Foremost Lithium Announces Winter Drilling Plans on Its Jean Lake Lithium/Gold Property

- Previous drill results of 7.50 g/t Au over 7.66 metres from 94.35 - 102.01 metres indicate significant gold mineralization potential.

- Arrangements with vendors for up to $3.0 million in credit financing for the drill program provide financial flexibility.

- Foremost aims to extend the mineralization laterally and down plunge, targeting lithium and gold exploration to increase value for shareholders.

- None.

Insights

The announcement by Foremost Lithium Resource & Technology Ltd. regarding its upcoming drilling plans on the Jean Lake Lithium/Gold Property is a significant development in the mining and exploration industry. The company's focus on extending the mineralization of the B-1 spodumene bearing pegmatite dyke and investigating gold mineralization at depth indicates a strategic move to capitalize on the increasing demand for lithium, which is a critical component in battery production and gold, a traditional safe-haven asset.

From a geological perspective, the integration of previous drill results showing high-grade gold and lithium intersections suggests that the Jean Lake Property has the potential to host economically viable mineral deposits. The continuity of the spodumene-bearing pegmatite dyke, as suggested by the company's field observations, is a positive indicator for resource estimation and potential future extraction.

The company's ability to secure credit financing up to $3.0 million for the drill program reflects confidence in the project's prospects and provides financial flexibility. However, investors should be mindful of the risks associated with exploration, such as the uncertainty of resource estimates and the potential for future capital requirements.

The financial implications of Foremost Lithium's drilling program for its stakeholders include the potential for increased asset valuation, should the exploration yield positive results. The high-grade gold and lithium assays previously reported are promising, but further exploration is necessary to confirm the extent and quality of the deposits. The credit financing arrangement indicates a non-dilutive funding strategy, which is beneficial for current shareholders as it avoids immediate equity dilution.

However, the payback obligations of the credit financing could place a future financial burden on the company if the exploration does not lead to profitable development. Investors should consider the long-term financial health of Foremost Lithium and monitor progress reports closely. The proximity to Snow Lake Resources' lithium property and the potential synergies or competition that could arise from this are additional factors to consider in the valuation of Foremost Lithium's stock.

Foremost Lithium's announcement is indicative of the broader trend in the mining sector where companies are aggressively pursuing battery metals like lithium due to the global push for electric vehicles and renewable energy storage solutions. The dual focus on gold provides a hedge against market volatility. The strategic location near the historic mining centre of Snow Lake in Manitoba is advantageous, given the existing infrastructure and mining-friendly regulatory environment.

The exploration results, if positive, could position Foremost Lithium as a significant player in the North American lithium market. However, it's essential to consider the competitive landscape, as many other companies are also ramping up lithium exploration and production. The successful development of the Jean Lake Property could attract partnership opportunities or even acquisition interest from larger mining companies seeking to secure lithium supplies.

- Target includes the B-1 spodumene bearing pegmatite dyke along strike towards the B-2 and B-3 pegmatites extending the mineralization laterally

- Potential for additional gold mineralization at depth will be targeted based on previous drill results of 7.50 g/t Au over 7.66 metres from 94.35 - 102.01 metres (including 102.0 g/t Au over 0.48 metres from 94.77 - 95.25 metres

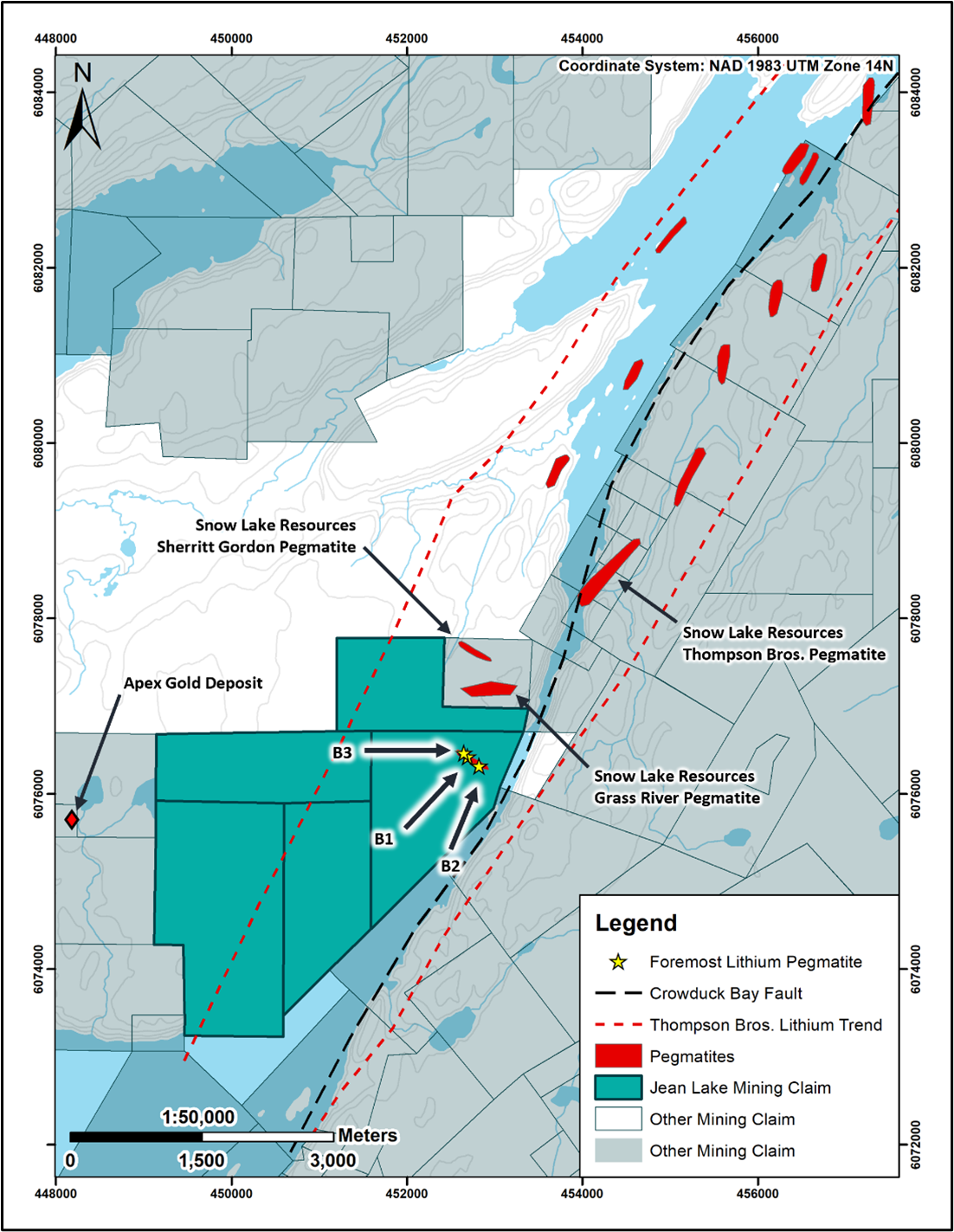

VANCOUVER, British Columbia, Dec. 19, 2023 (GLOBE NEWSWIRE) -- Foremost Lithium Resource & Technology Ltd. (NASDAQ: FMST) (CSE: FAT) (“Foremost Lithium”, “Foremost” or the “Company”), a North American hard-rock lithium exploration company, is pleased to announce today its drilling plans for its Jean Lake Lithium/Gold Property located near the historic mining centre of Snow Lake in Manitoba. The Company is completing plans in preparation for a 15-hole, 2,500-metre diamond drill winter program including submitting a work permit at the Manitoba Mines Branch.

Figure 1. Map of Jean Lake’s B1,B2 and B3 Spodumene Bearing Pegmatites

“Gold has hit an all-time high this month. This Jean Lake property has an added benefit of previous gold and lithium discoveries, which provides us an opportune position to be able to move forward to explore both batteries and precious metals with the drill," commented Jason Barnard, Chief Executive Officer and President of Foremost Lithium. "We have some phenomenal, long-standing vendors, who in support of our project, have offered to fund our drill programs in way of a credit finance, if we so desire. We are fortunate to be in a position where our exploration partners feel such confidence in our Company and our assets, to provide us with such a commitment. Foremost is looking forward to this drill season and increasing value for our company and shareholders.”

Lithium

Foremost will commence the drilling program in the beginning of Q1 in 2024 and is targeting the B-1 spodumene bearing pegmatite dyke along strike towards the B-2 and B-3 pegmatites to extend the mineralization laterally and down plunge. It is the Company’s goal to develop a better understanding of the spodumene-bearing pegmatite emplacement mechanisms at Jean Lake. Foremost’s drill program, combined with field observations, have indicated that B-1 and B-2 could be one spodumene-bearing pegmatite with a minimum length of 325 metres. Previous drilling, just north of the B1 pegmatite, intersected a 3.35 metre zone of spodumene mineralization between surface and 3.35 metres, assaying

Gold

Previous drill testing in 2023 of integrated geological and geochemical targets elsewhere on the Jean Lake Property intersected numerous gold mineralized intervals at vertical depths of up to 110 metres below surface (Foremost news release June 6, 2023). Highlights from this program included 7.50 g/t Au over 7.66 metres from 94.35 - 102.01 metres (including 102.0 g/t Au over 0.48 metres from 94.77 - 95.25 metres). Further investigation and drilling will assess the potential for additional gold mineralization at depth as well as to create a geological framework to aid in delineating gold intersected during the 2022-23 drill program.

Sherritt Gordon – B-1 Spodumene Bearing Pegmatite

The northeast sector of Foremost’ s Jean Lake Property abuts the lithium property of Snow Lake Resources (“SNR”) that hosts the Sherritt Gordon (“SG”) and Grass River (“GRP”) pegmatites. Foremost’s SG-3 pegmatite, or the re-named B-1 Beryl pegmatite, and the B-2 Beryl pegmatite on the Jean Lake Property, appear to be on trend with the SG and GRP on Snow Lake lithium’s property. Both SG-1 and SG-2 can be interpreted to be components of the same pegmatite cluster of the now renamed B1 pegmatite. Highlights of recent drilling by SNR (January 2023 news release) include

Credit Finance Option and Next Steps

The Company has secured arrangements with some of its vendors to extend the Company up to

Qualified Person

Technical information in this news release has been reviewed and approved by Lindsay Bottomer, P.Geo., who is a Qualified Person as identified by Canadian National Instrument 43-101-Standards of Disclosure for Mineral Projects and as defined by the Securities and Exchange Commission’s S-K 1300 rules for mineral deposit disclosure.

About Foremost Lithium

Foremost Lithium (NASDAQ: FMST) (CSE: FAT) (FSE: F0R0) (WKN: A3DCC8) is a hard-rock lithium exploration company focused on empowering the North American clean energy economy. Foremost’s strategically located lithium properties extend over 43,000 acres in Snow Lake, Manitoba, and hosts a property in a known active lithium camp situated on over 11,400 acres in Quebec called Lac Simard South.

Foremost’s four flagship Lithium Lane Projects as well as its Lac Simard South project are located at the tip of the NAFTA superhighway to capitalize on the world's growing EV appetite, strongly positioning the Company to become a premier supplier of North America's lithium feedstock. As the world transitions towards decarbonization, the Company's objective is the extraction of lithium oxide (Li₂O), and to subsequently play a role in the production of high-quality lithium hydroxide (LiOH), to help power lithium-based batteries, critical in developing a clean-energy economy. Foremost Lithium also has the Winston Gold/Silver Property in New Mexico USA. Learn More at www.foremostlithium.com.

Contact and Information

Company

Jason Barnard, President and CEO

+1 (604) 330-8067

info@foremostlithium.com

Investor Relations

Lucas A. Zimmerman

Managing Director

MZ Group - MZ North America

(949) 259-4987

FMST@mzgroup.us

www.mzgroup.us

Follow us or contact us on social media:

Twitter: @foremostlithium

Linkedin: https://www.linkedin.com/company/foremost-lithium-resource-technology/

Facebook: https://www.facebook.com/ForemostLithium

Forward-Looking Statements

Except for the statements of historical fact contained herein, the information presented in this news release and oral statements made from time to time by representatives of the Company are or may constitute “forward-looking statements” as such term is used in applicable United States and Canadian laws and including, without limitation, within the meaning of the Private Securities Litigation Reform Act of 1995, for which the Company claims the protection of the safe harbor for forward-looking statements. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Any other statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect,” “is expected,” “anticipates” or “does not anticipate,” “plans,” “estimates” or “intends,” or stating that certain actions, events or results “may,” “could,” “would,” “might” or “will” be taken, occur or be achieved) are not statements of historical fact and should be viewed as forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and other factors include, among others, the availability of capital to fund programs and the resulting dilution caused by the raising of capital through the sale of shares, accidents, labor disputes and other risks of the automotive industry including, without limitation, those associated with the environment, delays in obtaining governmental approvals, permits or financing or in the completion of development or construction activities or claims limitations on insurance coverage. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved. Forward-looking information is subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected. Many of these factors are beyond the Company’s ability to control or predict. Important factors that may cause actual results to differ materially and that could impact the Company and the statements contained in this news release can be found in the Company’s filings with the Securities and Exchange Commission. The Company assumes no obligation to update or supplement any forward-looking statements whether as a result of new information, future events or otherwise. Accordingly, readers should not place undue reliance on forward-looking statements contained in this news release and in any document referred to in this news release. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities.

The Canadian Securities Exchange has neither approved nor disapproved the contents of this news release and accepts no responsibility for the adequacy or accuracy hereof.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/7562eb10-52eb-461e-a523-633b988babf6

FAQ

What are Foremost Lithium Resource & Technology Ltd.'s (FMST) plans for its Jean Lake Lithium/Gold Property in Manitoba?

What were the previous drill results at Jean Lake Property?

What financial arrangements has Foremost Lithium made for the drill program?

When will Foremost Lithium commence the drilling program?