Generation Mining Delivers Updated Feasibility Study for Canada’s Next Critical Mineral Mine - the Marathon Palladium-Copper Project

After-Tax NPV

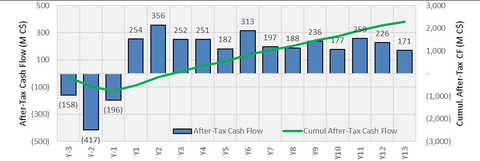

Project Cash Flow (After-Tax) (Graphic: Business Wire)

All dollar amounts are in Canadian dollars unless otherwise stated. All references to Mlbs are to millions of pounds and Moz are to millions of ounces and koz are to thousands of ounces.

Highlights:

-

Robust economics1: An after-tax Net Present Value (“NPV”) at a

6% discount rate of$1.16 billion 25.8% based on a long-term price ofUS /oz for palladium and$1,800 US /lb for copper$3.70 -

Quick payback period on

Initial Capital 2,3: 2.3 years -

Initial Capital :$1,112 million $898 million 25% from the 2021 FS -

Low Operating Costs and attractive AISC: Life of mine (“LOM”) average operating costs of

US /PdEq oz and all-in sustaining costs (“AISC”) of$709 US /PdEq oz 3 . Operating costs have increased$813 14% compared with the 2021 FS. -

Increased Mineral Reserve Estimate: an increase of

8.5% in Mineral Reserves tonnages and a decreased open pit strip ratio - Optimized operation: increased process plant throughput and improved metallurgical recoveries over LOM

- Average annual payable metals: 166 koz palladium, 41 Mlbs copper, 38 koz platinum, 12 koz gold and 248 koz silver

- LOM payable metals: 2.1 Moz palladium, 517 Mlbs copper, 485 koz platinum, 158 koz gold and 3.2 Moz silver

-

Strong cash flows in first three years of production following commercial production:

$851 million - Jobs: Creation of over 800 jobs during construction jobs and over 400 direct permanent jobs during operations

Following the 2021 Feasibility Study, the Company undertook considerable work to optimize and de-risk the Project, including:

- Detailed engineering on the process plant, Tailing Storage Facility (“TSF”), and site infrastructure designs.

- Additional metallurgical test program to optimize the flowsheet and plant design and improve confidence in metallurgical recoveries. Results allowed the Company to remove the PGM-Scavenger circuit from the process plant design and lower the process plant unit-operating costs.

- Geotechnical investigations completed in areas of key infrastructure location and confirmed the locations chosen in the construction design.

- Additional diamond drilling of 18,995 m within the Marathon Deposit targeting key areas within the open pit Mineral Reserves in the first three years of planned production, and areas within and proximal to the overall Mineral Resources.

-

Agreement finalized with Hycroft Mining Holding Corporation (“Hycroft”) for the purchase of an unused, surplus SAG mill and an unused, surplus ball mill4, which together with ancillary equipment allows the Company to increase throughput by

10% in the second full year of production. -

Community Benefits Agreement (“CBA”) signed and ratified with the Biigtigong Nishnaabeg (“BN”), on

November 12, 2022 . -

Federal and Provincial Environmental Assessment approvals received on

November 30, 2022 . - Initiated the process of obtaining various federal and provincial permits and approvals required to construct and operate the project.

Upcoming Webinar:

For more information on the updated Feasibility Study please join

The Feasibility Study was prepared by the Company and

KEY RESULTS AND ASSUMPTIONS IN UPDATED FEASIBILITY STUDY

Key results and assumptions for the updated Feasibility Study are summarized below.

|

Units |

2023 FS |

2021 FS |

Production Data |

|||

|

years |

12.5 |

12.8 |

Average Process Plant Throughput |

tpd |

27,700 |

25,200 |

Average Process Plant Throughput |

Mt/year |

10.1 |

9.2 |

Average |

tpd |

115,000 |

110,000 |

Average |

Mt/year |

42 |

40 |

Total Ore Mined |

Mt |

127 |

118 |

Strip Ratio |

waste:ore |

2.63 |

2.80 |

Palladium (payable) |

k oz |

2,122 |

1,905 |

Copper (payable) |

M lbs |

517 |

467 |

Platinum (payable) |

k oz |

485 |

537 |

Gold (payable) |

k oz |

158 |

151 |

Silver (payable) |

k oz |

3,156 |

2,823 |

LOM Palladium Equivalent Payable |

PdEq. koz |

3,613 |

3,195 |

Average Annual Palladium – Payable Metal |

k oz |

166 |

149 |

Average Annual Copper – Payable Metal |

M lbs |

41 |

36 |

Average Annual Platinum – Payable Metal |

k oz |

38 |

41 |

Average Annual Gold – Payable Metal |

k oz |

12 |

12 |

Average Annual Silver – Payable Metal |

k oz |

248 |

220 |

Operating Costs (Average LOM) |

|||

Mininga |

$/t mined |

3.25 |

2.53 |

Mining |

$/t milled |

11.45 |

9.23 |

Processing |

$/t milled |

8.70 |

9.08 |

G&Ab |

$/t milled |

2.67 |

2.48 |

Transport & Refining Charges |

$/t milled |

4.13 |

2.80 |

Royalty |

$/t milled |

0.09 |

0.04 |

Total Operating Cost |

$/t milled |

27.04 |

23.63 |

LOM Average Operating Costs |

US$/oz PdEq |

709 |

687 |

LOM Average AISCc |

US$/oz PdEq |

813 |

809 |

Capital Costs |

|||

|

$M |

1,112 |

888 |

Less: |

|

|

|

Pre-commercial production revenue |

$M |

( |

( |

Leased equipment, net of lease payments during construction |

$M |

( |

( |

|

$M |

898 |

665 |

|

$M |

424 |

423 |

Closure Costs |

$M |

72 |

66 |

Financial Evaluation |

|||

|

$M |

3,387 |

3,004 |

Pre-Tax NPV |

$M |

1,798 |

1,636 |

Pre-Tax IRR |

% |

31.9 |

38.6 |

Payback |

years |

2.0 |

1.9 |

|

$M |

2,285 |

2,060 |

After-Tax NPV |

$M |

1,164 |

1,068 |

After-Tax IRR |

% |

25.8 |

29.7 |

Payback |

years |

2.3 |

2.3 |

Key Assumptionsd |

|||

Palladium Price |

US$/oz |

|

|

Copper Price |

US$/lb |

|

|

Platinum Price |

US$/oz |

|

|

Gold Price |

US$/oz |

|

|

|

US$/oz |

|

|

Foreign Exchange (“FX”) |

C$:US$ |

1.35 |

1.28 |

Diesel Price |

$/litre |

1.17 |

0.77 |

Electricity |

$/kWhr |

0.07 |

0.08 |

Notes: a Including capitalized maintenance parts. b Includes estimated costs associated with certain commitments to and agreements with Indigenous communities. c AISC is calculated without the impact of the Precious Metal Purchase Agreement with Wheaton Precious Metals Corp. (“WPM PMPA”).

d Metal Price Assumptions are based on the lesser of the three-year trailing average and the spot price on |

|||

LOM Metal Production |

Recovered Metal |

Payable Metal |

Revenue %a |

Palladium |

2,266 koz |

2,122 koz |

58 |

Copper |

548 Mlbs |

517 Mlbs |

29 |

Platinum |

607 koz |

485 koz |

7 |

Gold |

204 koz |

158 koz |

4 |

Silver |

4,529 koz |

3,156 koz |

1 |

Notes: a Excludes the impact of the WPM PMPA on gold and platinum revenues. |

|||

Mining

The Company will mine using conventional open pit, truck and shovel operating methods. Three open pits will be mined over the 12.5-year operating mine life, with an additional two years of pre-production mining to be undertaken where waste material is being mined for construction and ore stockpiling ahead of process plant commissioning. The mining equipment fleet is to be owner-operated and will include outsourcing of certain support activities such as explosives manufacturing and blasting. Production drilling and mining operations will take place on a 10 m bench height. The primary loading equipment will consist of 660 tonne hydraulic face shovels (29 m3 bucket size) and large front-end wheel loader (19 m3 bucket size). The loading fleet is matched with a fleet of 246 tonne haulage trucks. A fleet of 90 and 45 tonne excavators will be used to excavate the limited volume of overburden material and will also be allocated to mining the narrow-thickness ore zones, mainly associated with the W-Horizon in the

Peak mining production will be 43 Mt per year (118,000 tonnes per day (“t/d”)). Total material moved over the LOM is expected to be 460 Mt of which

The Marathon Deposit is well defined and characterized by ore outcropping on surface, with wide and moderately dipping mineralized zones.

The open pit operation includes a waste rock dump immediately to the east of the open pits and an ore stockpile (peak capacity of approximately 10 Mt) to the west of the pits, proximal to the crusher location.

Processing

The 2023 FS outlines the process plant throughput starting at 9.2 Mt per year (25,200 t/d) and increasing to 10.1 Mt per year (27,700 t/d) following the completion of the powerline upgrade scheduled year two of operations. The increase in process plant throughput is possible with the inclusion of the Hycroft mills in the plant design. The process plant will produce a copper-palladium concentrate (“Cu-PGM concentrate”).

The process plant flowsheet includes a conventional comminution circuit consisting of a SAG mill, followed by a ball mill (an “SAB” circuit). With the added capacity of the Hycroft mills, the pebble crusher (included in the 2021 FS) is no longer required. The flotation portion of the process plant includes rougher flotation, concentrate regrind and three stages of cleaning.

The process plant metallurgical recovery (at the average head grade) is estimated at an average of

The flotation circuit design was revised to replace the Direct Flotation Reactors previously included in the 2021 FS with conventional open tank cells for the roughers followed by Woodgrove Staged Flotation Reactors™ for the cleaning circuit. Concentrate thickening, concentrate filtering, tailings thickening, water management and a TSF complete the flowsheet.

Site Infrastructure

The existing regional infrastructure in the area of the Project is well established and will allow for the efficient logistics associated with Project execution and operations, including the movement of the Cu-PGM concentrate to a third-party off-site smelter.

All site infrastructure facilities, including the roads and access, process plant buildings, workshops, warehouse, administrative buildings, water treatment plants, explosives plant, communication systems, power and power transmission line required for the Project during construction and operation have been considered in the Project design. Off-site infrastructure (including transload concentrate facility, assay lab and accommodation units) required to support the operation have also been included.

The TSF design includes downstream constructed embankments using run-of-mine waste rockfill with embankments founded directly on bedrock. The majority of the TSF area consists of exposed bedrock with a thin intermittent layer of sand and gravel. The upstream face of the embankments includes an HDPE Geomembrane to minimize seepage. The construction methodology includes bulk material placement with the mining fleet. Associated with the TSF are separate water management facilities which will ensure the protection of the environment.

Between 2007 and 2022, there have been 10 geotechnical site investigation (“SI”) programs completed. The SI programs have focused on TSF foundation conditions and location of key site infrastructure, including the most recent drilling which focused on the process plant site, crusher, mine rock storage area and water management structures foundations. The recent and historical SI programs along with the 2021 detailed LiDAR™ topography and imagery survey have resulted in a good understanding of the geotechnical conditions for the Project.

Capital and Operating Cost Summary

Construction Indirect costs and General and Owner’s costs are related to the expenses other than direct equipment purchases and direct construction costs.

Sustaining Capital items include future equipment purchases and replacements for the mining fleet and other site support equipment, the progressive build of the TSF over the LOM, and on and off-site infrastructure development to support the growth and contribute to operational improvements following initial construction.

The current capital cost estimate for the initial construction and the sustaining capital required during the LOM are shown in the table below. As noted above, this estimate represents a

Capital Costsa |

Initial ($M) |

Sustaining ($M) |

Total ($M) |

Mining and Surface Equipment |

117 |

130 |

247 |

Process Plant |

345 |

3 |

348 |

Infrastructure |

72 |

94 |

166 |

TSF, Water Management and Earthworks |

95 |

198 |

293 |

General and Owner’s Costs |

31 |

- |

31 |

Construction Indirects |

197 |

- |

197 |

Pre-production, Start-up and Commissioning |

159 |

- |

159 |

Contingencyb |

97 |

- |

97 |

Sub-Total |

1,112 |

424 |

1,537 |

Equipment Financing adjustment |

(58) |

- |

(58) |

Pre-Production Revenue |

(156) |

- |

(156) |

Total Capital (adjusted) |

898 |

424 |

1,322 |

Notes: a Sums in the table may not total due to rounding.

b Contingency included at project sub-category basis and totals approximately |

|||

Operating Costs and AISC (LOM) |

$ M |

US$/oz PdEq |

Mining |

1,432 |

300 |

Process Plant |

1,087 |

228 |

General & Administration |

334 |

70 |

Concentrate Transport Costs |

230 |

48 |

Treatment & Refining Charges |

286 |

60 |

Royalties |

12 |

2 |

Total Operating Cost |

3,381 |

709 |

Closure & Reclamation |

72 |

15 |

Sustaining Capital |

424 |

89 |

All-in Sustaining Cost (AISC) |

3,878 |

813 |

Economic Analysis

The economic analysis is carried out in real terms (i.e., without inflation factors) in Q4 2022 Canadian Dollars without any project financing but inclusive of the WPM PMPA, and anticipated financing of mobile equipment and closure bonding.

To provide a better understanding of the economic impact of the WPM PMPA to the overall economics of the Project, the economic analysis is shown below including the economic impact of the WPM PMPA (as required under the National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and excluding the economic impact of the WPM PMPA.

The economic analysis does not take into account any potential economic benefits which the

ECONOMIC ANALYSIS |

UNITS |

INCLUDING WPM PMPA |

EXCLUDING WPM PMPA |

Pre-tax Undiscounted Cash Flow |

$M |

3,387 |

3,780 |

Pre-tax NPV ( |

$M |

1,798 |

1,979 |

Pre-tax IRR |

% |

31.9 |

29.8 |

Pre-tax Payback |

years |

2.0 |

2.3 |

After-tax Undiscounted Cash Flow |

$M |

2,285 |

2,562 |

After-tax NPV ( |

$M |

1,164 |

1,285 |

After-tax IRR |

% |

25.8 |

24.2 |

After-tax Payback |

years |

2.3 |

2.5 |

Sensitivities

The Project has significant leverage to palladium and copper prices. The after-tax valuation sensitivities for the key metrics are shown below.

Palladium Price US$/oz |

1,400 |

1,600 |

1,700 |

1,800 |

1,900 |

2,000 |

2,200 |

NPV6% ($M) |

696 |

930 |

1,047 |

1,164 |

1,282 |

1,400 |

1,634 |

Payback (yrs) |

3.3 |

2.9 |

2.5 |

2.3 |

2.2 |

2.0 |

1.9 |

IRR (%) |

18.5 |

22.3 |

24.0 |

25.8 |

27.5 |

29.1 |

32.3 |

Copper Price US$/lb |

2.50 |

3.00 |

3.50 |

3.70 |

3.90 |

4.50 |

5.00 |

NPV6% ($M) |

836 |

972 |

1,109 |

1,164 |

1,219 |

1,386 |

1,522 |

Payback (yrs) |

3.0 |

2.6 |

2.4 |

2.3 |

2.2 |

2.0 |

1.9 |

IRR (%) |

21.1 |

23.1 |

25.0 |

25.8 |

26.5 |

28.7 |

30.4 |

After-Tax Results |

OPEX Sensitivity |

||||

+ |

+ |

|

- |

- |

|

NPV |

1,031 |

1,085 |

1,164 |

1,274 |

1,411 |

Payback (yrs) |

2.7 |

2.5 |

2.3 |

2.1 |

2.0 |

IRR (%) |

23.4 |

24.4 |

25.8 |

27.4 |

29.2 |

After-Tax Results |

CAPEX Sensitivity |

||||

+ |

+ |

|

- |

- |

|

NPV |

932 |

1,048 |

1,164 |

1,281 |

1,397 |

Payback (yrs) |

3.3 |

3.0 |

2.3 |

1.9 |

1.3 |

IRR (%) |

18.4 |

21.6 |

25.8 |

31.6 |

40.1 |

Discount Rate Sensitivity (%) |

NPV (After-Tax) ($M) |

|

Foreign Exchange Rate C$:US$ |

NPV (After-Tax) ($M) |

0 |

2,285 |

1.25 |

928 |

|

5 |

1,303 |

1.30 |

1,046 |

|

6 |

1,164 |

1.35 |

1,164 |

|

8 |

925 |

1.40 |

1,284 |

|

10 |

731 |

1.45 |

1,403 |

Fuel Price Sensitivity (C$/litre) |

NPV (After-Tax) ($M) |

|

Power Price Sensitivity ($/kWhr) |

NPV (After-Tax) ($M) |

0.90 |

1,197 |

0.05 |

1,207 |

|

1.00 |

1,185 |

0.06 |

1,186 |

|

1.10 |

1,173 |

0.07 |

1,164 |

|

1.17 |

1,164 |

0.08 |

1,143 |

|

1.30 |

1,148 |

0.09 |

1,121 |

|

1.40 |

1,136 |

0.10 |

1,100 |

Mineral Resources

The Mineral Resource Estimate below is for the combined Marathon, Geordie and Sally deposits. The Mineral Resource Estimates for Geordie and Sally were prepared by P&E. The Mineral Resource Estimate for Marathon was prepared by Gen Mining and reviewed by P&E.

Pit Constrained Combined Mineral Resource Estimate a-jfor the Marathon, Geordie and Sally Deposits (Effective date

Mineral

Classification |

Tonnes |

Pd |

Cu |

Pt |

Au |

Ag |

|||||

k |

g/t |

koz |

% |

M lbs |

g/t |

koz |

g/t |

koz |

g/t |

koz |

|

Marathon Deposit |

|||||||||||

Measured |

158,682 |

0.60 |

3,077 |

0.20 |

712 |

0.19 |

995 |

0.07 |

359 |

1.75 |

8,939 |

Indicated |

29,905 |

0.43 |

412 |

0.19 |

124 |

0.14 |

136 |

0.06 |

59 |

1.64 |

1,575 |

Meas. + Ind. |

188,587 |

0.58 |

3,489 |

0.20 |

836 |

0.19 |

1131 |

0.07 |

418 |

1.73 |

10,514 |

Inferred |

1,662 |

0.37 |

20 |

0.16 |

6 |

0.14 |

7 |

0.07 |

4 |

1.25 |

67 |

Geordie Deposit |

|||||||||||

Indicated |

17,268 |

0.56 |

312 |

0.35 |

133 |

0.04 |

20 |

0.05 |

25 |

2.4 |

1,351 |

Inferred |

12,899 |

0.51 |

212 |

0.28 |

80 |

0.03 |

12 |

0.03 |

14 |

2.4 |

982 |

Sally Deposit |

|||||||||||

Indicated |

24,801 |

0.35 |

278 |

0.17 |

93 |

0.2 |

160 |

0.07 |

56 |

0.7 |

567 |

Inferred |

14,019 |

0.28 |

124 |

0.19 |

57 |

0.15 |

70 |

0.05 |

24 |

0.6 |

280 |

|

|||||||||||

Measured |

158,682 |

0.60 |

3,077 |

0.20 |

712 |

0.19 |

995 |

0.07 |

359 |

1.75 |

8,939 |

Indicated |

71,974 |

0.43 |

1,002 |

0.22 |

350 |

0.14 |

316 |

0.06 |

140 |

1.5 |

3,493 |

Meas. + Ind. |

230,656 |

0.55 |

4,079 |

0.21 |

1,062 |

0.18 |

1,311 |

0.07 |

499 |

1.67 |

12,432 |

Inferred |

28,580 |

0.39 |

356 |

0.23 |

143 |

0.1 |

89 |

0.04 |

42 |

1.45 |

1,329 |

Notes:

|

|||||||||||

Mineral Reserves

The Mineral Reserve estimate for the Project includes only the Marathon Deposit. The Mineral Reserve Estimate was prepared by GMS.

Marathon Project Open Pit Mineral Reserve Estimatesa-i

(Effective Date of

Mineral Reserves |

Tonnes |

Pd |

Cu |

Pt |

Au |

Ag |

|||||

kt |

g/t |

koz |

% |

M lb |

g/t |

koz |

g/t |

koz |

g/t |

koz |

|

Proven |

114,798 |

0.65 |

2,382 |

0.21 |

530 |

0.20 |

744 |

0.07 |

259 |

1.68 |

6,191 |

Probable |

12,863 |

0.47 |

193 |

0.20 |

55 |

0.15 |

61 |

0.06 |

26 |

1.53 |

635 |

P & P |

127,662 |

0.63 |

2,575 |

0.21 |

586 |

0.20 |

806 |

0.07 |

285 |

1.66 |

6,825 |

Note:

|

|||||||||||

Community, Environment and Permitting

The Environmental Assessment for the Project was approved on

As of the effective date of this Feasibility Study, the Project is in the process of obtaining various federal, provincial and municipal permits, approvals and licenses required to construct and operate the Project.

A total of 16 Indigenous groups were identified by the Crown (

The Project is situated within the geographic territory of the Robinson Superior Treaty area. It is also within lands claimed by BN as its asserted exclusive Aboriginal Title territory. In

Qualified Persons

The news release has been reviewed and approved by

The Technical Report was prepared through the collaboration of the following consulting firms and Qualified Persons:

|

Primary Area of Responsibility |

Qualified Persons |

|

Overall integration, Mineral Reserve Estimate, mining methods, concentrate logistics, economic analysis, operating costs pertaining to mining and G&A |

|

|

Infrastructure, and power capital cost estimates, and project execution plan and schedule |

|

|

Recovery methods, processing plant capital and operating cost |

|

Knight Piésold Ltd. |

Tailings Storage Facility, water balance, geotechnical studies (mine rock storage piles, open pit and local infrastructure and foundations) |

|

|

Property description and location, accessibility, history, geological setting and mineralization, deposit types, exploration, drilling, sample preparation and security, data verification, and Mineral Resource Estimates and adjacent properties |

|

NI 43-101 Technical Report

Gen Mining plans to file the Feasibility Study as an NI 43-101 Technical Report on

About the Company

Gen Mining’s focus is the development of the

Non-IFRS Financial Measures

The Company has included certain non-IFRS financial measures in this news release such as initial capital cost, cash operating costs and AISC per palladium equivalent ounce (“PdEq”), unit operating costs, and Free Cash Flow, which are not measures recognized under IFRS and do not have a standardized meaning prescribed by IFRS. For the reconciliation of cash costs and AISC, on both a per tonne and PdEq basis, please see the table set forth in the Capital and Operating Cost Summary above. Non-IFRS measures do not have any standardized meaning prescribed under IFRS, and therefore, they may not be comparable to similar measures employed by other companies. The data presented is intended to provide additional information and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. These measures do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers.

-

Initial Capital includes all costs incurred from the Effective Date (excluding historical sunk costs) until the point where commercial production is achieved, including expenses related to engineering, equipment purchase and installation, process plant and mine infrastructure construction, and any other costs associated with putting the Project into operations. -

Initial Capital (Adjusted) includes all costs mentioned above in addition to adjustments for pre-commercial production revenue and equipment financing (net of payments, interest and fees incurred prior to commercial production). - Operating Costs include mining, processing, general and administrative and other, concentrate transportation costs, treatment and refining charges, and royalties. Costs related to the Wheaton PMPA are excluded.

- AISC include Operating Costs, closure, and reclamation and sustaining capital. For the full reconciliation of cash costs and AISC, please see the Capital and Operating Cost Summary set out above.

- LOM Average AISC includes LOM AISC divided by LOM PdEq.

- LOM Average Operating Cost includes LOM Operating Costs divided by LOM PdEq.

- Free Cash Flow includes total revenue less Operating Costs, working capital adjustments, equipment financing, initial capital, sustaining capital and closure costs

-

Palladium Equivalent ounces uses the formula PdEq oz = Pd oz +(Cu lb x

3.7 US$ /lb + Pt oz xUS /oz + Au oz x$100 0US /oz + Ag oz x$180 0US /oz) /$22.5 US Pd/oz. The grades used are the average grades of the respective metals over the LOM.$180 0

Information Concerning Estimates of Mineral Reserves and Resources

The Mineral Reserve and Mineral Resource estimates in this press release have been disclosed in accordance with NI 43-101, which differs from the requirements of the

The

Mineral Resources are not Mineral Reserves, and do not have demonstrated economic viability, but do have reasonable prospects for economic extraction. Measured and Indicated Mineral Resources are sufficiently well defined to allow geological and grade continuity to be reasonably assumed and permit the application of technical and economic parameters in assessing the economic viability of the Mineral Resource. Inferred Mineral Resources are estimated on limited information not sufficient to verify geological and grade continuity or to allow technical and economic parameters to be applied. Inferred Mineral Resources are too speculative geologically to have economic considerations applied to them to enable them to be categorized as Mineral Reserves. There is no certainty that Mineral Resources of any classification can be upgraded to Mineral Reserves through continued exploration.

The Company’s Mineral Reserve and Mineral Resource figures are estimates and the Company can provide no assurances that the indicated levels of mineral will be produced or that the Company will receive the price assumed in determining its Mineral Reserves. Such estimates are expressions of judgment based on knowledge, mining experience, analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. While the Company believes that these Mineral Reserve and Mineral Resource Estimates are well established and the best estimates of the Company’s management, by their nature Mineral Reserve and Mineral Resource Estimates are imprecise and depend, to a certain extent, upon analysis of drilling results and statistical inferences which may ultimately prove unreliable. If the Company’s Mineral Reserve or Mineral Reserve Estimates are inaccurate or are reduced in the future, this could have an adverse impact on the Company’s future cash flows, earnings, results or operations and financial condition.

The Company estimates the future mine life of the

Forward-Looking Information

This news release contains certain forward-looking information and forward-looking statements, as defined in applicable securities laws (collectively referred to herein as "forward-looking statements"). Forward-looking statements reflect current expectations or beliefs regarding future events or the Company’s future performance. All statements other than statements of historical fact are forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "continues", "forecasts", "Projects", "predicts", "intends", "anticipates", "targets" or "believes", or variations of, or the negatives of, such words and phrases or state that certain actions, events or results "may", "could", "would", "should", "might" or "will" be taken, occur or be achieved, including statements related to mineral resource and reserve estimates, proposed mine production plans, projected mining and process recovery rates (including mining dilution), estimates related closure costs and requirements, metal price and other economic assumptions (including currency exchange rates), projected capital and operating costs, and AISC, economic analysis estimates (including cash flow forecasts, IRRs and NPVs) and mine life.

Although the Company believes that the expectations expressed in such statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the statements. There are certain factors that could cause actual results to differ materially from those in the forward-looking information. These include the timing for a construction decision; the progress of development at the

Forward-looking statements are based on a number of assumptions which may prove to be incorrect, including, but not limited to, assumptions relating to: the availability of financing for the Company’s operations; operating and capital costs; results of operations; the mine development and production schedule and related costs; the supply and demand for, and the level and volatility of commodity prices; timing of the receipt of regulatory and governmental approvals for development Projects and other operations; the accuracy of Mineral Reserve and Mineral Resource Estimates, production estimates and capital and operating cost estimates; and general business and economic conditions.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking information. For more information on the Company, investors are encouraged to review the Company’s public filings on SEDAR at www.sedar.com. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

______________________________

1 Unless otherwise noted, the economic analysis includes the impacts of the WPM PMPA on the project cash flows.

2 The initial capital cost excludes the receipt of any deposits delivered under the WPM PMPA. However, such despots are included in the economic analysis used to determine expected cash flows, which are used to calculate NPVs, IRRs and Payback Period.

3 Refer to “Non-IFRS Measures” section.

4 See News Release from

5 30-days achieving

View source version on businesswire.com: https://www.businesswire.com/news/home/20230330005863/en/

President and Chief Executive Officer

(416) 640-2934 (O)

(416) 567-2440 (M)

jlevy@genmining.com

Vice President, Investor Relations

(416) 640-2954 (O)

(416) 357-5511 (M)

awilkinson@genmining.com

Source: