Progressive Corporate News Update Drilling Tender, Directors, Financing, Marketing

Golden Dawn Minerals Inc. (GDMRD) announced ongoing corporate restructuring efforts, including potential board changes and a name change. The company aims to fully own the Phoenix Mine by completing a $1.7 million payment arrangement, with $750,000 paid so far. Upcoming drilling activities are planned on the Phoenix property following a successful airborne survey. Additionally, a $300,000 loan agreement has been finalized to support working capital and drilling activities at a 12% annual interest rate, along with 800,000 bonus shares for the lender.

- Successful completion of a $750,000 payment towards full ownership of the Phoenix Mine.

- Plans for drilling on promising targets after an encouraging airborne survey.

- Secured a $300,000 loan for working capital and drilling activities.

- Need to complete additional payments totaling $950,000 to own the Phoenix Mine fully.

- Potential risks associated with restructuring and reliance on future financing.

Insights

Analyzing...

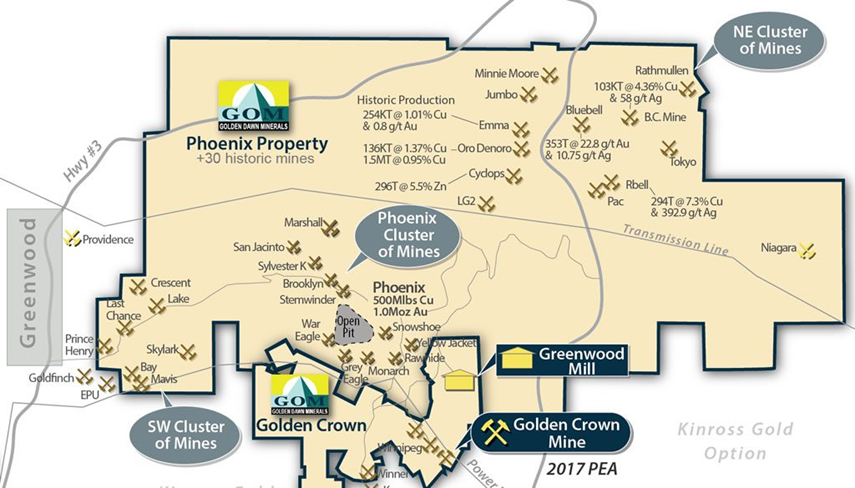

One of the Historic Past Producing Copper Mines

Phoenix Copper Gold Mine

Greenwood BC

VANCOUVER, BC / ACCESSWIRE / September 6, 2022 / Golden Dawn Minerals Inc., (TSXV:GOM | FRANKFURT:3G8C | OTC PINK:GDMRD), ("Golden Dawn" or the "Company"), is currently reviewing a corporate restructuring which may include the following, new directors joining the board, a name change, and a capital restructure. In addition, the Company's

The Company has recently completed an Airborne survey over the land package looking for the source of the former Phoenix Mine. The Company is extremely encouraged by the results and plans to start drilling the first target this month and is seeking tenders for the drilling contract.

The Company has also entered into a loan agreement with an arm's length accredited investor. The loan is in the amount of

On behalf of the Board of GOLDEN DAWN MINERALS INC.

Per: "Christopher R. Anderson"

Christopher R. Anderson

Chief Executive Officer

For further information, please contact:

Golden Dawn Minerals Inc. - Corporate Communications:

Tel: 604-221-8936

Email: Office@goldendawnminerals.com

Forward-Looking Statement Cautions:

This news release contains certain "forward-looking statements" within the meaning of Canadian securities legislation, relating to, among other things, preliminary plans for a consolidation of the Company's Shares. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts; they are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "aims," "potential," "goal," "objective," "prospective," and similar expressions, or that events or conditions "will," "would," "may," "can," "could" or "should" occur, or are those statements, which, by their nature, refer to future events. The Company cautions that forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made and they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include the possibility that the TSX Venture Exchange will not approve the proposed share consolidation, and that the Company may not be able to raise sufficient additional capital to continue its business. The reader is urged to refer to the Company's reports, publicly available through the Canadian Securities Administrators' System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com for a more complete discussion of such risk factors and their potential effects.

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of securities of the Company in any jurisdiction in which such offer, solicitation or sale would be unlawful, including any of the securities in the United States of America. The Company's securities have not been and will not be registered under the United States Securities Act of 1933 (the "1933 Act") or any state securities laws and may not be offered or sold within the United States or to, or for account or benefit of, U.S. Persons (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

THIS PRESS RELEASE DOES NOT CONSTITUTE AN OFFER TO SELL, OR THE SOLICITATION OF AN OFFER TO BUY, NOR SHALL THERE BE ANY SALE OF SECURITIES OF THE COMPANY IN ANY JURISDICTION IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE SECURITIES LAWS OF ANY SUCH JURISDICTION.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

SOURCE: Golden Dawn Minerals Inc.

View source version on accesswire.com:

https://www.accesswire.com/714858/Progressive-Corporate-News-Update-Drilling-Tender-Directors-Financing-Marketing