Fiserv Small Business Index™ for March 2024: Seasonal Factors Impact Small Business Sales as Spring Arrives

- None.

- None.

Insights

The recent update from Fiserv regarding the Small Business Index presents a nuanced picture of the small business sector's performance. While there is a slight month-over-month decline, the year-over-year growth figures are indicative of a resilient sector. The differentiation in performance among subsectors, such as the notable growth in restaurants, clothing and food manufacturing, suggests a disparity in consumer spending patterns that could influence stock market sentiments, particularly for companies operating within these niches.

The data on consumer spending shifts due to seasonal events, like Spring Break and Easter, provide valuable insights into the cyclical nature of certain industries. Investors may view these patterns as opportunities to adjust their portfolios according to predictable fluctuations in consumer behavior. However, the overall one-point decline in the index could signal caution, prompting stakeholders to closely monitor upcoming financial releases for signs of sustained growth or further contraction.

From a financial perspective, the Fiserv Small Business Index's slight decline juxtaposed with a solid annual growth rate suggests a healthy expansion pace that is not without its challenges. The retail sector's performance, particularly in segments like clothing and accessories, indicates a potential for targeted investment strategies. These segments might be attractive for investors seeking growth opportunities within the broader retail market.

Moreover, the robust performance in subsectors such as food manufacturing and web search portals points to specific areas where consumer demand remains strong. Investors might consider these subsectors as potential havens or growth areas, especially given the impressive year-over-year sales increases. However, the index's sensitivity to seasonal events must be considered when forecasting future performance, as these fluctuations could impact short-term stock valuations.

An economist's interpretation of the Fiserv Small Business Index would focus on the broader economic implications of the reported trends. The year-over-year growth in small business sales reflects a recovering economy, yet the month-over-month decline raises questions about the sustainability of this recovery amidst economic headwinds. The strong performance in the food manufacturing subsector suggests a shift in consumer preferences or possibly supply chain recoveries that are benefiting domestic producers.

The index serves as a barometer for consumer confidence and small business health, which are critical components of economic stability. The mixed signals from the index, with certain subsectors outperforming others, could indicate a realignment of consumer spending that may affect economic forecasts and policy considerations. Long-term investors and policymakers alike would do well to consider these subtleties when evaluating the economic landscape and potential regulatory responses.

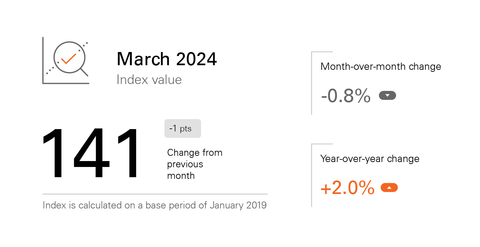

Fiserv Small Business Index reflects one point decline from February 2024

Small business sales grew +

March 2024 Fiserv Small Business Index Values (Graphic: Business Wire)

Nationally, the seasonally adjusted Fiserv Small Business Index decreased one point to 141. Small business sales grew +

“Consumer spending fluctuated throughout March, with Spring Break travel boosting sales and the Easter holiday contributing to a slow finish as many small businesses closed on the month’s final day,” said Prasanna Dhore, Chief Data Officer at Fiserv. “Restaurants were a particularly bright spot in March, with small businesses in this subsector seeing a +

Retail Spotlight

Nationally, sales at retail small businesses were soft compared to February (-

Additional Small Business Insights

Spring Break travel and celebrations also contributed to sizeable sales increases in the Accommodation subsector encompassing hotels and short-term vacation rentals, which grew +

Food Manufacturing was the most active small business subsector in March, with its index increasing 9 points to 175. Sales for small businesses in this subsector grew +

Other growing subsectors in March included: Web Search Portals, Libraries, Archives, and Other Information Services (+

About the Fiserv Small Business Index™

The Fiserv Small Business Index is published during the first week of every month and differentiated by its direct aggregation of consumer spending activity within the

Benchmarked to 2019, the Fiserv Small Business Index provides a numeric value measuring consumer spending, with an accompanying transaction index measuring customer traffic. Through a simple interface, users can access data by region, state, and/or across business types categorized by the North American Industry Classification System (NAICS). Computing a monthly index for 16 sectors and 34 sub-sectors, the Fiserv Small Business Index provides a timely, reliable and consistent measure of small business performance even in industries where large businesses dominate.

To access the full Fiserv Small Business Index visit fiserv.com and click on “Fiserv Small Business Index” or visit fiserv.com/FiservSmallBusinessIndex.

About Fiserv

Fiserv, Inc. (NYSE: FI), a Fortune 500 company, aspires to move money and information in a way that moves the world. As a global leader in payments and financial technology, the company helps clients achieve best-in-class results through a commitment to innovation and excellence in areas including account processing and digital banking solutions; card issuer processing and network services; payments; e-commerce; merchant acquiring and processing; and the Clover® cloud-based point-of-sale and business management platform. Fiserv is a member of the S&P 500® Index and has been recognized as one of Fortune® World’s Most Admired Companies™ for 9 of the last 10 years. Visit fiserv.com and follow on social media for more information and the latest company news.

FISV-G

View source version on businesswire.com: https://www.businesswire.com/news/home/20240404737908/en/

Media Relations:

Chase Wallace

Director, Communications

Fiserv, Inc.

+1 470-481-2555

chase.wallace@fiserv.com

Additional Contact:

Ann S. Cave

Vice President, External Communications

Fiserv, Inc.

+1 678-325-9435

ann.cave@fiserv.com

Source: Fiserv, Inc.