Forge Global Names the Private Magnificent 7 – the High-Performing Unicorns Driving the U.S. Innovation Economy

Forge Global Holdings (NYSE: FRGE) has identified the Private Magnificent 7, a group of high-performing unicorns driving the U.S. innovation economy. These companies, including SpaceX, OpenAI, Stripe, Databricks, Fanatics, Scale AI, and Rippling, have shown superior growth and resilience during the recent market cycle. Spanning sectors like AI, Aerospace, Fintech, and Enterprise Software, they collectively account for $473 billion in implied valuation.

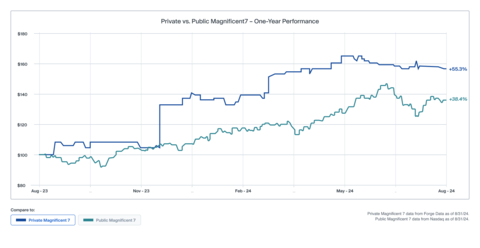

The Private Magnificent 7 has outperformed its public market counterpart by 16.9% in the 12-month period ending August 31, 2024, with a price performance increase of 55.3% compared to the public Magnificent 7's 38.4%. Forge's proprietary pricing model, Forge Price, was used to identify these companies based on criteria including size, share price performance, and market leadership.

Forge Global Holdings (NYSE: FRGE) ha identificato il Private Magnificent 7, un gruppo di unicorni ad alte prestazioni che guidano l'economia innovativa degli Stati Uniti. Queste aziende, tra cui SpaceX, OpenAI, Stripe, Databricks, Fanatics, Scale AI e Rippling, hanno dimostrato crescita e resilienza superiori durante il recente ciclo di mercato. Coprendo settori come IA, aerospaziale, fintech e software aziendale, rappresentano un valore implicito totale di $473 miliardi.

Il Private Magnificent 7 ha superato il suo equivalente nel mercato pubblico del 16,9% nel periodo di 12 mesi che termina il 31 agosto 2024, con un aumento delle prestazioni dei prezzi del 55,3% rispetto al 38,4% del pubblico Magnificent 7. È stato utilizzato il modello di prezzo proprietario di Forge, Forge Price, per identificare queste aziende basato su criteri come dimensione, prestazioni del prezzo delle azioni e leadership di mercato.

Forge Global Holdings (NYSE: FRGE) ha identificado el Private Magnificent 7, un grupo de unicornios de alto rendimiento que impulsan la economía de innovación de EE. UU. Estas compañías, incluyendo SpaceX, OpenAI, Stripe, Databricks, Fanatics, Scale AI y Rippling, han demostrado un crecimiento y resiliencia superiores durante el reciente ciclo del mercado. Cubriendo sectores como IA, aeroespacial, fintech y software empresarial, representan un valor implícito total de $473 mil millones.

El Private Magnificent 7 ha superado a su contraparte en el mercado público en un 16.9% en el período de 12 meses que termina el 31 de agosto de 2024, con un aumento en el rendimiento del precio del 55.3% en comparación con el 38.4% del Magnificent 7 público. Se utilizó el modelo de precios propietario de Forge, Forge Price, para identificar estas empresas según criterios como tamaño, desempeño del precio de las acciones y liderazgo en el mercado.

포지 글로벌 홀딩스(Forg Global Holdings)(NYSE: FRGE)는 미국 혁신 경제를 주도하는 고성과 유니콘 그룹인 Private Magnificent 7을 확인했습니다. 이들 회사에는 SpaceX, OpenAI, Stripe, Databricks, Fanatics, Scale AI 및 Rippling이 포함되어 있으며, 최근 시장 주기 동안 뛰어난 성장과 회복력을 보여주었습니다. AI, 항공우주, 핀테크 및 엔터프라이즈 소프트웨어와 같은 업종을 포괄하며, 이들은 $4730억 달러의 암시적 가치를 차지합니다.

Private Magnificent 7은 2024년 8월 31일 종료되는 12개월 동안 공공 시장 동료보다 16.9% 초과 성과를 보였고, 주가 성과는 55.3%의 증가율을 기록하여 공공 Magnificent 7의 38.4%와 비교됩니다. 이러한 회사들은 규모, 주가 성과, 시장 리더십과 같은 기준에 따라 포지의 독점 가격 모델인 Forge Price를 사용하여 확인되었습니다.

Forge Global Holdings (NYSE: FRGE) a identifié le Private Magnificent 7, un groupe de licornes à hautes performances qui stimulent l'économie d'innovation des États-Unis. Ces entreprises, y compris SpaceX, OpenAI, Stripe, Databricks, Fanatics, Scale AI et Rippling, ont montré une croissance et une résilience supérieures pendant le récent cycle du marché. Couvrant des secteurs tels que l'IA, l'aérospatiale, la fintech et les logiciels d'entreprise, elles représentent collectivement une valorisation implicite de 473 milliards de dollars.

Le Private Magnificent 7 a dépasse son homologue du marché public de 16,9% au cours de la période de 12 mois se terminant le 31 août 2024, avec une augmentation de la performance du prix de 55,3% par rapport à 38,4% pour le Magnificent 7 public. Le modèle de prix propriétaire de Forge, Forge Price, a été utilisé pour identifier ces entreprises sur la base de critères tels que la taille, la performance du prix des actions et le leadership sur le marché.

Forge Global Holdings (NYSE: FRGE) hat die Private Magnificent 7 identifiziert, eine Gruppe von leistungsstarken Einhörnern, die die Innovationswirtschaft der USA antreiben. Diese Unternehmen, zu denen SpaceX, OpenAI, Stripe, Databricks, Fanatics, Scale AI und Rippling gehören, haben während des jüngsten Marktzyklus überdurchschnittliches Wachstum und Resilienz gezeigt. Sie decken Sektoren wie KI, Luft- und Raumfahrt, Fintech und Unternehmenssoftware ab und haben insgesamt einen implizierten Wert von $473 Milliarden.

Die Private Magnificent 7 hat ihren öffentlichen Marktgegner um 16,9% im Zeitraum von 12 Monaten bis zum 31. August 2024 übertroffen, mit einem Preisleistungszuwachs von 55,3% im Vergleich zu den 38,4% des öffentlichen Magnificent 7. Es wurde das proprietäre Preismodell von Forge, Forge Price, verwendet, um diese Unternehmen anhand von Kriterien wie Größe, Aktienkursleistung und Marktführung zu identifizieren.

- Identification of high-performing private companies (Private Magnificent 7) with $473 billion implied valuation

- Private Magnificent 7 outperformed public counterpart by 16.9% in 12-month period

- 55.3% price performance increase for Private Magnificent 7 in the past year

- Demonstration of Forge's proprietary pricing model (Forge Price) capabilities

- Launch of Forge Private Market Index and Accuidity Private Market Index

- None.

Insights

Forge Global's identification of the "Private Magnificent 7" offers an intriguing perspective on the private market landscape, but its immediate impact on public market investors is The comparison between private and public "Magnificent 7" companies highlights the potential of private markets, with the private group outperforming by

The inclusion of companies like SpaceX, OpenAI and Stripe in this group underscores the growing importance of sectors such as AI, aerospace and fintech in the innovation economy. For public market investors, this could signal future IPO opportunities and potential disruption in related public company sectors. The outperformance of these private companies during the recent market downturn also suggests resilience in certain private market segments, which could influence investor sentiment towards growth and innovation-focused public companies.

While interesting, this news is more indicative of private market trends than directly impactful for most public market investors. It serves as a barometer for innovation and growth in the private sector, potentially influencing long-term investment strategies and sector outlooks in public markets.

Private vs. Public Magnificent 7 - One-Year Performance (Graphic: Business Wire)

“While the post-2021 market downturn was undoubtedly a challenging period for the private market, the Private Magnificent 7 proved resilient,” said Kelly Rodriques, CEO of Forge Global. “Forge believes these companies reflect the current and emerging themes of private investing and are driving the secular growth of the

The Private Magnificent 7 collectively account for

Though smaller in size, the Private Magnificent 7 has outperformed2 its public market counterpart by

Forge operates a leading platform for private market trading and data intelligence. This includes Forge Price, a proprietary pricing model for approximately 250 late-stage, venture-backed companies with secondary market liquidity. Forge Price underlies the methodology for identifying the Private Magnificent 7. The selection process for identifying the Private Magnificent 7 was based on a set of rigorous criteria, including company size, share price performance, secondary trading liquidity, market leadership, and brand equity. For more information, please visit this link.

Forge Price is also used to power Forge’s indices, which include the Forge Private Market Index, a first-of-its-kind benchmark for private market performance and the Forge Accuidity Private Market Index, which is tracked by the Accuidity Megacorn Fund. The Megacorn Fund adopts an index-based investment strategy to provide investors with low-cost, diversified exposure to late-stage, venture-backed companies.

About Forge

Forge is a leading provider of marketplace infrastructure, data services and technology solutions for private market participants. Forge Securities LLC is a registered broker-dealer and a Member of FINRA that operates an alternative trading system.

1 https://www.mellon.com/insights/insights-articles/a-closer-look-at-magnificent-seven-stocks.html

2 Performance is based on Forge Price.

3 Performance calculated based on hypothetical portfolios of both the Public Magnificent 7 and the Private Magnificent 7 with modified capitalization weighting scheme capped at

View source version on businesswire.com: https://www.businesswire.com/news/home/20240911178458/en/

Media Contact:

Lindsay Riddell

press@forgeglobal.com

Source: Forge Global