Erin Ventures Announces Positive Preliminary Economic Assessment for Piskanja Boron Project US$524.9 Million NPV10 (post-tax), 78.7% IRR (post-tax), 12-Month Capex Payback

Rhea-AI Summary

Erin Ventures Inc. announced a favorable Independent Technical Report and Preliminary Economic Assessment (PEA) for the Piskanja boron project in Serbia. Key highlights include a post-tax Net Present Value (NPV) of $524.9 million, an Internal Rate of Return (IRR) of 78.7%, and a life of mine cash flow of $1.21 billion. Initial capital costs are estimated at $79.9 million with a payback period of just 12 months. The project has potential for resource expansion and aims to contribute to global decarbonization efforts.

Positive

- Post-tax NPV of $524.9 million.

- IRR of 78.7%, indicating strong profitability.

- Life of Mine (LOM) cash flow projected at $1.21 billion.

- Initial capital costs estimated at $79.9 million with a rapid payback period of 12 months.

- Potential for expanding resources at the Piskanja project.

Negative

- None.

News Market Reaction 1 Alert

On the day this news was published, ERVFF declined 1.05%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Boron is critical for decarbonization as a high impact super material

Boron demand is expected to outpace supply with each step toward Net Zero

VICTORIA, BC / ACCESSWIRE / June 28, 2022 / Erin Ventures Inc. ("Erin" or the "Company") (TSXV:EV) and their partner Temas Resources Corp. [CSE: TMAS] are pleased to report positive results of an Independent Technical Report and Preliminary Economic Assessment ("PEA") for the Piskanja boron project located in Serbia.

PEA HIGHLIGHTS

Post-tax Net Present Value (NPV10%) | |

Post-tax IRR | |

Initial capital cost (Capex) (including | |

Capex payback from commercial production | 12 months |

Life of Mine ("LOM") | 16 years |

Gross Project Revenue | |

Net Project Cash Flow (post-tax) | |

Average Annual Gross Revenue | |

LOM average annual EBITDA | |

Net operating margin | |

Post-tax Operating Cost per t of product | |

Weighted average revenue per t of product | |

LOM Sustaining Capital (including | |

LOM average gross production | 305,304 tonnes |

Profitability Index (NPV/Capex) | 6.57X (post-tax) |

LOM Capital Intensity Index (Initial Capex/ROM tonnage) | |

LOM average C1 (cash operating) cost (run-of-mine production) | |

Average annual production (sales grade) colemanite | 258,272 t |

Average annual production of boric acid | 25,000 tonnes |

LOM average C1 cost (colemanite) post-tax | |

LOM average C1 cost (boric acid) post-tax | |

LOM mining production | 4.88 million tonnes |

LOM average grade B2O3 | 34.57 % |

Good potential for resource expansion | |

Note:

All values in this news release are reported in U.S. dollars unless otherwise noted

Assumed price/t (colemanite

Assumed price/t (boric acid, technical grade) for LOM: US

Units expressed in metric tonnes

MINERAL RESOURCES

The basis for the PEA is the Mineral Resource Estimate prepared by Prof. Miodrag Banješević PhD. P.Geo, EurGeol.

The updated Mineral Resource Statement generated for the Piskanja Project is as follows:

Resource Category | Geological Resource (tonne) | B2O3 % | Contained B2O3 (tonne) |

| Measured | 1,391,574 | 35.59 | 495,251 |

| Indicated | 5,478,986 | 34.05 | 1,865,677 |

| Measured + Indicated | 6,870,560 | 34.36 | 2,360,928 |

| Inferred | 284,771 | 39.59 | 112,732 |

Reported at a cut-off grade of 12 percent B2O3, at a minimum mining thickness of 1.2 m, considering reasonable underground mining, processing and selling technical parameters and costs benchmark against similar borate projects and a selling price of US

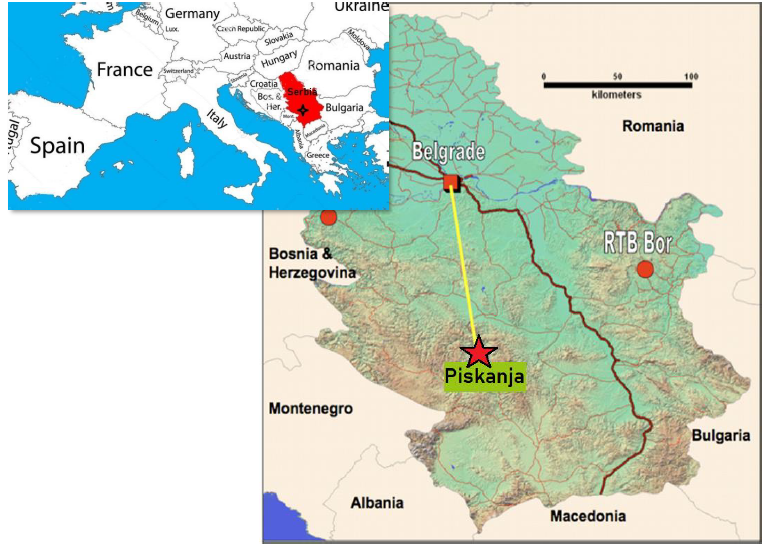

Location of Serbia and the Piskanja boron project:

SUMMARY OF PRELIMINARY ECONOMIC ASSESSMENT

The PEA was prepared independently under the supervision of Prof. Miodrag Banješević PhD. P.Geo, EurGeol, with contributions from Prof. Saša Stojadinović PhD. (mining engineer). The PEA was prepared in accordance with the requirements of National Instrument 43-101 and is based on the Mineral Resource Estimate for Piskanja with an effective date of June 24, 2022 (see "Mineral Resource Estimate" above).

ECONOMICS

Project economics were estimated assuming a constant price of US

In summary, the Project has a post-tax LOM net project cashflow (pre-finance) of some US

Project Cashflow | US$ Millions |

Gross Revenue | 2,016.8 |

Deductions | 106.7 |

Net Revenue | 1,910.1 |

Operating Costs | 449.2 |

Project Capital | 79.9 |

Sustaining Capital | 50.8 |

Closure Cost | 15.0 |

Project Cashflow | 1,315.1 |

Working Capital | 0 |

Corporation Tax | 101.1 |

Net Project Cashflow (post-tax) | 1,214.0 |

SENSITIVITIES

Discount Rate

The following table shows the pre- and post-tax NPVs at varying discount rates.(USD'000). The base case discount rate of

Discount Rate | Pre-Tax NPV (USD‘000) | Post-Tax NPV (USD‘000) |

831,083 | 777,955 | |

647,789 | 610,987 | |

553,917 | 524,893 | |

476,926 | 453,909 | |

385,467 | 369,049 |

The following table shows the effect on the post-tax NPV10 at varying revenue, opex, capex, and material price levels (from -

Sensitivities: Post Tax NPV at (USD'000,000) | |||||||||||

| - | - | - | - | - | |||||||

| Revenue | 121 | 201 | 282 | 363 | 444 | 525 | 606 | 687 | 767 | 848 | 929 |

| Opex | 616 | 598 | 580 | 561 | 543 | 525 | 507 | 488 | 470 | 452 | 434 |

| Capital | 562 | 555 | 547 | 540 | 532 | 525 | 517 | 510 | 503 | 495 | 488 |

| Colemanite Price | 148 | 223 | 299 | 374 | 450 | 525 | 600 | 676 | 751 | 826 | 902 |

| BA Price | 497 | 503 | 508 | 514 | 519 | 525 | 530 | 536 | 541 | 547 | 552 |

The following table illustrates the projected Post-tax Net Present Value ("NPV") sensitivity of the Piskanja project to Operating Cost and Capital Cost variations:

| NPV (USD'000) | OPEX | |||||||||||

| - | - | - | - | - | ||||||||

| CAPEX | - | 653,233 | 634,994 | 616,754 | 598,515 | 580,276 | 562,036 | 543,797 | 525,557 | 507,318 | 489,079 | 470,839 |

| - | 645,805 | 627,565 | 609,326 | 591,086 | 572,847 | 554,608 | 536,368 | 518,129 | 499,889 | 481,650 | 463,411 | |

| - | 638,376 | 620,136 | 601,897 | 583,658 | 565,418 | 547,179 | 528,940 | 510,700 | 492,461 | 474,221 | 455,982 | |

| - | 630,947 | 612,708 | 594,468 | 576,229 | 557,990 | 539,750 | 521,511 | 503,271 | 485,032 | 466,793 | 448,553 | |

| - | 623,519 | 605,279 | 587,040 | 568,800 | 550,561 | 532,322 | 514,082 | 495,843 | 477,603 | 459,364 | 441,125 | |

| 616,090 | 597,851 | 579,611 | 561,372 | 543,132 | 524,893 | 506,654 | 488,414 | 470,175 | 451,935 | 433,696 | ||

| 608,661 | 590,422 | 572,183 | 553,943 | 535,704 | 517,464 | 499,225 | 480,986 | 462,746 | 444,507 | 426,267 | ||

| 601,233 | 582,993 | 564,754 | 546,514 | 528,275 | 510,036 | 491,796 | 473,557 | 455,318 | 437,078 | 418,839 | ||

| 593,804 | 575,565 | 557,325 | 539,086 | 520,846 | 502,607 | 484,368 | 466,128 | 447,889 | 429,649 | 411,410 | ||

| 586,375 | 568,136 | 549,897 | 531,657 | 513,418 | 495,178 | 476,939 | 458,700 | 440,460 | 422,221 | 403,981 | ||

| 578,947 | 560,707 | 542,468 | 524,229 | 505,989 | 487,750 | 469,510 | 451,271 | 433,032 | 414,792 | 396,553 | ||

The table below illustrates the Post-tax NPV variability with changing Operating Cost and Revenue estimates:

| NPV (USD'000) | Revenue | |||||||||||

| - | - | - | - | - | ||||||||

| OPEX | - | 211,797 | 292,656 | 373,514 | 454,373 | 535,231 | 616,090 | 696,948 | 777,807 | 858,665 | 939,524 | 1,020,382 |

| - | 193,558 | 274,417 | 355,275 | 436,134 | 516,992 | 597,851 | 678,709 | 759,568 | 840,426 | 921,285 | 1,002,143 | |

| - | 175,319 | 256,177 | 337,036 | 417,894 | 498,753 | 579,611 | 660,470 | 741,328 | 822,187 | 903,045 | 983,904 | |

| - | 157,079 | 237,938 | 318,796 | 399,655 | 480,513 | 561,372 | 642,230 | 723,089 | 803,947 | 884,806 | 965,664 | |

| - | 138,840 | 219,698 | 300,557 | 381,415 | 462,274 | 543,132 | 623,991 | 704,849 | 785,708 | 866,566 | 947,425 | |

| 120,600 | 201,459 | 282,317 | 363,176 | 444,034 | 524,893 | 605,751 | 686,610 | 767,468 | 848,327 | 929,185 | ||

| 102,361 | 183,220 | 264,078 | 344,937 | 425,795 | 506,654 | 587,512 | 668,371 | 749,229 | 830,088 | 910,946 | ||

| 84,081 | 164,980 | 245,839 | 326,697 | 407,556 | 488,414 | 569,273 | 650,131 | 730,990 | 811,848 | 892,707 | ||

| 65,780 | 146,741 | 227,599 | 308,458 | 389,316 | 470,175 | 551,033 | 631,892 | 712,750 | 793,609 | 874,467 | ||

| 47,480 | 128,490 | 209,360 | 290,218 | 371,077 | 451,935 | 532,794 | 613,652 | 694,511 | 775,369 | 856,228 | ||

| 29,324 | 110,201 | 191,120 | 271,979 | 352,837 | 433,696 | 514,555 | 595,413 | 676,272 | 757,130 | 837,989 | ||

A more complete set of sensitivity tables are available within the PEA.

Tim Daniels, President of Erin Ventures commented on the PEA results:

"The robust results in the Piskanja PEA confirm what we have always believed - that Piskanja has the potential to be amongst the most impressive boron properties globally. Piskanja joins a very small group of study-backed, development stage boron assets in the world. Piskanja has several attributes that make it attractive for development including stout economics, strong value metrics and the potential for rapid returns with low capital investment. Additionally, Piskanja's projected low operating cost enhances the likelihood of profitability even in the weakest of boron market scenarios. The results of the PEA, combined with the potential for resource expansion, excellent existing local infrastructure, and a favourable mineral mix, make it a truly outstanding and unique project.

MINING

The geometry and depth of the mineralisation identified at Piskanja lends itself to an underground mining method. It is envisaged that mining will be by cut and fill method and that the key underground infrastructure will comprise:

- twin access declines from surface to the deposit: i) Main Haulage Decline ("MHD") from surface to the floor of Mineralized Zone 1 and ii) Main Ventilation Decline ("MVD") from surface to the roof of Mineralized Zone 3;

- anunderground spiral ramp connecting MHD and MVD and enabling access to all levels;

- a shaft connecting MHD and MVD to serve as an ore pass and temporary stockpile (if needed);

- footwall drives located belowseam horizons of Mineralized Zone 1, Mineralized Zone 2 and Mineralized Zone 3;

- level drives and ventilation connections between three footwall drives.

The PEA envisages a Run of Mine (ROM) average annual tonnage of 307,956 tonnes to produce some 261,821 tonnes of sale grade colemanite and 25,000 tonnes of boric acid for a period of 17 years.

Excavation is currently proposed by mechanical cutting using Continuous Miners ("CM"). The rationale of the application of mechanical cutting, as opposed to drill and blast operations, is the need to minimize ground vibrations which may affect the residential structures and cause annoyance to the residents of the nearby village, Korlace. Similarly, the application of any caving mining methods, or any mining methods which could cause ground subsidence is, at present moment, excluded from further considerations.

Material mined by the CMs would be hauled by shuttles or battery haulers to the nearest pass/bin and fed to the panel conveyor at the main haulage horizon. The panel conveyor would then haul the mined material to the main ore pass/ore bunker. The main ore pass has two functions: i) to reduce the mined material tonnes to the Main Haulage Decline and feed it to the Main belt conveyor and ii) to serve as a temporary ore storage/ore stockpile. Once fed to the main belt conveyor, the material is conveyed to the surface and fed to the ore processing system.

In order to achieve an overall planned mining recovery of

PROCESSING

All ROM production is to be fed to the Colemanite Plant for colemanite production with the aim of upgrading mined materials to desired concentrate levels of B2O3. A constant product grade of

The operating plan calls for the production of both colemanite concentrate and boric acid, the latter at a rate of 25 ktpa, and the former at a rate of approximately 250 ktpa. This production scenario has been modelled according to the process route shown in block form. It should be noted that further metallurgical test work is required to finalize the process flowsheet. However, the flowsheet for B2O3 beneficiation is well documented, shows that the process utilizes "off the shelf" technology, and is in fact commonly deployed in Turkish boron mines.

According to available data from Turkey, concentration of colemanite is carried out by crushing and grinding, washing and classification in the size fractions. For larger size fractions, colemanite concentrate is produced through attrition tumbling and hand sorting, while for finer size fractions (-6 mm), attrition scrubbing and classification are carried out. At the Emet Mine in Turkey, a colemanite concentration plant (with a capacity of 600,000 tons per year) processes colemanite feedstock averaging

The production of boric acid is also a well-documented process with readily available technology used by several producers globally.

CAPITAL and OPERATING COSTS

A breakdown of the capital and operating costs used in the economic analysis is presented in the tables below.

Project Capital Costs [expended over a 24 month development period]

| Project Capital (USD'000) | Base Cost | Contingency | Total |

| Mining | 39,400 | 11,820 | 51,220 |

| Processing - Colemanite | 2,000 | 600 | 2,600 |

| Processing - Boric Acid | - | - | - |

| Infrastructure | 16,250 | 4,875 | 21,225 |

| Tailings | 3,814 | 1,144 | 4,957 |

| Total | 61,464 | 18,439 | 79,903 |

Unit Operating Costs (USD/t)

| Colemanite | Boric Acid | |

| Mining | 70.8 | - |

| Processing - Colemanite | 3.6 | 6.4 |

| Processing - BA Plant | 1.7 | 205.8 |

| Tailings/Waste Disposal | 0.1 | 0.5 |

| Infrastructure | 4.3 | 6.4 |

| G&A | 23.5 | 34.6 |

| Royalty | 25.0 | 35.0 |

| Sales/Marketing | 1.5 | 1.5 |

| Tax | 23.9 | 50.4 |

| Unit Costs per tonne of production | 154.5 | 340.7 |

Michael Dehn, CEO of Temas Resources, partner with Erin Resources on the Piskanja Project, added:

"These positive economics demonstrate that the Piskanja project should be a favourable source of borates for the European markets. Turkey currently provides

Tim Daniels of Erin Ventures continues: "Piskanja is well positioned to benefit from, and contribute to, global decarbonization efforts and the evolving global economy, where reducing environmental impacts and contributions to preventing climate change are increasingly important. Boron is considered a critical, irreplaceable, and expanding strategic driver of decarbonization through reduction of emissions, enabling clean power, helping secure the food supply chain, and providing nutrients in diets for healthy living.

The PEA is the culmination of years of hard work by the team at Erin Ventures, our partners, and our stakeholders. I personally thank all involved for their efforts and support. While the PEA is a significant milestone for us, we are looking forward to the next developments. We have commenced the permitting process, with the data from the PEA forming the backbone of a submission to "certify the Piskanja resource" as an important step in a mine license application process."

KEY CONCLUSIONS

Exploration activities undertaken by Erin to date, in conjunction with the results of previous exploratory works, have outlined a significant boron minerals deposit which, in the opinion of the PEA Author, justifies further activities. Future activities should be undertaken in order to assess the potential of project development and, ultimately, mine construction.

The PEA reports a Mineral Resource estimate for the Project which includes a combined Measured and Indicated Mineral Resource of 6.87 Mt with a mean grade of

The report shows the potential of the project by demonstrating a post-tax NPV for the Project at a

It should be noted that there is a significant amount of future work to be undertaken in order to mitigate the risks before entering the mine construction phase. The authors of this PEA recommended appropriate actions and activities needed to properly assess and address these associated risks.

A future work program will be discussed with Erin in order to define the necessary steps towards the PFS stage, FS stage and ultimately, the mine construction phase in accordance with Serbian regulatory requirements and international standards, but also to define a set of decision-making milestones to assist in determining that the advancement of the project continues to be warranted.

RECOMMENDATIONS

Recommendations for work that may potentially lead to further improvements to the Project include:

- Expansion and improvement of the existing Piskanja Mineral Resource Estimate through further exploration and close-spaced drilling in the two unbounded directions

- Improvement and refinement of metallurgical recoveries and processes through further metallurgical test work

- Continued evaluation of different project operating scales ("right sizing") and optimization of mine plans

- Evaluation and incorporation of existing technologies to improve sustainability and reduce environmental impact

- Additional test work to define geotechnical parameters of the rock mass

- Additional modelling or model refining (geotechnical, structural, resource, economical) as an aid to appropriate mine design

- A comprehensive environmental impact assessment

- A demonstration of mitigation measures

CAUTIONARY NOTE

The PEA summarized in this news release is considered preliminary in nature, contains numerous assumptions and includes Inferred Mineral Resources that are considered too speculative, geologically, to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that the results of the PEA will be realized. No Mineral Reserves have been estimated for Piskanja. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. Inferred Mineral Resources are that part of the Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geologic evidence and sampling, which is sufficient to imply but not verify grade or quality continuity. Inferred Mineral Resources may not be converted to mineral reserves. It is reasonably expected, though not guaranteed, that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. Mineral Resources are captured within an optimized mine plan (within the constraints of a PEA) and meet the test of reasonable prospects for economic extraction.

The effective date of the PEA is June 24, 2022, and a technical report prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") in support of the PEA will be filed on SEDAR within 45 days of this news release.

QUALIFIED PERSONS

James E Wallis, M.Sc. (Eng), P. Eng., a director of Erin Ventures, and Nenad Rakic, EurGeol, a consultant to Erin Ventures, are qualified persons as defined by NI 43-101, have reviewed the technical information that forms the basis for this news release and have approved the disclosure herein.

Rory Kutluoglu, P.Geo, a director of Temas Resources, and Robert W. Schafer, P.Geo, a director of Temas Resources, are Qualified Persons as defined by NI 43-101, have reviewed and approved the technical information contained within this press release.

Prof. Miodrag Banješević PhD. P.Geo, EurGeol, is the qualified person as defined by NI 43-101 for the Preliminary Economic Assessment and for the Mineral Resource Estimate, and is independent of the Company. He has reviewed the technical information that forms the basis for this news release and has approved the disclosure herein.

The PEA will be available at Erin's website (www.erinventures.com) or Erin's filed documents at www.sedar.com within 45 days of the date of this release.

On behalf of the Board of Directors,

Tim Daniels, President

About Erin Ventures Inc.

Erin Ventures Inc. is an international mineral exploration and development company with boron assets in Serbia. Headquartered in Victoria, B.C., Canada, Erin's shares are traded on the TSX Venture Exchange under the symbol "EV". For detailed information please see Erin's website at www.erinventures.comor the Company's filed documents at www.sedar.com.

Temas may earn a

For further information, please contact:

Erin Ventures Inc.

Blake Fallis, General Manager

Phone: 1-250- 384-1999 or 1-888-289-3746

www.erinventures.com

645 Fort Street, Suite 203

Victoria BC V8W1G2

Canada

Erin's Public Quotations:

Canada

TSX Venture: EV

USA

SEC 12G3-2(B) #82-4432

OTCBB: ERVFF

Europe

Berlin Stock Exchange: EKV

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and U.S. securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, the results of the PEA, including the projected Capex, the estimated after-tax NPV and IRR, the estimated LOM and estimated concentrate grades, the potential production from and viability of Piskanja, the risks and opportunities outlined in the PEA, the potential tonnage, grades and content of deposits, the extent of mineral resource estimates, anticipated exploration program results from exploration activities, the discovery and delineation of mineral deposits/resources/reserves and the anticipated business plans and timing of future activities of the Company are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: "believes", "expects", "anticipates", "intends", "estimates", "plans", "may", "should", "would", "will", "potential", "scheduled" or variations of such words and phrases and similar expressions, which, by their nature, refer to future events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, that the Company will receive all necessary approvals required to develop Piskanja as outlined in the PEA, that the assumptions in the PEA are reasonably accurate, market fundamentals will result in sustained boron demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future development of Piskanja in a timely manner, the availability of financing on suitable terms for the development, construction and continued operation of the Company's projects and its ability to comply with environmental, health and safety laws.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks and other factors include, among others, requirements for additional capital, operating and technical difficulties in connection with mineral exploration and development activities, actual results of exploration activities, including on the Piskanja project, the estimation or realization of mineral reserves and mineral resources, and there is no guarantee that such interests, will be certain, the timing and amount of estimated future production, the costs of production, capital expenditures, the costs and timing of the development of new deposits, requirements for additional capital, future prices of boron, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, lack of investor interest in future financings, accidents, labour disputes and other risks of the mining industry, delays in obtaining governmental approvals (including of the TSX Venture Exchange), permits or financing or in the completion of development or construction activities, risks relating to epidemics or pandemics such as COVID-19, including the impact of COVID-19 on the Company's business, financial condition and results of operations, changes in laws, regulations and policies affecting mining operations, title disputes, the inability of the Company to obtain any necessary permits, consents, approvals or authorizations, the timing and possible outcome of any pending litigation, environmental issues and liabilities, and risks related to joint venture operations, and other risks and uncertainties disclosed in the company's continuous disclosure documents. All of the Company's Canadian public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not undertake any obligation to update any of the forward-looking statements in this news release or incorporated by reference herein, except as otherwise required by law.

Cautionary Note to United States Investors

Erin Ventures Inc. prepares its disclosure in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Terms relating to mineral resources in this news release are defined in accordance with NI 43-101 under the guidelines set out in CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the Canadian Institute of Mining, Metallurgy and Petroleum Council on May 19, 2014, as amended ("CIM Standards"). The U.S. Securities and Exchange Commission (the "SEC") has adopted amendments effective February 25, 2019 (the "SEC Modernization Rules") to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934.

As a result of the adoption of the SEC Modernization Rules, the SEC will now recognize estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", which are defined in substantially similar terms to the corresponding CIM Standards. In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be substantially similar to the corresponding CIM Standards.

U.S. investors are cautioned that while the foregoing terms are "substantially similar" to corresponding definitions under the CIM Standards, there are differences in the definitions under the SEC Modernization Rules and the CIM Standards. Accordingly, there is no assurance any mineral resources that Erin Ventures may report as "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had Erin Ventures Inc. prepared the resource estimates under the standards adopted under the SEC Modernization Rules.

In accordance with Canadian securities laws, estimates of "inferred mineral resources" cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101.

SOURCE: Erin Ventures Inc.

View source version on accesswire.com:

https://www.accesswire.com/706725/Erin-Ventures-Announces-Positive-Preliminary-Economic-Assessment-for-Piskanja-Boron-Project-US5249-Million-NPV10-post-tax-787-IRR-post-tax-12-Month-Capex-Payback