Fortuna intersects 23.7 g/t gold over 17.8 meters from the Kingfisher Prospect at the Séguéla Mine

Fortuna Silver Mines has announced significant drilling results at the Séguéla Mine in Côte d’Ivoire. The Kingfisher Prospect has returned 23.7 g/t gold over 17.9 meters, and other notable findings include 6.0 g/t over 11.9 meters and 6.4 g/t over 19.6 meters. At the Badior Prospect, key results include 20.5 g/t gold over 4.2 meters and 38.3 g/t over 3.5 meters. The Ancien Deposit revealed 27.4 g/t gold over 5.6 meters and 39.1 g/t over 2.8 meters. These findings expand high-grade gold potential, with Kingfisher showing continuous mineralization over 1 kilometer, remaining open at depth. Drilling at Badior and Ancien has also yielded promising high-grade intersections, supporting the underground mining potential. Drilling at Séguéla will continue through the second half of 2024, aiming for a maiden resource estimate by early 2025.

- Kingfisher Prospect: 23.7 g/t gold over 17.9 meters

- Badior Prospect: 20.5 g/t gold over 4.2 meters

- Ancien Deposit: 27.4 g/t gold over 5.6 meters

- Continuous mineralization at Kingfisher over 1 kilometer

- Drilling to continue throughout 2024 aiming for a maiden resource estimate by early 2025

- None.

Insights

The recent drill results from Fortuna Silver Mines' Séguéla Mine are promising for investors. The standout intercepts, such as 23.7 g/t gold over 17.8 meters, represent significant high-grade mineralization. Such results are critical because they can potentially increase the life span and productivity of the mine, directly impacting revenue.

For retail investors, it's essential to understand that high-grade findings often lead to a revaluation of a company's assets, which can positively influence stock prices. However, these results are still part of an ongoing exploration program and further delineation is required. Investors should watch for future updates on resource estimates and feasibility studies, which will provide a clearer picture of the potential economic benefits.

Rating: 1

The drill results from Fortuna Silver Mines' Séguéla Mine provide valuable geological insights. The continuity of high-grade mineralization over more than a kilometer at the Kingfisher Prospect indicates a robust geological system. The mineralization is associated with felsic intrusives, quartz veining and basaltic units, with alteration by silica-biotite-sericite-carbonate and pyrite development.

For investors, the geological context is important because it suggests the potential for additional discoveries along strike and at depth. The company's systematic approach, including infill and extension drilling, enhances the reliability of the data, reducing exploration risk. The presence of visible gold also indicates a relatively straightforward extraction process, which can lower operational costs.

Rating: 1

The exploration success at the Séguéla Mine could have broader market implications. High-grade gold discoveries generally attract significant attention, not just from investors but also from larger mining companies looking for acquisition targets. Fortuna Silver Mines' ability to define continuous mineralization enhances its attractiveness in the competitive mining sector.

Retail investors should note that exploration results can often lead to increased market activity and potentially higher stock volatility. It's also worth mentioning that the geographic location in Côte d’Ivoire poses both opportunities and risks, including geopolitical and logistical factors that could impact project development.

Rating: 1

VANCOUVER, British Columbia, June 20, 2024 (GLOBE NEWSWIRE) -- Fortuna Silver Mines Inc. (NYSE: FSM | TSX: FVI) is pleased to provide an update on its exploration program at the Séguéla Mine in Côte d’Ivoire.

Séguéla exploration program highlights:

| Kingfisher Prospect | |

| SGDD133: | 23.7 g/t Au over an estimated true width of 17.9 meters from 113 meters |

| SGRC1795: | 6.0 g/t Au over an estimated true width of 11.9 meters from 23 meters |

| SGRC1833: | 6.4 g/t Au over an estimated true width of 19.6 meters from 119 meters |

| SGRC1841: | 2.3 g/t Au over an estimated true width of 28.1 meters from 156 meters |

| Badior Prospect | |

| SGRC1955: | 20.5 g/t Au over an estimated true width of 4.2 meters from 53 meters |

| SGRC1961: | 16.2 g/t Au over an estimated true width of 5.6 meters from 53 meters |

| SGRC1967: | 38.3 g/t Au over an estimated true width of 3.5 meters from 27 meters |

| SGRC1969: | 15.7 g/t Au over an estimated true width of 10.5 meters from 132 meters |

| SGRC1971: | 15.6 g/t Au over an estimated true width of 11.9 meters from 122 meters |

| Ancien Deposit | |

| SGRD1892: | 12.3 g/t Au over an estimated true width of 9.1 meters from 297 meters, including 53.6 g/t Au over an estimated true width of 1.4 meters from 297 meters |

| SGRD1894: | 27.4 g/t Au over an estimated true width of 5.6 meters from 335 meters, including 209.0 g/t Au over an estimated true width of 0.7 meters from 335 meters |

| SGRD1895: | 39.1 g/t Au over an estimated true width of 2.8 meters from 254 meters, including 49.2 g/t Au over an estimated true width of 2.1 meters from 254 meters |

| SGRD1890: | 4.3 g/t Au over an estimated true width of 7.0 meters from 194 meters |

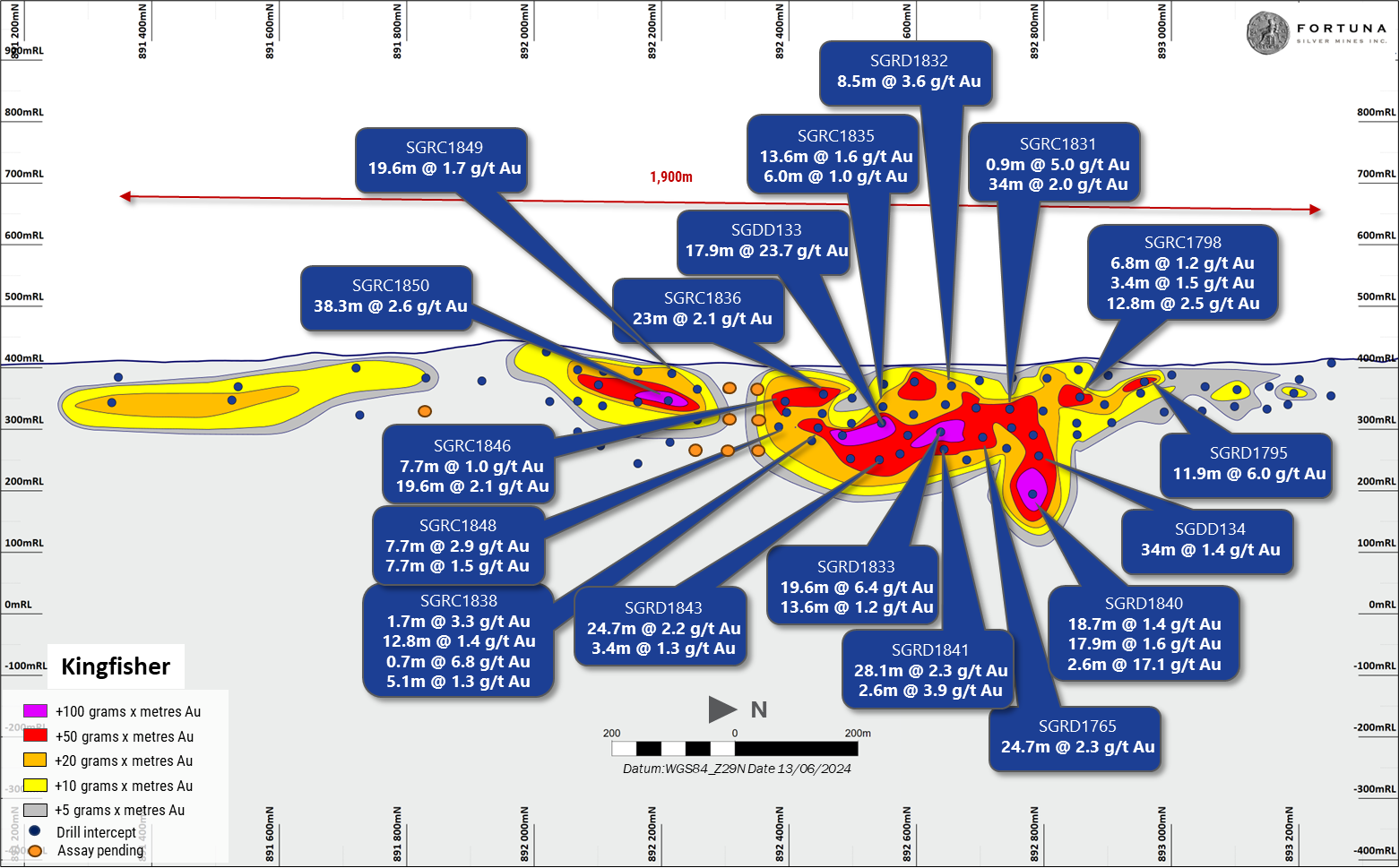

Paul Weedon, Senior Vice President of Exploration at Fortuna, commented, “The Kingfisher Prospect discovery, first announced in March 2024, has shown impressive growth with continuous drill defined mineralization now delineated along more than 1 kilometer of strike, with highlights including 23.7 g/t Au over an estimated true width of 17.9 meters from drill hole SGDD133, with mineralization remaining open along strike to the south and at depth.” Mr. Weedon continued, “In addition to the success at Kingfisher, infill and extension drilling at Badior has highlighted the high-grade potential of this prospect, exemplified by results such as 15.6 g/t Au over an estimated true width of 11.9 meters from drill hole SGRC1971.” Mr. Weedon concluded, “Results from deeper drilling at Ancien returned several high-grade intersections and continues to build underground mining opportunities at Séguéla.”

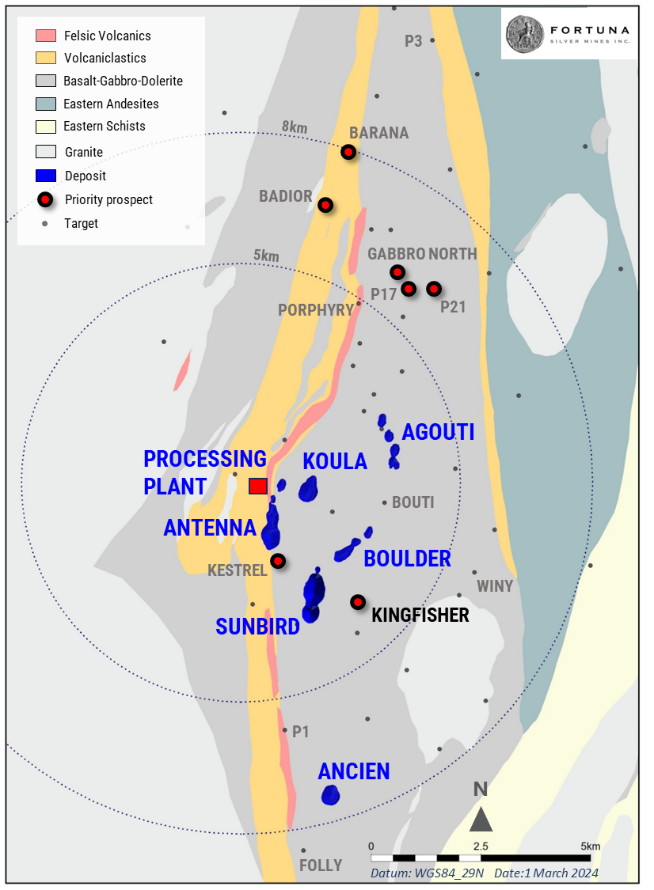

Séguéla Mine, Côte d’Ivoire

Kingfisher Prospect

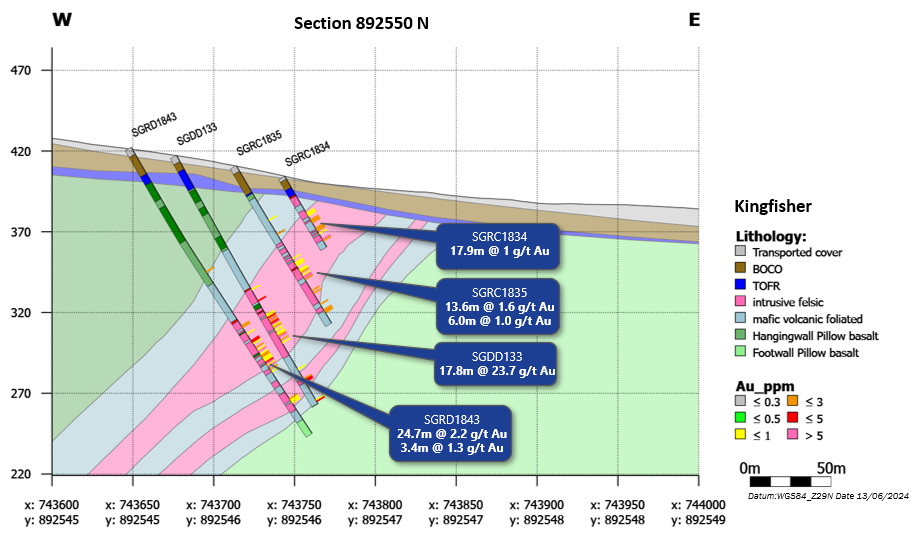

Since the discovery announcement made earlier this year (refer to Fortuna news release dated March 11, 2024) an additional 5,423-meter, 40-hole program was completed at Kingfisher. Results defined continuous mineralization over more than 1-kilometer of strike and joined the previous central and northern lodes (refer to Figures 1, 2 and 3). Drilling continues, testing the depth potential along this zone, as well as progressively infilling the area between the southern and central lodes, which collectively form a strike extent of over 1.9 kilometers. Kingfisher remains open at depth for most of the drilled strike, with the deepest drilling only testing to approximately 200 meters below surface.

The additional drilling at Kingfisher has further refined the understanding of the mineralization controls, with a clear association identified along the strongly deformed contact zone between a series of felsic intrusives, quartz veining, and basaltic units. Mineralization is characterized by silica-biotite-sericite-carbonate alteration and pyrite development, within and adjacent to the quartz veining, similar to the Boulder and Agouti deposits, 1 to 3 kilometers further north in the same sequence.

Drilling is scheduled to continue throughout the second half of 2024 with the aim of expanding the strike and depth potential of Kingfisher to support a maiden resource estimate by early 2025.

Figure 1: Kingfisher’s location, approximately 1-kilometer east of Sunbird

Figure 2: Kingfisher prospect long section - looking west

Figure 3: Kingfisher prospect cross section: section line 892550 - looking north

Badior Prospect

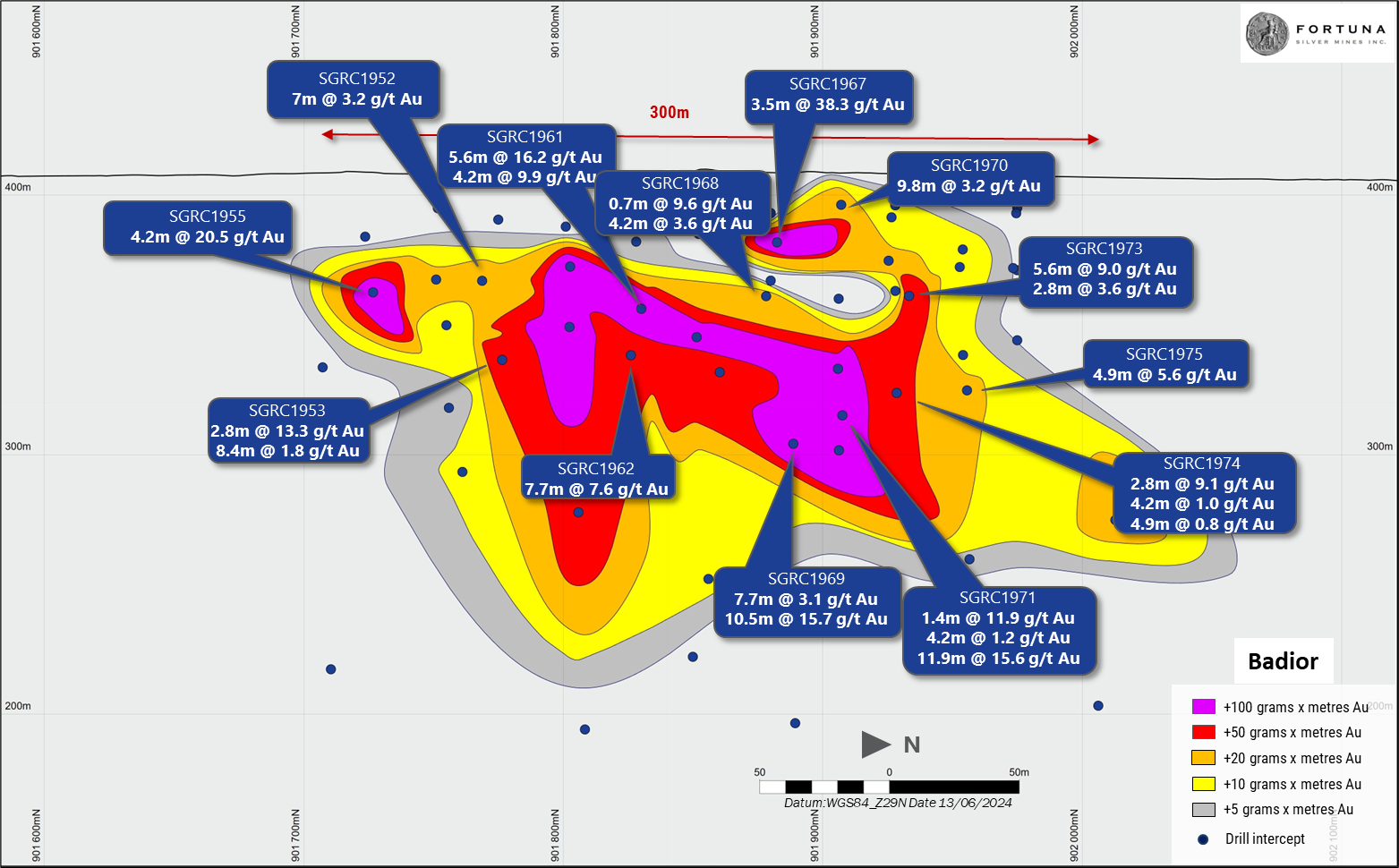

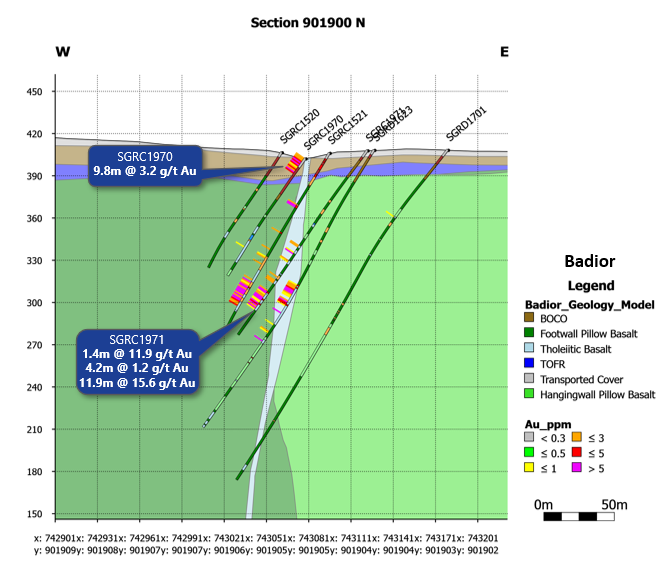

At Badior, an additional 2,727-meter, 30-hole program was completed during 2024 (refer to Figures 4 and 5), to infill and test depth extensions to previous high-grade intersections (refer to Fortuna news release dated December 12, 2023). Drilling was successful in defining and extending the high-grade core with several intervals returning multiple counts of visible gold (>25 points) associated with quartz-pyrite veining and associated silica-biotite-sericite-carbonate alteration of the host basaltic units, with examples of corresponding grades including 38.3 g/t Au over an estimated true width of 3.5 meters from 27 meters in drill hole SGRC1967, 15.7 g/t Au over an estimated true width of 10.5 meters from 132 meters, including 73.5 g/t Au over 2.1 meters from 132 meters in drill hole SGRC1969, and 16.2 g/t Au over an estimated true width of 5.6 meters from 53 meters in drill hole SGRC1961.

Figure 4: Badior long-section showing select recent results - looking west

Figure 5: Badior cross section showing select recent results - looking north

Ancien Deposit

At Ancien, an additional 3,255-meter, 11-hole infill drill program was completed during the second quarter of 2024 to further refine the controls on the high-grade mineralized shoots at depth. This followed the previously reported results (refer to Fortuna news release dated December 12, 2023).

Results from this program will support an evaluation of the underground mining potential at the Ancien deposit and the wider Séguéla land package.

Refer to Appendix 1 for full details of the Séguéla drill holes and assay results.

Quality Assurance & Quality Control (QA - QC)

Séguéla Mine, Côte d’Ivoire

All drilling data completed by the Company utilized the following procedures and methodologies. All drilling was carried out under the supervision of the Company’s personnel.

All RC drilling used a 5.25-inch face sampling pneumatic hammer with samples collected into 60-liter plastic bags. Samples were kept dry by maintaining enough air pressure to exclude groundwater inflow. If water ingress exceeded the air pressure, RC drilling was stopped, and drilling converted to diamond core tails. Once collected, RC samples were riffle split through a three-tier splitter to yield a

All diamond drilling (DD) drill holes were drilled with HQ sized diamond drill bits. The core was logged, marked up for sampling using standard lengths of one meter or to a geological boundary. Samples were then cut into equal halves using a diamond saw. One half of the core was left in the original core box and stored in a secure location at the Company core yard at the project site. The other half was sampled, catalogued, and placed into sealed bags and securely stored at the site until shipment.

All RC and DD core samples were shipped to ALS Laboratories’ preparation laboratory in Yamoussoukro for preparation and then, via commercial courier, to ALS’s facility in Ouagadougou, Burkina Faso for finishing. Routine gold analysis using a 50-gram charge and fire assay with an atomic absorption finish was completed for all samples. Quality control procedures included the systematic insertion of blanks, duplicates and sample standards into the sample stream. In addition, the ALS laboratory inserted its own quality control samples.

Qualified Person

Paul Weedon, Senior Vice President of Exploration for Fortuna Silver Mines Inc., is a Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects being a member of the Australian Institute of Geoscientists (Membership #6001). Mr. Weedon has reviewed and approved the scientific and technical information contained in this news release. Mr. Weedon has verified the data disclosed, including the sampling, analytical and test data underlying the information or opinions contained herein by reviewing geochemical and geological databases and reviewing diamond drill core. There were no limitations to the verification process.

About Fortuna Silver Mines Inc.

Fortuna Silver Mines Inc. is a Canadian precious metals mining company with five operating mines in Argentina, Burkina Faso, Côte d’Ivoire, Mexico, and Peru. Sustainability is integral to all our operations and relationships. We produce gold and silver and generate shared value over the long-term for our stakeholders through efficient production, environmental protection, and social responsibility. For more information, please visit our website.

ON BEHALF OF THE BOARD

Jorge A. Ganoza

President, CEO, and Director

Fortuna Silver Mines Inc.

Investor Relations:

Carlos Baca | info@fortunasilver.com | www.fortunasilver.com | X | LinkedIn | YouTube

Forward-looking Statements

This news release contains forward-looking statements which constitute “forward-looking information” within the meaning of applicable Canadian securities legislation and “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 (collectively, “Forward-looking Statements”). All statements included herein, other than statements of historical fact, are Forward-looking Statements and are subject to a variety of known and unknown risks and uncertainties which could cause actual events or results to differ materially from those reflected in the Forward-looking Statements. The Forward-looking Statements in this news release include, without limitation; statements regarding the exploration potential at Séguéla, the potential for the development of underground mining at Ancien; the Company’s plans to conduct further work at the Kingfisher prospect during 2024 and the expected timing of a maiden resource estimate; the Company’s business strategy, plans and outlook; the merit of the Company’s mines and mineral properties; mineral resource and reserve estimates; timelines; the future financial or operating performance of the Company; expenditures; approvals and other matters. Often, but not always, these Forward-looking Statements can be identified by the use of words such as “estimated”, “potential”, “open”, “future”, “assumed”, “projected”, “used”, “detailed”, “has been”, “gain”, “planned”, “reflecting”, “will”, “containing”, “remaining”, “to be”, or statements that events, “could” or “should” occur or be achieved and similar expressions, including negative variations. Forward-looking Statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any results, performance or achievements expressed or implied by the Forward-looking Statements. Such uncertainties and factors include, among others, changes in general economic conditions and financial markets; changes in prices for silver, gold and other metals; the timing and success of the Company’s proposed exploration programs; technological and operational hazards in Fortuna’s mining and mine development activities; risks inherent in mineral exploration; fluctuations in prices for energy, labor, materials, supplies and services; fluctuations in currencies; uncertainties inherent in the estimation of mineral reserves, mineral resources, and metal recoveries; the possibility that the appeal in respect of the ruling in favor of Compañia Minera Cuzcatlan S.A. de C.V. reinstating the environmental impact authorization at the San Jose Mine (the “EIA”) will be successful; the Company’s ability to obtain all necessary permits, licenses and regulatory approvals in a timely manner; governmental and other approvals; political unrest or instability in countries where Fortuna is active; labor relations issues; as well as those factors discussed under “Risk Factors” in the Company's Annual Information Form for the financial year ended December 31, 2023. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in Forward-looking Statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking Statements contained herein are based on the assumptions, beliefs, expectations and opinions of management, including but not limited to expectations regarding the results from the exploration programs conducted at the Company’s mineral properties ; expected trends in mineral prices and currency exchange rates; the accuracy of the Company’s information derived from its exploration programs at the Company’s mineral properties; current mineral resource and reserve estimates; the presence and continuity of mineralization at the Company’s properties; that the Company’s activities will be in accordance with the Company’s public statements and stated goals; that there will be no material adverse change affecting the Company or its properties; that the appeal filed in the Mexican Collegiate Court challenging the reinstatement of the EIA will be unsuccessful; that all required approvals will be obtained; that there will be no significant disruptions affecting operations and such other assumptions as set out herein. Forward-looking Statements are made as of the date hereof and the Company disclaims any obligation to update any Forward-looking Statements, whether as a result of new information, future events or results or otherwise, except as required by law. There can be no assurance that Forward-looking Statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, investors should not place undue reliance on Forward-looking Statements.

Cautionary Note to United States Investors Concerning Estimates of Reserves and Resources

Reserve and resource estimates included in this news release have been prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards on Mineral Resources and Mineral Reserves. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for public disclosure by a Canadian company of scientific and technical information concerning mineral projects. Unless otherwise indicated, all mineral reserve and mineral resource estimates contained in the technical disclosure have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards on Mineral Resources and Reserves. Canadian standards, including NI 43-101, differ significantly from the requirements of the Securities and Exchange Commission, and mineral reserve and resource information included in this news release may not be comparable to similar information disclosed by U.S. companies.

Appendix 1: Séguéla Mine, Côte d’Ivoire

| HoleID | Easting (WGS84_29N) | Northing (WGS84_29N) | Elev (m) | EOH1 Depth (m) | UTM Azimuth | Dip | Depth From (m) | Depth To (m) | Drilled Width (m) | ETW3 (m) | Au (ppm) | Hole Type | Area |

| SGDD132 | 743881 | 892798 | 403 | 117.8 | 90 | -60 | 76 | 80 | 4 | 3.4 | 4.1 | DD | Kingfisher |

| 90 | 96 | 6 | 5.1 | 0.9 | DD | Kingfisher | |||||||

| SGDD133 | 743830 | 892799 | 408 | 177.3 | 90 | -60 | 113 | 134 | 21 | 17.8 | 23.7 | DD | Kingfisher |

| Incl | 120 | 121 | 1 | 0.9 | 29.4 | DD | Kingfisher | ||||||

| And | 129 | 130 | 1 | 0.9 | 440.0 | DD | Kingfisher | ||||||

| SGDD134 | 743700 | 892800 | 416 | 238.3 | 90 | -60 | 163 | 203 | 40 | 34.0 | 1.4 | DD | Kingfisher |

| 226 | 227 | 1 | 0.9 | 17.1 | DD | Kingfisher | |||||||

| SGRC1765 | 743705 | 892706 | 418 | 176 | 90 | -60 | 141 | 170 | 29 | 24.7 | 2.3 | RC | Kingfisher |

| Incl | 167 | 168 | 1 | 0.9 | 15.9 | RC | Kingfisher | ||||||

| And | 169 | 170 | 1 | 0.9 | 24.7 | RC | Kingfisher | ||||||

| SGRC1790 | 743920 | 893248 | 415 | 100 | 90 | -60 | NSI | RC | Kingfisher | ||||

| SGRC1791 | 743876 | 893150 | 413 | 112 | 90 | -60 | NSI | RC | Kingfisher | ||||

| SGRC1792 | 743911 | 893150 | 406 | 60 | 90 | -60 | NSI | RC | Kingfisher | ||||

| SGRC1793 | 743881 | 893053 | 406 | 66 | 90 | -60 | 41 | 44 | 3 | 2.6 | 1.9 | RC | Kingfisher |

| SGRC1794 | 743849 | 893053 | 408 | 110 | 90 | -60 | NSI | RC | Kingfisher | ||||

| SGRC1795 | 743863 | 892955 | 403 | 45 | 90 | -60 | 23 | 37 | 14 | 11.9 | 6.0 | RC | Kingfisher |

| Incl | 26 | 27 | 1 | 0.9 | 23.6 | RC | Kingfisher | ||||||

| And | 28 | 29 | 1 | 0.9 | 49.9 | RC | Kingfisher | ||||||

| SGRC1796 | 743829 | 892955 | 408 | 95 | 90 | -60 | NSI | RC | Kingfisher | ||||

| SGRC1797 | 743835 | 892858 | 415 | 42 | 90 | -60 | 14 | 27 | 13 | 11.1 | 1.0 | RC | Kingfisher |

| SGRC1798 | 743805 | 892858 | 416 | 108 | 90 | -60 | 46 | 54 | 8 | 6.8 | 1.2 | RC | Kingfisher |

| 58 | 62 | 4 | 3.4 | 1.5 | RC | Kingfisher | |||||||

| 85 | 100 | 15 | 12.8 | 2.5 | RC | Kingfisher | |||||||

| Incl | 90 | 91 | 1 | 0.9 | 19.1 | RC | Kingfisher | ||||||

| SGRC1799 | 743775 | 892858 | 417 | 137 | 90 | -60 | 85 | 87 | 2 | 1.7 | 2.5 | RC | Kingfisher |

| 116 | 130 | 14 | 11.9 | 1.0 | RC | Kingfisher | |||||||

| SGRC1830 | 743807 | 892750 | 403 | 56 | 90 | -60 | 17 | 29 | 12 | 10.2 | 1.2 | RC | Kingfisher |

| 43 | 52 | 9 | 7.7 | 0.7 | RC | Kingfisher | |||||||

| SGRC1831 | 743773 | 892750 | 407 | 114 | 90 | -60 | 57 | 58 | 1 | 0.9 | 5.0 | RC | Kingfisher |

| 67 | 107 | 40 | 34.0 | 2.0 | RC | Kingfisher | |||||||

| Incl | 103 | 104 | 1 | 0.9 | 23.9 | RC | Kingfisher | ||||||

| SGRC1832 | 743780 | 892650 | 405 | 60 | 90 | -60 | 35 | 45 | 10 | 8.5 | 3.6 | RC | Kingfisher |

| Incl | 39 | 40 | 1 | 0.9 | 18.9 | RC | Kingfisher | ||||||

| SGRD1833 | 743710 | 892650 | 419 | 181.9 | 90 | -60 | 119 | 142 | 23 | 19.6 | 6.4 | RCD | Kingfisher |

| Incl | 139 | 141 | 2 | 1.7 | 49.3 | RCD | Kingfisher | ||||||

| 148 | 164 | 16 | 13.6 | 1.2 | RCD | Kingfisher | |||||||

| SGRC1834 | 743745 | 892550 | 404 | 51 | 90 | -60 | 26 | 47 | 21 | 17.9 | 1.0 | RC | Kingfisher |

| SGRC1835 | 743711 | 892550 | 412 | 114 | 90 | -60 | 67 | 83 | 16 | 13.6 | 1.6 | RC | Kingfisher |

| Incl | 81 | 82 | 1 | 0.9 | 10.4 | RC | Kingfisher | ||||||

| 100 | 107 | 7 | 6.0 | 1.0 | RC | Kingfisher | |||||||

| SGRC1836 | 743720 | 892450 | 403 | 71 | 90 | -60 | 41 | 68 | 27 | 23.0 | 2.1 | RC | Kingfisher |

| Incl | 60 | 61 | 1 | 0.9 | 10.4 | RC | Kingfisher | ||||||

| SGRC1837 | 743687 | 892450 | 406 | 133 | 90 | -60 | 65 | 69 | 4 | 3.4 | 1.6 | RC | Kingfisher |

| 112 | 124 | 12 | 10.2 | 1.2 | RC | Kingfisher | |||||||

| SGRC1838 | 743654 | 892450 | 412 | 162 | 90 | -60 | 94 | 96 | 2 | 1.7 | 3.3 | RC | Kingfisher |

| 117 | 132 | 15 | 12.8 | 1.4 | RC | Kingfisher | |||||||

| 136 | 144 | 8 | 6.8 | 0.7 | RC | Kingfisher | |||||||

| 148 | 154 | 6 | 5.1 | 1.3 | RC | Kingfisher | |||||||

| SGRD1839 | 743650 | 892700 | 433 | 260.1 | 90 | -60 | 238 | 241 | 3 | 2.6 | 3.8 | RCD | Kingfisher |

| SGRD1840 | 743650 | 892800 | 425 | 310.8 | 90 | -60 | 220 | 242 | 22 | 18.7 | 1.4 | RCD | Kingfisher |

| 248 | 269 | 21 | 17.9 | 1.6 | RCD | Kingfisher | |||||||

| 279 | 282 | 3 | 2.6 | 17.1 | RCD | Kingfisher | |||||||

| Incl | 280 | 282 | 2 | 1.7 | 25.0 | RCD | Kingfisher | ||||||

| SGRD1841 | 743667 | 892650 | 428 | 242.9 | 90 | -60 | 156 | 189 | 33 | 28.1 | 2.3 | RCD | Kingfisher |

| Incl | 159 | 161 | 2 | 1.7 | 17.2 | RCD | Kingfisher | ||||||

| 201 | 204 | 3 | 2.6 | 3.9 | RCD | Kingfisher | |||||||

| SGRD1842 | 743706 | 892750 | 421 | 228 | 90 | -60 | 151 | 164 | 13 | 11.1 | 0.8 | RCD | Kingfisher |

| 168 | 183 | 15 | 12.8 | 0.9 | RCD | Kingfisher | |||||||

| SGRD1843 | 743649 | 892550 | 422 | 210 | 90 | -60 | 136 | 165 | 29 | 24.7 | 2.2 | RCD | Kingfisher |

| Incl | 149 | 150 | 1 | 0.9 | 21.0 | RCD | Kingfisher | ||||||

| And | 160 | 161 | 1 | 0.9 | 13.5 | RCD | Kingfisher | ||||||

| 184 | 188 | 4 | 3.4 | 1.3 | RCD | Kingfisher | |||||||

| SGRD1845 | 743616 | 892450 | 420 | 230 | 90 | -60 | 147 | 157 | 10 | 8.5 | 0.6 | RCD | Kingfisher |

| 170 | 180 | 10 | 8.5 | 0.9 | RCD | Kingfisher | |||||||

| SGRC1846 | 743702 | 892394 | 403 | 96 | 90 | -60 | 49 | 58 | 9 | 7.7 | 1.0 | RC | Kingfisher |

| 63 | 86 | 23 | 19.6 | 2.1 | RC | Kingfisher | |||||||

| Incl | 78 | 79 | 1 | 0.9 | 12.1 | RC | Kingfisher | ||||||

| SGRC1847 | 743673 | 892394 | 406 | 110 | 90 | -60 | 54 | 57 | 3 | 2.6 | 2.1 | RC | Kingfisher |

| 74 | 80 | 6 | 5.1 | 0.9 | RC | Kingfisher | |||||||

| 84 | 95 | 11 | 9.4 | 1.4 | RC | Kingfisher | |||||||

| 102 | 107 | 5 | 4.3 | 1.3 | RC | Kingfisher | |||||||

| SGRC1848 | 743638 | 892394 | 410 | 162 | 90 | -60 | 88 | 97 | 9 | 7.7 | 2.9 | RC | Kingfisher |

| Incl | 92 | 93 | 1 | 0.9 | 14.4 | RC | Kingfisher | ||||||

| 135 | 144 | 9 | 7.7 | 1.5 | RC | Kingfisher | |||||||

| SGRC1849 | 743711 | 892199 | 403 | 60 | 90 | -60 | 3 | 26 | 23 | 19.6 | 1.7 | RC | Kingfisher |

| SGRC1850 | 743667 | 892201 | 406 | 101 | 90 | -60 | 45 | 90 | 45 | 38.3 | 2.6 | RC | Kingfisher |

| Incl | 64 | 65 | 1 | 0.9 | 15.0 | RC | Kingfisher | ||||||

| And | 67 | 68 | 1 | 0.9 | 13.1 | RC | Kingfisher | ||||||

| SGRD1851 | 743625 | 892090 | 428 | 140 | 90 | -60 | 96 | 110 | 14 | 11.9 | 1.0 | RCD | Kingfisher |

| SGRC1852 | 743677 | 892000 | 431 | 54 | 90 | -60 | 0 | 12 | 12 | 10.2 | 0.9 | RC | Kingfisher |

| SGRC1853 | 743647 | 892000 | 433 | 120 | 90 | -60 | NSI | RC | Kingfisher | ||||

| SGRD1854 | 743636 | 892589 | 430 | 240 | 90 | -60 | 168 | 180 | 12 | 10.2 | 5.2 | RCD | Kingfisher |

| Incl | 170 | 171 | 1 | 0.9 | 50.2 | RCD | Kingfisher | ||||||

| 185 | 209 | 24 | 20.4 | 0.8 | RCD | Kingfisher | |||||||

| SGRC1856 | 743745 | 892858 | 417 | 180 | 90 | -60 | 142 | 147 | 5 | 4.3 | 1.8 | RC | Kingfisher |

| SGRC1857 | 743781 | 892907 | 423 | 151 | 90 | -60 | NSI | RC | Kingfisher | ||||

| SGRC1951 | 743048 | 901775 | 408 | 30 | 270 | -55 | NSI | RC | Badior | ||||

| SGRC1952 | 743066 | 901775 | 408 | 60 | 270 | -55 | 47 | 57 | 10 | 7.0 | 3.2 | RC | Badior |

| SGRC1953 | 743083 | 901775 | 408 | 90 | 270 | -55 | 74 | 78 | 4 | 2.8 | 13.3 | RC | Badior |

| Incl | 74 | 76 | 2 | 1.4 | 25.3 | RC | Badior | ||||||

| 86 | 98 | 12 | 8.4 | 1.8 | RC | Badior | |||||||

| SGRC1954 | 743047 | 901724 | 409 | 30 | 270 | -55 | NSI | RC | Badior | ||||

| SGRC1955 | 743063 | 901724 | 408 | 60 | 270 | -55 | 53 | 59 | 6 | 4.2 | 20.5 | RC | Badior |

| Incl | 54 | 55 | 1 | 0.7 | 57.7 | RC | Badior | ||||||

| And | 56 | 57 | 1 | 0.7 | 47.1 | RC | Badior | ||||||

| SGRC1956 | 743048 | 901750 | 408 | 40 | 270 | -55 | NSI | RC | Badior | ||||

| SGRC1957 | 743074 | 901750 | 408 | 90 | 270 | -55 | 71 | 72 | 1 | 0.7 | 7.4 | RC | Badior |

| SGRC1958 | 743049 | 901800 | 408 | 30 | 270 | -55 | NSI | RC | Badior | ||||

| SGRC1959 | 743050 | 901828 | 408 | 30 | 270 | -55 | NSI | RC | Badior | ||||

| SGRC1960 | 743067 | 901828 | 409 | 70 | 270 | -55 | NSI | RC | Badior | ||||

| SGRC1961 | 743084 | 901828 | 408 | 100 | 270 | -55 | 53 | 61 | 8 | 5.6 | 16.2 | RC | Badior |

| Incl | 53 | 57 | 4 | 2.8 | 25.5 | RC | Badior | ||||||

| And | 60 | 61 | 1 | 0.7 | 17.8 | RC | Badior | ||||||

| 67 | 73 | 6 | 4.2 | 9.9 | RC | Badior | |||||||

| Incl | 68 | 69 | 1 | 0.7 | 53.1 | RC | Badior | ||||||

| SGRC1962 | 743101 | 901828 | 409 | 130 | 270 | -55 | 79 | 90 | 11 | 7.7 | 7.6 | RC | Badior |

| Incl | 82 | 83 | 1 | 0.7 | 16.8 | RC | Badior | ||||||

| And | 86 | 88 | 2 | 1.4 | 25.7 | RC | Badior | ||||||

| SGRC1963 | 743077 | 901853 | 407 | 60 | 270 | -55 | NSI | RC | Badior | ||||

| SGRC1964 | 743111 | 901853 | 409 | 120 | 270 | -55 | 86 | 90 | 4 | 2.8 | 3.1 | RC | Badior |

| SGRC1965 | 743051 | 901880 | 409 | 30 | 270 | -55 | NSI | RC | Badior | ||||

| SGRC1966 | 743068 | 901880 | 407 | 60 | 270 | -55 | NSI | RC | Badior | ||||

| SGRC1967 | 743084 | 901880 | 406 | 90 | 270 | -55 | 27 | 32 | 5 | 3.5 | 38.3 | RC | Badior |

| Incl | 28 | 31 | 3 | 2.1 | 63.0 | RC | Badior | ||||||

| SGRC1968 | 743101 | 901880 | 408 | 120 | 270 | -55 | 51 | 52 | 1 | 0.7 | 9.6 | RC | Badior |

| 63 | 69 | 6 | 4.2 | 3.6 | RC | Badior | |||||||

| SGRC1969 | 743118 | 901880 | 408 | 150 | 270 | -55 | 112 | 123 | 11 | 7.7 | 3.1 | RC | Badior |

| Incl | 118 | 119 | 1 | 0.7 | 15.2 | RC | Badior | ||||||

| 132 | 147 | 15 | 10.5 | 15.7 | RC | Badior | |||||||

| Incl | 132 | 135 | 3 | 2.1 | 73.5 | RC | Badior | ||||||

| SGRC1970 | 743079 | 901909 | 402 | 100 | 270 | -55 | 0 | 14 | 14 | 9.8 | 3.2 | RC | Badior |

| SGRC1971 | 743123 | 901909 | 408 | 160 | 270 | -55 | 89 | 91 | 2 | 1.4 | 11.9 | RC | Badior |

| Incl | 90 | 91 | 1 | 0.7 | 22.9 | RC | Badior | ||||||

| 110 | 116 | 6 | 4.2 | 1.2 | RC | Badior | |||||||

| 122 | 139 | 17 | 11.9 | 15.6 | RC | Badior | |||||||

| Incl | 123 | 124 | 1 | 0.7 | 106.5 | RC | Badior | ||||||

| And | 128 | 131 | 3 | 2.1 | 27.7 | RC | Badior | ||||||

| And | 133 | 134 | 1 | 0.7 | 19.4 | RC | Badior | ||||||

| And | 135 | 136 | 1 | 0.7 | 26.1 | RC | Badior | ||||||

| SGRC1972 | 743099 | 901928 | 406 | 120 | 270 | -55 | 22 | 28 | 6 | 4.2 | 2.2 | RC | Badior |

| 34 | 35 | 1 | 0.7 | 5.1 | RC | Badior | |||||||

| SGRC1973 | 743116 | 901928 | 407 | 150 | 270 | -55 | 53 | 61 | 8 | 5.6 | 9.0 | RC | Badior |

| Incl | 54 | 55 | 1 | 0.7 | 23.0 | RC | Badior | ||||||

| And | 59 | 61 | 2 | 1.4 | 18.1 | RC | Badior | ||||||

| 115 | 119 | 4 | 2.8 | 3.6 | RC | Badior | |||||||

| Incl | 144 | 145 | 1 | 0.7 | 14.9 | RC | Badior | ||||||

| SGRC1974 | 743134 | 901928 | 408 | 187 | 270 | -55 | 83 | 87 | 4 | 2.8 | 9.1 | RC | Badior |

| Incl | 86 | 87 | 1 | 0.7 | 28.5 | RC | Badior | ||||||

| 100 | 106 | 6 | 4.2 | 1.0 | RC | Badior | |||||||

| 125 | 132 | 7 | 4.9 | 0.8 | RC | Badior | |||||||

| SGRC1975 | 743140 | 901954 | 407 | 163 | 270 | -55 | 104 | 111 | 7 | 4.9 | 5.6 | RC | Badior |

| Incl | 105 | 106 | 1 | 0.7 | 30.3 | RC | Badior | ||||||

| SGRC1976 | 743048 | 901975 | 407 | 30 | 270 | -55 | NSI | RC | Badior | ||||

| SGRC1977 | 743064 | 901975 | 406 | 60 | 270 | -55 | NSI | RC | Badior | ||||

| SGRC1978 | 743083 | 901975 | 405 | 97 | 270 | -55 | NSI | RC | Badior | ||||

| SGRC1979 | 743100 | 901975 | 404 | 120 | 270 | -55 | NSI | RC | Badior | ||||

| SGRC1980 | 743117 | 901975 | 405 | 150 | 270 | -55 | 39 | 43 | 4 | 2.8 | 1.3 | RC | Badior |

| SGRD1890 | 743330 | 888568 | 367 | 220.3 | 277 | -55 | 194 | 204 | 10 | 7.0 | 4.3 | RCD | Ancien |

| Incl | 202 | 203 | 1 | 0.7 | 18.5 | RCD | Ancien | ||||||

| SGRD1891 | 743383 | 888459 | 370 | 340.3 | 277 | -55 | 284 | 291 | 7 | 4.9 | 0.8 | RCD | Ancien |

| SGRD1892 | 743340 | 888388 | 373 | 327 | 277 | -55 | 297 | 310 | 13 | 9.1 | 12.3 | RCD | Ancien |

| Incl | 297 | 299 | 2 | 1.4 | 53.6 | RCD | Ancien | ||||||

| And | 307 | 308 | 1 | 0.7 | 38.4 | RCD | Ancien | ||||||

| SGRD1893 | 743368 | 888384 | 373 | 350 | 277 | -55 | 303 | 314 | 11 | 7.7 | 0.7 | RCD | Ancien |

| 334 | 342 | 8 | 5.6 | 0.7 | RCD | Ancien | |||||||

| SGRD1894 | 743358 | 888337 | 373 | 350.3 | 277 | -55 | 335 | 343 | 8 | 5.6 | 27.4 | RCD | Ancien |

| Incl | 335 | 336 | 1 | 0.7 | 209.0 | RCD | Ancien | ||||||

| SGRD1895 | 743282 | 888372 | 373 | 270 | 277 | -55 | 233 | 234 | 1 | 0.7 | 6.5 | RCD | Ancien |

| 239 | 241 | 2 | 1.4 | 5.0 | RCD | Ancien | |||||||

| 254 | 258 | 4 | 2.8 | 39.1 | RCD | Ancien | |||||||

| Incl | 254 | 257 | 3 | 2.1 | 49.2 | RCD | Ancien | ||||||

| SGRD1896 | 743385 | 888358 | 372 | 370.4 | 277 | -55 | 356 | 368 | 12 | 8.4 | 0.6 | RCD | Ancien |

| SGRC1897 | 743278 | 888326 | 375 | 61 | 277 | -55 | Not Sampled | abandoned | RC | Ancien | |||

| SGRD1898 | 743278 | 888326 | 375 | 280 | 277 | -55 | 260 | 270 | 10 | 7.0 | 2.7 | RCD | Ancien |

| SGRD1899 | 743340 | 888365 | 374 | 340.2 | 277 | -55 | 303 | 309 | 6 | 4.2 | 2.9 | RCD | Ancien |

| Incl | 308 | 309 | 1 | 0.7 | 13.4 | RCD | Ancien | ||||||

| 315 | 316 | 1 | 0.7 | 5.0 | RCD | Ancien | |||||||

| SGRD1900 | 743376 | 888422 | 371 | 345 | 277 | -55 | 273 | 275 | 2 | 1.4 | 4.8 | RCD | Ancien |

| 295 | 306 | 11 | 7.7 | 1.0 | RCD | Ancien | |||||||

Notes:

- EOH: End of hole

- NSI: No significant intercepts

- ETW: Estimated true width

- Depths and widths reported to nearest significant decimal place

- DD: diamond drilling tail | RC: reverse circulation drilling | RCD: reverse circulation drilling with diamond tail

A PDF accompanying this announcement is available at http://ml.globenewswire.com/Resource/Download/19283803-2652-4911-939a-3b1b6a579045

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/aa86e5fd-35c7-4e5b-8c13-0a2814a44aca

https://www.globenewswire.com/NewsRoom/AttachmentNg/78d95528-e360-4966-bd9f-e6ad4738a485

https://www.globenewswire.com/NewsRoom/AttachmentNg/d97ce61e-260f-436a-800b-9e097d96d08b

https://www.globenewswire.com/NewsRoom/AttachmentNg/d27670ee-254f-4993-beca-af26e97685df

https://www.globenewswire.com/NewsRoom/AttachmentNg/3aca221b-aab3-4be2-9698-77a910a55903

FAQ

What are the key drilling results from Fortuna Silver Mines' Kingfisher Prospect?

What notable drilling results were reported at the Badior Prospect?

What significant gold findings were announced for the Ancien Deposit?

How is the exploration program at Kingfisher progressing?