such one tonne sample. The calculation makes no provision for expected metal recoveries or smelter payables. USD per ounce commodity prices of

3. The Palladium Equivalent (“PdEq”) calculation expressed in g/t is calculated as the sum of the theoretical in situ value of the constituent metals (Au + Pt + Pd + Cu + Ag) in one tonne sampled divided by the value of one gram of palladium. The calculation makes no provision for expected metal recoveries or smelter payables. USD per ounce commodity prices of

Four Dams Prospect

Drilling at Four Dams was designed to test the down dip and eastern extension of the Four Dams Prospect, including a large untested Magnetotelluric target 400 metres east of the main Four Dams occurrence.

Drilling on the main Four Dams ultramafic pipe yielded mixed results. FD-24-046 encountered 74 metres of mineralized ultramafic rock grading

Two drillholes completed on the eastern MT anomaly confirmed the MT response is related to mineralization. FD-24-044 targeted the upper portion of the anomaly and yielded

Table 3: 2024 Four Dams Drilling Location and Orientation

HoleID |

Total Depth |

CollarAzi |

Colar Dip |

Easting UTM NAD83 |

Northing UTM NAD83 |

Elevation |

FD-24-044 |

463 |

30 |

-65 |

548094 |

5408970 |

378 |

FD-24-045 |

510 |

31 |

-56 |

547797 |

5409165 |

376 |

FD-24-046 |

477 |

13 |

-52 |

547797 |

5409165 |

376 |

FD-24-047 |

483 |

27 |

-57 |

547659 |

5409204 |

375 |

FD-24-048 |

537 |

13 |

-73 |

548185 |

5408947 |

381 |

Table 4: 2024 Four Dams Drilling Results

HoleID |

From |

To |

Length1 |

Cu (%) |

Pd (g/t) |

Pt (g/t) |

Au (g/t) |

Ag (g/t) |

CuEq (%)2 |

FD-24-044 |

406 |

428 |

22 |

0.20 |

0.01 |

0.01 |

0.02 |

0.38 |

0.23 |

including |

422 |

426.5 |

4.5 |

0.42 |

0.01 |

0.02 |

0.03 |

0.39 |

0.47 |

FD-24-045 |

318 |

326 |

8 |

0.11 |

0.06 |

0.20 |

0.42 |

0.30 |

0.60 |

including |

320 |

322 |

2 |

0.25 |

0.14 |

0.43 |

0.91 |

0.80 |

1.32 |

FD-24-046 |

374 |

448 |

74 |

0.20 |

0.00 |

0.01 |

0.01 |

0.52 |

0.22 |

including |

392 |

416 |

24 |

0.29 |

0.00 |

0.01 |

0.00 |

0.81 |

0.30 |

and |

438 |

440 |

2 |

0.59 |

0.02 |

0.03 |

0.03 |

0.85 |

0.65 |

FD-24-047 |

356 |

368 |

12 |

0.12 |

0.10 |

0.06 |

0.07 |

0.58 |

0.28 |

FD-24-048 |

308 |

326 |

18 |

0.25 |

0.16 |

0.04 |

0.07 |

1.31 |

0.45 |

including |

324 |

326 |

2 |

0.55 |

0.17 |

0.02 |

0.18 |

2.70 |

0.86 |

1. All lengths are in metres. Interval lengths of interceptions are assumed to be approximate to true width.

2. The Copper Equivalent (“CuEq”) calculation expressed in % is calculated as the sum of the theoretical in situ value of the constituent metals (Au + Pt + Pd + Cu + Ag) in one tonne sampled divided by the value of one percent of copper in such one tonne sample. The calculation makes no provision for expected metal recoveries or smelter payables. USD per ounce commodity prices of

Biiwobik Prospect

A borehole electromagnetic survey was completed in two holes drilled over the winter at the Biiwobik Prospect.

The survey yielded three strong off hole conductors, two of which were targeted during Phase 2 of the 2024 Biiwobik drill program (see news release dated April 23, 2024, for phase 1 results). MB-24-060 targeted a narrow conductor which extended approximately 100 metres N-NE of mineralization in MB-24-059. Drilling was carried out on the very northern extent of this conductor but did not encounter any significant mineralization. MB-24-061 targeted an off-hole conductor located near the base of the gabbro unit in MB-24-055. The hole encountered multiple mineralized intervals such as

Table 5: 2024 Biiwobik Drilling Location and Orientation

HoleID |

Total Depth |

CollarAzi |

Colar Dip |

Easting UTM NAD83 |

Northing UTM NAD83 |

Elevation |

MB-24-054 |

474 |

86 |

-70 |

549914 |

5406823 |

376 |

MB-24-055 |

459 |

90 |

-72 |

549934 |

5406765 |

370 |

MB-24-056 |

468 |

99 |

-70 |

549967 |

5406846 |

380 |

MB-24-057 |

459 |

93 |

-71 |

550013 |

5406611 |

369 |

MB-24-058 |

447 |

82 |

-68 |

549928 |

5406937 |

370 |

MB-24-059 |

426 |

82 |

-71 |

549940 |

5407002 |

356 |

MB-24-060 |

273 |

135 |

-71 |

550019 |

5407146 |

307 |

MB-24-061 |

441 |

88 |

-79 |

549979 |

5406708 |

368 |

Table 6: 2024 Biiwobik Drilling Results, including MB-24-054 to MB-24-059 (see news release dated April 23, 2024)

HoleID |

From |

To |

Length1 |

Cu (%) |

Pd (g/t) |

Pt (g/t) |

Au (g/t) |

Ag (g/t) |

CuEq (%)2 |

PdEq (g/t)3 |

MB-24-054 |

240 |

256 |

16 |

0.08 |

0.33 |

0.08 |

0.04 |

0.39 |

0.38 |

0.56 |

and |

262 |

296 |

34 |

0.11 |

1.02 |

0.17 |

0.08 |

0.29 |

0.96 |

1.41 |

including |

262 |

282 |

20 |

0.13 |

1.37 |

0.23 |

0.1 |

0.33 |

1.27 |

1.85 |

and |

374 |

385 |

11 |

0.39 |

0.5 |

0.09 |

0.04 |

2.25 |

0.84 |

1.22 |

and |

436 |

450 |

14 |

0.33 |

0.77 |

0.21 |

0.05 |

1.36 |

1.02 |

1.49 |

Including |

440 |

450 |

10 |

0.38 |

0.93 |

0.26 |

0.05 |

1.53 |

1.21 |

1.76 |

MB-24-055 |

172 |

198 |

26 |

0.07 |

0.16 |

0.08 |

0.04 |

0.4 |

0.26 |

0.38 |

and |

242 |

272 |

30 |

0.11 |

0.31 |

0.08 |

0.05 |

0.6 |

0.41 |

0.6 |

including |

242 |

262 |

20 |

0.04 |

0.42 |

0.1 |

0.05 |

0.26 |

0.42 |

0.62 |

and |

262 |

272 |

10 |

0.25 |

0.09 |

0.03 |

0.04 |

1.28 |

0.37 |

0.55 |

and |

378 |

384 |

6 |

0.15 |

0.26 |

0.1 |

0.06 |

0.6 |

0.43 |

0.64 |

and |

402 |

430 |

28 |

0.11 |

0.34 |

0.1 |

0.03 |

0.46 |

0.42 |

0.62 |

MB-24-056 |

168 |

174 |

6 |

0.12 |

0.5 |

0.14 |

0.08 |

0.5 |

0.6 |

0.88 |

and |

194 |

212 |

18 |

0.07 |

0.33 |

0.07 |

0.03 |

0.4 |

0.36 |

0.53 |

and |

422 |

428 |

6 |

0.19 |

0.39 |

0.12 |

0.05 |

1.87 |

0.58 |

0.85 |

MB-24-057 |

164 |

188 |

24 |

0.03 |

0.32 |

0.09 |

0.03 |

0.11 |

0.32 |

0.47 |

and |

362 |

378 |

16 |

0.3 |

0.68 |

0.15 |

0.07 |

1.97 |

0.92 |

1.35 |

MB-24-058 |

194 |

208 |

14 |

0.11 |

0.62 |

0.2 |

0.07 |

0.67 |

0.7 |

1.02 |

including |

198 |

208 |

10 |

0.13 |

0.77 |

0.23 |

0.08 |

0.76 |

0.85 |

1.24 |

and |

348 |

378 |

30 |

0.41 |

1.02 |

0.24 |

0.1 |

1.88 |

1.33 |

1.95 |

including |

364 |

372 |

8 |

0.85 |

2.48 |

0.57 |

0.22 |

4 |

3.06 |

4.47 |

and |

394 |

404 |

10 |

0.25 |

0.46 |

0.07 |

0.07 |

0.94 |

0.67 |

0.98 |

MB-24-059 |

216 |

250 |

34 |

0.05 |

0.4 |

0.14 |

0.08 |

0.19 |

0.46 |

0.68 |

including |

230 |

236 |

6 |

0.11 |

1.35 |

0.41 |

0.19 |

0.3 |

1.4 |

2.04 |

and |

324 |

346 |

22 |

0.19 |

0.9 |

0.19 |

0.08 |

0.89 |

0.98 |

1.43 |

including |

324 |

329 |

5 |

0.56 |

1.12 |

0.21 |

0.15 |

2.92 |

1.59 |

2.32 |

MB-24-060 |

240 |

256 |

16 |

0.08 |

0.33 |

0.08 |

0.04 |

0.39 |

0.38 |

0.56 |

MB-24-061 |

182 |

232 |

50 |

0.10 |

0.52 |

0.13 |

0.06 |

0.32 |

0.58 |

0.84 |

including |

214 |

224 |

10 |

0.23 |

1.50 |

0.26 |

0.13 |

0.80 |

1.50 |

2.20 |

and |

408 |

420 |

12 |

0.21 |

0.44 |

0.14 |

0.05 |

1.18 |

0.63 |

0.92 |

including |

408 |

414 |

6 |

0.35 |

0.69 |

0.22 |

0.08 |

1.90 |

1.02 |

1.49 |

1. All lengths are in metres. Interval lengths of interceptions are assumed to be approximate to true width.

2. The Copper Equivalent (“CuEq”) calculation expressed in % is calculated as the sum of the theoretical in situ value of the constituent metals (Au + Pt + Pd + Cu + Ag) in one tonne sampled divided by the value of one percent of copper in such one tonne sample. The calculation makes no provision for expected metal recoveries or smelter payables. USD per ounce commodity prices of

3. The Palladium Equivalent (“PdEq”) calculation expressed in g/t is calculated as the sum of the theoretical in situ value of the constituent metals (Au + Pt + Pd + Cu + Ag) in one tonne sampled divided by the value of one gram of palladium. The calculation makes no provision for expected metal recoveries or smelter payables. USD per ounce commodity prices of

Continuation of the 2024 Exploration Program

Field crews are currently on site carrying out surface stripping, field mapping and soil sampling programs over priority exploration targets, including multiple high priority Goldspot targets presented above. The company looks forward to presenting results from these programs as the progress advances over the summer field season.

Quality Assurance/Quality Control

Quality assurance and quality control protocols for the 2024 drilling assay program were unchanged from previous years and involve a rotating inclusion of one duplicate, blank, low-grade standard and high-grade standard every 15 samples. All controls are checked to be within a working limit of 2 standard deviations. Sample intervals are selected in 1m or 2m lengths dependent on the nature of the mineralized zone. The core samples are split on site using a diamond saw where half of the core is sent for analysis and the other half is securely stored on site for future reference. All samples are shipped to the ALS Global laboratory in

Data verification programs have included a review of QA/QC data, re-sampling and sample analysis programs, and database verification. Validation checks were performed on data, and comprise checks on surveys, collar coordinates and assay data.

About Generation Mining Limited

Gen Mining’s focus is the development of the Marathon Project, a large undeveloped palladium-copper deposit in

The Feasibility Study estimated a Net Present Value (using a

The Marathon Property covers a land package of approximately 22,000 hectares, or 220 square kilometres. Gen Mining owns a

Qualified Person

The scientific and technical content of this news release was reviewed, verified, and approved by Mauro Bassotti , P.Geo , Vice President Geology of the Company, and Drew Anwyll, P.Eng, Chief Operating Officer both Qualified Persons as defined by Canadian Securities Administrators’ National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Forward-Looking Information

This news release contains certain forward-looking information and forward-looking statements, as defined in applicable securities laws (collectively referred to herein as "forward-looking statements"). Forward-looking statements reflect current expectations or beliefs regarding future events or the Company’s future performance. All statements other than statements of historical fact are forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "continues", "forecasts", "projects”, “predicts”, “intends”, “anticipates”, “targets” or “believes”, or variations of, or the negatives of, such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “should”, “might” or “will” be taken, occur or be achieved, including statements relating to the ability of the current or future exploration programs to extend feeder zones, target higher grade mineralization, extend mine life, expand or alter potential mine pit designs; the possibility of future drilling adding to an inferred mineral resource or increasing potential metal grades in reserves or resources; and the anticipated life of mine; mineral production estimates, payback period, and financial returns from the Marathon Project.

Although the Company believes that the expectations expressed in such statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the statements. There are certain factors that could cause actual results to differ materially from those in the forward-looking information. These include the timing for a construction decision; the progress of development at the Marathon Project, including progress of project expenditures and contracting processes, the Company’s plans and expectations with respect to liquidity management, continued availability of capital and financing, the future price of palladium and other commodities, permitting timelines, exchange rates and currency fluctuations, increases in costs, requirements for additional capital, and the Company’s decisions with respect to capital allocation, and the impact of COVID-19, inflation, global supply chain disruptions, global conflicts, including the wars in

Exploration results that include geophysics, sampling, and drill results on wide spacings may not be indicative of the occurrence of a mineral deposit. Such results do not provide assurance that further work will establish sufficient grade, continuity, metallurgical characteristics and economic potential to be classed as a category of mineral resource. Forward-looking statements are based on a number of assumptions which may prove to be incorrect, including, but not limited to, assumptions relating to: the availability of financing for the Company’s operations; operating and capital costs; results of operations; the mine development and production schedule and related costs; the supply and demand for, and the level and volatility of commodity prices; timing of the receipt of regulatory and governmental approvals for development projects and other operations; the accuracy of Mineral Reserve and Mineral Resource Estimates, production estimates and capital and operating cost estimates; and general business and economic conditions.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking information. For more information on the Company, investors are encouraged to review the Company’s public filings on SEDAR+ at www.sedarplus.ca. The Company disclaims any intention or obligation to update or revise any forward- looking information, whether as a result of new information, future events or otherwise, other than as required by law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240726949339/en/

For further information please contact:

Jamie Levy

President and Chief Executive Officer

(416) 640-2934 (O)

(416) 567-2440 (M)

jlevy@genmining.com

Source: Generation Mining Limited