Foremost Lithium Sets Date for Special Meeting of its Plan of Arrangement to Spin-Out the Winston Group of Gold/Silver Properties

Foremost Lithium Resource & Technology (NASDAQ: FMST) (CSE: FAT) has announced a strategic spin-out of its Winston Group of Gold and Silver Properties into a new company, Rio Grande Resources The plan, approved by the Board of Directors, will be executed through a court-approved arrangement. Foremost shareholders will receive two Rio Grande shares for each Foremost share, maintaining their proportionate interest in Foremost. The company plans to retain a 19.95% stake in Rio Grande and aims to raise at least $1.5 million through financings.

A special shareholder meeting is scheduled for November 06, 2024, with a record date of September 09, 2024. The arrangement requires 66 2/3% shareholder approval, court approval, and regulatory clearances. Foremost believes this spin-out will maximize long-term value for shareholders by allowing independent valuation of the gold and silver properties during a strong precious metals market.

Foremost Lithium Resource & Technology (NASDAQ: FMST) (CSE: FAT) ha annunciato uno spin-off strategico del suo Gruppo Winston di proprietà di oro e argento in una nuova compagnia, Rio Grande Resources. Il piano, approvato dal Consiglio di Amministrazione, sarà attuato tramite un accordo autorizzato dal tribunale. Gli azionisti di Foremost riceveranno due azioni di Rio Grande per ogni azione di Foremost, mantenendo così il loro interesse proporzionale in Foremost. L'azienda prevede di mantenere una partecipazione del 19,95% in Rio Grande e punta a raccogliere almeno 1,5 milioni di dollari tramite finanziamenti.

Un'assemblea speciale degli azionisti è prevista per il 6 novembre 2024, con una data di registrazione del 9 settembre 2024. L'accordo richiede l'approvazione del 66 2/3% degli azionisti, l'approvazione del tribunale e le autorizzazioni regolatorie. Foremost è convinta che questo spin-off massimizzerà il valore a lungo termine per gli azionisti permettendo una valutazione indipendente delle proprietà di oro e argento durante un forte mercato dei metalli preziosi.

Foremost Lithium Resource & Technology (NASDAQ: FMST) (CSE: FAT) ha anunciado un escisión estratégica de su Grupo Winston de propiedades de oro y plata en una nueva compañía, Rio Grande Resources. El plan, aprobado por la Junta Directiva, se llevará a cabo a través de un acuerdo aprobado por el tribunal. Los accionistas de Foremost recibirán dos acciones de Rio Grande por cada acción de Foremost, manteniendo así su interés proporcional en Foremost. La empresa planea retener un 19.95% de participación en Rio Grande y aspira a recaudar al menos $1.5 millones a través de financiamientos.

Una reunión especial de accionistas está programada para el 6 de noviembre de 2024, con una fecha de registro del 9 de septiembre de 2024. El acuerdo requiere la aprobación del 66 2/3% de los accionistas, la aprobación judicial y autorizaciones regulatorias. Foremost cree que esta escisión maximizará el valor a largo plazo para los accionistas al permitir una valoración independiente de las propiedades de oro y plata durante un fuerte mercado de metales preciosos.

포어모스트 리튬 리소스 & 테크놀로지(나스닥: FMST)(CSE: FAT)는 자신의 윈스턴 그룹의 금 및 은 자산을 새로운 회사인 리오 그란데 리소스(Rio Grande Resources)로 전략적으로 분리하기로 발표했습니다. 이 계획은 이사회에 의해 승인되었으며, 법원의 승인된 절차를 통해 실행될 예정입니다. 포어모스트 주주들은 포어모스트 주식 1주당 리오 그란데 주식 2주를 받게 됩니다, 이를 통해 포어모스트에 대한 비율적인 지분을 유지하게 됩니다. 회사는 리오 그란데에서 19.95%의 지분을 유지할 계획이며, 최소 150만 달러를 모금할 목표를 가지고 있습니다.

특별 주주 총회는 2024년 11월 6일로 예정되어 있으며, 기록일은 2024년 9월 9일입니다. 이 절차는 66 2/3% 주주 승인, 법원 승인 및 규제 승인이 필요합니다. 포어모스트는 이번 스핀오프가 귀금속 시장이 강세를 보이는 동안 금 및 은 자산의 독립적인 평가를 가능하게 하여 주주들에게 장기적인 가치를 극대화할 것이라고 믿고 있습니다.

Foremost Lithium Resource & Technology (NASDAQ: FMST) (CSE: FAT) a annoncé une spin-off stratégique de son groupe Winston de propriétés d'or et d'argent dans une nouvelle société, Rio Grande Resources. Le plan, approuvé par le conseil d'administration, sera mis en œuvre par le biais d'un arrangement approuvé par le tribunal. Les actionnaires de Foremost recevront deux actions de Rio Grande pour chaque action de Foremost, maintenant ainsi leur intérêt proportionnel dans Foremost. La société prévoit de conserver une participation de 19,95 % dans Rio Grande et vise à lever au moins 1,5 million de dollars lors des financements.

Une assemblée générale des actionnaires est prévue pour le 6 novembre 2024, avec une date d'enregistrement au 9 septembre 2024. L'arrangement nécessite l'approbation de 66 2/3 % des actionnaires, l'approbation du tribunal et les autorisations réglementaires. Foremost est convaincu que cette spin-off maximisera la valeur à long terme pour les actionnaires en permettant une évaluation indépendante des propriétés d'or et d'argent pendant un marché des métaux précieux fort.

Foremost Lithium Resource & Technology (NASDAQ: FMST) (CSE: FAT) hat eine strategische Abspaltung seiner Winston-Gruppe von Gold- und Silberressourcen in ein neues Unternehmen, Rio Grande Resources, bekannt gegeben. Der Plan wurde vom Vorstand genehmigt und wird durch eine vom Gericht genehmigte Vereinbarung umgesetzt. Die Aktionäre von Foremost erhalten zwei Aktien von Rio Grande für jede Foremost-Aktie, wodurch ihr proportionaler Anteil an Foremost erhalten bleibt. Das Unternehmen plant, einen Anteil von 19,95% an Rio Grande zu halten und strebt an, mindestens 1,5 Millionen US-Dollar durch Finanzierungen zu beschaffen.

Eine außerordentliche Hauptversammlung der Aktionäre ist für den 6. November 2024 angesetzt, mit einem Stichtag vom 9. September 2024. Die Vereinbarung erfordert die Genehmigung von 66 2/3% der Aktionäre, die Genehmigung des Gerichts und die regulatorischen Freigaben. Foremost ist überzeugt, dass diese Abspaltung den langfristigen Wert für die Aktionäre maximieren wird, indem sie eine unabhängige Bewertung der Gold- und Silberressourcen während eines starken Marktes für Edelmetalle ermöglicht.

- Shareholders will receive two Rio Grande shares for each Foremost share, potentially increasing overall value

- Foremost will retain a 19.95% stake in Rio Grande, maintaining exposure to potential upside

- Planned financing of at least $1.5 million for Rio Grande, providing capital for development

- Spin-out may unlock value by allowing independent valuation of gold and silver properties

- The arrangement is subject to various approvals, including shareholder, court, and regulatory, which may delay or prevent completion

- Potential dilution of Foremost's focus on lithium exploration by retaining interest in Rio Grande

Foremost Shareholders will receive two (2) Rio Grande Resources Shares for each Foremost Share

VANCOUVER, British Columbia, July 30, 2024 (GLOBE NEWSWIRE) -- Foremost Lithium Resource & Technology Ltd. (NASDAQ: FMST) (CSE: FAT) (“Foremost Lithium”, “Foremost” or the “Company”), a North American hard-rock lithium exploration company, today announces that its Board of Directors has unanimously approved the strategic spin-out of its Winston Group of Gold and Silver Properties (the “Properties”) into a newly incorporated and independent, publicly-traded company named Rio Grande Resources Ltd. (“Rio Grande”) pursuant to a court-approved plan of arrangement (the “Arrangement”).

Pursuant to the Arrangement, Foremost shareholders will receive two (2) common shares of Rio Grande for each Foremost common share and will continue to retain their same proportionate interest in Foremost. The Company intends to retain an approximate

“I firmly believe that this proposed spin-out – which will allow the market to value our Winston Group of Gold and Silver Properties independently of Foremost’s lithium projects – maximizes the long-term value potential to our shareholders,” said Jason Barnard, President & CEO of Foremost Lithium. “We believe that as a standalone entity, these incredible Gold and Silver properties can get the attention and development focus that they deserve, during what is a strong bull market for precious metals.”

The Arrangement and any other resolutions related to the Arrangement, will be put to shareholders for approval at a special meeting of shareholders of Foremost to be held on November 06, 2024. All shareholders of record as of September 09, 2024 (the “Record Date”) will be eligible to cast their vote. The Arrangement will require the approval of 66 2/

It is a condition of the completion of the Arrangement that the CSE shall have conditionally approved the listing of the Rio Grande shares and the Foremost shares. Full details of the proposed Arrangement will be provided in an Information Circular, which will be mailed to shareholders of record and available along with the Arrangement Agreement on SEDAR+ under the profile of Foremost Lithium Resource & Technology Ltd.

About The Winston Property

The Winston Property is comprised of three historic past-producing high-grade gold-silver mines on 147 unpatented lode mining claims, including the four (4) Little Granite Claims (the “LG Claims”) and (2) patented mining claims, Ivanhoe and Emporia (the “Ivanhoe/Emporia Claims”), for a total of 149 total mining claims across 3,000 acres. It is situated in in the Black Range Mountains in northwestern Sierra County, New Mexico, U.S.A.

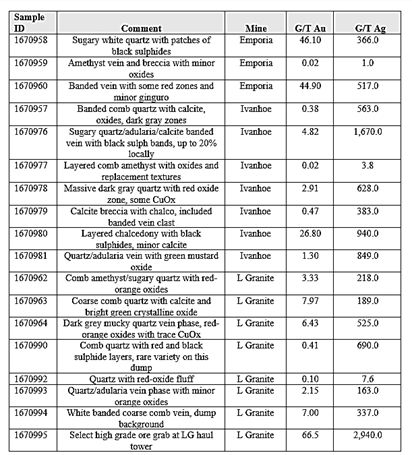

Exceptional results from property-wide confirmatory sampling completed in 2021 included many high-grade samples including 41.5 g/t Gold and 4610 g/t Silver on newly staked claims. Additional samples from these three mines returned peak values of 66.5 g/t gold and 2940 g/t silver from Little Granite, 26.8 g/t gold and 1670 g/t silver from Ivanhoe, and 46.1 g/t gold and 517 g/t silver from Emporia. Table 1 shows the descriptions and Gold/Silver values for Ore Characterization Samples collected by the QP.

Table 1. Ore Characterization samples collected from historic mine dumps, none omitted

Historically reported high-grade values have been confirmed in limited re-sampling by Foremost. Past drill reports from the Little Granite Vein suggest the primary vein widens to more than 4m (12ft) true width, at depth. These results, along with multiple site visits confirm that earlier reports of high-grade silver and gold values from historic workings have legitimacy and justify a major exploration program using modern methods to define the nature and size of mineralization.

Qualified Person

Technical information in this news release has been reviewed and approved by Michael Feinstein, PhD, CPG, who is a Qualified Person as identified by Canadian National Instrument 43-101-Standards of Disclosure for Mineral Projects and as defined by the Securities and Exchange Commission’s Regulation S-K 1300 rules for resource deposit disclosure.

About Foremost Lithium

Foremost Lithium (NASDAQ: FMST) (CSE: FAT) (FSE: F0R0) (WKN: A3DCC8) is a hard-rock lithium exploration company focused on empowering the North American clean energy economy. Foremost’s strategically located lithium properties extend over 43,000 acres in Snow Lake, Manitoba, and hosts a property in a known active lithium camp situated on over 11,400 acres in Quebec called Lac Simard South.

Foremost’s four flagship Lithium Lane Projects as well as its Lac Simard South project are located at the tip of the NAFTA superhighway to capitalize on the world’s growing EV appetite, strongly positioning the Company to become a premier supplier of North America’s lithium feedstock. As the world transitions towards decarbonization, the Company’s objective is the extraction of lithium oxide (Li₂O), and to subsequently play a role in the production of high-quality lithium hydroxide (LiOH), to help power lithium-based batteries, critical in developing a clean-energy economy. Foremost Lithium also has the Winston Gold/Silver Property in New Mexico USA. Learn More at www.foremostlithium.com.

Contact and Information

Company

Jason Barnard, President and CEO

+1 (604) 330-8067

info@foremostlithium.com

Investor Relations

Lucas A. Zimmerman

Managing Director

MZ Group - MZ North America

(949) 259-4987

FMST@mzgroup.us

www.mzgroup.us

Follow us or contact us on social media:

Twitter: @foremostlithium

Linkedin: https://www.linkedin.com/company/foremost-lithium-resource-technology/

Facebook: https://www.facebook.com/ForemostLithium

Forward-Looking Statements

Except for the statements of historical fact contained herein, the information presented in this news release and oral statements made from time to time by representatives of the Company are or may constitute “forward-looking statements” as such term is used in applicable United States and Canadian laws and including, without limitation, within the meaning of the Private Securities Litigation Reform Act of 1995, for which the Company claims the protection of the safe harbor for forward-looking statements. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Any other statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect,” “is expected,” “anticipates” or “does not anticipate,” “plans,” “estimates” or “intends,” or stating that certain actions, events or results “may,” “could,” “would,” “might” or “will” be taken, occur or be achieved) are not statements of historical fact and should be viewed as forward-looking statements. Forward-looking statements in this news release include, among others, statements relating to: the timing, structure and completion of the Arrangement; the timing and receipt of required shareholder, court, stock exchange and regulatory approvals for the Arrangement; the retained ownership interest of Foremost in Rio Grande; the terms of the Arrangement; the completion of the concurrent financing and the amount of proceeds to be received therefrom; and the listing of Rio Grande on the CSE. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and other factors include, among others, the availability of capital to fund programs and the resulting dilution caused by the raising of capital through the sale of shares, accidents, labor disputes and other risks of the automotive industry including, without limitation, those associated with the environment, delays in obtaining governmental approvals, permits or financing or in the completion of development or construction activities or claims limitations on insurance coverage. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved. Forward-looking information is subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected. Many of these factors are beyond the Company’s ability to control or predict. Important factors that may cause actual results to differ materially and that could impact the Company and the statements contained in this news release can be found in the Company’s filings with the Securities and Exchange Commission. The Company assumes no obligation to update or supplement any forward-looking statements whether as a result of new information, future events or otherwise. Accordingly, readers should not place undue reliance on forward-looking statements contained in this news release and in any document referred to in this news release. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities. and information. Please refer to the Company’s most recent filings under its profile at www.sedarplus.ca for further information respecting the risks affecting the Company and its business.

The Canadian Securities Exchange has neither approved nor disapproved the contents of this news release and accepts no responsibility for the adequacy or accuracy hereof.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/8f8ffc42-23da-427a-a591-74cd0f18d9e7