FICO UK Credit Card Market Report: December 2022

Seasonal increases plus higher prices result in festive spending highs and big rise in cardholders missing one payment

Highlights

-

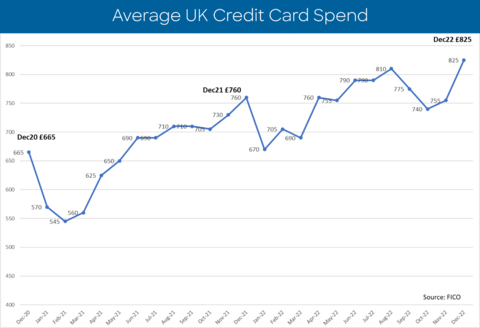

Average total sales up 9 percent over

November 2022 at£825 -

Average balances rise by 5 percent month-on-month to

£1,660 - Accounts missing one payment jumped month-on-month by 19 percent

-

Percentage of accounts with two missed payments was 19 percent higher than

December 2021 and 20 percent higher for three missed payments -

The pattern of falling payments to balance also continued in

December 2022 with a 2 percent month-on-month drop and a 4 percent year-on-year decrease

FICO comment

Analysis of the largest consortium of

The Financial Conduct Authority’s (FCA) Consumer Duty rules, which will apply to new and existing products or services that are open to sale or renewal and come into force on

As financial institutions face increasing numbers of late payments they will benefit from using optimised strategies to determine who and when to contact, and omnichannel communications to ensure those messages land. Those with the ability to incorporate digital-first communications will be in a much stronger position to deploy effective collections strategies.

Key Trend Indicators – |

|||

Metric |

Amount |

Month-on-Month Change |

Year-on-Year Change |

Average |

|

+ |

+ |

Average Card Balance |

|

+ |

+ |

Percentage of Payments to Balance |

|

- |

- |

Accounts with One Missed Payment |

|

+ |

+ |

Accounts with Two Missed Payments |

|

+ |

+ |

Accounts with Three Missed Payments |

|

+ |

+ |

Average Credit Limit |

|

+ |

+ |

Average Overlimit Spend |

|

|

- |

Cash Sales / Total Sales |

|

- |

- |

Source: FICO |

|||

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80 percent of

About FICO

FICO (NYSE: FICO) powers decisions that help people and businesses around the world prosper. Founded in 1956, the company is a pioneer in the use of predictive analytics and data science to improve operational decisions. FICO holds more than 200 US and foreign patents on technologies that increase profitability, customer satisfaction and growth for businesses in financial services, telecommunications, health care, retail and many other industries. Using FICO solutions, businesses in nearly 120 countries do everything from protecting 2.6 billion payment cards from fraud, to helping people get credit, to ensuring that millions rental cars are in the right place at the right time.

Learn more at https://www.fico.com

FICO and TRIAD are registered trademarks of

View source version on businesswire.com: https://www.businesswire.com/news/home/20230221005173/en/

For further comment on the FICO

FICO

ficoteam@harrisonsadler.com

0208 977 9132

Source: FICO