Generation Extends Biiwobik Zone by 150 m, intersects 8.0 m of 3.06% CuEq 350 m north of Marathon Deposit

- Positive: Results from the Biiwobik drilling program show a substantial step-out of 150 meters from previous drilling, indicating an increase in overall copper grade in the northern direction. The mineralization extends approximately 450 meters north of the Marathon deposit Mineral Resource, confirming the deposit is open to the north and at depth. Higher copper mineralization zones are successfully identified, supporting the model for back-draining and settling of massive sulphides in a feeder conduit setting.

- Positive: Significant intercepts in the first phase of drilling include 8.0 meters of 3.06% CuEq within a broader 30-meter interval grading 1.33% CuEq in MB-24-058, and additional mineralization styles in other drill holes such as oxide cumulates and massive sulphides. These results provide valuable data for further exploration and potential resource expansion.

- Positive: The company's multi-phased exploration program targets copper-dominant and higher-grade PGM prospects within its vast land package, indicating a strategic approach to maximizing the resource potential. The confidence in the drilling results and the plan to extend the mineralization zone bode well for future resource estimation and project development.

- Positive: Quality assurance and quality control protocols for the drilling assay program are robust, maintaining consistency and reliability in the data obtained. The use of duplicates, blanks, standards, and stringent sampling intervals ensures the accuracy and integrity of the results, enhancing the credibility of the exploration findings.

- None.

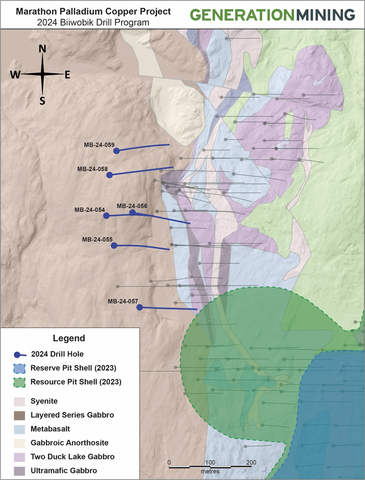

Figure 1: Plan view of Biiwobik Prospect, showing location of 2024 drilling. (Graphic: Business Wire)

Results from the first phase of drilling have returned positive results including 8.0 metres of

Additional drill holes from this program such as MB-24-054 encountered a variety of mineralization styles including 34 metres of oxide cumulates grading up to 1.37 g/t Pd,

Jamie Levy, President and CEO says, “This is a great start to the drill program. We were anticipating that the Biiwobik zone drilling would give us an improved understanding of the potential to extend the current pit included in our Feasibility Study into this area and potentially increasing mine life and average copper grade. These significant intercepts mark a substantial step-out of 150 metres from previous drilling and indicates that the overall copper grade appears to increase in this direction.”

These holes at the Biiwobik zone effectively extend the mineralization approximately 450 metres north of the Marathon deposit Mineral Resource and confirm that the deposit is open to the north and at depth. The results also confirm that zones of higher copper mineralization are present and can be successfully identified. Further drilling programs will aim at extending this zone, with the possibility of adding an Inferred Mineral Resource in the future with additional drilling success. The company is confident, that the addition of these six drill holes at Biiwobik will assist in better understanding the northern extension of the deposit.

Table 1: Summary of results from phase one of the 2024 Biiwobik drill program

HoleID* |

From |

To |

Length (m) |

Cu (%) |

Pd (g/t) |

Pt (g/t) |

Au (g/t) |

Ag (g/t) |

CuEq*** (%) |

PdEq** (g/t) |

MB-24-054 |

240 |

256 |

16 |

0.08 |

0.33 |

0.08 |

0.04 |

0.39 |

0.38 |

0.56 |

and |

262 |

296 |

34 |

0.11 |

1.02 |

0.17 |

0.08 |

0.29 |

0.96 |

1.41 |

including |

262 |

282 |

20 |

0.13 |

1.37 |

0.23 |

0.1 |

0.33 |

1.27 |

1.85 |

and |

374 |

385 |

11 |

0.39 |

0.50 |

0.09 |

0.04 |

2.25 |

0.84 |

1.22 |

and |

388 |

416 |

28 |

0.34 |

0.49 |

0.13 |

0.05 |

1.36 |

0.80 |

1.17 |

and |

436 |

450 |

14 |

0.33 |

0.77 |

0.21 |

0.05 |

1.36 |

1.02 |

1.49 |

Including |

440 |

450 |

10 |

0.38 |

0.93 |

0.26 |

0.05 |

1.53 |

1.21 |

1.76 |

MB-24-055 |

172 |

198 |

26 |

0.07 |

0.16 |

0.08 |

0.04 |

0.4 |

0.26 |

0.38 |

and |

242 |

272 |

30 |

0.11 |

0.31 |

0.08 |

0.05 |

0.6 |

0.41 |

0.60 |

including |

242 |

262 |

20 |

0.04 |

0.42 |

0.1 |

0.05 |

0.26 |

0.42 |

0.62 |

and |

262 |

272 |

10 |

0.25 |

0.09 |

0.03 |

0.04 |

1.28 |

0.37 |

0.55 |

and |

378 |

384 |

6 |

0.15 |

0.26 |

0.1 |

0.06 |

0.6 |

0.43 |

0.64 |

and |

402 |

430 |

28 |

0.11 |

0.34 |

0.1 |

0.03 |

0.46 |

0.42 |

0.62 |

MB-24-056 |

168 |

174 |

6 |

0.12 |

0.5 |

0.14 |

0.08 |

0.5 |

0.60 |

0.88 |

and |

194 |

212 |

18 |

0.07 |

0.33 |

0.07 |

0.03 |

0.4 |

0.36 |

0.53 |

and |

422 |

428 |

6 |

0.19 |

0.39 |

0.12 |

0.05 |

1.87 |

0.58 |

0.85 |

MB-24-057 |

164 |

188 |

24 |

0.03 |

0.32 |

0.09 |

0.03 |

0.11 |

0.32 |

0.47 |

and |

362 |

378 |

16 |

0.3 |

0.68 |

0.15 |

0.07 |

1.97 |

0.92 |

1.35 |

MB-24-058 |

194 |

208 |

14 |

0.11 |

0.62 |

0.2 |

0.07 |

0.67 |

0.70 |

1.02 |

including |

198 |

208 |

10 |

0.13 |

0.77 |

0.23 |

0.08 |

0.76 |

0.85 |

1.24 |

and |

348 |

378 |

30 |

0.41 |

1.02 |

0.24 |

0.1 |

1.88 |

1.33 |

1.95 |

including |

364 |

372 |

8 |

0.85 |

2.48 |

0.57 |

0.22 |

4 |

3.06 |

4.47 |

and |

394 |

404 |

10 |

0.25 |

0.46 |

0.07 |

0.07 |

0.94 |

0.67 |

0.98 |

MB-24-059 |

216 |

250 |

34 |

0.05 |

0.4 |

0.14 |

0.08 |

0.19 |

0.46 |

0.68 |

including |

230 |

236 |

6 |

0.11 |

1.35 |

0.41 |

0.19 |

0.3 |

1.40 |

2.04 |

and |

324 |

346 |

22 |

0.19 |

0.9 |

0.19 |

0.08 |

0.89 |

0.98 |

1.43 |

including |

324 |

329 |

5 |

0.56 |

1.12 |

0.21 |

0.15 |

2.92 |

1.59 |

2.32 |

* Interval lengths of interceptions are assumed to be approximate to true width.

** The Palladium Equivalent (“PdEq”) calculation expressed in g/t is calculated as the sum of the theoretical in situ value of the constituent metals (Au + Pt + Pd + Cu + Ag) per tonne divided by the value of one gram of palladium. The calculation makes no provision for expected metal recoveries or smelter payables. USD per ounce commodity prices of

*** The Copper Equivalent (“CuEq”) calculation expressed in % is calculated as the sum of the theoretical in situ value of the constituent metals (Au + Pt + Pd + Cu + Ag) in one tonne sampled divided by the value of one percent of copper in such one tonne sample. The calculation makes no provision for expected metal recoveries or smelter payables. USD per ounce commodity prices of

As part of the initial phase of the Biiwobik program, a geophysical surveying crew have mobilized to site and will be completing borehole electromagnetic surveys on two of the six recently drilled holes. The goal of this program is to vector in on zones of higher grade disseminated to massive sulphides at depth which will be targeted during the next phase of drilling at Biiwobik.

See attached Figure 1: Plan view of Biiwobik Prospect, showing location of 2024 drilling.

See attached Figure 2: Long section looking east through the entire Biiwobik prospect, showing the notable intersections from the first phase of 2024 drilling.

Sally Deposit

The company is also pleased to announce that drilling is underway at its Sally deposit, on a single 1000 metre drillhole where a 2019 borehole electromagnetic survey and subsequent magnetotelluric survey carried out in 2020 indicate the presence of a large untested conductor occurring between 600-900 meters depth. Results from this program will be released in the coming months.

Four Dams

Upon completion of drilling at the Sally deposit, drilling will immediately commence on multiple targets at the company’s Four Dams prospect. The primary target at Four Dams is a 250-metre-wide by 60-metre-thick ultramafic pipe where drilling by previous operators has indicated a prospective environment for the settling of high grade massive sulphides at depth (see news release dated March 7th, 2024).

Property Map and 2024 Exploration Areas

See attached Figure 3: Map of Marathon Palladium project showing locations of 2024 exploration programs.

Quality Assurance/Quality Control

Quality assurance and quality control protocols for the 2024 drilling assay program were unchanged from previous years and involve a rotating inclusion of one duplicate, blank, low-grade standard and high-grade standard every 15 samples. All controls are checked to be within a working limit of 2 standard deviations. Sample intervals are selected in 1 m or 2 m lengths dependent on the nature of the mineralized zone. The core samples are split on site using a diamond saw where half of the core is sent for analysis and the other half is securely stored on site for future reference. All samples are shipped to the ALS Global laboratory in

About Generation Mining Limited

Gen Mining’s focus is the development of the Marathon Project, a large undeveloped palladium-copper deposit in

The Feasibility Study Update estimated a Net Present Value (using a

The Marathon Property covers a land package of approximately 26,000 hectares, or 260 square kilometres. Gen Mining owns a

Qualified Person

The scientific and technical content of this news release, including the sampling, analytical and test data underlying the technical content, was reviewed, verified, and approved by Mauro Bassotti, P.Geo, Vice President Geology of the Company, and a Qualified Person as defined by Canadian Securities Administrators’ National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Forward-Looking Information

This news release contains certain forward-looking information and forward-looking statements, as defined in applicable securities laws (collectively referred to herein as "forward-looking statements"). Forward-looking statements reflect current expectations or beliefs regarding future events or the Company’s future performance. All statements other than statements of historical fact are forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "continues", "forecasts", "projects”, “predicts”, “intends”, “anticipates”, “targets” or “believes”, or variations of, or the negatives of, such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “should”, “might” or “will” be taken, occur or be achieved, including statements relating to the final location and depth of drill holes, surveys and targets; the ability of the current or future exploration programs to extend feeder zones, target higher grade mineralization, extend mine life, expand or alter potential mine pit designs; the possibility of future drilling adding to an inferred mineral resource or increasing potential metal grades in reserves or resources; and the anticipated life of mine; mineral production estimates, payback period, and financial returns from the Marathon Project.

Although the Company believes that the expectations expressed in such statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the statements. There are certain factors that could cause actual results to differ materially from those in the forward-looking information. These include the timing for a construction decision; the progress of development at the Marathon Project, including progress of project expenditures and contracting processes, the Company’s plans and expectations with respect to liquidity management, continued availability of capital and financing, the future price of palladium and other commodities, permitting timelines, exchange rates and currency fluctuations, increases in costs, requirements for additional capital, and the Company’s decisions with respect to capital allocation, and the impact of COVID-19, inflation, global supply chain disruptions, global conflicts, including the wars in

Exploration results that include geophysics, sampling, and drill results on wide spacings may not be indicative of the occurrence of a mineral deposit. Such results do not provide assurance that further work will establish sufficient grade, continuity, metallurgical characteristics and economic potential to be classed as a category of mineral resource. Forward-looking statements are based on a number of assumptions which may prove to be incorrect, including, but not limited to, assumptions relating to: the availability of financing for the Company’s operations; operating and capital costs; results of operations; the mine development and production schedule and related costs; the supply and demand for, and the level and volatility of commodity prices; timing of the receipt of regulatory and governmental approvals for development projects and other operations; the accuracy of Mineral Reserve and Mineral Resource Estimates, production estimates and capital and operating cost estimates; and general business and economic conditions.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking information. For more information on the Company, investors are encouraged to review the Company’s public filings on SEDAR+ at www.sedarplus.ca. The Company disclaims any intention or obligation to update or revise any forward- looking information, whether as a result of new information, future events or otherwise, other than as required by law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240423797602/en/

For further information:

Jamie Levy

President and Chief Executive Officer

(416) 640-2934 (O)

(416) 567-2440 (M)

jlevy@genmining.com

Source: Generation Mining Limited