Experion Provides Fiscal 2020 Update

Experion Holdings Ltd. reported a significant 400% revenue increase for the first three quarters of 2020, compared to the same period in 2019. The company expanded its licensed cultivation space by 20% and processing space by 100%, while also increasing distribution from 2 to 7 provinces. Its premium brand, Citizen Stash, launched new products, including pre-rolls and edible gummies, contributing to its success. Overall expenses decreased by 32%, paving a clearer path to profitability.

- 400% revenue growth in the first three quarters of 2020 compared to 2019.

- Increased licensed cultivation space by 20% and processing space by 100%.

- Expanded distribution from 2 provinces to 7, including Ontario.

- Launched premium pre-rolls and edible gummies, enhancing product offerings.

- Decreased expenses by over 32%, aiding profitability.

- Net income reported a loss of $188,000 for the latest quarter.

- Adjusted EBITDA remains negative at $(149,000).

Insights

Analyzing...

VANCOUVER, BC / ACCESSWIRE / December 7, 2020 / Experion Holdings Ltd. (the "Company" or "Experion") (TSXV:EXP)(OTCQB:EXPFF)(FRANKFURT:MB31) is pleased to provide an update from the CEO regarding the Company's strategic and operational execution highlights to date for fiscal 2020.

Key Comments on our Strategic Execution

The last four quarters have been a transformational period for Experion. Early this year, we embarked on a mission to create an "aggregation and distribution" model for high-quality, premium cannabis products for the Canadian market. The model was focused on expanding both our cultivation capacity and distribution reach across Canada while building awareness of our premium brand Citizen Stash. When we look back on our initial operational and commercial goals stated at the beginning of the year, we are pleased to report, we have delivered on our promises, making significant strides in distribution, cost optimization and retail penetration. Specifically, our results over the last three quarters include:

- Increased revenues

400% when compared to the same period 2019 by:- Completing facility and license improvements:

- Increasing licensed cultivation space by

20% within our licensed facility in March - Increasing our licensed processing space by

100% within our licensed facility in March - Granted our sales license for Extractions, Topicals and Edibles

- Increasing licensed cultivation space by

- Increasing distribution from 2 provinces to 7 provinces and territories:

- Citizen Stash entered Ontario, Canada's largest cannabis market in Sept

- Citizen Stash is now available in BC, Alberta, Manitoba, Sask., Yukon, NWT and Ontario

- Currently secured 8 active strategic cultivation partner agreements to supply over 4,000 KG of Experion flower with more cultivation partnerships to come

- Increasing and diversifying product lines to complement our dried flower:

- Launched premium Citizen Stash pre-rolls in April

- Launched Citizen Stash edible gummies in October

- Built Citizen Stash into one of the strongest premium cannabis brands in Canada

- Completing facility and license improvements:

- Decreased expenses by over

32% when compared to the same period 2019 by:- Streamlining and terminating redundant roles

- Reducing expenditures, closing offices, and hibernating research projects

- Optimizing business processes, functions, and services

By increasing revenues, distribution and product lines and reducing expenses, our path to profit becomes increasingly clear. Our track record of growth is proven, as we have delivered significant quarter over quarter improvement on all key metrics. Moving forward, we are extremely optimistic of the runway ahead and fully expect this momentum of growth will continue in the upcoming quarters as we enter 2021. The table below shows a positive trend in every key metric:

Experion Holdings Ltd. Key Metrics | |||||

Three Months Ended | |||||

(000's of Cad dollars, except per gram metrics) | Aug 31, | May 31, | Feb 29 | Nov 30, | Aug 31, |

Grams Sold | 240,017 | 190,272 | 99,978 | 91,781 | 24,442 |

Average Net Realized Price (Revenue) per Gram * | 7.31 | 7.52 | 6.60 | 5.38 | 5.02 |

Gross Revenue | 2,124 | 1,720 | 804 | 632 | 173 |

Net Revenue * | 1,781 | 1,442 | 679 | 531 | 160 |

Gross Profit before Fair Value Adjustments | 448 | 298 | 24 | (114) | 25 |

Selling, General and Administration Expense | 598 | 888 | 986 | 1,669 | 1,521 |

Net Income / (Loss) | (188) | (278) | (1,300) | (10,512) | (940) |

Adjusted EBITDA | (149) | (124) | (799) | (1,942) | (626) |

Weighted Average Shares Outstanding (000's) | 100,672 | 100,532 | 100,505 | 99,028 | 98,808 |

* Net of excise tax | |||||

Moving forward, over the next twelve months our growth will be realized by opening additional markets within Canada; further expanding our product lines with new consumer offerings to leverage our Citizen Stash brand equity in the retail marketplace. These initiatives will ensure we further establish Experion as the top distributor of premium branded cannabis products first nationally, then globally as we expand beyond the Canadian border over the coming years.

Consumer Demand and Citizen Stash, 2021

Statistics Canada recently reported that national cannabis sales in 2020 are on track to double from 2019 numbers with dried flower making up

To date, no single brand or company has been recognized as the dominant supplier of premium grade cannabis products nationally. Experion and its premium retail brand Citizen Stash are well positioned to take advantage of this gap in the marketplace. Our goal for 2021 is to own

Products 2021

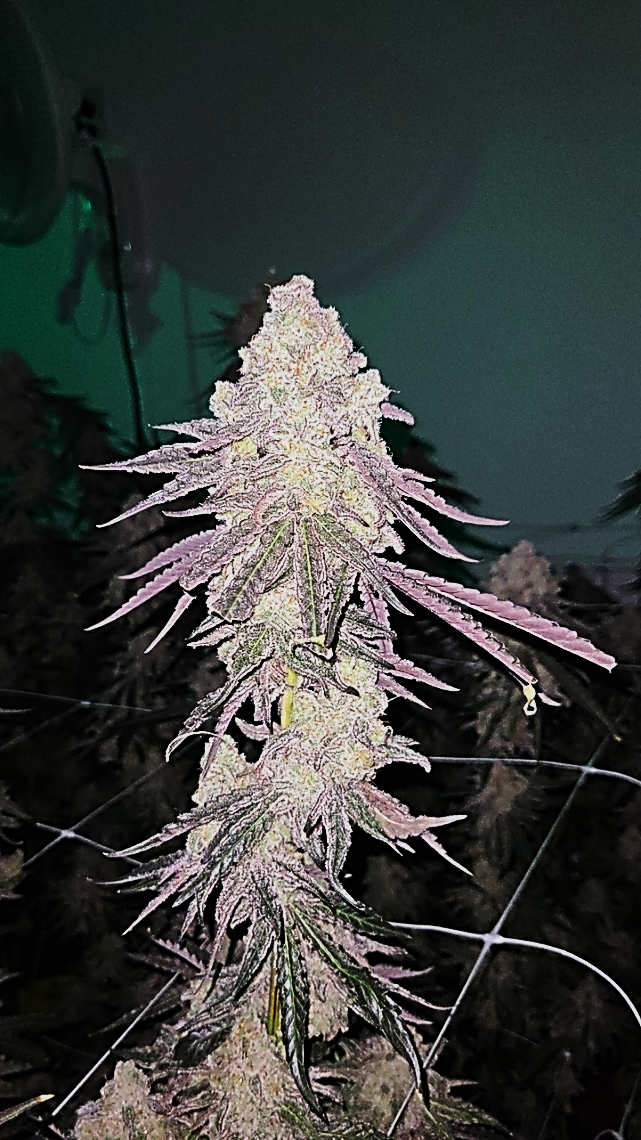

Over the past year, Citizen Stash launched 5 first-mover strains in our category with a range of cannabinoid and terpene content to appeal to the full spectrum of retail consumers. Our flagship strain MAC1 has been nominated for several best-in-class awards and continues to be highly sought after across Canada. Citizen Stash now has 8 strains available in the market and continues to gain market share due to exceptional quality and consistent performance. We will continue our efforts in this direction throughout 2021 as we introduce new and innovative first to market strains across the country. For more information, please see our website, https://www.citizenstash.com/.

To complement our flower products and appeal to consumer convenience, in April we introduced Citizen Stash premium pre-rolls made entirely of fresh, high quality flower. Using premium, quality flower is an important differentiator, as unlike most competitive pre-roll products, our pre-rolls deliver the same user experience as premium whole flower products. Consumers have been impressed, as we have sold over 300,000 premium pre-rolls since our recent launch and we continue to see month over month sales growth in this product category and pre-rolls will be an ongoing source of revenue throughout 2021.

The edible sector is a fast-growing market segment. Responding to this subtle shift in consumer taste, Citizen Stash launched its edible line in western Canada in October 2020, with a 5mg THC sugar coated vegan gummy, one of the first gummy products in the growing vegan category. We will further expand distribution by rolling out this edible product across Canada by year end.

Path to Profit

I am pleased with the progress we have made since taking over as CEO of the company in January of 2020, but I'm not fully satisfied as we see enormous potential for the company over the next 12 to 24 months. Citizen Stash, our flagship brand, is gaining national prominence in the premium category as our growing sales attest. We have successfully added new product lines to our portfolio with pre-rolls and edibles, which bodes well for the future as we will continue to leverage our brand strength in the market. As we enter 2021, we will remain focused on profit. The path is clear:

- Expand our aggregation and distribution model

- Increase our product offerings

- Extend our brand recognition of Citizen Stash

- Develop positive strategic partnerships, and

- Grow our distribution footprint

Our immediate objective remains the same: to increase volume and grow revenue to return a profit for shareholders.

Why Invest in Experion

Like the boom and bust dotcom era, successful companies will emerge by delivering positive performance rebuilding confidence in the market over time. Despite the volatile market over the last year, the underlying reason why investors originally invested in cannabis remains the same: Cannabis is and will continue to be a thriving multi-billion-dollar industry, with significant growth potential year over year. We believe that Experion is building a strong foundation based on the traditional business principles of providing quality products, effective branding, and strong operational execution.

I strongly believe Experion is an attractive investment for existing and new shareholders based on what we have achieved in the past 11 months, as well as how we are currently positioned for increased growth in 2021 and beyond:

- Premium product distribution model executed with

400% revenue growth over the first 3 quarters of 2020 versus same period in 2019 - EBITDA positive is realistic and achievable in the near term

- Nationally distributed and highly regarded premium brand: Citizen Stash

- Fully licensed and well capitalized

- Under-valued with a market cap below cash and assets on hand

- Significant upside as we continue our growth and begin to raise the company's profile in the investment community

Experion is committed to keeping both the consumer and investment community informed of new developments and milestones. We are implementing an improved communication and marketing program over the next quarter to keep our stakeholders informed and reach a wider investor audience.

As we look forward to 2021, we are confident that we will continue to be recognized as a national leader of top branded cannabis products, as we seek to become a logical choice for cannabis investors seeking a profitable, growth driven opportunity.

For more information about our company, plans and frequently asked questions, please email to ir@experionwellness.com.

On behalf of the Management team, we thank you for your continued support,

Sincerely,

Jarrett Malnarich, CEO

For further information, please visit the Company's website www.experionwellness.com or contact me through Investor Relations, Email: IR@experionwellness.com.

About Experion Holdings Ltd.

Experion Holdings Ltd. is the parent company of Experion Biotechnologies Inc., a Health Canada licensed cultivator and processor of Cannabis, based in Mission, BC.

Experion Holdings Ltd. is invested in a portfolio of products to address a wide spectrum of consumer needs' including Adult-use, Wellness and Therapeutic, and Medical products.

Experion trades on the TSX Venture Exchange as a Tier 1 issuer under the symbol "EXP" on the OTCQB Venture under the symbol "EXPFF" and on the Frankfurt Stock Exchange under the symbol "MB31"

For further information, please visit the Company's website www.experionwellness.com or contact Investor Relations, Email: IR@experionwellness.com.

Disclosure

This press release contains forward-looking information within the meaning of Canadian securities laws. Although the Company believes that such information is reasonable, it can give no assurance that such expectations will prove to be correct.

Forward looking information is typically identified by words such as: believe, expect, anticipate, intend, estimate, forecast, postulate and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking information provided by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward looking information as a result of various factors, including, but not limited to: the state of the financial markets for the Company's equity securities; recent market volatility; the Company's ability to raise the necessary capital or to be fully able to implement its business strategies; the risks identified in the Filing Statement, and other risks and factors that the Company is unaware of at this time. The reader is referred to the Filing Statement dated September 25, 2017 and/or the most recent annual and interim Management's Discussion and Analysis for a more complete discussion of such risk factors and their potential effects, copies of which may be accessed through the Company page on SEDAR at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Experion Holdings Ltd.

View source version on accesswire.com:

https://www.accesswire.com/619666/Experion-Provides-Fiscal-2020-Update