Fiserv Small Business Index™ for June 2024: Small Business Sales Slow as Consumers Pull Back

The Fiserv Small Business Index for June 2024 shows a decline to 140, reflecting a slowing pace in small business growth. Year-over-year, small business sales increased by 1.6% and transactions by 4.4%, but month-over-month, sales fell by 2.9% and transactions by 1.5%. Retail sales saw mixed results, with general merchandise up 8.5% yearly but significant monthly declines in categories like gasoline stations (-4.5%) and health/personal care (-7.2%). Restaurant sales grew 3.6% annually but declined 1.2% monthly. Other sectors like professional services and specialty trade contractors experienced slower growth. Fiserv attributes the slowdown to inflation reduction and seasonal demand shifts.

- Small business sales grew 1.6% year-over-year.

- Small business transactions increased by 4.4% year-over-year.

- General Merchandise sales grew 8.5% year-over-year.

- Restaurant sales grew 3.6% year-over-year.

- Food and Beverage stores saw a 4.6% increase in sales year-over-year.

- Professional, Scientific, and Technical Services sales increased 9.0% year-over-year.

- Amusement/Gambling/Recreation experienced a 13.4% year-over-year growth.

- Small business sales declined 2.9% month-over-month.

- Small business transactions fell 1.5% month-over-month.

- Retail sales dropped 3.3% month-over-month.

- Restaurant sales declined by 1.2% month-over-month.

- Health and Personal Care sales decreased by 7.2% month-over-month.

- Motor Vehicle and Parts Dealers saw a 5.9% month-over-month drop in sales.

- Truck Transportation spending reduced by 8.9% month-over-month.

Insights

From a financial perspective, the Fiserv Small Business Index for June 2024 reflects a slowing trend in small business sales and transactions. The year-over-year sales growth of

Investors should also note the sector-specific variations; for instance, while General Merchandise and Gasoline Stations showed some resilience, sectors like Motor Vehicle and Parts Dealers experienced significant declines. This mixed performance across sectors underscores the importance of diversification and understanding sector-specific risks when investing in small business-focused funds or stocks.

Additionally, slowing growth in the restaurant sector might reflect consumer prioritization of essential spending, with modest increases in average ticket sizes potentially hinting at inflationary pressures. It's important for investors to monitor these trends as they can have substantial implications on overall consumer spending power and economic stability.

The data from the Fiserv Small Business Index offers a granular view of consumer behavior and its impact on small businesses. The year-over-year growth in sales and transactions in certain sectors like Professional, Scientific and Technical Services (+

The monthly declines across various sectors suggest a cooling off after a period of growth and could imply a shift in consumer priorities towards more essential spending. For example, the sharp decline in Health and Personal Care sales suggests that consumers are cutting back on non-essential purchases. This reallocation of spending is important for understanding market dynamics and potential investment risks.

Investors should consider the broader economic context, noting that short-term fluctuations may be influenced by seasonal factors and not necessarily indicative of long-term trends. However, the overall slowdown is a signal to remain vigilant about consumer confidence and economic conditions that might further impact small business performance.

Fiserv Small Business Index declines to 140

Small business sales grew

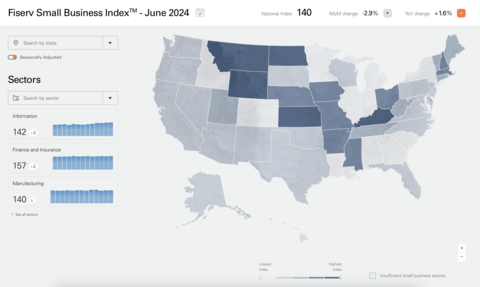

June 2024 Fiserv Small Business Index Map (Graphic: Business Wire)

“The Fiserv Small Business Index provides timely insight into small business performance well ahead of other economic indicators,” said Jennifer LaClair, Head of Merchant Solutions at Fiserv. “As consumers adjust their spending patterns, our ability to understand the impact on small businesses helps us work across our ecosystem to better support clients through a changing economic landscape.”

Nationally, the seasonally adjusted Fiserv Small Business Index for June declined to 140. On a year-over-year basis, both small business sales (+

“As the quarter came to a close, consumers throttled back both spending and foot traffic across retail, restaurants and other service-based businesses,” said Prasanna Dhore, Chief Data Officer at Fiserv. “The slowdown was driven by a combination of lower average ticket sizes—the result of abating inflation and budget-conscious consumers—and a series of short-term seasonal demand shifts.”

Retail

Nationally, small business retail sales indexed at 142 in June, which reflects growth in year-over-year sales (+

On a monthly basis, the impact was more significant as consumers sought deals and pulled-back on discretionary purchases, with month-over-month sales (-

Restaurant and Food Categories

Small business restaurant sales (+

Month-over-month, total restaurant sales (-

Other Industry Movers

-

Professional, Scientific, and Technical Services are seeing growth in sales (+

9.0% ) and transactions (+7.7% ) year-over-year. Month-over-month sales declined (-2.9% ) from May, although transactions were mostly flat (-0.3% ). -

Specialty Trade Contractors grew sales (+

1.6% ) and transactions (+3.8% ) year-over-year. Month-over-month sales (-2.1% ) and transactions (-2.8% ) tapered off as demand for general carpentry and light construction cooled. -

Additional strong year-over-year growth categories included Web Search Portals, Libraries and Related Services (+

22.9% ) and Amusement/Gambling/Recreation (+13.4% ); the sharpest annual declines were in Real Estate (-14.2% ) and Transportation Equipment Manufacturing (-14.0% ). -

Web Search Portals, Libraries and Related Services (+

2.4% ), Amusement/Recreation/Gambling (+1.5% ), and Insurance (+1.4% ) were the fastest growing categories month-over-month. Spending slowed most in Truck Transportation (-8.9% ) compared to May.

About the Fiserv Small Business Index™

The Fiserv Small Business Index is published during the first week of every month and differentiated by its direct aggregation of consumer spending activity within the

Benchmarked to 2019, the Fiserv Small Business Index provides a numeric value measuring consumer spending, with an accompanying transaction index measuring customer traffic. Through a simple interface, users can access data by region, state, and/or across business types categorized by the North American Industry Classification System (NAICS). Computing a monthly index for 16 sectors and 34 sub-sectors, the Fiserv Small Business Index provides a timely, reliable and consistent measure of small business performance even in industries where large businesses dominate.

To access the full Fiserv Small Business Index, visit fiserv.com/FiservSmallBusinessIndex.

About Fiserv

Fiserv, Inc. (NYSE: FI), a Fortune 500 company, aspires to move money and information in a way that moves the world. As a global leader in payments and financial technology, the company helps clients achieve best-in-class results through a commitment to innovation and excellence in areas including account processing and digital banking solutions; card issuer processing and network services; payments; e-commerce; merchant acquiring and processing; and the Clover® cloud-based point-of-sale and business management platform. Fiserv is a member of the S&P 500® Index and has been recognized as one of Fortune® World’s Most Admired Companies™ for 9 of the last 10 years. Visit fiserv.com and follow on social media for more information and the latest company news.

FI-G

View source version on businesswire.com: https://www.businesswire.com/news/home/20240708304470/en/

Media Relations:

Chase Wallace

Director, Communications

Fiserv, Inc.

+1 470-481-2555

chase.wallace@fiserv.com

Source: Fiserv, Inc.