Genesco Highlights Increased Share Price Driven By Strong Operational Performance

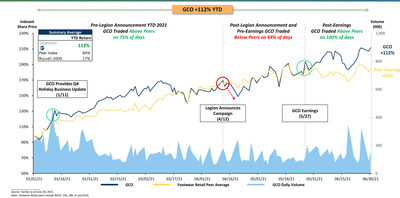

Genesco Inc. (NYSE: GCO) reported a remarkable 112% increase in share price year-to-date, surpassing both its peer index (84%) and the Russell 2000 (17%). The company attributed this surge to its successful footwear strategy and strong operational performance, despite claims by Legion Partners suggesting their involvement positively influenced the stock. Notably, Genesco's stock traded above peers consistently following their Q1 earnings announcement, while Legion's campaign correlated with a decline in stock performance. Shareholders are urged to support the company's director nominees by voting the BLUE proxy card.

- Share price increased by 112% year-to-date.

- Outperformed peer index (84%) and Russell 2000 (17%).

- Strong operational performance attributed to footwear strategy.

- Legion Partners' campaign negatively impacted stock performance during its launch.

- Stock traded below peer group on 64% of days during Legion's campaign.

Insights

Analyzing...

NASHVILLE, Tenn., July 1, 2021 /PRNewswire/ -- Genesco Inc. (NYSE: GCO) ("Genesco" or the "Company") today provided an update to highlight its increased share price resulting from the successful execution of its footwear focused strategy under the current Board and management team. Genesco's share price, outlined in the below indexed stock chart, has increased by

Following significant company announcements, including Genesco's report of holiday sales on January 11, 2021 and its Q1 earnings announcement on May 27, 2021, the Company's stock significantly outperformed its peers. Conversely, and contrary to Legion Partners' assertions that its involvement in Genesco had a positive impact on Genesco's share price, Legion's campaign, launched on April 12, 2021, in fact had a negative impact on Genesco's stock, causing the stock to underperform peers.

Since Genesco's Q1 earnings announcement through yesterday's close, Genesco's stock has traded above its peer group every single day. In the 2021 period leading up to Legion's campaign announcement, Genesco's stock traded above its peer group on

We believe the data is clear: Genesco's share price performance is driven by its operational performance, not by Legion's baseless and value-destructive campaign.

Genesco strongly urges shareholders to vote the BLUE proxy card FOR ALL the Company's highly qualified and experienced director nominees. Shareholders are reminded that their vote is important, no matter how many or how few shares they own. Voting the WHITE proxy card, even in protest, will revoke any previous proxy submitted using the BLUE proxy card. Only the latest-dated proxy counts.

Shareholders with questions, or need help voting their BLUE proxy card, may contact:

Innisfree M&A Incorporated

1 (877) 825-8772

(toll-free from the U.S. and Canada)

+1 (412) 232-3651

(from other locations)

About Genesco Inc.

Genesco Inc., a Nashville-based specialty retailer and branded company, sells footwear and accessories in more than 1,455 retail stores throughout the U.S., Canada, the United Kingdom and the Republic of Ireland, principally under the names Journeys, Journeys Kidz, Little Burgundy, Schuh, Schuh Kids, Johnston & Murphy, and on internet websites www.journeys.com, www.journeyskidz.com, www.journeys.ca, www.littleburgundyshoes.com, www.schuh.co.uk, www.johnstonmurphy.com, www.johnstonmurphy.ca, www.nashvilleshoewarehouse.com, and www.dockersshoes.com. In addition, Genesco sells footwear at wholesale under its Johnston & Murphy brand, the licensed Levi's brand, the licensed Dockers brand, the licensed Bass brand, and other brands. For more information on Genesco and its operating divisions, please visit www.genesco.com.

Forward-Looking Statements

This release contains forward-looking statements, including those regarding the performance outlook for the Company and all other statements not addressing solely historical facts or present conditions. Forward- looking statements are usually identified by or are associated with such words as "intend," "expect," "believe," "should," "anticipate," "optimistic" and similar terminology. Actual results could vary materially from the expectations reflected in these statements. A number of factors could cause differences. These include adjustments to projections reflected in forward-looking statements, including those resulting from the effects of COVID-19 on the Company's business, including COVID-19 case spikes in locations in which the Company operates, the roll-out of COVID-19 vaccines and the public's acceptance of the vaccines, additional stores closures due to COVID-19, the timing of the re-opening of our stores, the timing of in-person back-to-work and back-to-school and sales with respect thereto, weakness in store and shopping mall traffic, restrictions on operations imposed by government entities and/or landlords, changes in public safety and health requirements, and limitations on the Company's ability to adequately staff and operate stores. Differences from expectations could also result from stores closures and effects on the business as a result of civil disturbances; the level and timing of promotional activity necessary to maintain inventories at appropriate levels; the imposition of tariffs on product imported by the Company or its vendors as well as the ability and costs to move production of products in response to tariffs; the Company's ability to obtain from suppliers products that are in-demand on a timely basis and effectively manage disruptions in product supply or distribution, including disruptions as a result of COVID-19; unfavorable trends in fuel costs, foreign exchange rates, foreign labor and material costs, and other factors affecting the cost of products; the effects of the British decision to exit the European Union and other sources of market weakness in the U.K. and Republic of Ireland; the effectiveness of the Company's omni-channel initiatives; costs associated with changes in minimum wage and overtime requirements; wage pressure in the U.S. and the U.K.; weakness in the consumer economy and retail industry; competition and fashion trends in the Company's markets; risks related to the potential for terrorist events; risks related to public health and safety events; changes in buying patterns by significant wholesale customers; retained liabilities associated with divestitures of businesses including potential liabilities under leases as the prior tenant or as a guarantor; and changes in the timing of holidays or in the onset of seasonal weather affecting period-to-period sales comparisons. Additional factors that could cause differences from expectations include the ability to renew leases in existing stores and control or lower occupancy costs, and to conduct required remodeling or refurbishment on schedule and at expected expense levels; the Company's ability to realize anticipated cost savings, including rent savings; the Company's ability to achieve expected digital gains and gain market share; deterioration in the performance of individual businesses or of the Company's market value relative to its book value, resulting in impairments of fixed assets, operating lease right of use assets or intangible assets or other adverse financial consequences and the timing and amount of such impairments or other consequences; unexpected changes to the market for the Company's shares or for the retail sector in general; costs and reputational harm as a result of disruptions in the Company's business or information technology systems either by security breaches and incidents or by potential problems associated with the implementation of new or upgraded systems; the Company's ability to realize any anticipated tax benefits; and the cost and outcome of litigation, investigations and environmental matters involving the Company, and the impact of actions initiated by activist shareholders. Additional factors are cited in the "Risk Factors," "Legal Proceedings" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of, and elsewhere in, the Company's SEC filings, copies of which may be obtained from the SEC website, www.sec.gov, or by contacting the investor relations department of Genesco via the Company's website, www.genesco.com. Many of the factors that will determine the outcome of the subject matter of this release are beyond Genesco's ability to control or predict. Genesco undertakes no obligation to release publicly the results of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Forward-looking statements reflect the expectations of the Company at the time they are made. The Company disclaims any obligation to update such statements.

Important Additional Information and Where to Find It

Genesco has filed a definitive proxy statement (the "Proxy Statement") and accompanying proxy card in connection with the solicitation of proxies for the 2021 annual meeting of Genesco shareholders (the "Annual Meeting"). INVESTORS AND SHAREHOLDERS ARE STRONGLY ENCOURAGED TO READ THE PROXY STATEMENT AND ACCOMPANYING PROXY CARD AND OTHER DOCUMENTS FILED WITH THE U.S. Securities and Exchange Commission (the "SEC") CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders may obtain the Proxy Statement, any amendments or supplements to the Proxy Statement and other documents filed by Genesco with the SEC for no charge at the SEC's website at www.sec.gov. Copies will also be available at no charge in the Investors section of Genesco's corporate website at www.genesco.com.

Participants in the Solicitation

Genesco, its directors and certain of its executive officers may be deemed to be participants in the solicitation of proxies from Genesco shareholders in connection with the matters to be considered at the Annual Meeting. Information regarding the names of Genesco's directors and executive officers and certain other individuals and their respective interests in Genesco by security holdings or otherwise is set forth in the Annual Report on Form 10-K of Genesco for the fiscal year ended January 30, 2021, and in the Proxy Statement. To the extent holdings of such participants in Genesco's securities have changed since the amounts described in the Proxy Statement, such changes have been reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/genesco-highlights-increased-share-price-driven-by-strong-operational-performance-301324605.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/genesco-highlights-increased-share-price-driven-by-strong-operational-performance-301324605.html

SOURCE Genesco Inc.