GAMCO Investors, Inc. Reports Results for the 2nd Quarter 2024

GAMCO Investors, Inc. (GAMI) reported its Q2 2024 results with $30.7 billion in assets under management (AUM) as of June 30, 2024. The company achieved an operating margin of 27.1% and diluted EPS of $0.61, up from $0.58 in Q2 2023. Key financial highlights include:

- Revenue of $57.6 million

- Operating income of $15.7 million

- Net income of $15.0 million

- $232.3 million in cash, cash equivalents, and investments with no debt

GAMI saw a slight decrease in AUM from $31.7 billion in Q1 2024, attributed to market depreciation and net outflows. The company continued its shareholder returns through dividends and share repurchases, while also announcing the creation of a $5 million private foundation for charitable giving.

GAMCO Investors, Inc. (GAMI) ha riportato i risultati del Q2 2024 con 30,7 miliardi di dollari in attivi gestiti (AUM) al 30 giugno 2024. L'azienda ha raggiunto un margine operativo del 27,1% e un EPS diluito di 0,61 dollari, in aumento rispetto a 0,58 dollari nel Q2 2023. I principali punti finanziari includono:

- Ricavi di 57,6 milioni di dollari

- Utile operativo di 15,7 milioni di dollari

- Utile netto di 15,0 milioni di dollari

- 232,3 milioni di dollari in contante, equivalenti di cassa e investimenti senza debito

GAMI ha registrato un lieve calo degli AUM rispetto ai 31,7 miliardi di dollari nel Q1 2024, attribuito alla svalutazione del mercato e alle uscite nette. L'azienda ha continuato a restituire valore agli azionisti tramite dividendi e riacquisti di azioni, annunciando anche la creazione di una fondazione privata da 5 milioni di dollari per donazioni benefiche.

GAMCO Investors, Inc. (GAMI) reportó sus resultados del Q2 2024 con 30.7 mil millones de dólares en activos bajo gestión (AUM) al 30 de junio de 2024. La compañía logró un margen operativo del 27.1% y un EPS diluido de $0.61, en comparación con $0.58 en el Q2 2023. Los aspectos financieros clave incluyen:

- Ingresos de $57.6 millones

- Ingreso operativo de $15.7 millones

- Ingreso neto de $15.0 millones

- $232.3 millones en efectivo, equivalentes de efectivo e inversiones sin deudas

GAMI vio una ligera disminución en AUM de $31.7 mil millones en el Q1 2024, atribuida a la depreciación del mercado y flujos de salida netos. La compañía continuó retornando valor a los accionistas a través de dividendos y recompras de acciones, además de anunciar la creación de una fundación privada de $5 millones para donaciones a la caridad.

GAMCO Investors, Inc. (GAMI)는 2024년 2분기 결과를 발표하며 2024년 6월 30일 기준 307억 달러의 운용 자산 (AUM)을 기록했습니다. 회사는 운영 마진 27.1%와 희석 주당 순이익 $0.61을 달성했으며, 이는 2023년 2분기의 $0.58에서 증가한 수치입니다. 주요 재무 하이라이트는 다음과 같습니다:

- 매출 $5760만

- 운영 이익 $1570만

- 순이익 $1500만

- 부채 없는 $2억 3230만의 현금, 현금성 자산 및 투자

GAMI는 2024년 1분기 AUM이 317억 달러에서 약간 감소했으며, 이는 시장 하락 및 순유출에 기인합니다. 회사는 배당금과 자사주 매입을 통한 주주 수익을 지속했으며, 자선 기부를 위한 500만 달러 규모의 민간 재단 설립도 발표했습니다.

GAMCO Investors, Inc. (GAMI) a publié ses résultats du Q2 2024 avec 30,7 milliards de dollars d'actifs sous gestion (AUM) au 30 juin 2024. L'entreprise a réalisé une marge opérationnelle de 27,1% et un BPA dilué de 0,61 dollar, en hausse par rapport à 0,58 dollar au Q2 2023. Les principaux points financiers incluent :

- Chiffre d'affaires de 57,6 millions de dollars

- Résultat d'exploitation de 15,7 millions de dollars

- Résultat net de 15,0 millions de dollars

- 232,3 millions de dollars en liquidités, équivalents de liquidités et investissements sans dettes

GAMI a observé une légère baisse des AUM par rapport aux 31,7 milliards de dollars du Q1 2024, attribuée à la dépréciation du marché et aux sorties nettes. L'entreprise a continué à distribuer des retours aux actionnaires par le biais de dividendes et de rachats d'actions, tout en annonçant la création d'une fondation privée de 5 millions de dollars pour des dons caritatifs.

GAMCO Investors, Inc. (GAMI) hat seine Ergebnisse für das Q2 2024 veröffentlicht, mit 30,7 Milliarden Dollar an verwaltetem Vermögen (AUM) zum 30. Juni 2024. Das Unternehmen erreichte eine Betriebsgewinnmarge von 27,1% und einen verwässerten EPS von 0,61 Dollar, was einen Anstieg von 0,58 Dollar im Q2 2023 darstellt. Zu den wichtigsten finanziellen Eckdaten gehören:

- Umsatz von 57,6 Millionen Dollar

- Betriebsergebnis von 15,7 Millionen Dollar

- Nettogewinn von 15,0 Millionen Dollar

- 232,3 Millionen Dollar in Bargeld, Zahlungsmitteläquivalenten und Investitionen ohne Schulden

GAMI verzeichnete einen leichten Rückgang des AUM von 31,7 Milliarden Dollar im Q1 2024, was auf Marktblasen und netto Abflüsse zurückzuführen ist. Das Unternehmen setzte weiterhin auf die Renditen für die Aktionäre durch Dividenden und Aktienrückkäufe und kündigte zudem die Gründung einer privaten Stiftung in Höhe von 5 Millionen Dollar für wohltätige Zwecke an.

- Diluted EPS increased to $0.61 from $0.58 year-over-year

- Strong financial position with $232.3 million in cash, cash equivalents, and investments and no debt

- Operating margin remained solid at 27.1%

- Continued shareholder returns through dividends and share repurchases

- Increased buyback authorization by 500,000 shares

- Assets under management decreased 3.1% quarter-over-quarter to $30.7 billion

- Net outflows of $455 million during the quarter

- Revenue decreased to $57.6 million from $59.2 million year-over-year

- SICAV revenues dropped due to changes in revenue share for merger arbitrage SICAV

- Quarter End AUM of

$30.7 billion ; Average AUM of$31.1 billion for the Second Quarter - Operating Margin of

27.1% for the Second Quarter - Second Quarter Fully Diluted EPS of

$0.61 versus$0.58 in the Second Quarter of 2023 $232.3 million in Cash, Cash Equivalents, Investments and no Debt

GREENWICH, Conn., Aug. 06, 2024 (GLOBE NEWSWIRE) -- GAMCO Investors, Inc. (“GAMI”) (OTCQX: GAMI) today reported its operating results for the quarter ended June 30, 2024.

Financial Highlights

| (In thousands, except percentages and per share data) | |||||||||||||

| Three Months Ended | |||||||||||||

| June 30, 2024 | March 31, 2024 | June 30, 2023 | |||||||||||

| U.S. GAAP | |||||||||||||

| Revenue | $ | 57,644 | $ | 56,945 | $ | 59,171 | |||||||

| Expenses | 41,994 | 41,597 | 42,679 | ||||||||||

| Operating income | 15,650 | 15,348 | 16,492 | ||||||||||

| Non-operating income | 2,535 | 4,372 | 3,281 | ||||||||||

| Net income | 15,017 | 15,810 | 14,613 | ||||||||||

| Diluted earnings per share | $ | 0.61 | $ | 0.64 | $ | 0.58 | |||||||

| Operating margin | 27.1 | % | 27.0 | % | 27.9 | % | |||||||

Giving Back to Society -

Since our initial public offering in February 1999, our firm’s combined charitable donations total approximately

On August 6, 2024, the board of directors authorized the creation of a private foundation to continue our charitable giving program. The foundation will be funded with a

Revenue

| (In thousands) | Three Months Ended | ||||||

| June 30, 2024 | June 30, 2023 | ||||||

| Investment advisory and incentive fees | |||||||

| Funds | $ | 37,909 | $ | 37,480 | |||

| Institutional and Private Wealth Management | 15,377 | 15,222 | |||||

| SICAV | 4 | 1,704 | |||||

| Total | $ | 53,290 | $ | 54,406 | |||

| Distribution fees and other income | 4,354 | 4,765 | |||||

| Total revenue | $ | 57,644 | $ | 59,171 | |||

The quarter over quarter increase in Funds and Institutional and Private Wealth Management revenues was primarily the result of higher average equity assets under management. The drop in SICAV revenues reflects a change in the revenue share for the merger arbitrage SICAV (an open-end fund available to non-U.S. shareholders). The change better aligns the economics with the responsibilities of managing the fund.

Expenses

| (In thousands) | Three Months Ended | ||||||

| June 30, 2024 | June 30, 2023 | ||||||

| Compensation | $ | 29,006 | $ | 28,056 | |||

| Management fee | 2,021 | 2,197 | |||||

| Distribution costs | 5,709 | 6,369 | |||||

| Other operating expenses | 5,258 | 6,057 | |||||

| Total expenses | $ | 41,994 | $ | 42,679 | |||

- The higher compensation expense in the second quarter of 2024 reflected

$1.5 million higher stock-based compensation, partially offset by$0.4 million lower variable compensation. - The

$0.2 million decrease in management fee is attributable to the lower pre-management fee income of$1.8 million ; and, - Other operating expenses this quarter were lower versus the second quarter of 2023 reflecting the change in the agreement for merger arbitrage SICAV.

Operating Margin

The operating margin, which represents the ratio of operating income to revenue, was

Non-Operating Income

| (In thousands) | Three Months Ended | ||||||||

| June 30, 2024 | June 30, 2023 | ||||||||

| Gain / (loss) from investments, net | $ | 99 | $ | 1,616 | |||||

| Interest and dividend income | 2,726 | 1,958 | |||||||

| Interest expense | (290 | ) | (293 | ) | |||||

| Total non-operating income | $ | 2,535 | $ | 3,281 | |||||

Non-operating income decreased

Other Financial Highlights

The effective income tax rate for the second quarter of 2024 was

Cash, cash equivalents, and investments were

Assets Under Management

| (In millions) | As of | |||||||||

| June 30, 2024 | March 31, 2024 | June 30, 2023 | ||||||||

| Mutual Funds | $ | 8,035 | $ | 8,235 | $ | 8,271 | ||||

| Closed-end Funds | 7,052 | 7,313 | 7,195 | |||||||

| Institutional & PWM (a) (b) | 10,436 | 11,146 | 11,035 | |||||||

| SICAV (c) | 9 | 9 | 590 | |||||||

| Total Equities | 25,532 | 26,703 | 27,091 | |||||||

| 5,159 | 4,965 | 3,596 | ||||||||

| Institutional & PWM Fixed Income | 32 | 32 | 32 | |||||||

| Total Treasuries & Fixed Income | 5,191 | 4,997 | 3,628 | |||||||

| Total Assets Under Management | $ | 30,723 | $ | 31,700 | $ | 30,719 | ||||

| (a) Includes | ||||||||||

| (b) Includes | ||||||||||

| (c) Includes | ||||||||||

Assets under management on June 30, 2024 were

Assets under management in our

Assets Under Administration

| (In millions) | As of | ||||||

| June 30, 2024 | March 31, 2024 | ||||||

| Teton-Keeley Funds (a) | $ | 880 | $ | 952 | |||

| SICAV | 468 | 580 | |||||

| Total Assets Under Administration | $ | 1,348 | $ | 1,532 | |||

| (a) Includes | |||||||

AUA on June 30, 2024 were

Mutual Funds

Assets under management in Mutual Funds on June 30, 2024 were

- Distributions, net of reinvestment, of

$5 million ; - Net outflows of

$169 million ; and - Net market depreciation of

$26 million .

Closed-end Funds

Assets under management in Closed-end Funds on June 30, 2024 were

- Distributions, net of reinvestment, of

$126 million ; - Net outflows of

$46 million , including the redemption of$37 million of preferred shares, the repurchase of$12 million of common stock less the issuance of$3 million preferred shares; and - Net market depreciation of

$89 million .

Institutional & PWM

Assets under management in Institutional & PWM on June 30, 2024 were

- Net market depreciation of

$342 million ; and - Net outflows of

$368 million .

SICAV

Assets under management in the SICAV on June 30, 2024 of

Balance Sheet Information

As of June 30, 2024, cash and cash equivalents were

Return to Shareholders

During the second quarter of 2024, GAMI paid a dividend of

On August 6, 2024, GAMI’s board of directors declared a regular quarterly dividend of

Symposiums/Conferences

- On April 4th, we hosted the 10th Annual Waste & Environmental Services Symposium. The conference featured presentations by senior management of several leading companies, with a focus on the themes of waste, water treatment, and the environment.

- On May 3rd, GAMCO hosted its 18th annual Omaha Research Trip in conjunction with the Berkshire Hathaway Annual Meeting. This Value Investor Conference attracted a record number of participants with Gabelli portfolio managers anchoring panels with noted Berkshire experts and regional CEOs.

- On May 9th and 10th, we hosted our 39th GAMCO client meeting in New York City. We presented our annual Gabelli Prize in honor of Graham & Dodd, Murray, and Greenwald for Value Investing to Fidelity Management & Research Company’s Vice Chairman, Peter S. Lynch.

- On June 6th, we hosted the 16th Annual Media & Entertainment Symposium highlighted by a sports investing panel.

- At the June 26th and 27th Morningstar Conference, Gabelli Funds was a Principal Sponsor at Navy Pier in Chicago featuring keynote presentations by portfolio managers Tony Bancroft (Gabelli Commercial Aerospace & Defense ETF NYSE:GCAD) and John Belton (Gabelli Growth Innovators ETF NYSE: GGRW).

- We are hosting the following in the third quarter 2024:

- 30th Aerospace & Defense Symposium (September 5th)

- 2nd PFAS Symposium (September 26th)

- 30th Aerospace & Defense Symposium (September 5th)

- We are hosting the following in the fourth quarter of 2024:

- Rule 852(b)(6) Conference (October 25th)

- 48th Automotive Aftermarket Symposium (November 4th and 5th)

- 6th Healthcare Symposiums (November 15th)

- Rule 852(b)(6) Conference (October 25th)

About GAMCO Investors, Inc.

GAMI is best known for its research-driven value approach to equity investing (known as PMV with a CatalystTM). GAMI conducts its investment advisory business principally through two subsidiaries: Gabelli Funds, LLC (24 open-end funds, 14 closed-end funds, 5 actively managed semi-transparent ETFs, and a SICAV) and GAMCO Asset Management Inc. (approximately 1,400 institutional and private wealth separate accounts). GAMI serves a broad client base including institutions, intermediaries, offshore investors, private wealth, and direct retail investors. In recent years, GAMI has successfully integrated new teams of RIAs by providing attractive compensation arrangements and extensive research capabilities.

GAMI offers a wide range of solutions for clients across Value and Growth Equity, Convertibles, actively managed semi-transparent ETFs, sector-focused strategies including Gold and Utilities, Merger Arbitrage, Fixed Income, and

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Our disclosure and analysis in this press release, which do not present historical information, contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements convey our current expectations or forecasts of future events. You can identify these statements because they do not relate strictly to historical or current facts. They use words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” and other words and terms of similar meaning. They also appear in any discussion of future operating or financial performance. In particular, these include statements relating to future actions, future performance of our products, expenses, the outcome of any legal proceedings, and financial results. Although we believe that we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know about our business and operations, the economy, and other conditions, there can be no assurance that our actual results will not differ materially from what we expect or believe. Therefore, you should proceed with caution in relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance.

Forward-looking statements involve a number of known and unknown risks, uncertainties and other important factors, some of which are listed below, that are difficult to predict and could cause actual results and outcomes to differ materially from any future results or outcomes expressed or implied by such forward-looking statements. Some of the factors that may cause our actual results to differ from our expectations include risks associated with the duration and scope of the ongoing coronavirus pandemic resulting in volatile market conditions, a decline in the securities markets that adversely affect our assets under management, negative performance of our products, the failure to perform as required under our investment management agreements, and a general downturn in the economy that negatively impacts our operations. We also direct your attention to the more specific discussions of these and other risks, uncertainties and other important factors contained in our Annual Report and other public filings. Other factors that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We do not undertake to update publicly any forward-looking statements if we subsequently learn that we are unlikely to achieve our expectations whether as a result of new information, future developments or otherwise, except as may be required by law.

Gabelli Funds, LLC is a registered investment adviser with the Securities and Exchange Commission and is a wholly owned subsidiary of GAMCO Investors, Inc. (OTCQX: GAMI).

Investors should carefully consider the investment objectives, risks, charges and expenses of the fund before investing. The prospectus, which contains more complete information about this and other matters, should be read carefully before investing. To obtain a prospectus, please call 800 GABELLI or visit www.gabelli.com

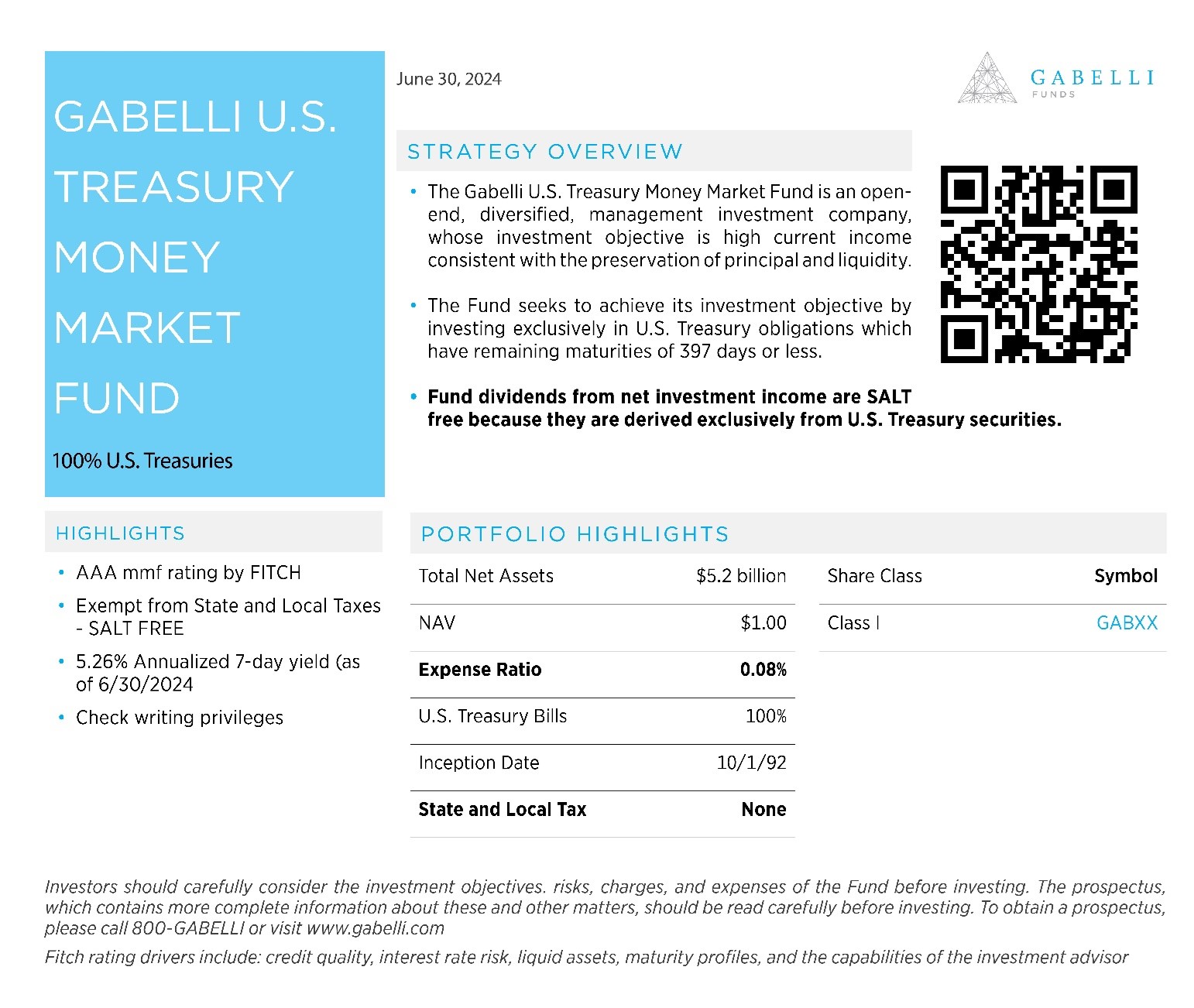

Money Market Fund

Investment in the fund is neither guaranteed nor insured by the Federal Deposit Insurance Corporation or any government agency. Although the fund seeks to preserve the value of your investment at

| GAMCO Investors, Inc. and Subsidiaries | |||||||||||||

| Condensed Consolidated Statements of Operations (Unaudited) | |||||||||||||

| (in thousands, except per share data) | |||||||||||||

| Three Months Ended | |||||||||||||

| June 30, 2024 | March 31, 2024 | June 30, 2023 | |||||||||||

| Revenue: | |||||||||||||

| Investment advisory and incentive fees | $ | 53,290 | $ | 52,472 | $ | 54,406 | |||||||

| Distribution fees and other income | 4,354 | 4,473 | 4,765 | ||||||||||

| Total revenue | 57,644 | 56,945 | 59,171 | ||||||||||

| Expenses: | |||||||||||||

| Compensation | 29,006 | 28,554 | 28,056 | ||||||||||

| Management fee | 2,021 | 2,191 | 2,197 | ||||||||||

| Distribution costs | 5,709 | 5,950 | 6,369 | ||||||||||

| Other operating expenses | 5,258 | 4,902 | 6,057 | ||||||||||

| Total expenses | 41,994 | 41,597 | 42,679 | ||||||||||

| Operating income | 15,650 | 15,348 | 16,492 | ||||||||||

| Non-operating income: | |||||||||||||

| Gain from investments, net | 99 | 1,632 | 1,616 | ||||||||||

| Interest and dividend income | 2,726 | 3,033 | 1,958 | ||||||||||

| Interest expense | (290 | ) | (293 | ) | (293 | ) | |||||||

| Total non-operating income | 2,535 | 4,372 | 3,281 | ||||||||||

| Income before provision for income taxes | 18,185 | 19,720 | 19,773 | ||||||||||

| Provision for income taxes | 3,168 | 3,910 | 5,160 | ||||||||||

| Net income | $ | 15,017 | $ | 15,810 | $ | 14,613 | |||||||

| Earnings per share attributable to common | |||||||||||||

| stockholders: | |||||||||||||

| Basic | $ | 0.61 | $ | 0.64 | $ | 0.58 | |||||||

| Diluted | $ | 0.61 | $ | 0.64 | $ | 0.58 | |||||||

| Weighted average shares outstanding: | |||||||||||||

| Basic | 24,442 | 24,808 | 25,358 | ||||||||||

| Diluted | 24,442 | 24,808 | 25,358 | ||||||||||

| Shares outstanding | 24,335 | 24,585 | 25,313 | ||||||||||

| GAMCO Investors, Inc. and Subsidiaries | ||||||||||

| Condensed Consolidated Statements of Financial Condition (Unaudited) | ||||||||||

| (in thousands) | ||||||||||

| June 30, | December 31, | June 30, | ||||||||

| 2024 | 2023 | 2023 | ||||||||

| Assets | ||||||||||

| Cash and cash equivalents | $ | 76,093 | $ | 61,801 | $ | 149,153 | ||||

| Short-term investments in U.S. Treasury Bills | 99,061 | 99,025 | - | |||||||

| Investments in securities | 30,606 | 19,998 | 21,476 | |||||||

| Seed capital investments | 26,475 | 24,044 | 22,995 | |||||||

| Receivable from brokers | 3,244 | 4,562 | 2,078 | |||||||

| Other receivables | 19,009 | 21,178 | 20,155 | |||||||

| Deferred tax asset and income tax receivable | 8,822 | 8,927 | 13,650 | |||||||

| Other assets | 10,546 | 9,896 | 11,538 | |||||||

| Total assets | $ | 273,856 | $ | 249,431 | $ | 241,045 | ||||

| Liabilities and stockholders' equity | ||||||||||

| Income taxes payable | $ | 120 | $ | 17 | $ | - | ||||

| Compensation payable | 36,395 | 23,399 | 36,147 | |||||||

| Accrued expenses and other liabilities | 44,912 | 45,036 | 43,473 | |||||||

| Total liabilities | 81,427 | 68,452 | 79,620 | |||||||

| Stockholders' equity | 192,429 | 180,979 | 161,425 | |||||||

| Total liabilities and stockholders' equity | $ | 273,856 | $ | 249,431 | $ | 241,045 | ||||

| Shares outstanding | 24,335 | 24,906 | 25,313 | |||||||

| GAMCO Investors, Inc. and Subsidiaries | ||||||||||||||||||||

| Assets Under Management | ||||||||||||||||||||

| By investment vehicle | ||||||||||||||||||||

| (in millions) | ||||||||||||||||||||

| Three Months Ended | % Changed From | |||||||||||||||||||

| June 30, | March 31, | June 30, | March 31, | June 30, | ||||||||||||||||

| 2024 | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||

| Equities: | ||||||||||||||||||||

| Mutual Funds | ||||||||||||||||||||

| Beginning of period assets | $ | 8,235 | $ | 7,973 | $ | 8,288 | ||||||||||||||

| Inflows | 189 | 176 | 168 | |||||||||||||||||

| Outflows | (359 | ) | (432 | ) | (423 | ) | ||||||||||||||

| Net inflows (outflows) | (170 | ) | (256 | ) | (255 | ) | ||||||||||||||

| Market appreciation (depreciation) | (26 | ) | 523 | 242 | ||||||||||||||||

| Fund distributions, net of reinvestment | (4 | ) | (5 | ) | (4 | ) | ||||||||||||||

| Total increase (decrease) | (200 | ) | 262 | (17 | ) | |||||||||||||||

| Assets under management, end of period | $ | 8,035 | $ | 8,235 | $ | 8,271 | -2.4 | % | -2.9 | % | ||||||||||

| Percentage of total assets under management | 26.2 | % | 26.0 | % | 26.9 | % | ||||||||||||||

| Average assets under management | $ | 8,095 | $ | 7,965 | $ | 8,165 | 1.6 | % | -0.9 | % | ||||||||||

| Closed-end Funds | ||||||||||||||||||||

| Beginning of period assets | $ | 7,313 | $ | 7,097 | $ | 7,155 | ||||||||||||||

| Inflows | 3 | 41 | 1 | |||||||||||||||||

| Outflows | (48 | ) | (103 | ) | (24 | ) | ||||||||||||||

| Net inflows (outflows) | (45 | ) | (62 | ) | (23 | ) | ||||||||||||||

| Market appreciation (depreciation) | (89 | ) | 404 | 191 | ||||||||||||||||

| Fund distributions, net of reinvestment | (127 | ) | (126 | ) | (128 | ) | ||||||||||||||

| Total increase (decrease) | (261 | ) | 216 | 40 | ||||||||||||||||

| Assets under management, end of period | 7,052 | $ | 7,313 | $ | 7,195 | -3.6 | % | -2.0 | % | |||||||||||

| Percentage of total assets under management | 23.0 | % | 23.1 | % | 23.4 | % | ||||||||||||||

| Average assets under management | $ | 7,166 | $ | 7,060 | $ | 7,117 | 1.5 | % | 0.7 | % | ||||||||||

| Institutional & PWM | ||||||||||||||||||||

| Beginning of period assets | $ | 11,146 | $ | 10,738 | $ | 10,764 | ||||||||||||||

| Inflows | 125 | 66 | 66 | |||||||||||||||||

| Outflows | (493 | ) | (428 | ) | (297 | ) | ||||||||||||||

| Net inflows (outflows) | (368 | ) | (362 | ) | (231 | ) | ||||||||||||||

| Market appreciation (depreciation) | (342 | ) | 770 | 502 | ||||||||||||||||

| Total increase (decrease) | (710 | ) | 408 | 271 | ||||||||||||||||

| Assets under management, end of period | $ | 10,436 | $ | 11,146 | $ | 11,035 | -6.4 | % | -5.4 | % | ||||||||||

| Percentage of total assets under management | 34.0 | % | 35.2 | % | 35.9 | % | ||||||||||||||

| Average assets under management | $ | 10,775 | $ | 10,798 | $ | 10,628 | -0.2 | % | 1.4 | % | ||||||||||

| SICAV | ||||||||||||||||||||

| Beginning of period assets | $ | 9 | $ | 631 | $ | 824 | ||||||||||||||

| Inflows | - | - | 48 | |||||||||||||||||

| Outflows | - | (2 | ) | (269 | ) | |||||||||||||||

| Net inflows (outflows) | - | (2 | ) | (221 | ) | |||||||||||||||

| Market appreciation (depreciation) | - | - | (13 | ) | ||||||||||||||||

| Reclassification to AUA | - | (620 | ) | - | ||||||||||||||||

| Total increase (decrease) | - | (622 | ) | (234 | ) | |||||||||||||||

| Assets under management, end of period | $ | 9 | $ | 9 | $ | 590 | 0.0 | % | -98.5 | % | ||||||||||

| Percentage of total assets under management | 0.0 | % | 0.0 | % | 1.9 | % | ||||||||||||||

| Average assets under management | $ | 9 | $ | 10 | $ | 683 | -10.0 | % | -98.7 | % | ||||||||||

| Total Equities | ||||||||||||||||||||

| Beginning of period assets | $ | 26,703 | $ | 26,439 | $ | 27,031 | ||||||||||||||

| Inflows | 317 | 283 | 283 | |||||||||||||||||

| Outflows | (900 | ) | (965 | ) | (1,013 | ) | ||||||||||||||

| Net inflows (outflows) | (583 | ) | (682 | ) | (730 | ) | ||||||||||||||

| Market appreciation (depreciation) | (457 | ) | 1,697 | 922 | ||||||||||||||||

| Fund distributions, net of reinvestment | (131 | ) | (131 | ) | (132 | ) | ||||||||||||||

| Reclassification to AUA | - | (620 | ) | - | ||||||||||||||||

| Total increase (decrease) | (1,171 | ) | 264 | 60 | ||||||||||||||||

| Assets under management, end of period | $ | 25,532 | $ | 26,703 | $ | 27,091 | -4.4 | % | -5.8 | % | ||||||||||

| Percentage of total assets under management | 83.1 | % | 84.2 | % | 88.2 | % | ||||||||||||||

| Average assets under management | $ | 26,045 | $ | 25,833 | $ | 26,593 | 0.8 | % | -2.1 | % | ||||||||||

| GAMCO Investors, Inc. and Subsidiaries | ||||||||||||||||||||

| Assets Under Management | ||||||||||||||||||||

| By investment vehicle - continued | ||||||||||||||||||||

| (in millions) | ||||||||||||||||||||

| Three Months Ended | % Changed From | |||||||||||||||||||

| June 30, | March 31, | June 30, | March 31, | June 30, | ||||||||||||||||

| 2024 | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||

| Fixed Income: | ||||||||||||||||||||

| Beginning of period assets | $ | 4,965 | $ | 4,615 | $ | 3,609 | ||||||||||||||

| Inflows | 1,290 | 1,605 | 931 | |||||||||||||||||

| Outflows | (1,162 | ) | (1,315 | ) | (988 | ) | ||||||||||||||

| Net inflows (outflows) | 128 | 290 | (57 | ) | ||||||||||||||||

| Market appreciation (depreciation) | 66 | 60 | 44 | |||||||||||||||||

| Total increase (decrease) | 194 | 350 | (13 | ) | ||||||||||||||||

| Assets under management, end of period | $ | 5,159 | $ | 4,965 | $ | 3,596 | 3.9 | % | 43.5 | % | ||||||||||

| Percentage of total assets under management | 16.8 | % | 16.2 | % | 11.7 | % | ||||||||||||||

| Average assets under management | $ | 5,064 | $ | 4,832 | $ | 3,618 | 4.8 | % | 40.0 | % | ||||||||||

| Institutional & PWM Fixed Income | ||||||||||||||||||||

| Beginning of period assets | $ | 32 | $ | 32 | $ | 32 | ||||||||||||||

| Inflows | - | - | - | |||||||||||||||||

| Outflows | - | - | - | |||||||||||||||||

| Net inflows (outflows) | - | - | - | |||||||||||||||||

| Market appreciation (depreciation) | - | - | - | |||||||||||||||||

| Total increase (decrease) | - | - | - | |||||||||||||||||

| Assets under management, end of period | $ | 32 | $ | 32 | $ | 32 | 0.0 | % | 0.0 | % | ||||||||||

| Percentage of total assets under management | 0.1 | % | 0.1 | % | 0.1 | % | ||||||||||||||

| Average assets under management | $ | 32 | $ | 32 | $ | 32 | 0.0 | % | 0.0 | % | ||||||||||

| Total Treasuries & Fixed Income | ||||||||||||||||||||

| Beginning of period assets | $ | 4,997 | $ | 4,647 | $ | 3,641 | ||||||||||||||

| Inflows | 1,290 | 1,605 | 931 | |||||||||||||||||

| Outflows | (1,162 | ) | (1,315 | ) | (988 | ) | ||||||||||||||

| Net inflows (outflows) | 128 | 290 | (57 | ) | ||||||||||||||||

| Market appreciation (depreciation) | 66 | 60 | 44 | |||||||||||||||||

| Total increase (decrease) | 194 | 350 | (13 | ) | ||||||||||||||||

| Assets under management, end of period | $ | 5,191 | $ | 4,997 | $ | 3,628 | 3.9 | % | 43.1 | % | ||||||||||

| Percentage of total assets under management | 16.9 | % | 15.8 | % | 11.8 | % | ||||||||||||||

| Average assets under management | $ | 5,096 | $ | 4,864 | $ | 3,650 | 4.8 | % | 39.6 | % | ||||||||||

| Total AUM | ||||||||||||||||||||

| Beginning of period assets | $ | 31,700 | $ | 31,086 | $ | 30,672 | ||||||||||||||

| Inflows | 1,607 | 1,888 | 1,214 | |||||||||||||||||

| Outflows | (2,062 | ) | (2,280 | ) | (2,001 | ) | ||||||||||||||

| Net inflows (outflows) | (455 | ) | (392 | ) | (787 | ) | ||||||||||||||

| Market appreciation (depreciation) | (391 | ) | 1,757 | 966 | ||||||||||||||||

| Fund distributions, net of reinvestment | (131 | ) | (131 | ) | (132 | ) | ||||||||||||||

| Reclassification to AUA | - | (620 | ) | - | ||||||||||||||||

| Total increase (decrease) | (977 | ) | 614 | 47 | ||||||||||||||||

| Assets under management, end of period | $ | 30,723 | $ | 31,700 | $ | 30,719 | -3.1 | % | 0.0 | % | ||||||||||

| Average assets under management | $ | 31,141 | $ | 30,697 | $ | 30,243 | 1.4 | % | 3.0 | % | ||||||||||

| GAMCO Investors, Inc. and Subsidiaries | |||||||||||||

| Assets Under Management | |||||||||||||

| By investment vehicle | |||||||||||||

| (in millions) | |||||||||||||

| Six Months Ended | |||||||||||||

| June 30, | June 30, | ||||||||||||

| 2024 | 2023 | % Change | |||||||||||

| Equities: | |||||||||||||

| Mutual Funds | |||||||||||||

| Beginning of period assets | $ | 7,973 | $ | 8,140 | |||||||||

| Inflows | 365 | 410 | |||||||||||

| Outflows | (791 | ) | (801 | ) | |||||||||

| Net inflows (outflows) | (426 | ) | (391 | ) | |||||||||

| Market appreciation (depreciation) | 497 | 530 | |||||||||||

| Fund distributions, net of reinvestment | (9 | ) | (8 | ) | |||||||||

| Total increase (decrease) | 62 | 131 | |||||||||||

| Assets under management, end of period | $ | 8,035 | $ | 8,271 | -2.9 | % | |||||||

| Percentage of total assets under management | 26.2 | % | 26.9 | % | |||||||||

| Average assets under management | $ | 8,030 | $ | 8,227 | -2.4 | % | |||||||

| Closed-end Funds | |||||||||||||

| Beginning of period assets | $ | 7,097 | $ | 7,046 | |||||||||

| Inflows | 44 | 25 | |||||||||||

| Outflows | (151 | ) | (39 | ) | |||||||||

| Net inflows (outflows) | (107 | ) | (14 | ) | |||||||||

| Market appreciation (depreciation) | 315 | 424 | |||||||||||

| Fund distributions, net of reinvestment | (253 | ) | (261 | ) | |||||||||

| Total increase (decrease) | (45 | ) | 149 | ||||||||||

| Assets under management, end of period | $ | 7,052 | $ | 7,195 | -2.0 | % | |||||||

| Percentage of total assets under management | 23.0 | % | 23.4 | % | |||||||||

| Average assets under management | $ | 7,113 | $ | 7,164 | -0.7 | % | |||||||

| Institutional & PWM | |||||||||||||

| Beginning of period assets | $ | 10,738 | $ | 10,714 | |||||||||

| Inflows | 191 | 127 | |||||||||||

| Outflows | (921 | ) | (855 | ) | |||||||||

| Net inflows (outflows) | (730 | ) | (728 | ) | |||||||||

| Market appreciation (depreciation) | 428 | 1,049 | |||||||||||

| Total increase (decrease) | (302 | ) | 321 | ||||||||||

| Assets under management, end of period | $ | 10,436 | $ | 11,035 | -5.4 | % | |||||||

| Percentage of total assets under management | 34.0 | % | 35.9 | % | |||||||||

| Average assets under management | $ | 10,787 | $ | 10,876 | -0.8 | % | |||||||

| SICAV | |||||||||||||

| Beginning of period assets | $ | 631 | $ | 867 | |||||||||

| Inflows | - | 172 | |||||||||||

| Outflows | (2 | ) | (445 | ) | |||||||||

| Net inflows (outflows) | (2 | ) | (273 | ) | |||||||||

| Market appreciation (depreciation) | - | (4 | ) | ||||||||||

| Reclassification to AUA | (620 | ) | - | ||||||||||

| Total increase (decrease) | (622 | ) | (277 | ) | |||||||||

| Assets under management, end of period | $ | 9 | $ | 590 | -98.5 | % | |||||||

| Percentage of total assets under management | 0.0 | % | 1.9 | % | |||||||||

| Average assets under management | $ | 9 | $ | 769 | -98.8 | % | |||||||

| Total Equities | |||||||||||||

| Beginning of period assets | $ | 26,439 | $ | 26,767 | |||||||||

| Inflows | 600 | 734 | |||||||||||

| Outflows | (1,865 | ) | (2,140 | ) | |||||||||

| Net inflows (outflows) | (1,265 | ) | (1,406 | ) | |||||||||

| Market appreciation (depreciation) | 1,240 | 1,999 | |||||||||||

| Fund distributions, net of reinvestment | (262 | ) | (269 | ) | |||||||||

| Reclassification to AUA | (620 | ) | - | ||||||||||

| Total increase (decrease) | (907 | ) | 324 | ||||||||||

| Assets under management, end of period | $ | 25,532 | $ | 27,091 | -5.8 | % | |||||||

| Percentage of total assets under management | 83.1 | % | 88.2 | % | |||||||||

| Average assets under management | $ | 25,939 | $ | 27,036 | -4.1 | % | |||||||

| GAMCO Investors, Inc. and Subsidiaries | |||||||||||||

| Assets Under Management | |||||||||||||

| By investment vehicle - continued | |||||||||||||

| (in millions) | |||||||||||||

| Six Months Ended | |||||||||||||

| June 30, | June 30, | ||||||||||||

| 2024 | 2023 | % Change | |||||||||||

| Fixed Income: | |||||||||||||

| Beginning of period assets | $ | 4,615 | $ | 2,462 | |||||||||

| Inflows | 2,895 | 2,776 | |||||||||||

| Outflows | (2,477 | ) | (1,720 | ) | |||||||||

| Net inflows (outflows) | 418 | 1,056 | |||||||||||

| Market appreciation (depreciation) | 126 | 78 | |||||||||||

| Total increase (decrease) | 544 | 1,134 | |||||||||||

| Assets under management, end of period | $ | 5,159 | $ | 3,596 | 43.5 | % | |||||||

| Percentage of total assets under management | 16.8 | % | 11.7 | % | |||||||||

| Average assets under management | $ | 4,948 | $ | 3,433 | 44.1 | % | |||||||

| Institutional & PWM Fixed Income | |||||||||||||

| Beginning of period assets | $ | 32 | $ | 32 | |||||||||

| Inflows | - | - | |||||||||||

| Outflows | - | - | |||||||||||

| Net inflows (outflows) | - | - | |||||||||||

| Market appreciation (depreciation) | - | - | |||||||||||

| Total increase (decrease) | - | - | |||||||||||

| Assets under management, end of period | $ | 32 | $ | 32 | 0.0 | % | |||||||

| Percentage of total assets under management | 0.1 | % | 0.1 | % | |||||||||

| Average assets under management | $ | 32 | $ | 32 | 0.0 | % | |||||||

| Total Treasuries & Fixed Income | |||||||||||||

| Beginning of period assets | $ | 4,647 | $ | 2,494 | |||||||||

| Inflows | 2,895 | 2,776 | |||||||||||

| Outflows | (2,477 | ) | (1,720 | ) | |||||||||

| Net inflows (outflows) | 418 | 1,056 | |||||||||||

| Market appreciation (depreciation) | 126 | 78 | |||||||||||

| Total increase (decrease) | 544 | 1,134 | |||||||||||

| Assets under management, end of period | $ | 5,191 | $ | 3,628 | 43.1 | % | |||||||

| Percentage of total assets under management | 16.9 | % | 11.8 | % | |||||||||

| Average assets under management | $ | 4,980 | $ | 3,465 | 43.7 | % | |||||||

| Total AUM | |||||||||||||

| Beginning of period assets | $ | 31,086 | $ | 29,261 | |||||||||

| Inflows | 3,495 | 3,510 | |||||||||||

| Outflows | (4,342 | ) | (3,860 | ) | |||||||||

| Net inflows (outflows) | (847 | ) | (350 | ) | |||||||||

| Market appreciation (depreciation) | 1,366 | 2,077 | |||||||||||

| Fund distributions, net of reinvestment | (262 | ) | (269 | ) | |||||||||

| Reclassification to AUA | (620 | ) | - | ||||||||||

| Total increase (decrease) | (363 | ) | 1,458 | ||||||||||

| Assets under management, end of period | $ | 30,723 | $ | 30,719 | 0.0 | % | |||||||

| Average assets under management | $ | 30,919 | $ | 30,501 | 1.4 | % | |||||||

191 Mason Street

Greenwich, CT 06830

GABELLI.COM

Contact:

Kieran Caterina

Chief Accounting Officer

(914) 921-5149

For further information please visit:

www.gabelli.com

FAQ

What was GAMCO Investors' (GAMI) earnings per share in Q2 2024?

How much were GAMI's assets under management as of June 30, 2024?

What was GAMCO Investors' (GAMI) operating margin in Q2 2024?