ESSA Bancorp, Inc. Announces Fiscal 2021 First Quarter Financial Results

ESSA Bancorp, Inc. (NASDAQ:ESSA) reported a net income of $4.1 million for the fiscal first quarter of 2021, translating to $0.41 per diluted share, representing a 21% increase from $3.4 million in Q1 2020. The bank maintained a strong balance sheet with total assets of $1.87 billion and $217.2 million in cash, up $61.3 million from the previous quarter. Noninterest income surged 29% to $3.1 million, driven by mortgage originations. However, total net loans decreased to $1.38 billion, reflecting the impact of the pandemic.

- Net income increased by 21% to $4.1 million for Q1 2021.

- Noninterest income rose 29% to $3.1 million compared to Q1 2020.

- Cash and cash equivalents grew by $61.3 million to $217.2 million.

- The provision for loan losses increased prudently to address economic uncertainties.

- Total net loans decreased to $1.38 billion from $1.42 billion.

- Nonperforming assets increased to 1.12% of total assets from 1.09%.

Insights

Analyzing...

STROUDSBURG, PA / ACCESSWIRE / January 27, 2021 / ESSA Bancorp, Inc. (the "Company") (NASDAQ:ESSA), the holding company for ESSA Bank & Trust (the "Bank"), a

Net income was

Gary S. Olson, President and CEO, commented: "The Company's financial performance in the fiscal first quarter of 2021 reflected the ongoing commitment of ESSA to provide responsive service and personalized financial solutions with increased use of digital capabilities, ensure the health and safety of customers and employees, and maintain a strong balance sheet, asset quality and liquidity.

"Fiscal first quarter earnings results reflected the positive impact of reduced interest expense and increased noninterest income. We continued to maintain increased cash reserves to ensure liquidity and expanded loan loss reserves to address economic and pandemic-related uncertainties.

"Although economic uncertainty and pandemic-related conditions have understandably dampened commercial banking activity, we continued to see relative stability in commercial lending and only a modest year-over-year decline in interest income from loans. Managing interest expense contributed to higher year-over-year net interest income. Strong growth of noninterest income, fueled in part by brisk residential mortgage originations that generated fee income and resulting gains on the sale of mortgages, was an important factor in generating double-digit net income growth. The Company's financial performance continued to build shareholder value.

"Our bankers continued to efficiently serve customers through a variety of channels from digital delivery to safe personal interactions. We believe fiscal 2021 first quarter results affirmed our commitment to reimagining the future of banking that will incorporate increased digital capabilities, new ways of collaborating with customers, less reliance on physical facilities, and new ways to educate and communicate with customers.

"Although the pandemic continues to impact our served markets, we have been encouraged by the economic health and resilience demonstrated throughout the region. Most customers who requested loan payment deferrals in 2020 are now current, and there have been few requests for relief in recent months. Loans still in forbearance at December 31, 2020 included

"While businesses continue to take a conservative and cautious stance, they are generally holding their own. ESSA has provided the support and services to help clients, including our active participation in the Paycheck Protection Program ("PPP") last year. We assisted many existing and new customers, and we are participating in the current round of government-guaranteed financing.

"The pandemic and resulting economic uncertainty continue to present challenges. We believe ESSA has demonstrated the ability to effectively address the challenges. We remained focused on maintaining liquidity, an appropriate loan loss reserve, credit quality management, managing interest and noninterest expense, and delivering superior service."

FIRST QUARTER 2021 HIGHLIGHTS

- Net interest income after provision for loan losses increased to

$12.0 million for the three months of fiscal 2021 compared to$11.5 million for the three months of fiscal 2020 as the Company more than offset lower year-over-year total interest income and increased loan loss provision with lower interest expense. - Quarterly interest expense declined sharply year-over-year. The interest expense reduction primarily reflected balance sheet management and repricing of interest bearing liabilities to reflect the current low-interest environment. The Company's cost of funds declined to

0.55% in the fiscal first quarter of 2021 from1.33% a year earlier. - Noninterest income growth contributed to the Company's net income in the fiscal first quarter of 2021, rising

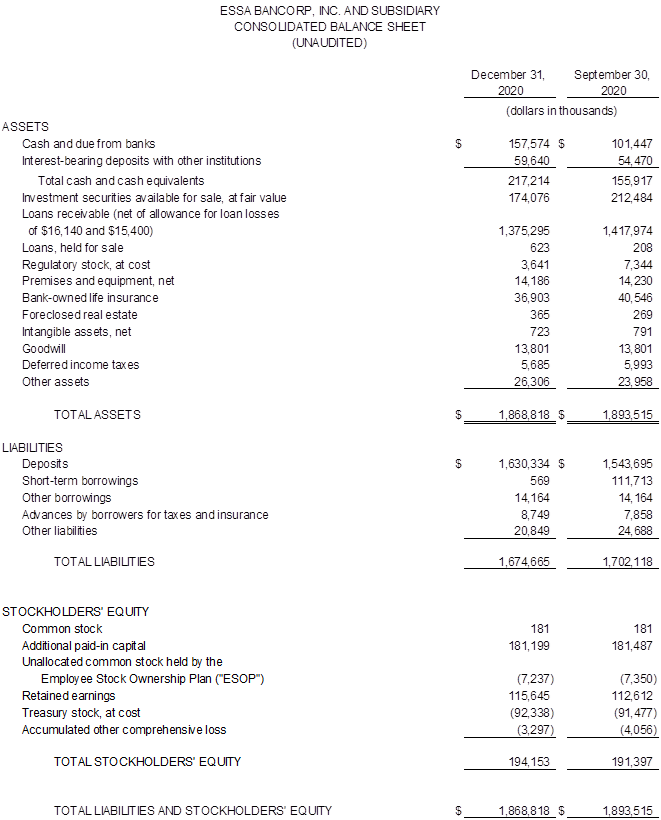

29% to$3.1 million compared with$2.4 million a year earlier. The year-over-year increase primarily reflected additional income from loan swap fees, gains on the sale of long-term residential mortgages to the secondary market of$818,000 , and increased earnings from bank owned life insurance. - Total assets were

$1.87 billion at December 31, 2020 compared with$1.89 billion at September 30, 2020, primarily reflecting a slight decrease in net loans receivable and lower amounts of investment securities available for sale, offset in part, by increased cash. - Focusing on maintaining strong liquidity, the Company held

$217.2 million in cash and cash equivalents at December 31, 2020, a$61.3 million increase from September 30, 2020 as a result of balance sheet adjustments made to mitigate potential risks early in the pandemic along with continued deposit growth. - Total net loans at December 31, 2020 were

$1.38 billion compared with$1.42 billion at September 30, 2020, primarily reflecting sales of$18.7 million of residential mortgage loans and paydowns of Paycheck Protection Program (PPP) loans of$9.7 million and Indirect Auto Loans of$7.8 million during the quarter. Commercial real estate and construction loans declined by$8.1 million . Home equity loans and lines of credit remained stable. - The Company maintained its focus on credit quality and increased its loan loss provision based on economic conditions. Nonperforming assets were

1.12% of total assets at December 31, 2020 compared to1.09% of total assets at September 30, 2020.The allowance for loan losses was1.16% of loans outstanding at December 31, 2020 compared to1.07% at September 30, 2020. - Core deposits (demand accounts, savings and money market) increased year-over-year, comprising

69% of total deposits at December 31, 2020 compared to64% at December 31, 2019. The increase reflected increased commercial customer deposits, including PPP and stimulus funds not deployed, and demand retail deposits. Total deposits grew by$86.6 million from September 30, 2020 through December 31, 2020. - The Bank continued to demonstrate financial strength with a Tier 1 leverage ratio of

9.28% at December 31, 2020, exceeding regulatory standards for a well-capitalized institution. - Total stockholders' equity increased to

$194.2 million at December 31, 2020 compared with$191.4 million at September 30, 2020. - Tangible book value per share at December 31, 2020 increased to

$16.60 , compared with$16.26 at September 30, 2020. - The Company paid a cash dividend of

$0.11 per share on December 31, 2020, continuing its trend of quarterly cash dividends to shareholders. - Broadening the size and scope of its Board of Directors, the Company in December, 2020 announced the appointment of Carolyn P. Stennett, Vice President, Human Resources at Victaulic Company, and Dr. Tina Q. Richardson, Chancellor of Penn State University's Lehigh Valley campus, to the Boards of Directors of ESSA Bancorp, Inc. and ESSA Bank & Trust.

Fiscal First Quarter 2021 Income Statement Review

Total interest income was

Interest expense declined to

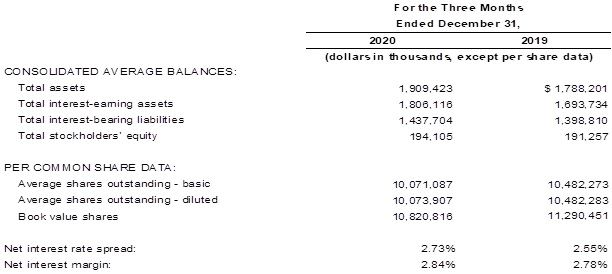

For the three months ended December 31, 2020, net interest income was

Net interest income after provision for loan losses in the three months of fiscal 2021 reflected a higher provision for loan losses, primarily due to prudent reserving practices in light of economic conditions and uncertainties. The Company's provision for loan losses was

Noninterest income increased

Noninterest expense was

Balance Sheet, Asset Quality and Capital Adequacy Review

Total assets decreased

Cash and cash equivalents increased

Decreases in investment and loan balances outstanding, offset in part by a decrease in liabilities, account for the majority of the first quarter increase. The Company built the majority of its cash position in the fiscal second quarter of 2020 and has maintained that position through the first quarter of fiscal 2021 to remain prepared for ongoing economic uncertainties.

Total net loans were

Commercial real estate loans were

Total deposits were

Nonperforming assets were

For the three months ended December 31, 2020, the Company's return on average assets and return on average equity were

The Bank continued to demonstrate financial strength with a Tier 1 leverage ratio of

Total stockholders' equity increased

About the Company: ESSA Bancorp, Inc. is the holding company for its wholly owned subsidiary, ESSA Bank & Trust, which was formed in 1916. Headquartered in Stroudsburg, Pennsylvania, the Company has total assets of

Forward-Looking Statements

Certain statements contained herein are "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements may be identified by reference to a future period or periods, or by the use of forward-looking terminology, such as "may," "will," "believe," "expect," "estimate," "anticipate," "continue," or similar terms or variations on those terms, or the negative of those terms. Forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, those related to the economic environment, particularly in the market areas in which the Company operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, changes in government regulations affecting financial institutions, including compliance costs and capital requirements, changes in prevailing interest rates, acquisitions and the integration of acquired businesses, credit risk management, asset-liability management, the financial and securities markets and the availability of and costs associated with sources of liquidity, and the Risk Factors disclosed in our annual and quarterly reports. In addition, the COVID-19 pandemic continues to have an adverse impact on the Company, its customers and the communities it serves. The adverse effect of the COVID-19 pandemic on the Company, its customers and the communities where it operates will continue to adversely affect the Company's business, results of operations and financial condition for an indefinite period of time.

The Company wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. The Company wishes to advise readers that the factors listed above could affect the Company's financial performance and could cause the Company's actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not undertake and specifically declines any obligation to publicly release the result of any revisions that may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

FINANCIAL TABLES FOLLOW

Contact: Gary S. Olson, President & CEO

Corporate Office: 200 Palmer Street, Stroudsburg, Pennsylvania 18360

Telephone: (570) 421-0531

SOURCE: ESSA Bancorp Inc.

View source version on accesswire.com:

https://www.accesswire.com/626419/ESSA-Bancorp-Inc-Announces-Fiscal-2021-First-Quarter-Financial-Results