First Mining Announces Plan to Consolidate Multi-Million Ounce Quebec Gold District with Acquisition of Duparquet Gold Project

First Mining Gold Corp. announced an offer to acquire Beattie Gold Mines Ltd., a significant step towards consolidating the Duparquet Gold Project in Quebec. The Beattie Offer includes $4.44 cash per share and 35 shares of First Mining for each Beattie share, totaling about $6.23 million and 49 million shares. First Mining already owns 25.3% of Beattie Gold, and after the offer, it expects to control 97.6%. This acquisition is projected to increase First Mining's gold resources by 40% and inferred resources by 50%. Consolidation will enhance project economics and create opportunities for exploration.

- Increases First Mining's M&I resource base in Quebec by +450% and inferred resource base by +150%.

- Consolidates ownership structure of the Duparquet Gold Project, enhancing operational efficiency.

- Creates potential for improved economics based on an enhanced gold market environment.

- Offers exciting exploration upside with additional drilling potential.

- Potential integration challenges with newly acquired properties.

- -

Insights

Analyzing...

TSX: FF

OTCQX: FFMGF

FRANKFURT: FMG

VANCOUVER, BC, July 18, 2022 /PRNewswire/ - First Mining Gold Corp. ("First Mining" or the "Company") (TSX: FF) (OTCQX: FFMGF) (FRANKFURT: FMG) is pleased to announce that it has made an offer to acquire all of the issued and outstanding shares of Beattie Gold Mines Ltd. ("Beattie Gold"), a private company that owns the mineral rights to mining claims that make up the former Beattie mining concession which forms a large part of the Duparquet Gold Project (the "Duparquet Gold Project") located in Quebec, Canada (the "Beattie Offer"). First Mining, directly and through its wholly-owned subsidiary, Clifton Star Resources Inc. ("Clifton Star), already owns approximately

The Duparquet Gold Project consists of several properties held in different entities which, in addition to the Beattie property, include the Donchester, Dumico and Central Duparquet properties. First Mining, through Clifton Star, is currently a

Concurrent with making the Beattie Offer, First Mining has entered into share purchase agreements to acquire all of the issued and outstanding shares of 258 Manitoba (the "258 Manitoba Transaction") and 269 Canada (the "269 Canada Transaction", and together with the 258 Transaction, the "Concurrent Transactions") that are not already owned by Clifton Star. The Concurrent Transactions are conditional on the Beattie Offer, and will close on the same day as the Beattie Offer, which is expected to be in mid-September.

The total consideration of the Concurrent Transactions is

"This transformational acquisition has been a few years in the making and grows First Mining's M&I gold resources by

"This is a transformational acquisition for First Mining and the Duparquet Gold Project as we plan on consolidating this highly fragmented ownership structure under the First Mining banner. Duparquet hosts a robust resource profile where two past producing mines have operated in Quebec's most prolific gold mining district. First Mining has been a long-time minority shareholder of the companies that own this Project, and the timing was right to acquire full ownership of these companies. We are confident that Duparquet and the district will prove to be a critical strategic asset in the gold sector in Canada as this transaction affirms First Mining's positioning as a multi-asset developer of major projects in Tier 1 jurisdictions," stated Dan Wilton, CEO of First Mining. "Together with our ownership of the Pitt and Duquesne projects in Quebec located just east of Duparquet, First Mining will now have

- Consolidates one of the largest advanced-stage, undeveloped gold projects in Canada – including the Duquesne and Pitt deposits, to create a multi-million ounce gold resource district (1, 2, 3)

- Transforms First Mining into a leading Tier I gold development company with ownership in two prolific Tier 1 multi-million ounce gold assets located in some of the best mining jurisdictions in the world in Quebec and Ontario

- NI 43-101 resource estimate of the Duparquet Gold Project (InnovExplo, 2014) 3.1 Moz M&I at 1.59 g/t Au and 1.4 Moz Inferred at 1.51 g/t Au meaningfully enhances total resource profile of First Mining

- Increases First Mining's M&I resource base in Quebec by +

450% and its inferred resource base in Quebec by +150% ; increases First Mining's global M&I resource base by +40% and its global inferred resource base by +50% - Accretive acquisition metrics to First Mining on a per ounce basis

- Consolidates and simplifies highly fragmented and complex ownership structure of the Duparquet Gold Project by combining properties, mineral rights and surface rights ownership under one entity

- Offers potential to significantly improve on 2014 Pre-Feasibility Study completed on the Duparquet Gold Project with development optimization and more robust economics based on an improved gold market environment

- Creates exciting exploration upside potential with additional exploration drilling to expand mineralized zones along strike and at-depth

- Provides platform for further district consolidation in Quebec

(1) | Source NI 43-101 Technical Report and Prefeasibility Study for the Duparquet Project, InnovExplo, May 23, 2014 |

(2) | Source NI 43-101 Technical Report Resource Estimate of the Duquesne Property, WSP Canada, Reissued May 25, 2016 |

(3) | Source NI 43-101 Technical Report and Review of the Preliminary Mineral Resource Estimate for the Pitt Gold Project, Micon International Limited, January 5, 2017 |

In connection with the Beattie Offer, First Mining has entered into binding lock-up agreements with certain shareholders ("Support Shareholders") of Beattie Gold who have agreed to support the Beattie Offer and to irrevocably tender all of their common shares of Beattie Gold to the Beattie Offer. The Support Shareholders collectively hold 1,358,652 Beattie Gold shares representing approximately

First Mining intends to make an offer to all registered holders of common shares of Beattie Gold in accordance with applicable Canadian securities laws. The Beattie Offer will be subject to the following conditions: (i) there being deposited under the Beattie Offer, and not withdrawn, at least 464,643 of the outstanding common shares of Beattie Gold (the "Take-Up Condition"), which, when combined with the common shares of Beattie Gold already held by First Mining (both directly and through Clifton Star), would represent ownership of Beattie Gold of

First Mining has entered into binding share purchase agreements in respect of the 258 Manitoba Transaction and the 269 Canada Transaction, which are both subject to the Take-Up Condition and are expected to close concurrently with the closing of the Beattie Offer. All of the transactions are expected to close in mid-September 2022.

First Mining has concluded substantial due diligence on the Duparquet Gold Project to date, including understanding the existing mineral resource estimate and exploration potential at the Duparquet Gold Project and in the district. First Mining intends to complete an updated mineral resource estimate in accordance with NI 43-101 shortly after closing the Beattie Offer and Concurrent Transactions which will incorporate additional drilling from 2014 to 2020 not included in the previous mineral resource estimate.

First Mining will commence an environmental data collection exercise to update the environmental baseline data collected by Clifton Star in 2012 and 2013. Work is also expected to commence on engineering trade-off studies and an updated economic study to build on the solid technical foundation established by the Project in the 2014 Pre-Feasibility Study. First Mining has initiated discussions with the relevant Quebec ministries and is committed to working in partnership with regulators, the local municipality, and Indigenous communities to address environmental matters and legacy infrastructure as part of the property's redevelopment. In addition, First Mining intends to commence a robust regional exploration data compilation, integration and targeting exercise to develop a path supporting potential resource expansion, resource classification upgrading, and exploration discovery.

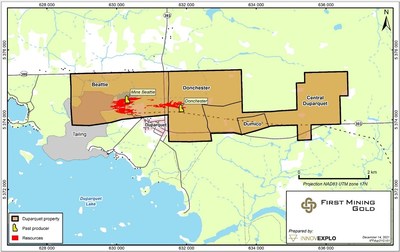

The Duparquet Gold Project is located immediately north of the town of Duparquet, Quebec and covers an area of 1,079 hectares, and consists of 50 mining claims, including two historical mining concessions, which include the four mining properties: the Beattie property (historical mining concession 292) owned by Beattie, the Donchester property (historical mining concession 384) and Dumico property owned by 2588111 Manitoba Ltd., and the Central Duparquet property owned by First Mining. Both the Beattie and Donchester properties contain past-producing underground gold mines. Historical underground workings and a shaft were developed at the Central Duparquet property, but no gold was produced. The Duparquet Gold Project also contains a tailings pond area straddling the southwest limit of the Beattie property.

Gold was first discovered in the Duparquet region in 1910 with production commencing in 1933 on the Beattie property and on the Donchester property in the 1940s. Mining and milling operations ceased at Duparquet in 1956 after 23 years of continuous production. During its lifetime, the Beattie mill at Duparquet produced over 1.3 million ounces of gold at grades higher than 4 g/t. The Duparquet Gold Project remained mostly dormant until 1987 when increased exploration and drilling activity resumed. Clifton Star began work on the Duparquet Gold Project in 2008 and between 2008 and 2013, Clifton Star and its partners completed in excess of 260,000 m of drilling that were incorporated into the mineral resource estimate and completed a positive Pre-Feasibility Study in 2014, which detailed a development plan including a 10,000 tpd open pit mine and mill. Clifton Star was acquired by First Mining in April 2016.

This mineral resource estimate was prepared for Clifton Star Resources Inc. by InnovExplo Inc titled "Technical Report and Prefeasibility Study for the Duparquet Project" effective March 26, 2014. The NI 43-101 technical report detailing the mineral resource estimate for the Duparquet Gold Project is filed on SEDAR (www.sedar.com) and available on First Mining Gold's website.

Area | Cut-off | Measured Resource | Indicated Resource | Inferred Resource | ||||||

(mining method) | (g/t) | Tonnage | Au | Ounces | Tonnage | Au | Ounces | Tonnage | Au | Ounces |

(g/t) | (g/t) | (g/t) | ||||||||

Open pit | 0.45 | 165,100 | 1.45 | 7,711 | 53,070,600 | 1.56 | 2,666,690 | 24,092,300 | 1.18 | 910,631 |

UG mining | 2.00 | - | - | - | 3,520,700 | 2.78 | 314,275 | 5,592,400 | 2.96 | 532,059 |

Tailings | 0.45 | 19,600 | 2.06 | 1,295 | 4,105,000 | 0.93 | 123,200 | - | - | - |

Total | 184,700 | 1.52 | 9,006 | 60,696,300 | 1.59 | 3,104,165 | 29,684,700 | 1.51 | 1,442,690 | |

Notes to accompany the Mineral Resource Estimate: | |

1. | The Independent and Qualified Persons for the Mineral Resource Estimate, as defined by NI 43-101, are Kenneth Williamson, M.Sc., P.Geo and Karine Brousseau, Eng. Under the supervision of Carl Pelletier, B.Sc., P.Geo. (InnovExplo Inc.), and the effective date of the estimate is May 22, 2012 for the Tailings resource and June 26, 2013 for the In-Pit and Underground mineral resources. |

2. | Mineral Resources which are not Mineral Reserves, do not have demonstrated economic viability. |

3. | Tailings results are presented undiluted and in situ. The estimate includes four (4) tailings ponds. |

4. | In-Pit results are presented undiluted and in situ, within Whittle-optimized pit shells. The estimate includes 60 gold-bearing zones and the envelope containing isolated gold intercepts. |

5. | Underground results are presented undiluted and in situ, outside Whittle-optimized pit shells. The estimate includes 60 gold-bearing zones and the envelope containing isolated gold intercepts. |

6. | Tailings resources were compiled at cut-off grades of 0.35, 0.40, 0.45, 0.50, 0.55, 0.60, 0.65, 0.70, 0.80 and 0.9 g/t Au. |

7. | In-Pit resources were compiled at cut-off grades of 0.35, 0.40, 0.45, 0.50, 0.55, 0.60, 0.65, 0.70, 0.80 and 0.9 g/t Au. |

8. | Underground resources were compiled at cut-off grades of 1.5, 2.0, 2.5, 3.0, 3.5, 4.0 and 5.0 g/t Au. |

9. | Cut-off grades must be re-evaluated in light of prevailing market conditions (gold price, exchange rate and mining cost). |

10. | Tailings: A fixed density of 1.45 g/cm3 was used in zones and waste. |

11. | In-Pit and Underground: A fixed density of 2.73 g/cm3 was used in the mineralized zones and in the envelope zone. |

12. | In-Pit and Underground: A minimum true thickness of 3.0 m was applied, using the grade of the adjacent material when assayed, or a value of zero when not assayed. |

13. | Tailings: High grade capping was done on the raw data and established at 13.0 g/t Au for Zone 1, 3.5 g/t Au for Zone 2, 1.7 g/t Au for Zone 3 and 2.2 g/t Au for Zone 4. |

14. | In-Pit and Underground: High grade capping was done on the raw data and established at 25.0 g/t Au for diamond drill hole assays and channel sample assays. |

15. | Tailings: Compositing was done on drill hole sections falling within the mineralized zone solids (composite = 0.5 m). |

16. | In-Pit and Underground: Compositing was done on drill hole and channel sample sections falling within the mineralized zone solids (composite = 1 m). |

17. | Tailings: Resources were evaluated from drill hole and surface channel samples using an ID2 interpolation method in a block model. |

18. | In-Pit and Underground: Resources were evaluated from drill hole and surface channel samples using an ID2 interpolation method in a multi-folder percent block model. |

19. | Tailings: Measured and Indicated categories were defined based on the drill hole spacing (Measured: zones 1 and 2 = 30m x 30m grid; Indicated: zone 3 = 100m x 100m grid and zone 4 = 200m x 200m grid). |

20. | The In-Pit Measured category is defined by blocks having a volume of at least |

21. | The In-Pit and Underground Indicated category is defined by the combination of blocks within a maximum distance of 15m from existing stopes and blocks for which the average distance to drill hole composites is less than 30 m. |

22. | Ounce (troy) = Metric tons x Grade / 31.10348. Calculations used metric units (metres, tonnes and g/t). |

23. | The number of metric tons was rounded to the nearest hundred. Any discrepancies in the totals are due to rounding effects; rounding followed the recommendations in NI 43-101. |

24. | InnovExplo is not aware of any known environmental, permitting, legal, title-related, taxation, socio-political or marketing issues or any other relevant issue that could materially affect the Mineral Resource Estimate. |

25. | Input parameters used for McoG estimation and Whittle pit design: Gold price: C |

26. | Parameters used for UcoG estimation: Gold price: C |

Property | Indicated Resource | Inferred Resource | ||||

Tonnage | Au | Ounces | Tonnage | Au | Ounces | |

(g/t) | (g/t) | |||||

Pitt(1) | - | - | - | 1,076,000 | 7.42 | 257,000 |

Duquesne(2) | 1,859,200 | 3.33 | 199,161 | 1,563,100 | 5.58 | 280,643 |

Total | 1,859,200 | 3.33 | 199,161 | 2,639,100 | 6.34 | 537,643 |

Notes to accompany the Pitt and Duquesne Mineral Resource Estimate: | |

(1) | Notes for Pitt: |

| |

(2) | Notes for Duquesne: |

| |

For more context, please join CEO Dan Wilton for a quick live event on July 19, 2022 at 9am PT / 12 pm ET. Click here to register: https://my.6ix.com/L1_Gqkwn.

Mr. Louis Martin P.Geo., (OGQ 0364), a consultant of First Mining, is a "Qualified Person" for the purposes of National Instrument 43-101 Standards of Disclosure for Mineral Projects, and he has reviewed and approved the scientific and technical disclosure contained in this news release.

First Mining is a Canadian gold developer focused on the development and permitting of the Springpole Gold Project in northwestern Ontario. Springpole is one of the largest undeveloped gold projects in Canada. The results of a positive Pre-Feasibility Study for the Springpole Gold Project were announced by First Mining in January 2021, and permitting activities are on-going with submission of a draft Environmental Assessment ("EA") and Environmental Impact Statement ("EIS") for the project targeted for 2022. The Company also holds a large equity position in Treasury Metals Inc. who are advancing the Goliath Gold Complex toward construction. First Mining's portfolio of gold projects in eastern Canada also includes the Pickle Crow (being advanced in partnership with Auteco Minerals Ltd.), Hope Brook (being advanced in partnership with Big Ridge Gold Corp.), Cameron, Duparquet, Duquesne, and Pitt gold projects.

First Mining was established in 2015 by Mr. Keith Neumeyer, founding President and CEO of First Majestic Silver Corp.

Daniel W. Wilton

Chief Executive Officer and Director

This news release includes certain "forward-looking information" and "forward-looking statements" (collectively "forward-looking statements") within the meaning of applicable Canadian and United States securities legislation including the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements are made as of the date of this news release. Forward-looking statements are frequently, but not always, identified by words such as "expects", "anticipates", "believes", "plans", "projects", "intends", "estimates", "envisages", "potential", "possible", "strategy", "goals", "opportunities", "objectives", or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions.

Forward-looking statements in this news release relate to future events or future performance and reflect current estimates, predictions, expectations or beliefs regarding future events and include, but are not limited to, statements with respect to: (i) the satisfaction of the Take-Up Condition and the closing date of the Beattie Offer and the Concurrent Transactions; (ii) First Mining's plans to complete an updated mineral resource estimate for the Duparquet Gold Project in accordance with NI 43-101 shortly after closing the Beattie Offer and the Concurrent Transactions, including its plans to incorporate drilling data from 2014 to 2022 in such updated estimate; (iii) First Mining's plans to commence an environmental data collection exercise for the Duparquet Gold Project and its plans to undertake engineering trade-off studies and complete an updated economic study for the project; and (iv) First Mining's plans to commence a regional exploration data compilation, integration and targeting exercise at the Duparquet Gold Project. All forward-looking statements are based on First Mining's or its consultants' current beliefs as well as various assumptions made by them and information currently available to them. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by the respective parties, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Such factors include, without limitation the Company's business, operations and financial condition potentially being materially adversely affected by the outbreak of epidemics, pandemics or other health crises, such as COVID-19, and by reactions by government and private actors to such outbreaks; risks to employee health and safety as a result of the outbreak of epidemics, pandemics or other health crises, such as COVID-19, that may result in a slowdown or temporary suspension of operations at some or all of the Company's mineral properties as well as its head office; fluctuations in the spot and forward price of gold, silver, base metals or certain other commodities; fluctuations in the currency markets (such as the Canadian dollar versus the U.S. dollar); changes in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins and flooding); the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities, indigenous populations and other stakeholders; availability and increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development; title to properties.; and the additional risks described in the Company's Annual Information Form for the year ended December 31, 2021 filed with the Canadian securities regulatory authorities under the Company's SEDAR profile at www.sedar.com, and in the Company's Annual Report on Form 40-F filed with the SEC on EDGAR.

First Mining cautions that the foregoing list of factors that may affect future results is not exhaustive. When relying on our forward-looking statements to make decisions with respect to First Mining, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. First Mining does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by the Company or on our behalf, except as required by law.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/first-mining-announces-plan-to-consolidate-multi-million-ounce-quebec-gold-district-with-acquisition-of-duparquet-gold-project-301587884.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/first-mining-announces-plan-to-consolidate-multi-million-ounce-quebec-gold-district-with-acquisition-of-duparquet-gold-project-301587884.html

SOURCE First Mining Gold Corp.