Granite Creek Copper Announces 2024 Exploration Program at Carmacks Project in Yukon, Canada

Granite Creek Copper announces its 2024 exploration program for the Carmacks copper-gold project in Yukon, Canada. The 2024 field program involves up to 1800 meters of diamond drilling focused on new targets, including the Gap, Sour Toe, and Zone 1213 targets, refined by IP surveys, trenching, and soil sampling. The project spans 177 sq km and contains 824 Mlbs Measured and Indicated and 29 Mlbs Inferred copper equivalent metal. Additionally, the company seeks to extend the expiry date of certain warrants and has granted 1.29 million stock options to its team.

- Granite Creek Copper has announced an extensive 2024 exploration program involving up to 1800 meters of diamond drilling.

- The Carmacks project hosts significant resources: 824 Mlbs Measured and Indicated and 29 Mlbs Inferred copper equivalent metal.

- The project benefits from infrastructure improvements, being located along the Freegold Road and within 20 km of the Yukon grid.

- Positive recent price action in copper and gold has increased interest in the sector, potentially boosting shareholder value.

- The company has applied for TSX Venture Exchange approval to extend the expiry dates of certain warrants, potentially increasing investor confidence.

- Granite Creek has granted 1.29 million stock options to directors, officers, employees, and consultants, which could align their interests with those of shareholders.

- The warrants issued have a low exercise price of $0.075, which might lead to significant dilution if exercised.

- The exploration targets, including the Gap and Sour Toe targets, are still in the early stages of exploration, presenting inherent risks and uncertainties.

- The need for TSX Venture Exchange approval for warrant extension and option grants indicates dependency on regulatory approval, which carries uncertainty.

- The exploration relies heavily on the successful application of IP surveys and geophysical models, which may not always accurately predict mineralization.

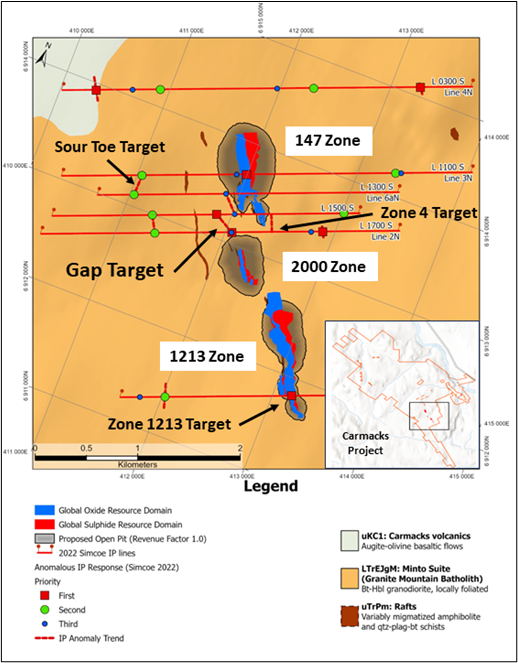

VANCOUVER, BC / ACCESSWIRE / May 28, 2024 / Granite Creek Copper Ltd. (TSXV:GCX)(OTCQB:GCXXF) ("Granite Creek" or the "Company") is pleased to announce exploration plans for the Company's wholly owned Carmacks copper-gold project located in central Yukon, Canada, within the traditional territory of the Little Salmon/Carmacks First Nation. The 2024 field program is expected to include up to 1800 meters of diamond drilling focused on new targets within 1 kilometre of the proposed pits identified by the 2021 Preliminary Economic Assessment ("PEA"). The Gap, Sour Toe and Zone 1213 targets (see Figure 1) were refined by Induced Polarity ("IP") surveys, trenching and soil sampling.

Figure 1 - Target Location

The 177 sq km, Carmacks Project contains over 824 Mlbs Measured and Indicated and 29 Mlbs Inferred copper equivalent ("CuEq") metal within a National Instrument 43-101 compliant, high-grade resource of 36.2 million tonnes grading 1.07 % CuEq (

Gap Target

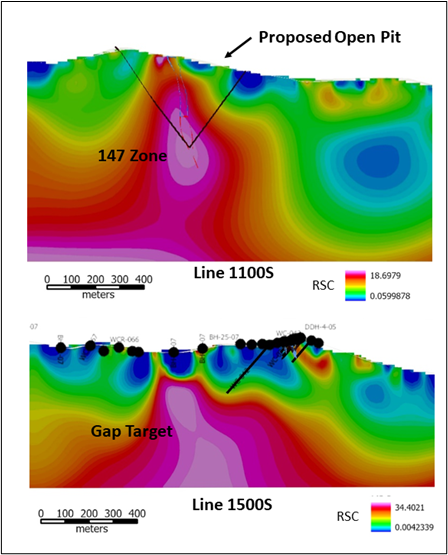

The Gap target lies between the 2000 and 147 zones and may represent a fault offset of either or both zones. The target area has only seen shallow drilling by previous operators and has no pierce points in the modeled geophysical volume. The target is characterised by an IP anomaly that is modeled using a Resistivity Scaled Chargeability ("RSC") technique where the ratio of resistivity to chargeability from IP readings over known mineralisation is adjusted until an RSC ratio that matches the known mineralisation is achieved. Once an RSC ratio is determined, the same ratio is applied to IP readings over new targets to identify areas with a similar signature. In this case, a survey over the well-defined 147 Zone established the RSC ratio over mineralisation, with the Gap Target exhibiting a response that is almost twice as strong as that of the 147 Zone.

Figure 2 - Gap Target IP Section

Note. Images cropped to highlight the similarities between known mineralisation at 147 Zone and Gap Zone Target

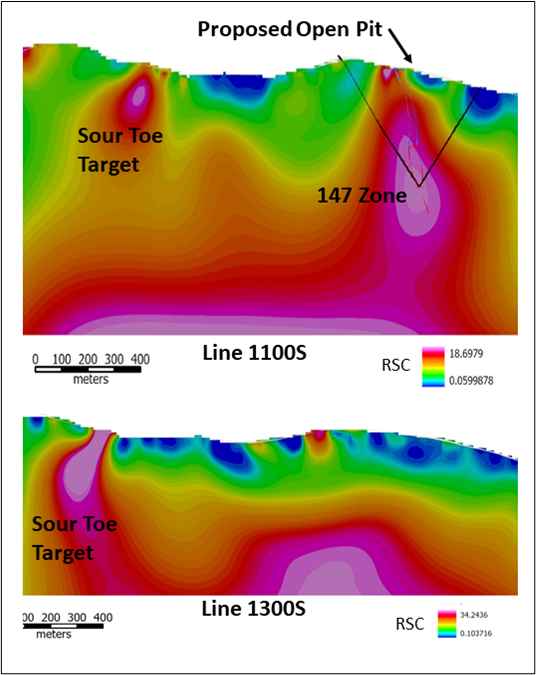

Sour Toe Target

The Sour Toe target is a new discovery located approximately 800 meters from the 147 zone. The target was discovered through an IP survey with potential confirmed through trenching and soil sampling. The target is seen across two IP lines giving the target a strike length greater than 200 meters.

Figure 3 - Sour Toe Target IP Section

Tim Johnson, President & CEO, stated, "We are very pleased to be launching this next phase of exploration and development of our Carmacks copper-gold-silver project. Recent positive price action in the metals, specifically copper and gold has brought new interest to the sector. This paired with the exploration upside at Carmacks creates the phenomenal opportunity to increase shareholder value."

Warrant Extension

Granite Creek further announces that the Company has applied for TSX Venture Exchange approval to extend the expiry date on certain warrants that are due to expire June 5 and June 11, 2024 (the "Warrants"). The Warrants, originally issued as part of a financing completed in June 2020 (see news release dated June 11, 2020), will, upon approval, have expiry dates of June 5 and June 11, 2025, respectively. Each Warrant entitles the holder to acquire one common share at an exercise price of CDN

Option Grant

Granite Creek also wishes to announce that, subject to TSX Venture Exchange approval, it has granted 1,290,000 incentive stock options to directors, officers, employees, and consultants of the Company, under its long-term incentive plan. The options are exercisable for up to five years, expiring on May 28, 2029, and each option will allow the holder to purchase one common share of the company at a price of

About Granite Creek Copper

Granite Creek Copper, a member of the Metallic Group of Companies, is focused on the exploration and development of critical minerals projects in North America. The Company's projects consist of its Carmacks project in the Minto copper district of Canada's Yukon Territory on trend with the formerly producing high-grade Minto copper-gold mine and the advanced stage LS molybdenum project and the Star copper-nickel-PGM project, both located in central British Columbia. More information about Granite Creek Copper can be viewed on the Company's website at www.gcxcopper.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Timothy Johnson, President & CEO

Telephone: 1 (604) 235-1982

Toll Free: 1 (888) 361-3494

Website: www.gcxcopper.com

Metallic Group: www.metallicgroup.ca

Qualified Person

Debbie James P.Geo, has reviewed and approved the technical information contained in this news release. Ms. James is a Qualified Person as defined in NI 43-101.

1Mineral Resources are reported within a conceptual constraining pit shell that includes the following input parameters: Metal prices of

Forward-Looking Statements

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Granite Creek Copper believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Granite Creek Copper and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Granite Creek Copper Ltd.

View the original press release on accesswire.com