GABY Reports Third Quarter Results for 2022

GABY Inc. (CSE:GABY, OTCQB:GABLF) reported Q3 2022 revenue of $5.4 million, a 4% increase from Q2 2022, but a 20% decline year-over-year. Gross margin rose to 46%, reflecting improved operational efficiencies despite challenges in California's cannabis market. The company recorded a net loss of $3.8 million, influenced by a $1.9 million non-cash foreign exchange loss. Deliveries increased, serving 9,360 customers. Management is focused on expanding proprietary brands, which yield higher margins.

- None.

- None.

Insights

Analyzing...

Highlights include:

Retail revenue of

Gross margin improved to

Reduced SG&A expenses by

New delivery record reached - serving 9,300 customers in Q3 2022

SAN DIEGO, CA / ACCESSWIRE / November 29, 2022 / GABY Inc. ("GABY" or the "Company") (CSE:GABY) (OTCQB:GABLF), a California consolidator of cannabis dispensaries and the parent company of San Diego's Mankind Dispensary ("Mankind"), reported its financial and operating results for the quarter ending September 30, 2022 ("Q3 2022") All financial information is provided in United States dollars unless otherwise indicated. GABYs financial statements are prepared in accordance with International Financial Reporting Standards ("IFRS").

Third Quarter 2022 Financial & Operational Highlights

- Revenue for Q3 2022 was

$5.4 million , which after adjustment for the closure of GABY's wholesale distribution business, is down$1.3 million or -20% over same quarter last year, but up$0.2 million or4% over Q2 2022. - Gross profit for Q3 2022 was

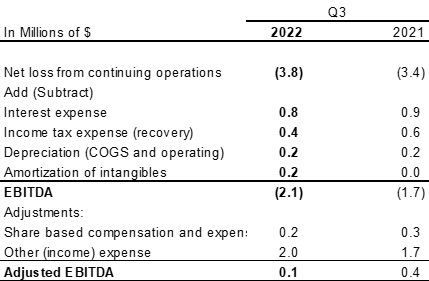

$2.5 million which reflects an increase of$0.3 million over Q2 2022, with gross margin increasing by 3 percentage points over the same period and7% points over same period last year. - Adjusted EBITDA1 was

$0.1 million or$0.3 million down from$0.4 million in Q3 2021 on lower revenue as described above. - The net loss of

$3.8 million for Q3 2022 includes a (non-cash)$1.9 million foreign exchange loss on translation of the$25.5 million promissory note (the "Note") issued as consideration for the acquisition of the Mankind Dispensary on April 1, 2021, and was$0.3 million down from the same quarter last year. - In Q3 2022 GABY's retail delivery business operating as "Mankind™" set a new delivery record, serving 9,360 customers which represents

10% more customers than the previous high earlier in the year and15% more customers than Q2 2022. As more dispensaries continue to open in close proximity and thus in competition to Mankind, management is focused on growing this business unit to service customers well outside of the reach of its brick and mortar location.

Management is also focused on building its portfolio of proprietary brands to increase its unique product offerings and increase retail margins. Proprietary brands have an average margin of approximately

Management's Commentary

Pricing headwinds in California wholesale flower have pushed retail revenue downwards over the last 12 months as operators look to pass cost savings on to the consumer. The retail price reductions have also impacted margins as the cannabis supply chain attempts to recover revenue losses.

Mankind saw a

The California cannabis market has demonstrated signs of stabilization from Q2 to Q3 of 2022. Mankind has experienced a

Management sees the stabilization of pricing in the California Retail market as "short term pain for long term gain" as the more realistic pricing allows the industry to better compete with pricing in the California illicit market. Management sees this ability to better compete as the nexus to move people from the illicit market to the legal market and as such creates as an opportunity for GABY to increase market share.

Management has given notice to the holders of the Note of certain claims to which they believe GABY is entitled to indemnification pursuant to the Stock Purchase Agreement dated February 15, 2021 entered into in connection with the acquisition of the Mankind Dispensary (the "Indemnity Claim"). Management is of the view that the Indemnity Claim has merit and is currently in discussions with the Note holders to offset the amount due under the Indemnity Claim against the principal amounts due under the Note.

ABOUT GABY

GABY Inc. is a California-focused retail consolidator and the owner of Mankind Dispensary, one of the oldest licensed dispensaries in California. Mankind Dispensary is a well-known and highly respected dispensary with deep roots in the California cannabis community operating in San Diego. GABY curates and sells a diverse portfolio of products, including its own proprietary brands, Kind Republic™ Dank Space™ and Lulu's™ through Mankind, A pioneer in the industry with a strong management team with experience in retail, consolidation, and cannabis, GABY is poised to grow its retail operations both organically and through acquisition.

GABY's common shares trade on the Canadian Securities Exchange ("CSE") under the symbol "GABY" and on the OTCQB under the symbol "GABLF". For more information on GABY, visit www.GABYInc.com or the Company's SEDAR profile at www.sedar.com.

For further inquiries, please contact:

General

Investor Relations at IR@GABYinc.com

Currency Presentation

All financial information is provided in United States dollars unless otherwise indicated.

Disclaimer and Forward-Looking Information

The CSE does not accept responsibility for the adequacy or accuracy of this release. Certain information set forth in this news release may contain forward-looking statements that involve substantial known and unknown risks and uncertainties, certain of which are beyond the control of the Company. Forward-looking statements are frequently characterized by words such as "plan", "continue", "expect", "project", "intend", "believe", "anticipate", "estimate", "may", "will", "potential", "proposed" and other similar words, or statements that certain events or conditions "may" or "will" occur. These statements are only predictions. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements. Forward-looking statements include, but are not limited to, management's expected setoff of any principal amounts owing under the Note in connection with the Indemnity Claim, the expected launch of the Kind Republic vape cartridge and pre-roll products in Q4, management's expected continued improvement to GABY's profitability in 2022, the estimated current and future cost savings of the Company, the Company's future business strategy, including its plans to expand organically and through future acquisitions or greenfield expansions, and the anticipated benefits to be derived from GABY's rationalization and cost cutting program. Although GABY believes that the expectations and assumptions on which such forward-looking statements and information are based are reasonable, undue reliance should not be placed on the forward-looking statements and information because GABY can give no assurance that they will prove to be correct. By its nature, such forward-looking information is subject to various risks and uncertainties, which could cause the actual results and expectations to differ materially from the anticipated results or expectations expressed. Without limitation, these risks and uncertainties include: a finding by an applicable governing authority that the Indemnity Claims are without merit; the severity of the COVID-19 pandemic; risks associated with the cannabis industry in general; failure to benefit from partnerships or successfully integrate acquisitions; actions and initiatives of federal, state and provincial governments and changes to government policies and the execution and impact of these actions, initiatives and policies; the size of the medical-use and adult-use cannabis market; competition from other industry participants; adverse United States ("U.S."), Canadian and global economic conditions; failure to comply with certain regulations; and departure of key management personnel or inability to attract and retain talent. GABY undertakes no obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law.

To the extent any information contained in forward-looking statements in this press release constitutes "future-oriented financial information" or "financial outlooks" within the meaning of applicable Canadian securities laws, such information is being provided to demonstrate the anticipated financial performance of the Company and the reader is cautioned that this information may not be appropriate for any other purpose and the reader should not place undue reliance on such future-oriented financial information or financial outlooks. Future-oriented financial information and financial outlooks, as with forward-looking statements generally, are, without limitation, based on the assumptions and subject to the risks set out above for forward-looking statements. The Company's actual financial position and results of operations may differ materially from its management's current expectations and, as a result, the Company's actual revenue may differ materially from the prospective revenue estimates or projections provided in this press release. Such information is presented for illustrative purposes only and may not be an indication of the Company's actual financial position or results of operations for the applicable financial periods.

Selected financial information outlined above for the Company's Q3 2022 should be read in conjunction with, GABY's interim annual financial statements and management's discussion and analysis ("MD&A") for the three and nine months ended September 30, 2022, which has been filed on the Company's SEDAR profile at www.sedar.com and the Company's website www.GABYinc.com.

Each of Mankind and GABY Manufacturing, are subsidiaries of GABY and hold a cannabis license in the State of California. Readers are cautioned that unlike in Canada which has Federal 032320-F legislation uniformly governing the cultivation, distribution, sale and possession of medical cannabis under the Cannabis Act (Federal), in the U.S., cannabis is largely regulated at the State level. Cannabis is legal in the State of California; however, cannabis remains illegal under U.S. federal laws. Notwithstanding the permissive regulatory environment of cannabis at the State level, cannabis continues to be categorized as a controlled substance under the Controlled Substances Act in the U.S. and as such, cannabis-related practices or activities, including without limitation, the manufacture, importation, possession, use or distribution of cannabis are illegal under U.S. federal law. To the knowledge of the Company, the businesses operated by each of GABY's subsidiaries are conducted in a manner consistent with the State law of California, as applicable, and are in compliance with regulatory and licensing requirements applicable in the State of California, respectively. However, readers should be aware that strict compliance with State laws with respect to cannabis will neither absolve GABY, or its subsidiary of liability under U.S. federal law, nor will it provide a defense to any federal proceeding in the U.S. which could be brought against any of GABY, or its subsidiary. Any such proceedings brought against GABY, or its subsidiary may materially adversely affect the Company's operations and financial performance generally in the U.S. market specifically.

Non-GAAP Measures

(1) Adjusted EBITDA does not have any standardized meaning as prescribed by IFRS , and, therefore, is considered a non-GAAP measure and may not be comparable to similar measures presented by other issuers and should not be viewed as a substitute for measures reported under IFRS.. Adjusted EBITDA from continuing operations is used by management and investors to analyze the Corporation's profitability based on the Corporation's principal business activities regardless of how: these activities are financed; assets are depreciated and amortized, and results are taxed in various jurisdictions or subject to entity specific tax planning. It therefore excludes interest expense, taxes, depreciation, and items which management considers are not related to operational performance of its core businesses. In addition, Adjusted EBITDA provides an indication of the Corporation's ongoing ability to service its debt, income taxes and capital expenditures and therefore excludes non-cash expenses. Readers should refer to GABY's MD&A under section entitled "NON-GAAP DISCLOSURE" for a full description of why certain items are excluded from net loss in arriving at the non-GAAP measure Adjusted EBITDA.

Below is a reconciliation of the non-GAAP measure Adjusted EBITDA from continuing operations for the quarters ended September 30, 2022 and 2021:

SOURCE: GABY Inc.

View source version on accesswire.com:

https://www.accesswire.com/729396/GABY-Reports-Third-Quarter-Results-for-2022