Global Entertainment Enterprise Falcon’s Beyond and Hong Kong-Based Cultural Commerce Giant K11 Group Plan to Launch New Entertainment Franchises and Attractions Across China

Joint Venture’s Debut Project Bolsters Falcon’s Global Expansion into

Ocean Adventure-Themed Vquarium Attraction to Debut at Hong Kong’s Iconic 11 SKIES in 2025

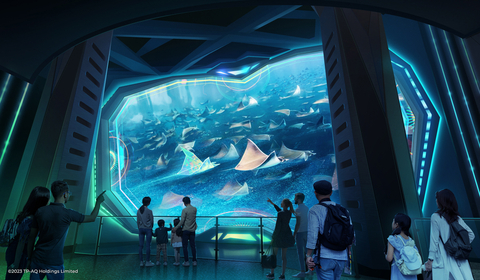

Ocean adventure-themed Vquarium attraction from Falcon’s Beyond and K11 to launch at Hong Kong’s 11 Skies in 2025. (Photo: Business Wire)

The new global alliance comes ahead of Falcon’s planning to become a publicly listed company on Nasdaq, strengthens its position in the world’s second largest economic market, and accelerates the

“As a global giant who shares our mission to develop state-of-the-art, game-changing consumer entertainment experiences, K11 Group is an ideal partner for Falcon’s as we continue our international growth, particularly across

Falcon’s alliance with K11 Group bolsters its strong track record in

The first new attraction experience being developed by Falcon’s under the joint venture is the underwater adventure themed Vquarium™. Providing a science fiction-like experience that is rooted entirely in the natural world, Vquarium will be a story-driven interactive adventure that explores oceans and waterways around the globe in a wonder-filled narrative that offers intimate and empowering encounters with virtual sea life to entertain, educate, and inspire. Vquarium will be introduced through an interactive attraction that allows visitors to simulate going on an immersive undersea voyage. A multi-room, multi-level experience, the attraction will also provide creative food and beverage offerings, along with retail components.

The first Vquarium immersive LBE is expected to launch in 2025 at K11 Group’s heralded 11 SKIES retailtainment destination. This is the first collaboration between Falcon’s and K11 Group, following Falcon’s nearly two decades of work in

Following its debut at 11 SKIES, Vquarium is planned to expand to nearly a dozen additional locations across

Under the joint venture, Falcon’s plans to expand the Vquarium experience beyond LBEs, across all forms of entertainment, including media content, video games, and consumer products. This IP expansion model is core to the company’s mission and purpose, to accelerate franchise activations concurrently across physical and digital experiences. The growth of the Vquarium franchise follows Falcon’s acceleration of its first global franchise, Katmandu™, which originated at Katmandu Park in Mallorca. Now, the company has opened a second park – Katmandu Park |

Last year, Falcon’s Beyond announced plans to become a publicly listed company through a definitive merger agreement with FAST Acquisition Corp. II (NYSE: FZT), a special purpose acquisition company founded by Doug Jacob and headed by Sandy Beall (“FAST II”). Upon the closing of the transaction, the new combined company will be named “Falcon’s Beyond Global, Inc.” and is expected to be listed on Nasdaq under the ticker symbol “FBYD.” More information about the transaction can be found in the Investor Relations section of Falcon’s website.

About Falcon’s Beyond

Falcon’s Beyond is a diversified global entertainment, consumer experience, and technology enterprise that is reimagining how we play, travel, shop, dine, relax and are entertained. Situated at the intersection of technology and entertainment, Falcon’s accelerates intellectual property (IP) activations concurrently across physical and digital experiences through three core business units: Falcon’s Creative Group, Falcon’s Beyond Destinations, and Falcon’s Beyond Brands. Falcon’s Creative Group is one of the world’s leading master planners having planned more than

FALCON'S BEYOND, VQUARIUM and KATMANDU and their related trademarks are owned or licensed by Falcon’s Beyond. Other trademarks are owned by their respective owners.

About K11 Group

K11 Group was founded in 2008 by renowned entrepreneur Adrian Cheng. The unique concept brand combines culture and commerce through all of its projects, sustaining an ecosystem that caters to all walks of life with a growing portfolio of brands spanning sectors in

A destination 10 years in the making, the flagship K11 MUSEA is K11 Group's most ambitious "cultural-retail" development and reinvigorates

11 SKIES is an upcoming mega project that will create a new landmark in

In addition to its K11 Art Malls, K11 Group operates K11 ATELIER as a network of office buildings for the next-generation workforce, alongside K11 ARTUS's luxury residences for worldly travellers, and K11 Select, which is a "cultural sandbox" for the modern generation, and marked K11 Group's entry into the asset-light management market. To cultivate cultural richness through its operational goals, the group also proudly runs the

K11 Group is based in

Additional Information and Where to Find It

In connection with the proposed business combination, Falcon’s Beyond Global, Inc. (“Pubco”) has filed with the

Investors and security holders can obtain free copies of the Registration Statement, and will be able to obtain free copies of amendments to the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by FAST II or Pubco through the website maintained by the SEC at www.sec.gov. The documents filed by FAST II with the SEC also may be obtained free of charge upon written request to 109 Old Branchville Road

Participants in the Solicitations

FAST II and its directors and executive officers may be deemed participants in the solicitation of proxies from FAST II’s stockholders with respect to the proposed business combination. A list of the names of those directors and executive officers and a description of their interests in FAST II is contained in FAST II’s final prospectus related to its initial public offering dated March 15, 2021 and the Registration Statement, each of which was filed with the SEC and is available free of charge at the SEC’s website at www.sec.gov. Additional information regarding the interests of such participants will be contained in amendments to the Registration Statement for the proposed business combination when available.

The Company and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the stockholders of FAST II in connection with the proposed business combination. A list of the names of such directors and executive officers and information regarding their interests in the proposed business combination is included in the Registration Statement, which was filed with the SEC and is available free of charge at the SEC’s website at www.sec.gov. Additional information regarding the interests of such participants will be included in amendments to the Registration Statement for the proposed business combination when available.

No Offer or Solicitation

This press release is for informational purposes only and shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed business combination and shall not constitute an offer to sell or a solicitation of an offer to buy any securities, nor shall there be any sale of securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 the Securities Act of 1933, as amended, or an exemption therefrom.

Caution About Forward-Looking Statements

This press release includes certain statements that are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters.

These forward-looking statements include, but are not limited to, the expectation that the proposed transaction will occur and Pubco will be listed on Nasdaq, expansion plans for Vquarium, and anticipated timing of and benefits associated with the opening of the 11 SKIES destination. These statements are based on various assumptions and on the current expectations of the Company, Pubco and FAST II and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and should not be relied on by an investor or others as, a guarantee, an assurance, a prediction, or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Falcon’s Beyond and FAST II. These forward-looking statements are subject to a number of risks and uncertainties, including, but not limited to, the likelihood of which could be adversely affected by (1) changes in domestic and foreign business, market, financial, political, and legal conditions in general and in the entertainment industry in particular; (2) the outcome of any legal proceedings that may be instituted against FAST II, Falcon’s Beyond or Pubco following the announcement of the proposed business combination; (3) the inability of the parties to successfully or timely consummate the proposed business combination, including the risk that any regulatory approvals or the SEC’s declaration of the effectiveness of our prospectus/proxy statement are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect Falcon’s Beyond or the expected benefits of the proposed transaction or that the approval of the requisite equity holders of FAST II is not obtained; (4) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; (5) volatility in the price of FAST II’s or Falcon’s Beyond’s securities; (6) the risk that the proposed business combination disrupts current plans and operations as a result of the announcement and consummation of the business combination; (7) the enforceability of Falcon’s Beyond’s intellectual property, including its patents, and the potential infringement on the intellectual property rights of others, cyber security risks or potential breaches of data security; (8) any failure to realize the anticipated benefits of the proposed transaction; (9) risks relating to the uncertainty of the projected financial information with respect to Falcon’s Beyond; (10) risks related to the rollout of Falcon’s Beyond's business and the timing of expected business milestones; (11) the effects of competition on Falcon’s Beyond's business; (12) the risk that the proposed business combination may not be completed by FAST II’s business combination deadline; (13) the amount of redemption requests made by FAST II's stockholders; (14) the ability of FAST II or Falcon’s Beyond to issue equity or equity-linked securities or obtain debt financing in connection with the proposed transaction or in the future; (15) and those factors discussed in the Registration Statement and FAST II's Form 10-K for the year ended December 31, 2022 under the heading "Risk Factors," and other documents FAST II or Pubco has filed, or will file, with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither FAST II nor Falcon’s Beyond presently know, or that FAST II or Falcon’s Beyond currently believe are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, the forward-looking statements reflect FAST II's and Falcon’s Beyond's expectations, plans, or forecasts of future events and views as of the date of this press release. FAST II and Falcon’s Beyond anticipate that subsequent events and developments will cause FAST II's and Falcon’s Beyond's assessments to change. However, while FAST II and Falcon’s Beyond may elect to update these forward-looking statements at some point in the future, FAST II and Falcon’s Beyond specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as a representation of FAST II's and Falcon’s Beyond's assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230907878202/en/

Media:

DKC Public Relations

Falcons@dkcnews.com

Investor Relations:

Brett Milotte, ICR

FalconsBeyondIR@icrinc.com

Source: Falcon’s Beyond