Galiano Gold Provides Asanko Gold Mine 2023 Exploration Program Update

- Drilling at Nkran confirms zones of strong mineralization extending beyond current mineral reserve pit shell

- Early results from Abore drilling show strong intercepts outside current mineral reserve pit shell, indicating potential pit expansion opportunities

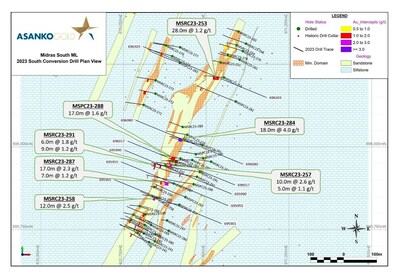

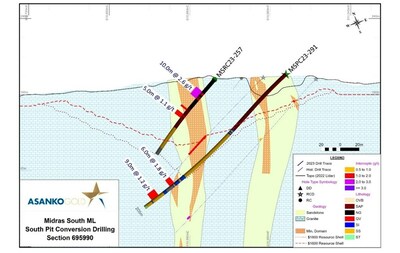

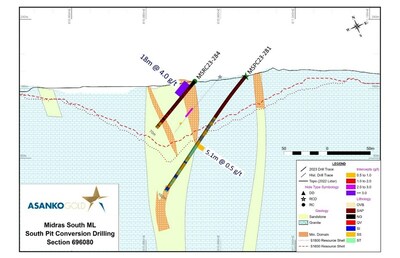

- Infill drilling at Midras South yields significant intercepts, advancing deposit towards maiden Mineral Reserve estimate

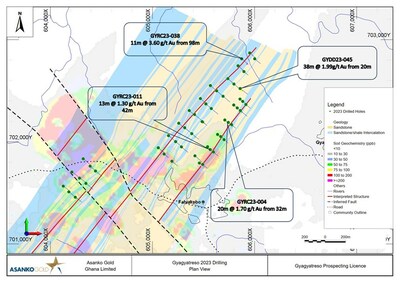

- Encouraging results from drilling at Gyagyatreso regional prospect highlight presence of fertile gold bearing system with significant strike length potential

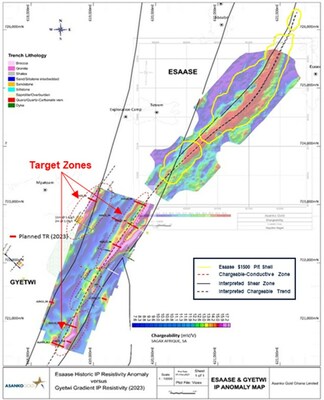

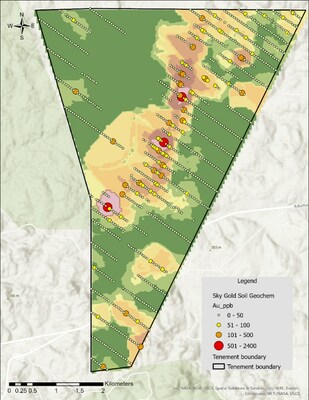

- Identification of large soil geochemical anomalies and IP chargeability anomalies in regional greenfield exploration indicate potential for new discoveries

- None.

The 2023 exploration program at the AGM has focused on expanding mineralization at known deposits, as well as advancing a robust pipeline of regional greenfields targets towards potential new discoveries. Highlights include:

- Resource and Reserve upgrade drilling at Nkran: Completed 6,689 metres ("m") of drilling focused on the southern extent of the deposit which has further demonstrated the upside potential of the orebody. The drilling confirmed zones of strong mineralization extend beyond the current mineral reserve pit shell, which remains open along strike and at depth, with intercepts including 19m @ 3.0 grams per tonne ("g/t") gold ("Au") from 567m, and 18m @ 2.6 g/t Au from 361m.

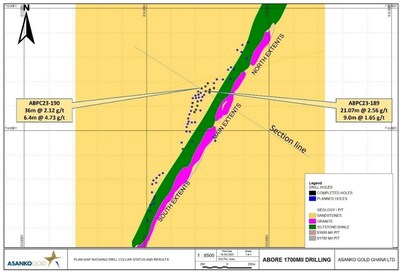

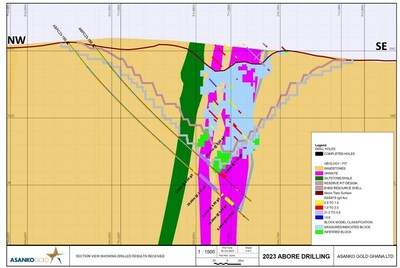

- Resource conversion drilling at Abore: Early results returned strong intercepts outside the current mineral reserve pit shell including 36m @ 2.1 g/t Au from 278m and 21m @ 2.6 g/t Au from 226m, highlighting potential pit expansion opportunities.

- Resource conversion drilling at Midras South: Completed the first phase of infill drilling of inferred mineral resources at Midras South, with the deposit advancing towards a maiden Mineral Reserve estimate. Significant intercepts from the first two holes drilled include 18m @ 4.0 g/t Au from 7m, 17m @ 2.3 g/t Au from 24m, and 28m @ 1.2 g/t Au from 24m.

- Drilling at the Gyagyatreso regional prospect: Encouraging first results including intercepts of 38m @ 2.0 g/t Au from 20m, 20m @ 1.7 g/t Au from 32m and 11m @ 3.6 g/t Au from 98m, highlighting the presence of a fertile gold bearing system with significant strike length potential.

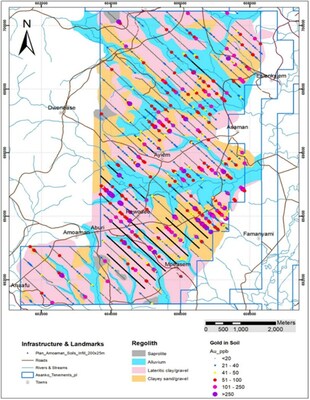

- Regional greenfield exploration: Through early-stage mapping, geochemistry and geophysics work, large soil geochemical anomalies have been identified at the Aburi and Sky Gold targets, as well as Induced Polarization ("IP") chargeability anomalies on the Esaase-Abore shear zone have been identified for follow up trenching and/or drilling.

"The 2023 exploration results received to-date bode well not only for extending the life of our current operations at the AGM, but also in identifying additional deposits located throughout our large, underexplored land package," stated Galiano's Vice President of Exploration, Chris Pettman. "The positive drill results at Nkran and Abore highlight examples of the growth potential at our existing deposits, and it is exciting to see robust new regional targets, including Gyagyatreso, being proven across the wider AGM tenements. We look forward to continuing our aggressive exploration program in 2024 and beyond in order to further extend the life of the mine."

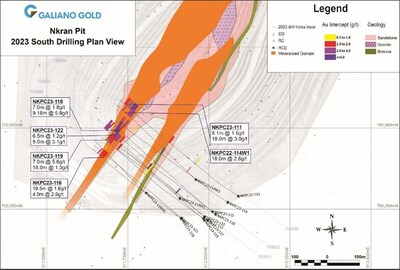

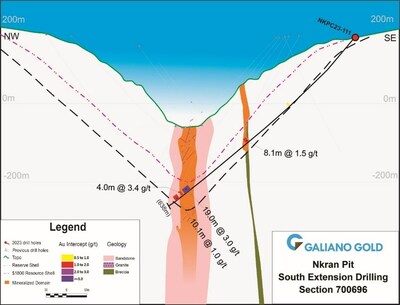

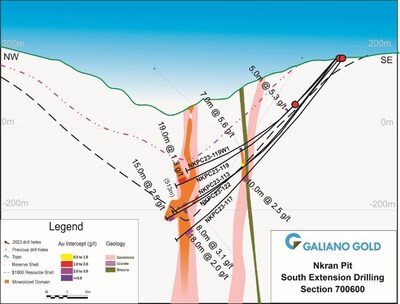

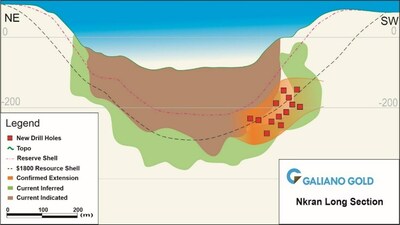

The Nkran South drill program was designed to upgrade a zone of inferred mineral resources at the south end of the deposit and determine the potential for growth in the open pit mineral reserves. In addition to the potential expansion of mineral reserves, the Company is incorporating the drilling results into the Nkran underground study that is currently underway. Drilling began in late 2022 and was completed in 2023.

Based on these positive results, the Company has confirmed the primary mineralized zones at Nkran are contiguous and remain open at the southern end of the deposit. The mineralized zones currently extend up to 185m immediately along strike to the south of the proposed Nkran Cut 3 pit shell.

Highlighted Drilling intercepts (see Table 1 for full drilling results)

13 combination reverse circulation ("RC")/diamond drill holes totaling 6,689m were drilled as part of this program. Results include:

- Hole NKPC22-111: 19m @ 3.0 g/t gold from 567m

- Hole NKPC22-114W1: 18m @ 2.6 g/t gold from 361m

- Hole NKPC23-118: 9m @ 5.9 g/t gold from 565m

- Hole NKPC23-116: 19.5m @ 1.6 g/t gold from 451m

- Hole NKPC23-119: 19m @ 1.3 g/t gold from 483m and 7m @ 5.6 g/t gold from 324m

The Nkran pit is located immediately adjacent to the AGM's processing plant and has historically yielded the highest average mined grades on the Asankrangwa Gold Belt, while contributing significant cash flows over the years. During the mining of Cut 2 (years 2016 – 2020), Nkran produced 15.2 million tonnes ("Mt") at 1.63 g/t and reported metallurgical recoveries of

The Nkran geological setting is typical of the Asankrangwa Gold Belt with a sedimentary sequence of interlayered shale, siltstone, and sandstone. Two granitic bodies intrude along shear zones that control mineralization which dips steeply to the northwest along with the sheared host stratigraphy.

Abore is located directly on the Esaase haul road approximately 13 kilometers ("km") north of the AGM processing plant and has current Measured and Indicated Mineral Resources of 477,000 ounces @ 1.16 g/t Au and Inferred Resources of 131,000 ounces @ 1.14 g/t Au as described in the "NI 43-101 Technical Report and Feasibility Study for Asanko Gold Mine,

Exploration drilling throughout 2023 has been primarily focused on the conversion of inferred mineral resources below the mineral reserve pit shell and infilling zones below the

The deposit sits along the Esaase shear corridor, which also hosts the Esaase deposit. Geology here is characterized by a sedimentary sequence composed primarily of siltstones, shales and thickly bedded sandstones that has been intruded by a granite which lies parallel to the shear and dipping steeply to the northwest. Mineralization is mostly constrained to the granite, hosted in west dipping quartz vein areas developed primarily along the eastern margin of the granite/sediment contact.

The Midras South deposit lies approximately 5km south of the AGM processing plant along the Takorase – Afraso shear zone, a laterally extensive structure recognized from airborne VTEM, magnetic surveys and extensive ground mapping. Midras South consists of 3 distinct zones of mineralization, interpreted to be fault offsets of the primary mineralized structure. Typical of Asankrangwa Gold Belt deposits, indicated mineralization at Midras South is developed within a package of deformed sandstone, siltstone and phyllite with stratigraphy and structure both steeply dipping to the northwest. Gold mineralization occurs in association with quartz veining, arsenopyrite and pyrite, within a broader envelope of quartz-sericite-pyrite and carbonate alteration.

Midras South has a current Inferred Mineral Resource of 5.4Mt @ 1.32 g/t Au totaling 232,000 oz. Current drilling is designed to upgrade the primary mineralized zones to the Indicated Mineral Resource category to advance the deposit towards a maiden Mineral Reserve estimate.

Drilling throughout 2023 consisted of 5,061 m of resource conversion drilling which targeted inferred mineral resources within the southern zones of the deposit. Notable results from the program include:

- Hole MSRC23-253: 28m @ 1.2 g/t Au from 24m

- Hole MSRC23-257: 10m @ 2.6 g/t Au from 18m

- Hole MSRC23-258: 12m @ 2.5 g/t Au from 5m

- Hole MSRC23-284: 18m @ 4.0 g/t Au from 7m

- Hole MSRC23-285: 3m @ 26.6 g/t Au from 24m

- Hole MSRC23-287: 17m @ 2.3 g/t Au from 24m

See Table 3 for full assay results.

Two of the fertile structural trends that host mineralization at Midras South also remain open along strike and are considered targets for further exploration drilling.

The AGM controls the largest land package on the Asankrangwa Gold Belt with tenements covering 476 km2 of highly prospective ground with a portfolio of high quality greenfields exploration targets.

Work in the regional tenements throughout 2023 has focused on a series of prioritized targets in various stages of exploration. This work has included initial mapping and target identification, surficial geochemical and geophysical surveying, and early-stage drill testing. Highlights of some of this work is outlined below.

The Gyagyatreso prospect is located approximately 4km northwest of the AGM processing plant and is highlighted by an approximately 3km long surficial gold in soils anomaly that is coincident to interpreted northeast trending structural zone believed to be a southwest extension of the Esaase-Abore shear zone. A small historic drilling campaign confirmed gold mineralization, but the drilling was localized and limited to shallow depths leaving the target largely untested. Subsequent field mapping conducted by AGM Geologists identified visible gold in hand samples and the area was prioritized for follow-up drilling.

Drilling throughout the year has consisted of 5,783m of combined RC and diamond drilling across 55 holes. Results have been very encouraging, returning multiple significant intercepts including 38m @ 2.0 g/t Au from 20m (GYDD23-045), 20m @ 1.7 g/ t Au from 32m (GYRC23-004), 11m @3.6g/t Au from 98m (GYRC23-038), and 13m @ 1.3 g/t Au from 42m (GYRC23-011), demonstrating that mineralization is present over at least 2km of strike length. The full extent of the surficial geochemical anomaly has not yet been tested and mineralization remains open along strike to the southwest and northeast. See Table 4 for full assay results received to date.

Data from the 2023 exploration programs have also provided a significantly increased understanding of the local geology and structural controls which will be integrated into the design of follow-up drilling planned for 2024.

The Gyetwi prospect is located immediately along strike to the south of the Esaase deposit. Esaase has produced nearly 500,000 ounces to-date and still contains over 1.2M ounces in Indicated Mineral Resources and 0.3M ounces in Inferred Mineral Resources, and lies on the same structural corridor.

Visible gold in hand samples have been identified during prospecting work and the area was prioritized for ground IP survey follow-up. Line-cutting and a combination of ground pole-dipole and gradient array IP surveys were carried out between late 2022 and early 2023. A total of 56 line km of IP were collected, which identified a series of chargeability anomalies interpreted to be associated with the southwest extension of the Esaase shear zone across a strike length of approximately 1.3 km. These anomalies have been prioritized and follow-up surface trenching is planned to test for shallow oxide mineralization.

The SkyGold B target area is located approximately 9km northwest of the Esaase deposit and has seen no known historic exploration work. As part of the ongoing regional generative targeting program, AGM geologists recognized through regional geophysics that the area may be underlain by lithologies and structural settings similar to those that host the known Asankrangwa gold deposits.

The 2023 exploration program included initial mapping and reconnaissance prospecting along with a tenement-wide soil geochemical survey. Mapping of surface pits and small-scale artisanal workings successfully identified a structural corridor of interest and lithologies favourable to gold mineralization. The first phase of soil sampling consisted of 768 samples collected across approximately 23 km2. A 4km-long trend of highly anomalous gold in soils has been identified, coincident with the newly mapped structures and consistent with the orientation of the major gold bearing shear zones of the Asankrangwa Gold Belt. Follow-up work is planned to delineate potential drill targets for 2024.

The Aburi target area lies directly southwest of Nkran, covering approximately 46 km2 and is interpreted to be underlain by the extension of the Adubiaso shear zone over a strike length of approximately 5km. Historic work in this area has been sporadic and localized with small mapping and shallow drilling programs identifying gold mineralization with little to no follow-up.

The AGM exploration team undertook a holistic review of all historic data including regional VTEM surveys with drilling data and prioritized the area for a regional surficial geochemical survey. The 2023 program consisted of a regional soil geochemistry survey that covered the entire tenement area with 3,141 samples collected. A second infill survey was conducted consisting of 1,038 additional samples to further delineate several robust geochemical anomalies identified.

The results have identified two distinct trends highlighted by anomalous gold coincident with interpreted structures that extend across the length of the tenement. Follow-up work is planned to delineate possible drill targets in 2024.

Table 1: Intercepts for 2022/23 Nkran South Extension Drilling 1,2,3,4

Hole ID | From | To (m) | Width | Grade (g | Intercept |

NKPC22-111 | 237.2 | 242 | 4.8 | 0.6 | 4.8m @ 0.6 g/t |

NKPC22-111 | 375.9 | 384 | 8.1 | 1.5 | 8.1m @ 1.5 g/t |

NKPC22-111 | 567 | 586 | 19 | 3 | 19.0m @ 3.0 g/t |

NKPC22-111 | 591 | 595 | 4 | 3.4 | 4.0m @ 3.4 g/t |

NKPC22-111 | 599 | 601 | 2 | 4.6 | 2.0m @ 4.6 g/t |

NKPC22-111 | 605 | 615.1 | 10.1 | 1 | 10.1m @ 1.0 g/t |

NKPC22-113 | 343.7 | 351.6 | 7.9 | 0.5 | 7.9m @ 0.5 g/t |

NKPC22-113 | 483.6 | 490.6 | 7.0 | 1.1 | 7.0m @ 1.1 g/t |

NKPC22-113 | 516.6 | 527.1 | 10.5 | 2.6 | 10.5m @ 2.6 g/t |

NKPC22-113 | 537.6 | 540.6 | 3.0 | 9.5 | 3.0m @ 9.5 g/t |

NKPC22-113 | 545.1 | 548.1 | 3.0 | 0.8 | 3.0m @ 0.8 g/t |

NKPC22-114 | 257.6 | 260.4 | 2.8 | 1.3 | 2.0m @ 1.3 g/t |

NKPC22-114 | 402.8 | 407.9 | 5.1 | 5.3 | 5.1m @ 5.3 g/t |

NKPC22-114 | 560 | 564.4 | 4.4 | 0.6 | 4.4m @ 0.6 g/t |

NKPC22-114 | 575.2 | 577.6 | 2.4 | 0.6 | 2.4m @ 0.6 g/t |

NKPC22-114 | 596 | 603.6 | 7.6 | 2.7 | 7.6m @ 2.7 g/t |

NKPC22-114 | 612.9 | 617 | 4.1 | 1.7 | 4.1m @ 1.7 g/t |

NKPC22-114 | 620.8 | 624 | 3.2 | 6.4 | 3.2m @ 6.4 g/t |

NKPC22-114W1 | 361 | 379 | 18.0 | 2.6 | 18.0m @ 2.6 g/t |

NKPC22-114W1 | 396 | 398 | 2.0 | 3.8 | 2.0m @ 3.8 g/t |

NKPC23-115 | 512 | 530 | 18.0 | 4.7 | 18.0m @ 4.7 g/t |

NKPC23-115 | 546 | 551.1 | 5.1 | 1.2 | 5.1m @ 1.2 g/t |

NKPC23-115 | 555 | 563 | 8.0 | 2.5 | 8.0m @ 2.5 g/t |

NKPC23-116 | 451.2 | 470.7 | 19.5 | 1.6 | 19.0m @ 1.6 g/t |

NKPC23-116 | 478.2 | 482.2 | 4.0 | 2.6 | 4.0m @ 2.6 g/t |

NKPC23-117 | 371 | 381 | 10.0 | 2.5 | 10.0m @ 2.5 g/t |

NKPC23-117 | 558 | 576 | 18.0 | 2.0 | 18.0m @ 2.0 g/t |

NKPC23-118 | 553 | 560 | 7.0 | 1.8 | 7.0m @ 1.8 g/t |

NKPC23-118 | 564.8 | 574 | 9.2 | 5.9 | 9.2m @ 5.9 g/t |

NKPC23-119 | 175 | 180 | 5.0 | 5.3 | 5.0m @ 5.3 g/t |

NKPC23-119 | 324 | 331 | 7.0 | 5.6 | 7.0m @ 5.6 g/t |

NKPC23-119 | 483 | 502 | 19.0 | 1.3 | 19.0m @ 1.3 g/t |

NKPC23-119W1 | 27 | 29 | 2.0 | 2 | 2.0m @ 2.0 g/t |

NKPC23-121 | 419 | 421 | 2.0 | 0.8 | 2.0m @ 0.8 g/t |

NKPC23-122 | 343 | 350 | 7.0 | 0.9 | 7.0m @ 0.9 g/t |

NKPC23-122 | 495.5 | 502 | 6.5 | 1.2 | 6.5m @ 1.2 g/t |

NKPC23-122 | 524 | 532 | 8.0 | 3.1 | 8.0m @ 3.1 g/t |

NKPC23-122 | 560 | 575.2 | 15.2 | 2.5 | 15.2m @ 2.5 g/t |

Table 2: Abore 2023 drilling intercepts received as of October 19, 20235,6,7

Hole ID | From | To (m) | Width | Grade (g | Intercept |

ABPC23-181 | 143 | 146 | 3.0 | 0.7 | 3.00m @ 0.7 g/t |

ABPC23-183 | 145 | 151 | 6.0 | 0.9 | 6.00m @ 0.9 g/t |

ABPC23-183 | 176 | 178 | 2.0 | 0.8 | 2.0m @ 0.8 g/t |

ABPC23-183 | 191 | 205 | 14.0 | 0.8 | 14.0m @ 0.8 g/t |

ABPC23-184 | 99 | 110 | 11.0 | 1.4 | 11.0m @ 1.4 g/t |

ABPC23-184 | 118 | 131 | 13.0 | 0.6 | 13.0m @ 0.6 g/t |

ABPC23-184 | 137 | 140 | 3.0 | 1.1 | 3.0m @ 1.1 g/t |

ABPC23-184 | 157 | 174 | 17.0 | 1.0 | 17.0m @ 1.0 g/t |

ABPC23-186 | 79 | 87 | 8.0 | 2.3 | 8.0 @ 2.3 g/t |

ABPC23-186 | 92 | 97 | 5.0 | 0.8 | 5.0m @ 0.8 g/t |

ABPC23-186 | 101 | 103 | 2.0 | 4.7 | 2.0m @ 4.7 g/t |

ABPC23-186 | 149 | 158 | 9.0 | 0.5 | 9.0m @ 0.5 g/t |

ABPC23-186 | 194 | 208.5 | 14.5 | 2.8 | 14.5m @ 2.8 g/t |

ABPC23-189 | 225 | 247 | 21.0 | 2.6 | 21.0m @ 2.6 g/t |

ABPC23-189 | 270 | 279 | 9 | 1.7 | 9.0m @ 1.7 g/t |

ABPC23-190 | 267 | 272.6 | 5.6 | 0.6 | 5.6m @ 0.6 g/t |

ABPC23-190 | 278 | 314 | 36 | 2.1 | 36.0m @ 2.1 g/t |

ABPC23-190 | 322 | 325 | 2.6 | 0.9 | 2.6m @ 0.9 g/t |

ABPC23-190 | 330 | 346 | 16 | 0.8 | 16.0m @ 0.8 g/t |

ABPC23-190 | 350 | 356.4 | 6.4 | 4.7 | 6.4m @ 4.7 g/t |

ABPC23-191 | 249 | 256.7 | 7.7 | 1.0 | 7.7m @ 1.0 g/t |

ABPC23-191 | 306 | 326 | 20 | 1.1 | 20.0m @ 1.1 g/t |

ABPC23-191 | 330 | 335 | 5 | 0.6 | 5.0m @ 0.6 g/t |

ABPC23-191 | 344 | 351 | 7 | 2.6 | 7.0m @ 2.6 g/t |

ABPC23-191 | 355 | 357.5 | 2.5 | 1.9 | 2.5m @ 1.9 g/t |

ABPC23-203 | 79 | 99 | 20 | 0.9 | 20.0m @ 0.9 g/t |

ABPC23-204 | 75 | 77 | 2 | 1.2 | 2.0m @ 1.2 g/t |

ABPC23-204 | 83 | 88 | 5 | 0.9 | 5.0m @ 0.9 g/t |

ABPC23-204 | 107 | 110 | 3 | 0.6 | 3.0m @ 0.6 g/t |

Hole ID | From | To (m) | Width | Grade (g | Intercept |

MSPC23-267 | 139 | 142.6 | 3.6 | 1.6 | 3.6m @ 1.6 g/t |

MSPC23-275 | 91 | 95 | 4 | 0.6 | 4.0m @ 0.6 g/t |

MSPC23-280 | 103.5 | 109 | 5.5 | 2 | 5.5m @ 2.0 g/t |

MSPC23-281 | 95 | 100.1 | 5.1 | 0.5 | 5.1m @ 0.5 g/t |

MSPC23-282 | 188 | 190.2 | 2.2 | 1.4 | 2.2m @ 1.4 g/t |

MSPC23-282 | 195 | 200 | 5 | 1.4 | 5.0m @ 1.4 g/t |

MSPC23-282 | 210 | 214 | 4 | 0.5 | 4.0m @ 0.5 g/t |

MSPC23-283 | 95 | 98.5 | 3.5 | 0.8 | 3.5m @ 0.8 g/t |

MSPC23-288 | 63 | 66 | 3 | 0.5 | 3.0m @ 0.5 g/t |

MSPC23-288 | 72 | 89 | 17 | 1.6 | 17.0m @ 1.6 g/t |

MSPC23-290 | 197 | 199 | 2 | 1.5 | 2.0m @ 1.5 g/t |

MSPC23-291 | 61 | 63 | 2 | 0.6 | 2.0m @ 0.6 g/t |

MSPC23-291 | 165 | 171 | 6 | 1.8 | 6.0m @ 1.8 g/t |

MSPC23-291 | 186 | 195 | 9 | 1.2 | 9.0m @ 1.2 g/t |

MSPC23-292 | 74 | 78 | 4 | 1.2 | 4.0m @ 1.2 g/t |

MSPC23-292 | 183 | 187 | 4 | 1.2 | 4.0m @ 1.2 g/t |

MSRC23-242 | 85 | 90 | 5 | 1.4 | 5.0m @ 1.4 g/t |

MSRC23-243 | 14 | 16 | 2 | 1.1 | 2.0m @ 1.1 g/t |

MSRC23-243 | 74 | 81 | 7 | 0.7 | 7.0m @ 0.7 g/t |

MSRC23-244 | 41 | 45 | 4 | 0.9 | 4.0m @ 0.9 g/t |

MSRC23-245 | 1 | 7 | 6 | 1 | 6.0m @ 1.0 g/t |

MSRC23-246 | 10 | 12 | 2 | 4.9 | 2.0m @ 4.9 g/t |

MSRC23-246 | 62 | 66 | 4 | 3 | 4.0m @ 3.0 g/t |

MSRC23-249 | 1 | 11 | 10 | 1.6 | 10.0m @ 1.6 g/t |

MSRC23-249 | 26 | 29 | 3 | 0.8 | 3.0m @ 0.8 g/t |

MSRC23-250 | 53 | 55 | 2 | 2.3 | 2.0m @ 2.3 g/t |

MSRC23-250 | 67 | 70 | 3 | 0.5 | 3.0m @ 0.5 g/t |

MSRC23-253 | 17 | 19 | 2 | 0.6 | 2.0m @ 0.6 g/t |

MSRC23-253 | 24 | 52 | 28 | 1.2 | 28.0m @ 1.2 g/t |

MSRC23-256 | 11 | 16 | 5 | 1.3 | 500m @ 1.3 g/t |

MSRC23-257 | 18 | 28 | 10 | 2.6 | 10.0m @ 2.6 g/t |

MSRC23-257 | 42 | 44 | 2 | 1.3 | 2.0m @ 1.3 g/t |

MSRC23-257 | 49 | 54 | 5 | 1.1 | 5.0m @ 1.1 g/t |

MSRC23-258 | 5 | 17 | 12 | 2.5 | 12.0m @ 2.5 g/t |

MSRC23-258 | 21 | 25 | 4 | 0.5 | 4.0m @ 0.5 g/t |

MSRC23-258 | 30 | 32 | 2 | 0.8 | 2.0m @ 0.8 g/t |

MSRC23-259 | 42 | 44 | 2 | 1.6 | 2.0m @ 1.6 g/t |

MSRC23-260 | 25 | 45 | 20 | 1.2 | 20.0m @ 1.2 g/t |

MSRC23-260 | 56 | 60 | 4 | 0.5 | 4.0m @ 0.5 g/t |

MSRC23-260 | 66 | 68 | 2 | 0.6 | 2.0m @ 0.6 g/t |

MSRC23-261 | 37 | 46 | 9 | 0.7 | 9.0m @ 0.7 g/t |

MSRC23-261 | 71 | 73 | 2 | 0.7 | 2.0m @ 0.7 g/t |

MSRC23-264 | 44 | 46 | 2 | 1.1 | 2.0m @ 1.1 g/t |

MSRC23-268 | 49 | 51 | 2 | 0.8 | 2.0m @ 0.8 g/t |

MSRC23-268 | 70 | 72 | 2 | 0.6 | 2.0m @ 0.6 g/t |

MSRC23-270 | 31 | 33 | 2 | 1 | 2.0m @ 1.0 g/t |

MSRC23-270 | 39 | 45 | 6 | 0.9 | 6.0m @ 0.9 g/t |

MSRC23-270 | 72 | 74 | 2 | 1 | 2.0m @ 1.0 g/t |

MSRC23-270 | 84 | 103 | 19 | 0.6 | 19.0m @ 0.6 g/t |

MSRC23-270 | 121 | 130 | 9 | 0.4 | 9.0m @ 0.4 g/t |

MSRC23-271 | 48 | 53 | 5 | 0.7 | 500m @ 0.7 g/t |

MSRC23-272 | 44 | 56 | 12 | 1 | 12.0m @ 1.0 g/t |

MSRC23-273 | 33 | 39 | 6 | 1.2 | 6.0m @ 1.2 g/t |

MSRC23-273 | 53 | 56 | 3 | 0.5 | 3.0m @ 0.5 g/t |

MSRC23-274 | 51 | 57 | 6 | 1.1 | 6.0m @ 1.1 g/t |

MSRC23-274 | 116 | 120 | 4 | 0.5 | 4.0m @ 0.5 g/t |

MSRC23-277 | 61 | 72 | 11 | 0.9 | 11.0m @ 0.9 g/t |

MSRC23-279 | 10 | 12 | 2 | 1.2 | 2.0m @ 1.2 g/t |

MSRC23-284 | 7 | 25 | 18 | 4 | 18.0m @ 4.0 g/t |

MSRC23-285 | 24 | 27 | 3 | 26.6 | 3.00m @ 26.6 g/t |

MSRC23-287 | 17 | 20 | 3 | 0.6 | 3.0m @ 0.6 g/t |

MSRC23-287 | 24 | 41 | 17 | 2.3 | 17.0m @ 2.3 g/t |

MSRC23-287 | 56 | 63 | 7 | 1.2 | 7.0m @ 1.2 g/t |

MSRC23-289 | 17 | 20 | 3 | 0.9 | 3.0m @ 0.9 g/t |

MSRC23-289 | 27 | 34 | 7 | 2.2 | 7.0m @ 2.2 g/t |

Table 4: Gyagyatreso drilling intercepts6,7

Hole ID | From | To (m) | Width (m) | Grade (g | Intercept |

GYDD23-042 | 87.6 | 92.8 | 5.2 | 2.13 | 5.2m @ 2.1 g/t |

GYRC23-002 | 3 | 8 | 5 | 3.12 | 5.0m @ 3.1 g/t |

GYRC23-002 | 14 | 17 | 3 | 2.91 | 3.0m @ 2.1 g/t |

GYRC23-002 | 60 | 62 | 2 | 1.37 | 2.0m @ 1.4 g/t |

GYRC23-002 | 66 | 81 | 15 | 0.51 | 15.0m @ 0.5 g/t |

GYRC23-003 | 5 | 7 | 2 | 1.13 | 2.0m @ 1.1 g/t |

GYRC23-003 | 47 | 53 | 6 | 0.71 | 6.0m @ 0.7 g/t |

GYRC23-004 | 1 | 3 | 2 | 0.53 | 2.0m @ 0.5 g/t |

GYRC23-004 | 32 | 52 | 20 | 1.73 | 20.0m @ 1.7 g/t |

GYRC23-006 | 18 | 25 | 7 | 0.79 | 7.0m @ 0.8 g/t |

GYRC23-006 | 84 | 86 | 2 | 1.54 | 2.0m @ 1.5 g/t |

GYRC23-006 | 90 | 94 | 4 | 0.7 | 4.0m @ 0.7 g/t |

GYRC23-008 | 34 | 40 | 6 | 2.13 | 6.0m @ 2.1 g/t |

GYRC23-008 | 47 | 50 | 3 | 0.67 | 3.0m @ 07 g/t |

GYRC23-009 | 73 | 76 | 3 | 1.91 | 3.0m @ 1.9 g/t |

GYRC23-010 | 20 | 25 | 5 | 1.78 | 5.0m @ 1.8 g/t |

GYRC23-010 | 37 | 39 | 2 | 1.24 | 2.0m @ 1.2 g/t |

GYRC23-011 | 42 | 55 | 13 | 1.3 | 13.0m @ 1.3 g/t |

GYRC23-012 | 58 | 60 | 2 | 2.09 | 2.0m @ 2.1 g/t |

GYRC23-015 | 61 | 67 | 6 | 0.65 | 6.0m @ 0.7 g/t |

GYRC23-018 | 14 | 20 | 6 | 0.59 | 6.0m @ 0.6 g/t |

GYRC23-019 | 71 | 74 | 3 | 0.57 | 3.0m @ 0.6 g/t |

GYRC23-019 | 84 | 93 | 9 | 1.11 | 9.0m @ 1.1 g/t |

GYRC23-019 | 102 | 106 | 4 | 0.89 | 4.0m @ 0.9 g/t |

GYRC23-020 | 36 | 38 | 2 | 0.83 | 2.0m @ 0.8 g/t |

GYRC23-030 | 82 | 90 | 8 | 0.63 | 8.0m @ 0.6 g/t |

GYRC23-032 | 71 | 75 | 4 | 0.99 | 4.0m @ 1.0 g/t |

GYRC23-037 | 79 | 86 | 7 | 0.74 | 7.0m @ 0.7 g/t |

GYRC23-038 | 98 | 109 | 11 | 3.58 | 11.0m @ 3.6 g/t |

GYRC23-039 | 1 | 4 | 3 | 0.94 | 3.0m @ 0.9 g/t |

GYRC23-040 | 87 | 91 | 4 | 0.67 | 4.0m @ 0.7 g/t |

GYRC23-044 | 57 | 59 | 2 | 0.69 | 2.0m @ 0.7 g/t |

GYRC23-044 | 64 | 68 | 4 | 0.48 | 4.0m @ 0.5 g/t |

GYDD23-045 | 20 | 58 | 38 | 1.99 | 38.0m @ 2.0 g/t |

GYRC23-050 | 83 | 85 | 2 | 0.95 | 2.0m @ 1.0 g/t |

GYRC23-051 | 27 | 32 | 5 | 0.83 | 5.0m @ 0.8 g/t |

Notes: | |

1. | See Section 14.1.10 of the 2023 Technical Report for the assumptions used in preparing the Nkran reserve shell and |

2. | Intervals indicated are not true widths as there is insufficient information to calculate true widths. However, drill holes have been drilled to cross interpreted mineralized zones as close to perpendicular as possible. |

3. | Intervals are calculated with the assumptions of >0.5g/t and <3m of internal waste and displayed as weighted averages. |

4. | Includes results from diamond and RC drilling. |

5. | See Section 14.2.10 of the 2023 Technical Report for description of Abore Mineral Resource estimate and assumptions used in preparing the Abore |

6. | Intervals reported are hole lengths. |

7. | Intervals are calculated with the assumptions of >0.5 g/t and <3m of internal waste with a top cut of 30 g/t and displayed as weighted averages. The top cut threshold used is unchanged from that outlined in section 14.2.3.3 of the 2023 Technical Report, available on the Company's website and filed on SEDAR. |

Chris Pettman P. Geo, Vice President Exploration of Galiano, is a Qualified Person as defined by NI 43-101 (as defined below) and has supervised the preparation of the scientific and technical information that forms the basis for this news release. Mr. Pettman is responsible for all aspects of the work including the Data Verification and Quality Control/Quality Assurance programs and has verified the data disclosed, by reviewing all data and supervising its compilation. There are no known factors that could materially affect the reliability of data collected and verified under his supervision. No quality assurance/quality control issues have been identified to date. Mr. Pettman is not independent of Galiano.

Certified Reference Materials and Blanks are inserted by Galiano into the sample stream at the rate of 1:14 samples. Field duplicates are collected at the rate of 1:30 samples. All samples have been analysed by Intertek Minerals Ltd. ("Intertek") in Tarkwa,

Galiano is focused on creating a sustainable business capable of long-term value creation for its stakeholders through exploration and disciplined deployment of its financial resources. The company currently operates and manages the Asanko Gold Mine, located in

Certain statements and information contained in this news release constitute " forward-looking statements " within the meaning of applicable

Forward-looking statements in this news release include, but are not limited to: statements regarding drilling results; the interpretation of drilling results; additional drilling; underground mining potential; future mining at Nkran, Abore, Midras South, Gyagyatreso and regional greenfields, including with respect to the nature and extent of possible pit designs and the commencement of mining or further mining; and statements regarding the potential thereof; the expected results of the exploration program and the nature and timing of future exploration programs; the ability of future exploration programs to provide the basis for future mineral resources and mineral reserves, and the extension of the life of the mine; and information regarding planned future exploration, drilling and mining. Such forward-looking statements are based on a number of material factors and assumptions, including, but not limited to: the exploration program proceeding as anticipated; the exploration program achieving the targets and milestones included therein in the manner and on the timelines anticipated therein; the nature of drilling and exploration targets conforming to current expectations; mining proceeding as currently anticipated; the Company proceeding with further exploration programs as currently anticipated; future exploration programs will provide the basis for future mineral resources; the JV approves the Company's exploration budget; the ability of the AGM to continue to operate during the COVID-19 pandemic; that gold production and other activities will not be curtailed as a result of the COVID-19 pandemic; the AGM will be able to continue to ship doré from the AGM site to be refined; the doré produced by the AGM will continue to be able to be refined at similar rates and costs to the AGM, or at all; the Company's and the AGM's responses to the COVID-19 pandemic will be effective in continuing its operations in the ordinary course; the accuracy of the estimates and assumptions underlying Mineral Resource and Mineral Reserve estimates and prior exploration results, including future gold prices, cut-off grades and production and processing estimates; the successful completion of development and exploration projects, planned expansions or other projects within the timelines anticipated and at anticipated production levels; mineral resources can be developed as planned; the Company's relationship with its JV partner will continue to be positive and beneficial to the Company; required financing and permits will be obtained; general economic conditions; labour disputes or disruptions, flooding, ground instability, geotechnical failure, fire, failure of plant, equipment or processes to operate are as anticipated and other risks of the mining industry will not be encountered; contracted parties will provide goods or services in a timely manner; there is no material adverse change in the price of gold or other metals; title to mineral properties; costs; the retention of the Company's key personnel; and changes in laws, rules and regulations applicable to Galiano.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to differ materially from those anticipated in such forward-looking statements. The Company believes the expectations reflected in such forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct, and you are cautioned not to place undue reliance on forward-looking statements contained herein. Some of the risks and other factors which could cause actual results to differ materially from those expressed in the forward-looking statements contained in this news release, include, but are not limited to: the results of the Company's exploration programs will not conform with the Company's expectations, and will not be sufficient to support mineral resources or mineral reserves at the AGM or be sufficient to include in the Company's updated life of mine plan; the Company may not undertake planned future mining or exploration, or such future mining or exploration will not be sufficient to support mineral resources or mineral reserves at the AGM; the JV will approve the Company's proposed exploration and mining programs; the Company's and/or the AGM's operations may be curtailed or halted entirely as a result of the COVID-19 pandemic, whether as a result of governmental or regulatory law or pronouncement, or otherwise; the doré produced at the AGM may not be able to be refined at expected levels, on expected terms or at all; the Company and/or the AGM will experience increased operating costs as a result of the COVID-19 pandemic; the AGM may not be able to source necessary inputs on commercially reasonable terms, or at all; the Company's and the AGM's responses to the COVID-19 pandemic may not be successful in continuing its operations in the ordinary course; the AGM has a limited operating history and is subject to risks associated with establishing new mining operations; sustained increases in costs or decreases in the availability of commodities, consumed or otherwise used by the Company, may adversely affect the Company; actual production, costs, returns and other economic and financial performance may vary from the Company's estimates in response to a variety of factors, many of which are not within the Company's control; adverse geotechnical and geological conditions (including geotechnical failures) may result in operating delays and lower throughput or recovery, closures or damage to mine infrastructure; the ability of the Company to treat the number of tonnes planned, recover valuable materials, remove deleterious materials and process ore, concentrate and tailings as planned is dependent on a number of factors and assumptions which may not be present or occur as expected; the Company's operations may encounter delays in or losses of production due to equipment delays or the availability of equipment; the Company's operations are subject to continuously evolving legislation, compliance with which may be difficult, uneconomic or require significant expenditures; the Company may be unsuccessful in attracting and retaining key personnel; labour disruptions could adversely affect the Company's operations; the Company's business is subject to risks associated with operating in a foreign country; risks related to the Company's use of contractors; the hazards and risks normally encountered in the exploration, development and production of gold; the Company's operations are subject to environmental hazards and compliance with applicable environmental laws and regulations; the Company's operations and workforce are exposed to health and safety risks; unexpected costs and delays related to, or the failure of the Company to obtain, necessary permits could impede the Company's operations; the Company's title to exploration, development and mining interests can be uncertain and may be contested; the Company's properties may be subject to claims by various community stakeholders; risks related to limited access to infrastructure and water; the Company's exploration programs may not successfully expand its current mineral reserves or replace them with new reserves; the Company's revenues are dependent on the market prices for gold, which have experienced significant recent fluctuations; the Company may not be able to secure additional financing when needed or on acceptable terms; the Company's primary asset is held through a JV, which exposes the Company to risks inherent to JVs, including disagreements with its JV partner and similar risks; the Company may be liable for uninsured or partially insured losses; the Company may be subject to litigation; damage to the Company's reputation could result in decreased investor confidence and increased challenges in developing and maintaining community relations which may have adverse effects on the business, results of operations and financial conditions of the JV and the Company; and the Company must compete with other mining companies and individuals for mining interests.

Although the Company has attempted to identify important factors that could cause actual results or events to differ materially from those described in the forward-looking statements, you are cautioned that this list is not exhaustive and there may be other factors that the Company has not identified. Furthermore, the Company undertakes no obligation to update or revise any forward-looking statements included in, or incorporated by reference in, this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

Cautionary Note to US Investors Regarding Mineral Reporting Standards:

As a

Further, "inferred resources" have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore,

Neither the Toronto Stock Exchange nor the Investment Industry Regulatory Organization of

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/galiano-gold-provides-asanko-gold-mine-2023-exploration-program-update-301967266.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/galiano-gold-provides-asanko-gold-mine-2023-exploration-program-update-301967266.html

SOURCE Galiano Gold Inc.

FAQ

What are the highlights of the 2023 exploration program at the Asanko Gold Mine?

What were the results of the drilling at Nkran?

What were the results of the drilling at Abore?

What were the results of the drilling at Midras South?

What were the results of the drilling at the Gyagyatreso regional prospect?

What were the findings in the regional greenfield exploration?

What is the significance of these exploration results?