Energy Transfer to Acquire WTG Midstream in a $3.25 Billion Transaction

Energy Transfer (NYSE: ET) will acquire WTG Midstream in a $3.25 billion deal, enhancing its gas pipeline and processing network in the Permian Basin. The acquisition includes eight processing plants with a capacity of 1.3 Bcf/d, two new plants under construction, and over 6,000 miles of gas gathering pipelines. The transaction, expected to close in Q3 2024, involves $2.45 billion in cash and 50.8 million newly issued ET common units. It is anticipated to add $0.04 to 2025 DCF per unit, growing to $0.07 by 2027. Regulatory approval is pending.

- Acquisition valued at $3.25 billion, enhancing Energy Transfer's network in the Permian Basin.

- Includes eight gas processing plants with 1.3 Bcf/d capacity and two additional plants under construction.

- Adds over 6,000 miles of gas gathering pipelines and a 20% interest in the BANGL NGL Pipeline.

- Expected DCF accretion of ~$0.04 per common unit in 2025, increasing to ~$0.07 per unit by 2027.

- High-quality customer base with an average contract life of over eight years.

- Transaction supports future revenue growth from downstream NGL transportation and fees.

- Relies on $2.45 billion in cash, impacting liquidity.

- Issuance of approximately 50.8 million new common units may result in shareholder dilution.

- Completion of the deal is subject to regulatory approval and customary closing conditions.

- Construction of new plants adds pressure on capital expenditure and timeline adherence.

Insights

The acquisition of WTG Midstream by Energy Transfer for

From a financial standpoint, the deal is projected to increase Distributable Cash Flow (DCF) by approximately

Additionally, the financial advisor's involvement from RBC Capital Markets points toward meticulous financial scrutiny, ensuring that the deal is financially sound and aligns with Energy Transfer's strategic objectives. The Permian Basin remains the most active region in the U.S., adding to the growth potential of this acquisition. Therefore, the structured financial arrangement combined with the growth projections and stable contract life makes this acquisition financially sound in both the short and long term.

From an industry perspective, acquiring WTG Midstream provides Energy Transfer with substantial strategic advantages. WTG operates the largest private Permian gas gathering and processing business, comprising eight gas processing plants with a capacity of

Additionally, the inclusion of a 20% interest in the BANGL NGL Pipeline enhances Energy Transfer's ability to transport natural gas liquids to the Texas Gulf Coast, a key market area. The strategic location of these assets in the Midland Basin offers increased access to growing supplies of natural gas and NGL volumes, reinforcing Energy Transfer’s operational capabilities and market reach.

Moreover, the average contract life of over eight years with high-quality, investment-grade customers ensures stability and reduces operational risks. This acquisition is poised to bolster Energy Transfer's infrastructure and provides a platform for future growth as the Permian Basin's development continues. Overall, this acquisition strengthens Energy Transfer's market position and operational footprint in a highly competitive sector.

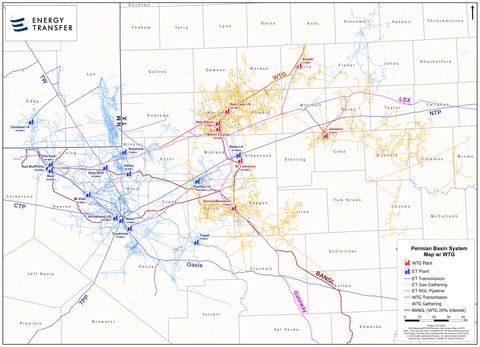

WTG Midstream Owns and Operates the Largest Private Permian Gas Gathering and Processing Business with Assets Located in the Core of the

- Expands Energy Transfer’s natural gas pipeline and processing network in the Permian Basin

- Includes eight gas processing plants (~1.3 Bcf/d) and two more under construction (~0.4 Bcf/d)

- Adds more than 6,000 miles of complementary gas gathering pipelines

-

Includes a

20% ownership interest in the BANGL NGL Pipeline1 - Supported by high-quality customers with an average contract life of more than eight years

- Structured mix of cash and equity consideration expected to provide strong equity returns while maintaining leverage target

-

Estimated DCF accretion of

~ per common unit in 2025, increasing to$0.04 ~ /unit in 2027$0.07

(Graphic: Business Wire)

Complementary Gathering and Processing Assets

WTG provides comprehensive midstream services including wellhead gathering, intra-basin transportation and processing services. The company’s 6,000-mile pipeline network serves significant operators in some of the most active areas of the

WTG’s extensive system processes significant volumes from large cap investment grade producers with firm, long-term contracts and acreage dedications. The addition of WTG assets is expected to provide Energy Transfer with increased access to growing supplies of natural gas and NGL volumes enhancing the partnership’s Permian operations and downstream businesses.

The acquisition also includes a

Positive Financial Impact

The transaction is expected to increasingly add incremental revenue from downstream NGL transportation and fractionation fees. Energy Transfer expects the WTG assets to add approximately

Advisors

RBC Capital Markets is serving as financial advisor to Energy Transfer, and Vinson & Elkins LLP is acting as Energy Transfer’s legal counsel on the transaction. Jefferies LLC is serving as financial advisor to WTG, and Sidley Austin LLP is acting as WTG’s legal counsel.

About Energy Transfer

Energy Transfer LP (NYSE: ET) owns and operates one of the largest and most diversified portfolios of energy assets in

About WTG Midstream

WTG Midstream, LLC is a privately held midstream company headquartered in

WTG is supported by dedications from many of the nation’s leading oil and gas producers and prides itself on delivering essential services in a safe and dependable manner.

About Stonepeak

Stonepeak is a leading alternative investment firm specializing in infrastructure and real assets with approximately

Forward Looking Statements

This news release may include certain statements concerning expectations for the future that are forward-looking statements as defined by federal law. Such forward-looking statements are subject to a variety of known and unknown risks, uncertainties, and other factors that are difficult to predict and many of which are beyond management’s control. An extensive list of factors that can affect future results, including future distribution levels, are discussed in the Partnership’s Annual Report on Form 10-K and other documents filed from time to time with the Securities and Exchange Commission. The Partnership undertakes no obligation to update or revise any forward-looking statement to reflect new information or events.

The information contained in this press release is available on our website at energytransfer.com.

1 Interest is subject to a right of first offer provision

View source version on businesswire.com: https://www.businesswire.com/news/home/20240527953986/en/

Energy Transfer

Investor Relations:

Bill Baerg

Brent Ratliff

Lyndsay Hannah

(214) 981-0795

Media Relations:

Vicki Granado

(214) 840-5820

Stonepeak

Kate Beers / Maya Brounstein

corporatecomms@stonepeak.com

(212) 907-5100

Source: Energy Transfer LP