First Atlantic Nickel Closes Acquisition of RPM South Claims at the Atlantic Nickel Project

First Atlantic Nickel (TSXV: FAN) (OTCQB: FANCF) has completed the acquisition of mining licence 038152M, comprising 12 mineral claims in central Newfoundland known as the RPM South claims. The acquisition strengthens the company's position in the 30-kilometer nickel trend within the Atlantic Nickel Project.

The company paid $20,000 in cash and issued 750,000 common shares at $0.1425 per share to acquire the claims, which are subject to a 2% NSR royalty. The shares are under voluntary escrow with a 30-month release period and a statutory hold until May 11, 2025.

The strategic acquisition enables exploration of potential awaruite nickel mineralization extending from the RPM Zone. The company is currently awaiting Phase 1 assay results and conducting preliminary metallurgical testing through Davis Tube Recovery (DTR) to measure magnetically recoverable nickel percentages.

First Atlantic Nickel (TSXV: FAN) (OTCQB: FANCF) ha completato l'acquisizione della licenza mineraria 038152M, che comprende 12 diritti minerari nel centro di Terranova, noti come i diritti RPM South. Questa acquisizione rafforza la posizione dell'azienda nel trend di nichel lungo 30 chilometri all'interno del progetto Atlantic Nickel.

L'azienda ha pagato 20.000 dollari in contante e ha emesso 750.000 azioni ordinarie a 0,1425 dollari per azione per acquisire i diritti, che sono soggetti a una royaltee NSR del 2%. Le azioni sono soggette a un'accettazione volontaria con un periodo di rilascio di 30 mesi e a un divieto legale fino all'11 maggio 2025.

Questa acquisizione strategica consente l'esplorazione della potenziale mineralizzazione di nichel awaruite che si estende dalla zona RPM. L'azienda è attualmente in attesa dei risultati dell'analisi della Fase 1 e sta conducendo test metallurgici preliminari attraverso il Davis Tube Recovery (DTR) per misurare le percentuali di nichel recuperabile magneticamente.

First Atlantic Nickel (TSXV: FAN) (OTCQB: FANCF) ha completado la adquisición de la licencia minera 038152M, que comprende 12 derechos minerales en el centro de Terranova, conocidos como los derechos RPM South. La adquisición fortalece la posición de la empresa en la tendencia de níquel de 30 kilómetros dentro del Proyecto Atlantic Nickel.

La empresa pagó 20,000 dólares en efectivo y emitió 750,000 acciones comunes a 0.1425 dólares por acción para adquirir los derechos, que están sujetos a una regalía NSR del 2%. Las acciones están bajo un periodo de escrow voluntario de 30 meses y un embargo legal hasta el 11 de mayo de 2025.

La adquisición estratégica permite la exploración de una potencial mineralización de níquel awaruite que se extiende desde la Zona RPM. La empresa está actualmente a la espera de los resultados del análisis de la Fase 1 y realizando pruebas metalúrgicas preliminares a través de Davis Tube Recovery (DTR) para medir los porcentajes de níquel recuperable magnéticamente.

퍼스트 아틀란틱 니켈 (TSXV: FAN) (OTCQB: FANCF)는 뉴펀들랜드 중앙에 위치한 RPM 사남권으로 알려진 12개의 광물권을 포함하는 광산 라이센스 038152M의 인수를 완료했습니다. 이 인수는 아틀란틱 니켈 프로젝트 내에서 30킬로미터 니켈 트렌드의 회사 위치를 강화합니다.

회사는 이 권리를 인수하기 위해 20,000달러의 현금을 지급하고, 1주당 0.1425달러로 750,000주의 보통주를 발행했습니다. 이 권리는 2% NSR 로열티의 적용을 받습니다. 주식은 자발적인 에스크로로 30개월의 해제 기간을 갖고 있으며, 2025년 5월 11일까지 법적 유예기간이 있습니다.

이 전략적 인수는 RPM 구역에서 연장되는 잠재적인 아와루이트 니켈 광물화를 탐사할 수 있게 해줍니다. 현재 회사는 1단계 분석 결과를 기다리고 있으며, 자기적으로 회수 가능한 니켈 비율을 측정하기 위해 데이비스 튜브 회수(DTR)를 통해 초기 금속 테스트를 진행하고 있습니다.

First Atlantic Nickel (TSXV: FAN) (OTCQB: FANCF) a finalisé l'acquisition de la licence minière 038152M, comprenant 12 concessions minérales au centre de Terre-Neuve, connues sous le nom de concessions RPM South. Cette acquisition renforce la position de l'entreprise dans le tendances du nickel de 30 kilomètres dans le cadre du projet Atlantic Nickel.

L'entreprise a payé 20 000 dollars en espèces et a émis 750 000 actions ordinaires à 0,1425 dollar par action pour acquérir les concessions, qui sont soumises à une redevance NSR de 2 %. Les actions sont sous séquestre volontaire avec une période de libération de 30 mois et une interdiction légale jusqu'au 11 mai 2025.

Cette acquisition stratégique permet l'exploration de la potentialité de minéralisation en nickel awaruite s'étendant depuis la zone RPM. L'entreprise attend actuellement les résultats de l'analyse de la Phase 1 et effectue des tests métallurgiques préliminaires par le biais de la récupération par tube de Davis (DTR) pour mesurer les pourcentages de nickel récupérable par magnétisme.

First Atlantic Nickel (TSXV: FAN) (OTCQB: FANCF) hat den Erwerb der Bergbaulizenz 038152M abgeschlossen, die 12 Mineralansprüche im zentralen Neufundland umfasst, die als RPM South Ansprüche bekannt sind. Der Erwerb stärkt die Position des Unternehmens im 30 Kilometer langen Nickeltrend innerhalb des Atlantic Nickel Projekts.

Das Unternehmen zahlte 20.000 Dollar in bar und gab 750.000 Stammaktien zu je 0,1425 Dollar pro Aktie aus, um die Ansprüche zu erwerben, die einer 2% NSR-Royalty unterliegen. Die Aktien befinden sich in einem freiwilligen Treuhandverhältnis mit einer Freigabezeit von 30 Monaten und einem gesetzlichen Halt bis zum 11. Mai 2025.

Die strategische Akquisition ermöglicht die Erkundung möglicher Awaruite-Nickelmineralisationen, die sich aus der RPM-Zone erstrecken. Das Unternehmen wartet derzeit auf die Ergebnisse der Phase 1 Analysen und führt vorläufige metallurgische Tests mittels Davis Tube Recovery (DTR) durch, um magnetisch recycelbare Nickelanteile zu messen.

- Strategic acquisition expands control over the 30km Pipestone Ultramafic Belt

- Potential for southward continuation of awaruite nickel mineralization

- Property amenable to magnetic separation processing, avoiding need for smelting

- Option to reduce NSR royalty from 2% to 1% for $1-million before production

- Additional share issuance of 750,000 shares causing dilution

- New 2% NSR royalty obligation on the acquired claims

- No confirmed mineralization data from the acquired claims yet

VANCOUVER, British Columbia, Jan. 13, 2025 (GLOBE NEWSWIRE) -- First Atlantic Nickel Corp. (TSXV: FAN) (OTCQB: FANCF) (FSE: P21) ("First Atlantic" or the "Company") advises that it has closed the previously announced asset purchase agreement (the “Purchase Agreement”) to acquire a

Highlights:

- Strategic Acquisition: The Company has successfully closed the acquisition of mining licence #038152M, which consists of 12 mineral claims located immediately south of the RPM Zone. This acquisition is a strategic step to support future project infrastructure and development. Additionally, the new licence provides the Company with an opportunity to investigate the potential southward continuation of awaruite nickel mineralization at depth within the RPM Zone.

- Drill-core Assays: Whole rock assays are in progress to determine the total grades of nickel and other metals including iron, chromium, and cobalt. Initial Phase 1 assay results are expected over the coming weeks.

- Metallurgical Testing: Preliminary metallurgical testing of Phase 1 drill core samples is underway. Davis Tube Recovery (DTR) testing measures the percentage of nickel that is magnetically recoverable to estimate potential recovery through commercial magnetic separation processes.

- Phase 2 Drilling Plans: The Company anticipates providing updates soon.

- Mineralization Expansion Potential: The RPM Zone remains open for drilling in all directions, with mineralization appearing more substantial towards the east while depth offers potential for further expansion along strike.

For further information, questions, or investor inquiries, please contact Rob Guzman at First Atlantic Nickel by phone at +1 844 592 6337 or via email at rob@fanickel.com

Adrian Smith, CEO of First Atlantic, provided an update on the company's recent progress and future plans:

"First Atlantic Nickel has successfully secured

The company eagerly anticipates the release of assay results from its initial drilling in the coming weeks and is preparing to launch a Phase 2 drill program aimed at delineating a larger footprint at the RPM zone, with the goal of defining more than a billion tonnes of mineralization. In addition to being on track to release Phase 1 assay results, First Atlantic Nickel has initiated metallurgical testing of the Phase 1 drill core and is currently planning a larger-scale metallurgical development process to demonstrate the feasibility of processing awaruite-bearing ore into a final nickel concentrate. The company expects to provide further updates on its progress in the near future as it continues to advance this exciting project."

Davis Tube Recovery Metallurgical Test

Davis Tube Recovery (DTR) is a metallurgical test used to determine potential commercial mining recoveries through magnetic separation. In this test, a prepared sample is placed in a glass tube positioned at a 45° angle between two powerful electromagnets. The sample is mixed with water to form a slurry, which is slowly poured through the tube while being rinsed with water. This process isolates the magnetic material, leaving it as a concentrate1. Once the concentrate is obtained from the Davis Tube, a second geochemical assay is conducted to determine the amounts of nickel and iron in the concentrate, providing a measurement of the nickel that was recovered magnetically.

The DTR test is a method used to analyze potential recovery using magnetic separation, which separates and concentrates magnetic minerals such as magnetite and awaruite. Awaruite is a naturally occurring, sulfur-free nickel-iron alloy (Ni₃Fe or Ni₂Fe) that contains approximately

RPM-South Claims

The Claims provide First Atlantic with a contiguous land package adjacent to the RPM Zone. The RPM Zone, which extends southward to the previous claim boundary, could potentially continue south into the newly acquired Claims, making this acquisition a key asset for future project development and infrastructure. The new Claims proximity to known mineralization boundaries enhances their strategic importance. Further expansion drilling will focus on defining the full extent of mineralization and testing for depth, as well as east, north and south extensions of the recent discovery at the RPM target zone. This strategic acquisition enables comprehensive exploration and development planning as the Project advances. The Company remains dedicated to realizing the full potential of the Atlantic Nickel Project through robust exploration and aggressive drilling campaigns.

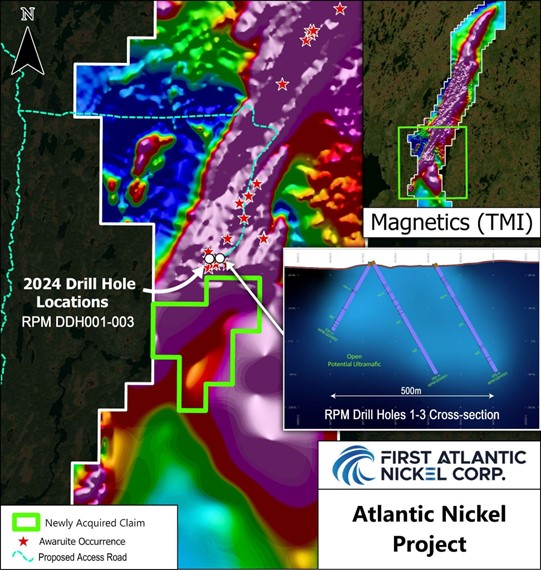

Figure 1: Claim location map showing RPM-South claims, which have been fully acquired by First Atlantic. The Claims are located adjacent to recent discoveries at the RPM Zone and form a critical piece of the Company's long term Atlantic Nickel development plans.

RPM Zone Geology: The RPM Zone is situated within the expansive 30 km highly magnetic ultramafic ophiolite belt, approximately 10 km south of the Super Gulp target and 25 km south of the historic drilling at Atlantic Lake, where significant mineralization was previously encountered in drill core. This zone is characterized by wide intervals of heavily sheared and serpentinized peridotite ultramafic rock. The serpentinized peridotite within the drilled areas is heavily broken due to extensive shearing and faulting, resulting from its vertical position within a subduction zone and vertical emplacement rather than being displaced and preserved as a massif. The vertical orientation of the crustal-scale ophiolite is highly favorable, absorbing additional structural breakage and increasing fluid porosity for serpentinization. This vertical orientation also provides significant depth potential for mineralized zones, where the nickel mineralization could extend to depths of 1 km or more, allowing ample room for depth extensions.

Awaruite (Nickel-iron alloy Ni₂Fe, Ni₃Fe)

Awaruite, a naturally occurring sulfur-free nickel-iron alloy composed of Ni₃Fe or Ni₂Fe with approximately ~

The U.S. Geological Survey (USGS) highlighted awaruite's potential, stating, "The development of awaruite deposits in other parts of Canada may help alleviate any prolonged shortage of nickel concentrate. Awaruite, a natural iron-nickel alloy, is much easier to concentrate than pentlandite, the principal sulfide of nickel"5. Awaruite's unique properties enable cleaner and safer processing compared to conventional sulfide and laterite nickel sources, which often involve smelting, roasting, or high-pressure acid leaching that can release toxic sulfur dioxide, generate hazardous waste, and lead to acid mine drainage. Awaruite's simpler processing, facilitated by its amenability to magnetic processing and lack of sulfur, eliminates these harmful methods, reducing greenhouse gas emissions and risks associated with toxic chemical release, addressing concerns about the large carbon footprint and toxic emissions linked to nickel refining.

Figure 2: Quote from USGS on Awaruite Deposits in Canada.

The development of awaruite resources is crucial, given China's control in the global nickel market. Chinese companies refine and smelt

Acquisition Closing Terms

The Company paid cash consideration of

The Claims are subject to a 2.0-per-cent net smelter return (NSR) royalty. Prior to commercial production, the Company can purchase up to a 1.0-per-cent royalty for

Investor Information

The Company's common shares trade on the TSX Venture Exchange under the symbol "FAN", the American OTCQB Exchange under the symbol “FANCF” and on several German exchanges, including Frankfurt and Tradegate, under the symbol "P21".

Investors can get updates about First Atlantic by signing up to receive news via email and SMS text at www.fanickel.com. Stay connected and learn more by following us on these social media platforms:

https://x.com/FirstAtlanticNi

https://www.facebook.com/firstatlanticnickel

https://www.linkedin.com/company/firstatlanticnickel/

FOR MORE INFORMATION:

First Atlantic Investor Relations

Robert Guzman

Tel: +1 844 592 6337

rob@fanickel.com

Disclosure

Adrian Smith, P.Geo., is a qualified person as defined by NI 43-101. The qualified person is a member in good standing of the Professional Engineers and Geoscientists Newfoundland and Labrador (PEGNL) and is a registered professional geoscientist (P.Geo.). Mr. Smith has reviewed and approved the technical information disclosed herein.

About First Atlantic Nickel Corp.

First Atlantic Nickel Corp. (TSXV: FAN) (OTCQB: FANCF) (FSE: P21) is a Canadian mineral exploration company developing the

First Atlantic aims to be a key input of a secure and reliable North American critical minerals supply chain for the stainless steel and electric vehicle industries in the USA and Canada. The company is positioned to meet the growing demand for responsibly sourced nickel that complies with the critical mineral requirements for eligible clean vehicles under the US IRA. With its commitment to responsible practices and experienced team, First Atlantic is poised to contribute significantly to the nickel industry's future, supporting the transition to a cleaner energy landscape. This mission gained importance when the US added nickel to its critical minerals list in 2022, recognizing it as a non-fuel mineral essential to economic and national security with a supply chain vulnerable to disruption.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements:

This news release may include "forward-looking information" under applicable Canadian securities legislation. Such forward-looking information reflects management's current beliefs and are based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, expectations regarding the timing, scope, and results from the 2024 work and drilling program; future project developments; the Company’s objectives, goals or future plans, statements, and estimates of market conditions. Readers are cautioned that such forward-looking information are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry. Additional factors and risks including various risk factors discussed in the Company’s disclosure documents which can be found under the Company’s profile on http://www.sedarplus.ca. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/40ba63c4-360f-45ee-90ef-334baaf959a4

https://www.globenewswire.com/NewsRoom/AttachmentNg/46da5fff-e95a-4094-91a2-62be22fb3abf

____________________________

1 https://www.sgs.com/en/-/media/sgscorp/documents/corporate/brochures/sgs-min-wa117-geochemical-analysis-of-iron-ore-en-11.cdn.en.pdf

2 https://fpxnickel.com/projects-overview/what-is-awaruite/

3 https://fpxnickel.com/projects-overview/what-is-awaruite/

4 https://home.treasury.gov/news/press-releases/jy1939

5 https://d9-wret.s3.us-west-2.amazonaws.com/assets/palladium/production/mineral-pubs/nickel/mcs-2012-nicke.pdf

6 https://www.brookings.edu/wp-content/uploads/2022/08/LTRC_ChinaSupplyChain.pdf

7 https://www.airuniversity.af.edu/JIPA/Display/Article/3703867/the-rise-of-great-mineral-powers/

8 https://home.treasury.gov/news/press-releases/jy1939

FAQ

What did First Atlantic Nickel (FANCF) acquire in the January 2024 transaction?

What is the strategic importance of the RPM South claims acquisition for FANCF?

What are the terms of the royalty agreement for FANCF's newly acquired RPM South claims?

When will First Atlantic Nickel (FANCF) release Phase 1 drilling results?