Gatos Silver Provides Updates on Cerro Los Gatos Mineral Reserve, Mineral Resource and Life of Mine Plan

Company Also Reports on Exploration and Provides Corporate Update

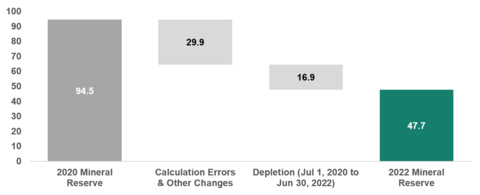

Figure 1: Reduction in contained silver between the 2020 Technical Report and the 2022 Updates (million ounces) (Graphic: Business Wire)

All dollar amounts are expressed in, and references to “$” refer to,

Highlights

-

CLG 2022 LOM Plan summary using only the 2022 Mineral Reserve (

100% basis):- CLG’s current reserve mine life continues to 2028;

-

Average annual production of 7.4 million ounces of silver with average annual cash flow of

$79 million $22 -

Average all-in sustaining costs (“AISC”) of

$7.06 -

Average operating costs of

$89.76 -

Pre-tax net present value (“NPV”) at a

5% discount rate of$491 million $377 million

-

Recent exploration success demonstrates extension potential that could, with additional drilling, significantly extend the mine life;

-

The Company is focused on resource extension drilling at depth in the North-West and Central zones, in addition to the undeveloped South-East zone. Drilling highlights from this program include hole GA-SE-467 that intercepted 17.0 meters (estimated 10.4 meters true width) at 291 g/t Ag,

5.55% Zn,6.14% Pb and1.01% Cu. See Table 10 for complete intercept details; and -

Recent drilling at CLG beneath the South-East zone (referred to as South-East Deeps) has discovered both silver-copper and silver-zinc-lead mineralization at depth. Drilling highlights from this program include hole GA-SE-477 that intercepted 7.5 meters (estimated 5.9 meters true width) at 247 g/t Ag,

5.97% Zn and3.58% Pb and hole GA-SE-475 that intercepted 16.0 meters (estimated 12.0 meters true width) at 135 g/t Ag and1.34% Cu. See Table 11 for complete intercept details.

-

The Company is focused on resource extension drilling at depth in the North-West and Central zones, in addition to the undeveloped South-East zone. Drilling highlights from this program include hole GA-SE-467 that intercepted 17.0 meters (estimated 10.4 meters true width) at 291 g/t Ag,

-

The Company is in the process of transitioning its executive office to

Vancouver, BC , fromDenver, Colorado , and has an experienced executive management team in place, further strengthened with the appointment ofStephen Bodley , General Counsel and Chief Compliance Officer, effectiveOctober 16, 2022 .

_________________________

1 Excludes

2 NPV as of

“We have taken the necessary time to rebuild the 2022 Mineral Reserve and 2022 Mineral Resource from the ground up and are pleased to be able to deliver this update to our shareholders. The 2022 LOM Plan displays low average all-in sustaining costs and strong cash flow until 2028 from our current reserve.

“Additionally, while still early days, it appears that there is potential to extend mine life as a result of significant mineralization that we have recently discovered in the South-East Deeps zone, which extends more than 300 meters below the bottom of the 2022 Mineral Reserve. By adding a new component to our geological interpretation of the mineralization, this new zone opens up geological prospects at depth – not only below the existing workings, but across our land position. Now that we have the solid foundation with this updated reserve, we can return our attention towards realizing our district-scale upside with further exploration.

“Demonstrated by our excellent operating performance and now with a solid foundation at CLG with one of the industry’s lowest cost operations throughout the 2022 LOM Plan, we are well-positioned for future growth. I am excited to work with a revitalized and experienced executive leadership team at

2022 Updates – CLG Summary

On

Working with independent engineering consultants to better understand the magnitude of the errors and overestimation, it has been determined that the reduction in contained metal of the 2022 Mineral Reserve compared to the 2020 Technical Report is as follows:

The 2022 LOM Plan is a reserve plan and reflects current cost estimates for mining only the 2022 Mineral Reserve using a “ground-up” approach including new geological data and interpretation, resource modelling, mine design and cost modelling. Production and cost guidance for 2023 is expected to be issued in the first quarter of 2023 after detailed planning and budgeting is completed, which is expected to include additional expenditures to further explore the district and support potential extension of the 2022 LOM Plan. The Company expects to file an updated technical report summary (TRS) prepared in accordance with subpart 1300 of Regulation S-K (“S-K 1300”) in

The Company anticipates completing an impairment assessment based on the 2022 Mineral Reserve in the fourth quarter of 2022 and is working towards completing all outstanding

2022 Mineral Reserve and 2022 Mineral Resource (CLG –

-

Mineral Reserve of 6.07 million tonnes grading 244 g/t silver,

4.48% zinc,2.14% lead and 0.27 g/t gold containing 47.7 million ounces silver, 599.1 million pounds zinc, 286.7 million pounds lead and 51.8 thousand ounces gold -

Measured and Indicated Mineral Resource (exclusive of reserves) of 1.94 million tonnes grading 96 g/t silver,

3.01% zinc,1.56% lead and 0.19 g/t gold -

Inferred Mineral Resource (exclusive of reserves) of 2.09 million tonnes grading 113 g/t silver,

4.30% zinc,2.45% lead and 0.20 g/t gold

2022 LOM Plan Economics (

Table 1: Summary of 2022 LOM Plan Economic Results Showing Sensitivity to Various Silver Prices

|

$/ounce |

|

|

|

|

| Total LOM Free Cash Flow | $M pre-tax |

|

|

|

|

| (undiscounted) | $M post-tax |

|

|

|

|

| Net Present Value(1) | $M pre-tax |

|

|

|

|

| ( |

$M post-tax |

|

|

|

|

(1) |

|

NPV is discounted to |

2022 Mineral Reserve – CLG

The methodology used to prepare the 2022 Updates has been substantially revised from that used to prepare the 2020 Technical Report. The changes that have been implemented, based on experience through mining operations since 2019, include:

- New geological and geochemical data;

- Updated geological interpretation methodology;

-

Updated Mineral Resource estimation methodology, including correction of the reserve calculation errors disclosed in our

January 25, 2022 press release; - Updated mining assumptions;

- Updated plant throughput and processing recovery assumptions; and

- Updated operating and capital cost assumptions.

The updated mineral reserve estimates by reserve category are summarized below in Table 2.

Table 2: 2022 Mineral Reserve as at

Mt |

Ag (g/t) |

Zn (%) |

Pb (%) |

Au (g/t) |

Ag (Moz) |

Zn (Mlbs) |

Pb (Mlbs) |

Au (koz) |

|

Proven |

2.32 |

309 |

4.33 |

2.20 |

0.31 |

23.1 |

221.6 |

112.3 |

23.0 |

Probable |

3.75 |

204 |

4.57 |

2.11 |

0.24 |

24.6 |

377.4 |

174.4 |

28.7 |

Proven and Probable Reserve |

6.07 |

244 |

4.48 |

2.14 |

0.27 |

47.7 |

599.1 |

286.7 |

51.8 |

(1) |

|

Mineral Reserves are reported on a |

(2) |

|

Specific gravity has been assumed on a dry basis. |

(3) |

|

Tonnage and contained metal have been rounded to reflect the accuracy of the estimate and numbers may not sum exactly. |

(4) |

|

Values are inclusive of mining recovery and dilution. Values are determined as of delivery to the mill and therefore not inclusive of milling recoveries. |

(5) |

|

Mineral Reserves are reported within stope shapes using a variable cut-off basis with a Ag price of |

(6) |

|

The Mineral Reserve is reported on a fully diluted basis defined by mining method, stope geometry and ground conditions. |

(7) |

|

Contained Metal (CM) is calculated as follows: |

|

|

|

(8) |

|

The |

(9) |

|

Mineral Reserves are those parts of Mineral Resources which, after the application of all mining factors, result in an estimated tonnage and grade which, in the opinion of the Qualified Person(s) making the estimates, is the basis of an economically viable project after taking account of all relevant Modifying Factors. Mineral Reserves are inclusive of diluting material that will be mined in conjunction with the Mineral Reserves and delivered to the treatment plant or equivalent facility. |

(10) |

|

The Mineral Reserve estimates were prepared by Mr. |

2022 Mineral Resource – CLG and Esther

The 2022 Mineral Resource uses additional geological and geochemical data that has been collected since the 2020 Technical Report up until

The 2022 Mineral Resource uses a different geological modelling methodology than was used for the 2020 Technical Report. The interpretation of the vein solids that were used to define the estimation domains are now lithology based, rather than grade shells used in the 2020 Technical Report. The interpretation was completed by local CLG exploration staff in collaboration with the underground mine geologists and the Qualified Person from

The 2022 Mineral Resource uses a different estimation methodology than previously used for the 2020 Technical Report. The current methodology applies high grade restrictions specific to individual vein estimation domains. The estimation was completed using Ordinary Kriging in 3D, rather than flattened-space. The estimation was completed using locally varying anisotropy to account for the variable vein dip. The Mineral Resource categorization methodology was modified to incorporate proximity to underground geological mapping and drilling, both surface and underground. The estimation was calibrated against production channel sampling and plant production.

The CLG 2022 Mineral Resource reported by category is summarized in Table 3 below, and the Esther 2022 Mineral Resource reported by category is summarized in Table 4.

Table 3: 2022 Mineral Resource – CLG (Exclusive of Mineral Reserves) (1,2,3,4,5,6,7,8,9,10,11)

Mt |

Ag (g/t) |

Zn (%) |

Pb (%) |

Au (g/t) |

Ag (Moz) |

Zn (Mlbs) |

Pb (Mlbs) |

Au (koz) |

|

Measured |

0.38 |

151 |

2.63 |

1.49 |

0.26 |

1.9 |

22.1 |

12.6 |

3.2 |

Indicated |

1.55 |

82 |

3.11 |

1.57 |

0.17 |

4.1 |

106.4 |

53.8 |

8.6 |

Measured and Indicated |

1.94 |

96 |

3.01 |

1.56 |

0.19 |

6.0 |

128.5 |

66.4 |

11.8 |

Inferred |

2.09 |

113 |

4.30 |

2.45 |

0.20 |

7.6 |

198.4 |

113.1 |

13.3 |

(1) |

|

Mineral Resources are reported on a |

(2) |

|

Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, marketing, or other relevant issues. |

(3) |

|

The |

(4) |

|

The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated or Measured Mineral Resource. It is uncertain if further exploration will result in upgrading Inferred Mineral Resources to an Indicated or Measured Mineral Resource category. |

(5) |

|

Specific gravity has been assumed on a dry basis. |

(6) |

|

Tonnage and contained metal have been rounded to reflect the accuracy of the estimate and numbers may not sum exactly. |

(7) |

|

Mineral Resources exclude all Mineral Resource material mined prior to |

(8) |

|

Mineral Resources are reported within stope shapes using a |

(9) |

|

No dilution was applied to the Mineral Resource. |

(10) |

|

Contained Metal (CM) is calculated as follows: |

|

|

|

(11) |

|

The Mineral Resource estimates were prepared by |

Stope optimizations have been generated to restrict the reported Mineral Resource to areas that demonstrate reasonable prospects of economic extraction.

Table 4: 2022 Mineral Resource – Esther (1,2,3,4,5,6,7,8,9,10)

Mt |

Ag (g/t) |

Zn (%) |

Pb (%) |

Au (g/t) |

Ag (Moz) |

Zn (Mlbs) |

Pb (Mlbs) |

Au (koz) |

|

Indicated |

0.28 |

122 |

4.30 |

2.17 |

0.14 |

1.1 |

26.8 |

13.6 |

1.2 |

Inferred |

1.20 |

133 |

3.69 |

1.53 |

0.09 |

5.1 |

98.0 |

40.6 |

3.3 |

(1) |

|

Mineral Resources are reported on a |

(2) |

|

Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, marketing, or other relevant issues. |

(3) |

|

The |

(4) |

|

The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated or Measured Mineral Resource. It is uncertain if further exploration will result in upgrading Inferred Mineral Resources to an Indicated or Measured Mineral Resource category. |

(5) |

|

Specific gravity has been assumed on a dry basis. |

(6) |

|

Tonnage and contained metal have been rounded to reflect the accuracy of the estimate and numbers may not sum exactly. |

(7) |

|

Mineral Resources are reported within stope shapes using a |

(8) |

|

No dilution was applied to the Mineral Resource. |

(9) |

|

Contained Metal (CM) is calculated as follows: |

|

|

|

(10) |

|

The Mineral Resource estimates were prepared by |

2022 Mineral Reserve – CLG Changes and Key Assumptions

The reserve numbers reported in the 2020 Technical Report were impacted by two material and compounding errors. First, the block model used in preparation of the reserve estimate was distorted during transfer between software packages resulting in reduced block dimensions and unestimated spaces between blocks. Second, an incorrect software parameter was used in calculating tonnes and grades within designed stope solids that resulted in any unestimated volume (both planned intentional dilution outside the estimated vein and unestimated spaces resulting from the distortion) being applied at the average mineralized grade instead of zero grade for dilution. The effective result of the combination of these errors is that metal grades were significantly overstated in the 2020 Technical Report. There were other minor errors identified during the analysis of the 2020 Mineral Reserve, including overlapping reserve stope solids, incorrect external dilution calculations and the inclusion of a small amount of Inferred grades within stope solids. In addition to correcting the errors identified in the 2020 Technical Report, which was the majority of the reduction, we previously disclosed the need to make additional adjustments in the 2020 Mineral Reserve. There are multiple factors that have contributed to the remaining adjustments in the 2022 Mineral Reserve since the 2020 Technical Report, and these adjustments have been addressed in the new 2022 Mineral Reserve, with all underlying assumptions modified based on actual operating experience since plant operations commenced in

The factors that have reduced the metal content in the Mineral Reserve include the South-East zone infill drilling data, updated geological modelling, updated mining dilution and recovery assumptions, increased operating cost assumptions and decreased zinc plant recoveries. The factors that have increased the metal content in the Mineral Reserve include increased plant throughput, increased silver and lead processing recoveries and higher metal price assumptions compared to the 2020 Technical Report.

Table 5: Summary of changes from the 2020 Technical Report to the 2022 Mineral Reserve

|

|

2020 Technical Report LOM (A) |

Depletion

from 2020 to June 30, 2022 (B) |

2022 Mineral Reserve

(C) |

2022 Mineral Reserve + Depletion

(B+C) |

% Change

(B+C)/A-1 |

P&P Reserve |

Mt |

9.62 |

1.73 |

6.07 |

7.79 |

(19)% |

|

g/t |

305 |

305 |

244 |

258 |

(16)% |

Zn Grade |

% |

5.65 |

4.07 |

4.48 |

4.39 |

(22)% |

Pb Grade |

% |

2.76 |

2.33 |

2.14 |

2.19 |

(21)% |

|

g/t |

0.35 |

0.34 |

0.27 |

0.28 |

(20)% |

Ag Contained |

Moz |

94.5 |

16.9 |

47.7 |

64.5 |

(32)% |

Zn Contained |

Mlbs |

1,199 |

155 |

599 |

754 |

(37)% |

Pb Contained |

Mlbs |

585 |

89 |

287 |

375 |

(36)% |

Au Contained |

kOz |

109 |

19 |

52 |

71 |

(35)% |

Figure 1 shows the Reduction in contained silver between the 2020 Technical Report and the 2022 Updates.

Key Assumptions Generally

The 2022 Updates are based on a variety of estimates and assumptions relating to, among other things, geological interpretation, statistical inferences, commodity prices, mining methodologies, operating and capital costs, plant throughput and processing recoveries and operating conditions. In particular, material assumptions and risks include those described below and elsewhere in this press release, including metal prices, as well as our ability to reduce operating costs, increase ramp development rates and dewater the mine in a cost-effective manner. There can be no assurance that the assumptions underlying the 2022 Updates will actualize or be correct, and changes to any of these assumptions or our inability to achieve these assumptions may result in actual results to deviate significantly from the 2022 Updates.

Mine Design

Long-hole (“LH”) mining methods were applied where applicable throughout the mine. The operation has successfully been mining steeper sections of the Central zone using LH mining methods and we expect to be able to mine appropriate areas of the South-East zone using the same methodology. The zones that are dipping at less than 55° are still planned to be extracted using cut and fill (“C+F”) methods.

Mineral Reserve stopes are planned to be filled using paste fill, cemented rock fill or uncemented rock fill. The paste fill plant is in the final stages of construction and the plant is anticipated to be commissioned in Q4-2022.

Mine dilution and mine recovery estimates are based on recent actual performance, with consideration for business improvement initiatives. These assumptions are applied based on the mining method, stope width, zone inclination and proximity to hanging-wall faults.

Operating and sustaining capital cost assumptions are based on recent actual costs with specific allowances for business improvement initiatives underway. Mine operating costs were developed separately for LH and C+F mining methods.

Figure 2 shows a Long Section of CLG 2022 Mineral Reserve solids.

Processing

The 2022 LOM Plan is based on an average processing rate of 2,891 tonnes per day, resulting in a mine plan that exhausts current reserves in Q1-2028.

Mineral processing at the current operation uses conventional sulphide flotation, producing separate lead and zinc concentrates. Predicted metallurgical recoveries over the 2022 LOM Plan average

A total of 42.4 million ounces of silver, 380 million pounds of zinc, 256 million pounds of lead and 29.5 thousand ounces of gold are estimated to be produced according to the 2022 LOM Plan.

Table 6: Life of Mine Projected Processing and Production Summary(1,2)

Plant Metrics |

Units |

2022- H2 |

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

LOM |

Processed Material |

Mt |

0.52 |

1.04 |

1.06 |

1.06 |

1.07 |

1.06 |

0.25 |

6.07 |

Process Rate |

tpd |

2,872 |

2,854 |

2,890 |

2,898 |

2,925 |

2,917 |

2,773 |

2,890 |

|

g/t |

288 |

257 |

255 |

241 |

206 |

236 |

272 |

244 |

Zn Grade |

% |

3.96 |

4.48 |

4.47 |

5.07 |

4.59 |

4.01 |

4.58 |

4.48 |

Pb Grade |

% |

2.14 |

2.06 |

1.93 |

2.33 |

2.31 |

2.08 |

2.15 |

2.14 |

|

g/t |

0.30 |

0.30 |

0.32 |

0.25 |

0.22 |

0.23 |

0.25 |

0.27 |

Ag Production |

Moz |

4.3 |

7.6 |

7.7 |

7.3 |

6.3 |

7.2 |

2.0 |

42.4 |

Zn Production |

Mlbs |

29.0 |

65.3 |

66.2 |

74.9 |

68.5 |

59.7 |

16.3 |

379.9 |

Pb Production |

Mlbs |

22.1 |

42.4 |

40.3 |

48.6 |

48.6 |

43.6 |

10.7 |

256.4 |

Au Production |

koz |

2.9 |

5.6 |

6.2 |

4.9 |

4.3 |

4.5 |

1.2 |

29.5 |

(1) |

|

LOM begins on |

(2) |

|

Ag production is silver contained in Pb and Zn concentrates, Zn production is zinc contained in Zn concentrate, Pb production is lead contained in Pb concentrate, and Au production is gold contained in Pb concentrate. |

CLG’s short term definition drilling and mine plan updates may cause actual results to differ from the 2022 LOM Plan schedule shown in Table 6.

Capital and Operating Costs

The total sustaining capital cost for the 2022 LOM Plan at CLG is estimated at

Sustaining capital costs include underground access development to the lower levels in the Central and North-West Zones, and development of the South-East zone, together with equipment replacements and miscellaneous infrastructure projects including upgrades to the underground dewatering system as the mine is further developed, a final tailings dam raise to be completed in 2025 and a zinc concentrate fluorine leach plant expected to be commissioned in the first half of 2023.

Table 7: Life of Mine Sustaining Capital Costs Summary

Sustaining Capital Costs |

LOM ($M) |

|

|

Infrastructure and Equipment |

|

Total Sustaining Capital Cost |

|

The average 2022 LOM Plan operating cost is estimated at

Table 8: Life of Mine Unit Operating Costs Summary

Unit Operating Costs |

LOM ($/t) |

Mining |

|

Processing |

|

Mine General and Administrative |

|

Total Operating Cost |

|

All-in sustaining costs are defined in the Non-GAAP Financial Performance Measures section and summarized in Table 9 below.

Table 9: Life of

Cash Costs and All-In Sustaining Costs |

Units |

LOM |

Cash Costs |

$M |

|

Sustaining Capital & Asset Retirement Obligation Accretion |

$M |

|

All-In Sustaining Costs |

$M |

|

Payable Silver Ounces |

Moz |

38.4 |

All-In Sustaining Costs before by-product credits |

$/oz Ag payable |

|

By-Product Credits |

$/oz Ag payable |

( |

All-In Sustaining Costs net of by-product credits |

$/oz Ag payable |

|

(1) |

|

Net of by-product credits at prices of |

(2) |

|

Silver represents approximately |

(3) |

|

Includes all site level costs but excludes |

CLG Exploration Update

Exploration has continued throughout 2022 on the CLG deposit as well as on regional targets in the Los Gatos Joint Venture (“LGJV”) district. Over 63,000 meters of surface drilling have been completed since mid-2021 with a focus on both resource definition and expansion on the CLG deposit, as well as on the adjacent Esther deposit.

Recent drilling in the area beneath the main South-East zone (referred to as South-East Deeps) on the CLG deposit has discovered both silver-copper and silver-lead-zinc mineralization down to an elevation of 820 meters above sea level (“masl”) which is approximately 330 meters in elevation below the bottom of the 2022 Mineral Reserve.

The drill results for drillholes used in the 2022 Mineral Resource will be described in the 2022 Technical Reports. The drill results since the cutoff dates for the 2022 Mineral Resource estimate, of

Resource definition drilling up until early

Resource definition drilling is now focused on higher grade areas of Inferred within the 2022 Mineral Resource. The first two holes in the

Table 10: Cerro Los Gatos Resource conversion drilling results

Drillhole |

|

From

(m) |

To

(m) |

Drill Width (m) |

Estimated True Width (m) |

Ag

(g/t) |

Zn

(%) |

Pb

(%) |

Au

(g/t) |

Cu

(%) |

GA-SE-461A |

286 |

289.5 |

3.5 |

3.2 |

216 |

10.69 |

5.82 |

0.34 |

0.19 |

|

GA-SE-464 |

324.8 |

330.3 |

5.5 |

4.3 |

79 |

7.56 |

3.64 |

0.09 |

0.23 |

|

|

445.8 |

450.8 |

5.0 |

2.8 |

80 |

3.29 |

1.68 |

0.14 |

0.12 |

|

GA-SE-465 |

and |

484.4 |

489.5 |

5.1 |

3.4 |

146 |

2.86 |

1.90 |

0.12 |

0.34 |

and |

496 |

498 |

2.0 |

1.3 |

23 |

7.21 |

1.77 |

0.52 |

0.18 |

|

GA-SE-466 |

435.5 |

437.3 |

1.8 |

1.4 |

141 |

5.52 |

4.75 |

0.05 |

0.68 |

|

and |

441.3 |

447.3 |

6.0 |

5.0 |

204 |

1.54 |

3.85 |

0.35 |

0.42 |

|

GA-SE-467 |

457.0 |

498.0 |

41.0 |

25.2 |

156 |

4.41 |

3.19 |

0.09 |

0.75 |

|

including |

481.0 |

498.0 |

17.0 |

10.4 |

291 |

5.55 |

6.14 |

0.10 |

1.01 |

|

|

|

|

|

|

|

|

|

|

|

|

GA-CZ-478 |

434.0 |

436.0 |

2.0 |

1.8 |

147 |

4.58 |

2.60 |

0.04 |

0.44 |

|

and |

448.0 |

450.0 |

2.0 |

1.8 |

17 |

2.95 |

1.40 |

5.27 |

0.06 |

|

GA-CZ-479 |

466.5 |

471.5 |

5.0 |

3.9 |

60 |

12.01 |

3.15 |

0.16 |

0.30 |

|

and |

478.3 |

480.3 |

2.0 |

1.6 |

32 |

14.40 |

1.40 |

0.06 |

0.30 |

Hole GA-SE-463 encountered drilling difficulties and did not reach the projected target. Holes GA-SE-468 and GA-SE-469 drilled above the Antigatos-2 Fault and did not intercept significant mineralization.

South-East Deeps

Resource expansion drilling after

The intercepts in this deeper zone contain silver, zinc, lead and in some instances copper. Most intersected structures contain Ag-Zn-Pb while the deepest structure in drillhole GA-SE-475 is high in Ag-Cu but low in Zn-Pb. The vertical extent of the mineralization and the mix of vein types indicates that

Table 11: Cerro Los Gatos South-East Deeps zone drilling results

Drillhole |

|

From

(m) |

To

(m) |

Drill Width (m) |

Estimated True Width (m) |

Ag

(g/t) |

Zn

(%) |

Pb

(%) |

Au

(g/t) |

Cu

(%) |

GA-SE-470 |

670.5 |

675.5 |

5.0 |

3.1 |

78 |

9.45 |

1.55 |

0.26 |

0.70 |

|

and |

690.0 |

692.0 |

2.0 |

1.3 |

415 |

15.15 |

14.90 |

0.20 |

0.82 |

|

GA-SE-471 |

620.35 |

635.5 |

15.2 |

10.4 |

75 |

2.75 |

1.70 |

0.27 |

0.34 |

|

including |

630.0 |

635.5 |

5.5 |

3.9 |

119 |

2.70 |

2.04 |

0.58 |

0.46 |

|

GA-SE-472 |

650.0 |

651.5 |

1.5 |

1.1 |

197 |

0.27 |

0.14 |

0.01 |

0.01 |

|

and |

655.0 |

660.0 |

5.0 |

3.5 |

31 |

4.67 |

2.57 |

0.33 |

0.06 |

|

and |

669.5 |

671.0 |

1.5 |

1.1 |

125 |

3.58 |

4.86 |

0.09 |

0.46 |

|

and |

674.3 |

675.9 |

1.6 |

1.2 |

36 |

6.72 |

3.42 |

0.14 |

0.06 |

|

GA-SE-475 |

774.0 |

778.0 |

4.0 |

3.0 |

39 |

2.90 |

2.84 |

0.37 |

0.50 |

|

and |

785.0 |

790.0 |

5.0 |

3.7 |

87 |

5.21 |

6.42 |

0.82 |

0.32 |

|

and |

792.0 |

808.0 |

16.0 |

12.0 |

135 |

0.65 |

0.45 |

0.04 |

1.34 |

|

including |

792.0 |

800.0 |

8.0 |

6.0 |

178 |

0.21 |

0.41 |

0.01 |

1.43 |

|

GA-SE-477 |

717.0 |

724.5 |

7.5 |

5.9 |

247 |

5.97 |

3.58 |

0.11 |

0.12 |

|

and |

752.0 |

754.0 |

2.0 |

1.6 |

217 |

5.51 |

14.40 |

0.45 |

0.13 |

GA-SE-473 drillhole encountered drilling difficulty and did not reach the target. GA-SE-474 was a wedge attempt from GA-SE-472 that was cancelled due to insufficient change of direction. GA-SE-476 and GA-SE-481 are awaiting final assay results. Neither drillhole exhibited visually high content of base metal sulphides.

Figure 3 shows Long Section of 2022 Mineral Reserve and Resource solids for CLG showing South-East Deeps intercepts.

Figure 4 shows a Long section showing selected South-East Deeps drilling intercepts.

Regional Exploration Update

Drill testing was conducted on four regional targets during the second half of 2021 and early 2022.

Esther (LGJV)

The Esther deposit is located approximately 3 km SW from the underground access development for CLG. The last five drillholes comprised of 1,467 meters of the Esther definition program were returned after the

Table 12: Significant Esther drilling results

Drillhole |

From

(m) |

To

(m) |

Drill Width (m) |

Estimated True Width (m) |

Ag

(g/t) |

Zn

(%) |

Pb

(%) |

Au

(g/t) |

Cu

(%) |

ES-106 |

100.65 |

104.65 |

4.0 |

3.2 |

109 |

0.14 |

0.15 |

0.01 |

0.01 |

The LGJV has updated the Esther Mineral Resource, as shown in Table 4, and plans to complete economic analysis to determine options for this zone.

Cascabel and

During late 2021 and early 2022, the LGJV drilled the Cascabel and

The Cascabel fault is a very strong structural feature and the LGJV still considers the area prospective for hosting mineralization. The LGJV is completing detailed mapping of the area between

Wall-e / Eva (LGJV)

During 2022, five holes for 2,676 meters were drilled at Wall-e / Eva area, approximately 11 km northwest of CLG.

The first four drillholes contained geological indications that the drilled intercepts were above the potential mineralization zone. The fifth drillhole (DDH-WA-05) was targeted to go below these initial intercepts and intersected Ag-Pb-Zn-Cu mineralization as shown in Table 13. DDH-WA-01 through DDH-WA-04 did not intercept significant mineralization.

Table 13: Significant Wall-e / Eva drilling results

Drillhole |

|

From

(m) |

To

(m) |

Drill Width (m) |

Estimated True Width (m) |

Ag

(g/t) |

Zn

(%) |

Pb

(%) |

Au

(g/t) |

Cu

(%) |

DDH-WA-05 |

|

582.4 |

588.5 |

6.1 |

3.7 |

23 |

2.77 |

0.83 |

0.18 |

0.15 |

including |

585.8 |

587.0 |

1.2 |

0.7 |

79 |

6.62 |

1.95 |

0.54 |

0.68 |

The LGJV has now permitted new platforms to drill down beneath the intercept in hole DDH-WA-05 and has completed detailed mapping of the area. The LGJV intends to use this mapping and drilling information to determine the highest priority for the next round of drilling which it expects to commence during Q4-2022.

During 2021, the Company drilled 15 drillholes on the Santa Valeria concession, located 16 km west of the CLG operations, for a total of 4,953 meters drilled. The drilling did not intercept significant mineralization. The area remains of interest to

Updated District Exploration Strategy

The LGJV has a large land package covering over 103,000 ha.

The updated approach is focused on two streams. One stream of work has started on the horst (exposed) section of the andesite running from the far north-west of the property and down to Esther and CLG in the centre of the property. The other stream of work is for the area of the basin that is underlain by the andesite.

On the horst section of the andesite, the LGJV exploration team has started detailed mapping between the Wall-e and Amapola areas in the north and the CLG-Cascabel-Esther area in the south. Follow-up drilling is expected over the coming months on Wall-e and Amapola as the new detailed mapping is analyzed with the results of historic and recent drilling.

On the basin section of the andesite, the LGJV has acquired magnetic and radiometric data for the area and is contemplating other geophysical surveys to identify the basement structures. Depending on the results of the geophysical analysis the LGJV is considering some deep stratigraphic holes east of CLG.

Figure 5 shows the LGJV District Surface Lithology map.

Corporate Update

The Company has refreshed the executive management team and is pleased to announce the appointment of

At the request of the LGJV and the Company’s Board of Directors, an independent review of the 2022 Updates was performed by

As announced on

About

Quality Assurance

The half core samples from the LGJV’s surface exploration drillholes are shipped directly in sealed bags to ALS-Laboratories preparation facilities in Chihuahua City,

Qualified Persons

Scientific and technical disclosure in this press release regarding the Cerro Los Gatos and Esther 2022 Mineral Resource was based upon information prepared by or under the supervision of

Non-GAAP Financial Performance Measures

This press release includes certain measures that are not defined by GAAP to evaluate various aspects of our business. These non-GAAP financial measures are intended to provide additional information only and do not have any standardized meaning prescribed by GAAP and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP. The measures are not necessarily indicative of operating profit or cash flow from operations as determined under GAAP.

Cash Costs and All-In Sustaining Costs (“AISC”), before and after by-product credits

Cash costs include all direct and indirect operating cash costs related to the physical activities of producing metals, including mining, processing and other plant costs, treatment and refining costs, freight and handling, general and administrative costs and royalties. AISC or AISC before by-product credits includes total production cash costs incurred at the LGJV’s mining operations plus sustaining capital expenditures and reclamation accretion expense and excludes

Table 14: Reconciliation of Cash Costs and AISC to Cost of Sales (as defined under US GAAP)

Cash Costs and All-In Sustaining Costs |

Units |

LOM |

Cost of Sales |

$M |

|

Royalties |

$M |

|

General and Administrative |

$M |

|

Expenses |

$M |

|

Treatment and Refining |

$M |

|

Cash Costs |

$M |

|

Sustaining Capital |

$M |

|

Accretion Expense |

$M |

|

All-in Sustaining Costs (AISC) |

$M |

|

By-Product Credits |

$M |

|

LOM Payable Silver |

Moz |

38.4 |

Cash Costs before By-Product Credits |

$/oz Ag payable |

|

AISC before By-Product Credits |

$/oz Ag payable |

|

By-Product Credits |

$/oz Ag payable |

|

Cash Costs after By-Product Credits |

$/oz Ag payable |

|

AISC after By-Product Credits |

$/oz Ag payable |

|

Notice Regarding Inferred Mineral Resources Disclosure

“Inferred Mineral Resources” are subject to uncertainty as to their existence and as to their economic and legal feasibility. The level of geological uncertainty associated with an Inferred Mineral Resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability.

Forward-Looking Statements

This press release contains statements that constitute “forward looking information” and “forward-looking statements” within the meaning of

View source version on businesswire.com: https://www.businesswire.com/news/home/20221003005310/en/

Investors and Media Contact

Chief Executive Officer

Director,

investors@gatossilver.com

(720) 726-9662

Source: