Fury to Commence Drilling at Éléonore South Gold Project

- None.

- None.

Insights

The announcement of Fury Gold Mines Limited's diamond core drilling operations at the Éléonore South gold project is indicative of the company's proactive approach to exploration. The focus on the Moni showing trend, which has yielded promising high-grade gold intercepts in the past, suggests a strategic attempt to delineate and expand known mineralized zones.

From a geological perspective, the decision to target areas near the Sirios' Cheechoo deposit and the operating Éléonore Mine is significant. The presence of structurally controlled quartz veins and intrusion-related disseminated gold mineralization hints at a complex geological setting that could host substantial gold resources. The mention of a 2,000 m x 750 m zone of lower-grade gold mineralization, with potential high-grade vein stockworks, is particularly noteworthy as it may represent a sizable deposit with economic extraction potential.

The biogeochemical survey planned for later in the spring could provide additional insights into the distribution of gold mineralization, potentially guiding future exploration efforts. The technical approach, involving fire assay and multi-element analysis, adheres to industry standards, ensuring reliable data for decision-making.

From a mining investment analysis standpoint, the commencement of drilling operations by Fury Gold Mines Limited represents a proactive measure to capitalize on the Éléonore South project's potential. The historical drill results, including intercepts of up to 294 g/t Au, are impressive and suggest the presence of high-grade ore that could significantly impact Fury's resource estimates and future valuation.

The proximity to existing mining operations adds logistical advantages, potentially reducing infrastructure costs if the project advances to production. However, investors should consider the inherent risks associated with exploration, including the possibility that the drilling may not yield the expected results or that the mineralization may not be economically viable to extract.

The company's fully funded drilling program indicates a strong financial position and commitment to exploration, which could be a positive sign for investors. The exploration strategy appears methodically planned, with a follow-up on previous high-grade intercepts and a comprehensive survey to identify new targets. This systematic approach could enhance the probability of success, thereby potentially increasing shareholder value.

Exploration activities like those announced by Fury Gold Mines Limited are typically viewed favorably in the market, as they demonstrate a company's commitment to growth and the potential for increased reserves. The strategic location of the Éléonore South project, alongside the historical high-grade intercepts, could position Fury favorably in the eyes of investors seeking exposure to the gold sector.

However, the costs associated with exploration and the uncertainty of outcomes require careful financial analysis. Investors should monitor the company's burn rate and the impact of these activities on its cash position. The market will also be looking for updates on the progress of the drilling program and any subsequent resource estimate revisions, which can significantly influence the stock's performance.

While the short-term market reaction to such news may be positive, the long-term value creation will hinge on the actual results from the drilling program and the company's ability to efficiently leverage these results into proven reserves.

VANCOUVER, BC / ACCESSWIRE / March 20, 2024 / Fury Gold Mines Limited (TSX:FURY)(NYSE American:FURY) ("Fury" or the "Company") is pleased to announce its intention to commence diamond core drilling operations at its

"Fury is excited to get an early start to our year with a fully funded, targeted drill program in the northeast region of the Éléonore South property," commented Tim Clark, CEO of Fury. "This area, given its strategic significance near the border to Sirios' Cheechoo deposit, proximity to the operating Éléonore Mine, and historical high-grade gold drill intercepts, represents a tremendous amount of potential upside to investors. Going forward, we will also be exploring other priority targets across the whole

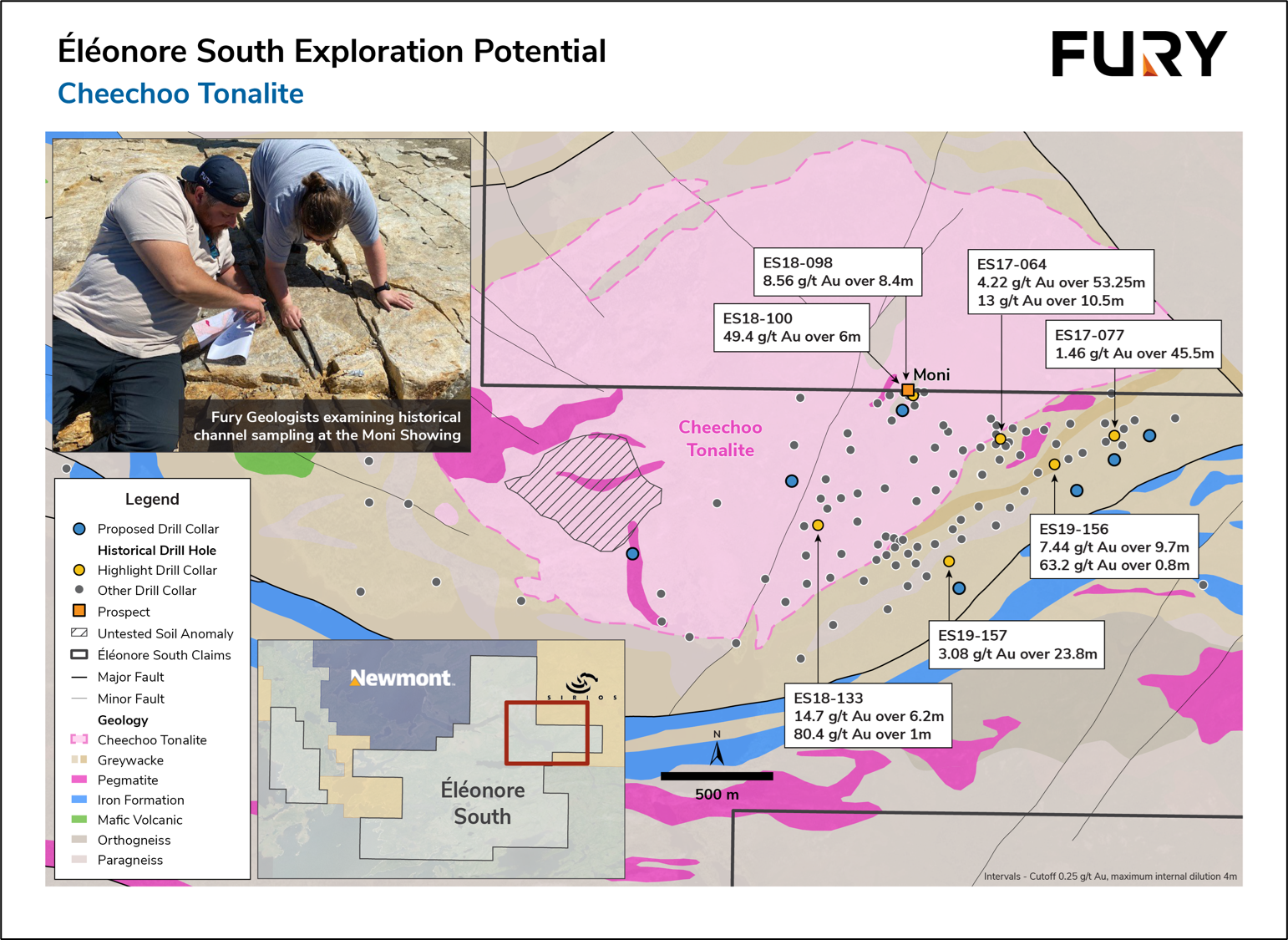

Éléonore South Project

The Éléonore South project is strategically located in an area of prolific gold mineralization with Newmont's Éléonore Mine to the north and Sirios' Cheechoo deposit to the east (Figure 1 inset). Two distinct styles of mineralization have been identified to date; structurally controlled quartz veins hosted within sedimentary rocks, similar to the high-grade mineralization observed at the Éléonore Mine; and intrusion-related disseminated gold mineralization, similar to that seen at the lower-grade bulk tonnage Cheechoo deposit with potential for higher grades hosted in stockwork quartz veining as observed at the JT and Moni showings.

Previous drilling at Éléonore South, 38,037 m in 164 drill holes, was largely focussed in the Moni area and successfully defined a 2,000 m x 750 m zone of lower-grade intrusion related gold mineralization similar to that of the Cheechoo gold deposit. Within the lower-grade gold halo, there are a series of structurally controlled quartz vein stockworks which host significantly higher grades of gold. Fury's Spring 2024 drilling campaign will focus on these structural corridors following up on previous drill intercepts of 53.25 m of 4.22 g/t Au; 6.0 m of 49.50 g/t Au and 23.8 m of 3.08 g/t Au.

In late spring Fury will complete the biogeochemical grid where a robust geochemical gold anomaly within the same sedimentary rock package that hosts Newmont's Éléonore Mine has been identified (see news release dated March 5, 2024).

Table 1: Éléonore South Previous Drill Highlights (2017-2019) from the Moni Showing (Cheechoo Style Mineralization)

| Hole ID | From | To | Length (m) | Au g/t | |

| ES17-64 | 167.25 | 220.50 | 53.25 | 4.22 | |

| 202.5 | 213.0 | 10.5 | 13.00 | ||

| Incl. | 204.0 | 207.0 | 3.0 | 37.90 | |

| ES18-098 | 8.1 | 16.5 | 8.4 | 8.56 | |

| Incl. | 8.9 | 9.8 | 1.0 | 71.40 | |

| ES18-100 | 14.0 | 20.0 | 6.0 | 49.40 | |

| Incl. | 17.0 | 18.0 | 1.0 | 294.00 | |

| ES18-133 | 164.8 | 171.0 | 6.2 | 14.70 | |

| Incl. | 167.0 | 168.0 | 1.0 | 80.40 | |

| ES19-156 | 140.3 | 150.0 | 9.7 | 7.44 | |

| Incl. | 144.7 | 145.5 | 0.8 | 63.20 | |

| ES19-157 | 169.4 | 193.2 | 23.8 | 3.08 | |

| Incl. | 181.0 | 182.5 | 1.5 | 27.80 | |

| and | 186.4 | 187.2 | 0.8 | 13.35 | |

| ES17-077 | 142.5 | 188.0 | 45.5 | 1.46 | |

| Incl. | 186.5 | 188.0 | 1.5 | 23.10 | |

*Cutoff 0.25 g/t Au, maximum internal dilution 4m | |||||

"We've been given an excellent opportunity to get drilling at Éléonore South several months ahead of what we had initially envisioned. This will allow us the ability to confirm our recent targeting within the Cheechoo tonalite and test our ideas on the controls of the high-grade quartz vein hosted gold mineralization. Our teams will be mobilizing within the week," stated Bryan Atkinson, P.Geol., SVP Exploration of Fury.

Historical JT and Moni Drilling

Analytical samples were taken by sawing BTW diameter core into equal halves on site and sent one of the halves to ALS Lab in Rouyn-Noranda, Val d'Or, QC, and Sudbury, ON for preparation and analysis. All samples are assayed using 50 g nominal weight fire assay with atomic absorption finish (Au-AA24) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). Where Au-AA24 results were greater than 3 ppm Au the assay were repeated with 50 g nominal weight fire assay with gravimetric finish (Au-GRA22). QA/QC programs using internal standard samples, field and lab duplicates and blanks indicate good accuracy and precision in a large majority of standards assayed. True widths of mineralization are unknown based on current geometric understanding of the mineralized intervals.

David Rivard, P.Geo, Exploration Manager at Fury, is a "qualified person" within the meaning of Canadian mineral projects disclosure standards instrument 43-101 and has reviewed and approved the technical disclosures in this press release.

About Fury Gold Mines Limited

Fury Gold Mines Limited is a well-financed Canadian-focused exploration company positioned in two prolific mining regions across Canada and holds a 54 million common share position in Dolly Varden Silver Corp (

For further information on Fury Gold Mines Limited, please contact:

Margaux Villalpando, Manager Investor Relations

Tel: (844) 601-0841

Email: info@furygoldmines.com

Website: www.furygoldmines.com

Forward-Looking Statements and Additional Cautionary Language

This release includes certain statements that may be deemed to be "forward-looking statements" within the meaning of applicable securities laws, which statements relate to the future exploration operations of the Company and may include other statements that are not historical facts. Forward-looking statements contained in this release primarily relate to statements that suggest that the future work at Éléonore South will potentially increase or upgrade the gold resources.

Although the Company believes that the assumptions and expectations reflected in those forward-looking statements were reasonable at the time such statements were made, there can be no certainty that such assumptions and expectations will prove to be materially correct. Mineral exploration is a high-risk enterprise.

Readers should refer to the risks discussed in the Company's Annual Information Form and MD&A for the year ended December 31, 2022 and subsequent continuous disclosure filings with the Canadian Securities Administrators available at www.sedarplus.ca and the Company's Annual Report available at www.sec.gov. Readers should not place heavy reliance on forward-looking information, which is inherently uncertain.

SOURCE: Fury Gold Mines Limited

View the original press release on accesswire.com