Energy Transfer and Sunoco Announce Strategic Permian Basin Crude Oil Joint Venture

Energy Transfer LP (NYSE: ET) and Sunoco LP (NYSE: SUN) have announced a strategic joint venture combining their crude oil and produced water gathering assets in the Permian Basin. The joint venture, effective July 1, 2024, will be operated by Energy Transfer with a 67.5% interest, while Sunoco will hold a 32.5% interest.

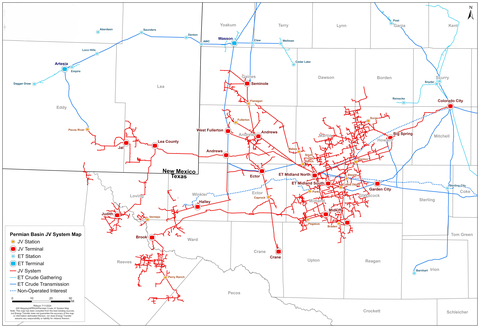

The venture will operate over 5,000 miles of pipelines with crude oil storage capacity exceeding 11 million barrels. Energy Transfer's long-haul crude pipeline network is excluded from the deal. The formation is expected to be immediately accretive to distributable cash flow per LP unit for both companies.

- Formation of a strategic joint venture in the Permian Basin

- Operation of over 5,000 miles of crude oil and water gathering pipelines

- Crude oil storage capacity exceeding 11 million barrels

- Expected to be immediately accretive to distributable cash flow per LP unit for both companies

- None.

Insights

Energy Transfer (ET) and Sunoco (SUN) have joined forces in a strategic joint venture, merging their respective crude oil and produced water gathering assets in the Permian Basin. This venture will be beneficial as it consolidates resources and operations, potentially reducing costs and improving efficiency. Energy Transfer holds a 67.5% interest, indicating their dominant role, while Sunoco holds 32.5%. This will likely have a positive impact on the distributable cash flow per LP unit for both companies, making them more attractive to investors in the short term.

Storage capacity exceeding 11 million barrels and over 5,000 miles of pipelines will enhance their logistical capabilities, positioning them well to meet market demands. However, investors should note the exclusion of Energy Transfer’s long-haul crude pipeline network from the venture, which might limit some synergies.

Overall, this joint venture is a strategic move to strengthen market position and operational efficiency in a resource-rich region.

This joint venture between Energy Transfer and Sunoco in the Permian Basin strategically combines their assets, emphasizing their commitment to strengthening their presence in one of the most prolific oil production regions. This collaboration will enhance their ability to manage crude oil and produced water gathering, a critical aspect in the energy supply chain.

The decision for Energy Transfer to operate the joint venture reflects its experience and capabilities in handling large-scale operations. For retail investors, this suggests stability and experienced management, potentially mitigating operational risks.

In the long term, this venture can lead to enhanced market share and improved bargaining power due to consolidated operations. However, close monitoring is required to gauge the actual performance and integration success post-July 2024.

The establishment of this joint venture involved extensive legal counsel, with multiple firms providing expertise to ensure compliance and address potential conflicts of interest. The involvement of prominent legal advisors like Potter Anderson & Corroon LLP and Richards, Layton & Finger, P.A. underscores the complexity and significance of this transaction.

This meticulous legal structuring aims to safeguard the interests of both parties, ensuring a clear framework for operation and governance. Investors should feel reassured by the legal due diligence, which aims to minimize regulatory risks and facilitate smoother integration of assets.

It’s essential for investors to keep an eye on any future legal updates or challenges that might arise as the joint venture progresses.

(Graphic: Business Wire)

Energy Transfer will serve as the operator of the joint venture and contribute its Permian crude oil and produced water gathering assets and operations. Sunoco will contribute all of its Permian crude oil gathering assets and operations to the joint venture. Energy Transfer’s long-haul crude pipeline network that provides transportation of crude oil out of the Permian Basin to

As depicted in the included map, the joint venture will operate more than 5,000 miles of crude oil and water gathering pipelines with crude oil storage capacity in excess of 11 million barrels.

Energy Transfer will hold a

The formation of the joint venture has an effective date of July 1, 2024, and is expected to be immediately accretive to distributable cash flow per LP unit for both Energy Transfer and Sunoco.

Intrepid Partners, LLC served as financial advisor to Energy Transfer’s conflicts committee, while Guggenheim Securities, LLC served as financial advisor to Sunoco’s special committee. Potter Anderson & Corroon LLP acted as

About Energy Transfer

Energy Transfer LP (NYSE: ET) owns and operates one of the largest and most diversified portfolios of energy assets in

About Sunoco LP

Sunoco LP (NYSE: SUN) is a leading energy infrastructure and fuel distribution master limited partnership operating in over 40 U.S. states,

Forward-Looking Statements

This news release may include certain statements concerning expectations for the future that are forward-looking statements as defined by federal law. Such forward-looking statements are subject to a variety of known and unknown risks, uncertainties, and other factors that are difficult to predict and many of which are beyond management’s control. An extensive list of factors that can affect future results are discussed in Energy Transfer’s and Sunoco’s Annual Reports on Forms 10-K and other documents filed from time to time with the Securities and Exchange Commission. Energy Transfer and Sunoco undertake no obligation to update or revise any forward-looking statement to reflect new information or events.

The information contained in this press release is available on Energy Transfer’s website at www.energytransfer.com and Sunoco’s website at www.sunocolp.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240716166218/en/

Energy Transfer

Investors:

Bill Baerg, Vice President – Investor Relations

Brent Ratliff, Vice President – Investor Relations

Lyndsay Hannah, Director – Investor Relations

(214) 840-0795, InvestorRelations@energytransfer.com

Media:

Vicki Granado – Vice President, Media & Communications

(214) 981-0761, vicki.granado@energytransfer.com

Sunoco LP

Investors:

Scott Grischow, Treasurer, Senior Vice President – Finance

(214) 840-5660, scott.grischow@sunoco.com

Media:

Chris Cho, Senior Manager – Communications

(210) 918-3953, chris.cho@sunoco.com

Source: Energy Transfer LP