Flora Growth Reports Fiscal Year End 2021 Results

-

Flora reports

~ in revenue for FY 2021, versus$9.0 million $0.1M -

Second Half 2021 revenues grew by

329% vs. First Half 2021 -

Unaudited Q1 2022 revenues show increase of

450% over Q1 2021 -

Company reiterates guidance of

$35 -$45M 288% -400% projected revenue growth from fiscal year 2021

“Fiscal year 2021 was a foundational year for our company as we closed our first full year of revenues. In 2022 we anticipate accelerating revenue growth as we activate our Wholesale and Life Sciences growth pillars, while fueling expansion in our global

Merchan added, “The completion of our cultivation and extraction facilities has positioned Flora for success in this rapidly evolving industry, as we satisfied the requirements for the cultivation, transformation and export of up to 43.6 tonnes of THC cannabis flower. And in our Life Sciences pillar, we look forward to potential commercial distribution of pharmaceutical-grade products based on the research of Dr.

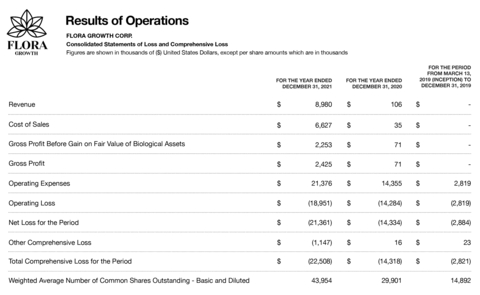

FY 2021 Financial Highlights:

-

Total revenue for the year ended

December 31, 2021 was approximately$9.0 million May 2021 . -

Gross profit on sales for the period was approximately

$2.4 million $19 million -

Cash on hand as of

December 31, 2021 was approximately$37.6 million -

One-time charges for the year totaled approximately

$8.2M $4.7M $3.5M -

Company reiterates guidance of

$35M -$45M USD288% -400% year over year.

FY 2021 Operating Highlights:

-

Completed its IPO listing on Nasdaq under the ticker FLGC in

May 2021 , as well as completed a subsequent secondary offering, raising an aggregate of approximately$53.7 million -

Completed the acquisition and integration of

Vessel Brand, Inc. , establishing a foothold in theU.S. cannabis accessories business and improving its e-commerce capabilities across the Flora portfolio of brands. - Completed build-out of Flora’s all-outdoor cultivation and on-site extraction facility to prepare for Colombia’s recently announced regulations allowing for the export of high-THC dry flower.

-

Signed licensing agreement with

Tonino Lamborghini for the development and distribution of cannabis-based beverage products inthe United States . -

Entered into a strategic partnership with

Hoshi International to increase Flora’s presence inPortugal ,Malta and other key European countries. -

Expanded brand portfolio and retail presence, including Macys.com, Walmart.com

Mexico and Coppel as well as the opening of a brick-and-mortar location inMiami, FL. -

Initiated development of new life sciences division, Flora Life Sciences, which launched initial clinical trial protocols to study fibromyalgia in partnership with the

University of Manchester .

2022 Recent Achievements:

-

Completed the acquisition of JustCBD, adding its portfolio of award-winning products and 14,000

U.S. points of distribution. -

Received 2022 export quota for 43.6 tonnes of high-THC cannabis in

Colombia and completed the necessary steps to allow for the commercial planting and export of psychoactive cannabis. - Interest and LOI’s for both high-THC and high-CBD flower to begin distributing globally in the third quarter of 2022.

Earnings Call:

Live Audio Webcast Details:

Date:

Time:

Online Participation Link: https://floragrowth.com/flora-growth-2021-earnings/

The live webcast will be available online through the above participant link and will be archived and available on the Company’s website within approximately 24 hours.

About

Flora is building a connected, design-led collective of plant-based wellness and lifestyle brands, designed to deliver the most compelling customer experiences in the world, one community at a time. As the operator of one of the largest outdoor cannabis cultivation facilities, Flora leverages natural, cost-effective cultivation practices to supply cannabis derivatives to its commercial, house of brands, and life sciences divisions. Visit www.floragrowth.com or follow @floragrowthcorp on social media for more information.

Cautionary Statement Concerning Forward-Looking Statements

This document contains forward-looking statements. In addition, from time to time, we or our representatives may make forward-looking statements orally or in writing. We base these forward-looking statements on our expectations and projections about future events, which we derive from the information currently available to us. Such forward-looking statements relate to future events or our future performance, including: expected future revenue, integration of our recent acquisitions, expansion of our global footprint, expansion of our product offerings; our financial performance and projections; our growth in revenue and earnings; and our business prospects and opportunities. You can identify forward-looking statements by those that are not historical in nature, particularly those that use terminology such as “may,” “should,” “expects,” “anticipates,” “contemplates,” “estimates,” “believes,” “plans,” “projected,” “predicts,” “potential,” or “hopes” or the negative of these or similar terms. In evaluating these forward-looking statements, you should consider various factors, including: our ability to change the direction of the Company; our ability to keep pace with new technology and changing market needs; and the competitive environment of our business. These and other factors may cause our actual results to differ materially from any forward-looking statement. Forward-looking statements are only predictions. The forward-looking events discussed in this document and other statements made from time to time by us or our representatives may not occur, and actual events and results may differ materially and are subject to risks, uncertainties and assumptions about us. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of uncertainties and assumptions, or the forward-looking events discussed in this document and other statements made from time to time by us or our representatives not occurring, except as may be required by applicable law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220510005663/en/

Investor Relations:

james.williams@floragrowth.com

Public Relations:

+1 (858) 221-8001

flora@cmwmedia.com

Source: