Citizen Stash Reports Financial Results for The Second Quarter of Fiscal 2021

Citizen Stash Cannabis Corp. reported strong growth in Q2 2021, with gross revenue increasing 92% to $3.3 million compared to $1.7 million in Q2 2020. Year-to-date sales soared over 250%.

Despite challenges from COVID-19 and inventory constraints, the company expanded its SKU listings by 35% across several provinces and maintained premium pricing at an average of $8.12 per gram. However, Q2 revenue decreased 19% from Q1 due to ongoing restrictions. The company's net working capital stands at $5.7 million.

- Year-to-date sales increased over 250% compared to the previous year.

- Gross revenue rose 92% in Q2 2021 to $3.3 million.

- SKU listings increased by 35% to 38 in Q2 2021.

- Average price per gram rose to $8.12, reflecting premium market positioning.

- Strong balance sheet with $13.5 million in assets and $5.7 million in net working capital.

- Gross revenue decreased 19% in Q2 2021 compared to Q1 2021.

- COVID-19 restrictions impacted sales opportunities.

Insights

Analyzing...

VANCOUVER, BC / ACCESSWIRE / July 30, 2021 / Citizen Stash Cannabis Corp. (Formally Experion Holdings Ltd.) (the "Company" or "Citizen Stash") (TSXV:CSC)(OTCQB:EXPFF)(FRA:MB31) Canada's solution to craft cannabis and premium products is pleased to report its second quarter financial results for the period ended May 31, 2021.

"Our year-to-date sales for the first six months of 2021 represent a more than

"Our unique business model gives us flexibility to ramp up quickly despite ongoing challenges presented within the industry. In addition, our business strategy and model continues to demonstrate its effectiveness as we gained significant market penetration across the country compared to last year and we continue to expand shelf space, gaining new SKUs every quarter as our brand continues to lead in the premium space."

Key Financial and Corporate Highlights:

In the second quarter ending May 31, 2021, Citizen Stash continued to execute on its corporate strategy and advance its ‘aggregation and distribution' model driving shareholder value as illustrated by the following milestones and initiatives:

- Gross revenueincreased

92% in Q2 2021 to$3.3 million compared to$1.7 million in Q2 2020. - To ensure better alignment of the consumer brand Citizen Stash and the Corporate brand identity, the Company approved a name change from Experion Holdings Ltd. to Citizen Stash Cannabis Corp.

- SKU listings increased by

35% in British Columbia, Alberta and Ontario in Q2 2021 to 38 compared to 28 in Q1 2021. - New pre-roll listings of Fruity Pebbles OG ("FPOG") in both British Columbia and Alberta, as well as "Chocolate Sour Diesel" and "Sundae Driver" in Alberta with expected revenues in Q3 from these listings.

- New listings for 3.5 gram jars for Alberta with new strains "Chocolate Sour Diesel", "Sundae Driver" and FPOG.

- The Companyprocessed and sold 409,335 grams of premiumdried flower throughretail distribution in Q2 2021 compared to 190,272 in Q2 2020, a

115% increase. - Citizen Stash's average price per gram realized of

$8.12 in Q2 2021 continues to be strong and reflect premium pricing in the Canadian market, as compared to$7.52 for Q2 2020. - Citizen Stash signed a contract in Q2 2021 to license the Burb trademark, a cannabis retailer, and will distribute Burb branded products through the Ontario Cannabis Store. Citizen Stash will process and sell our unique strain, "BC ZAZA" in 3.5 gram jars, under the Burb brand, with sales starting in Q3.

- Signed a processing agreement with The Valens Company to outsource the production of Citizen Stash pre-rolls, supporting a lower cost of goods moving forward for pre-rolls.

- Experion is recognized as a top 20 supplier to the Ontario Cannabis Stores in total sales and volume within three months of entering the Ontario market.

- Well positioned balance sheet with a total of

$13.5 million in assets and a net working capital balance (current assets less current liabilities) of$5.7 million .

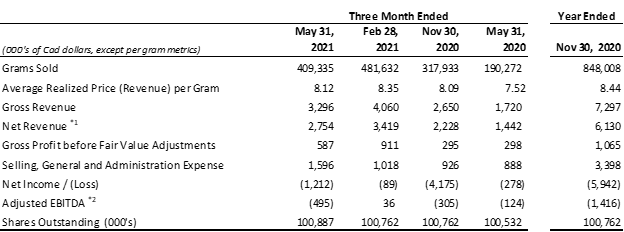

Experion Holdings Ltd. Q2 2021 Financial Summary:

*1 - Net of excisetax.

*2 - Adjusted EBITDA is a non-GAAP measure used by management that does not have any standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other companies. Management defines adjusted EBITDA as comprehensive loss for the period, as reported, before interest, taxes, depreciation and amortization, and adjusted by removing share-based payments, and other one- time and non-cash items, including impairment losses and inventorywrite-downs. See reconciliation of "Adjusted EBITDA"in the Company's Management's Discussion & Analysis for the period ended May 31, 2021.

- Gross revenueincreased

92% in Q2 2021 to$3.3 million compared to$1.7 million in Q2 2020. - Gross revenue decreased

19% in Q2 2021 compared to Q1 2021 mainly due to COVID-19 restrictions and provincial health orders. - In Q2 2021 the Company sold 409,335 grams of flower, which on its own represents

48% of the total grams sold for the entire fiscal year ending November 30, 2020. - Gross profit before fair value adjustments was

$0.58 7 million or21% of net revenue in Q2 2021, compared to$0.29 8 million or21% of net revenue in Q2 2020. - Adjusted gross margin before fair value adjustments would have been

27% , excluding inventory and other write-downs of$0.16 6 million within costs of sales in Q2 2021. - Adjusted EBITDA for Q2 2021 was

$(0.49 5) million versus a$(0.12 4) million loss in Q2 2020.

Business update

Citizen Stash continues to remain focused on executing against its strategic priorities. In the second quarter of 2021, the Company made significant progress in expanding its premium supply chains, developing innovative strains and expanding its customer network generating shareholder value and accelerating its path to profit including:

Innovative Genetics and Strain development

Citizen Stash continues to launch first to market genetics and strains and expand its premium dry flower cultivar offering with the addition of new listings in British Columbia, Alberta and Ontario increasing our listings by

Distribution Network

Citizen Stash currently serves seven provinces and territories. Citizen Stash continues to make headway into the remaining markets including Quebec and the Maritimes. The Company expects to be in the remaining provinces by early Q4 2021 with revenues from these markets being realized upon entry.

Premium Brands

Citizen Stash is one of the leading brands in the industry, known for producing top-shelf craft cannabis flower. The Company's focus on providing new, innovative and consistent flower offerings allows the Company to maintain above average prices for its products with a net selling price of

About Citizen Stash Cannabis Corp.

Citizen Stash is the parent company of Experion Biotechnologies Inc., a Health Canada licensed cultivator and processor of Cannabis, based in Mission, B.C.

Citizen Stash is best known as a rapidly growing adult-use premium cannabis brand offered nationally in 7 provinces and territories. Citizen Stash has invested and developed a portfolio of premium cannabis genetics, strains and products with a unique growth strategy incorporating a highly scalable aggregation and distribution business model to drive revenues across its national sales network.

Citizen Stash trades on the TSX Venture Exchange as a Tier 1 issuer under the symbol "CSC" on the OTCQB Venture under the symbol "EXPFF" and on the Frankfurt Stock Exchange under the symbol "MB31".

For further information, please visit the Company's website www.experionwellness.com or contact Investor Relations, Email: IR@experionwellness.com.

Disclosure

This news release contains "forward-looking statements" and "forward-looking information" (collectively referred to herein as "forward-looking statements") within the meaning of applicable securities legislation. Such forward-looking statements include, without limitation, forecasts, estimates, expectations and objectives for future operations that are subject to a number of material factors, assumptions, risks and uncertainties, many of which are beyond the control of the Company.

Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "continues", "future", "forecasts", "potential", "outlook" and similar expressions, or are events or conditions that "will", "would", "may", "likely", "could", "should", "can", "typically", "traditionally" or "tends to" occur or be achieved. This news release contains forward-looking statements, pertaining to, among other things, the following: The Company's capital spending forecast and expectations of how it will be funded; near-term impacts from the COVID-19 pandemic; the Company's capital management strategy and financial position; the impact of governmental and Company measures implemented in response to the COVID-19 pandemic; the Company's outlook, activity levels, supply chains and sales channels; loss of markets; further legislative and regulatory developments involving cannabis or otherwise affecting the Company's business or its consumers generally, including delays in the issuance of licenses; competition; currency and interest rate fluctuations; and marketing costs.

Although the Company believes that the material factors, expectations and assumptions expressed in such forward-looking statements are reasonable based on information available to it on the date such statements are made, undue reliance should not be placed on the forward-looking statements because the Company can give no assurances that such statements and information will prove to be correct and such statements are not guarantees of future performance. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties.

Actual performance and results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to: known and unknown risks, including those set forth in the Filing Statement dated September 25, 2017 and/or the most recent annual and interim Management's Discussion and Analysis ("MD&A") (a copy of which can be found under Experion's profile on SEDAR at www.sedar.com); a significant expansion of COVID-19 pandemic and the impacts thereof; the Company's ability to raise the necessary capital or to be fully able to implement its business strategy; integration of acquisitions, competition, and uncertainties resulting from potential delays or changes in plans with respect to acquisitions, development projects or capital expenditures and changes in legislation; stock market volatility and the inability to access sufficient capital from external and internal sources; general economic, market or business conditions including those in the event of an epidemic, natural disaster or other event; global economic events; changes to the Company's financial position and cash flow; the availability of qualified personnel, management or other key inputs; currency exchange fluctuations; changes in political and security stability; potential industry developments; and other unforeseen conditions which could impact the Company. Accordingly, readers should not place undue importance or reliance on the forward-looking statements. Readers are cautioned that the foregoing list of factors is not exhaustive and should refer to "Risk Factors" set out in the MD&A.

Statements, including forward-looking statements, contained in this news release are made as of the date they are given and the Company disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. The forward-looking statements contained in this news release are expressly qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Citizen Stash Cannabis Corp.

View source version on accesswire.com:

https://www.accesswire.com/657733/Citizen-Stash-Reports-Financial-Results-for-The-Second-Quarter-of-Fiscal-2021