EQONEX Exchange Exceeds US$5 billion in 30 Day Volume

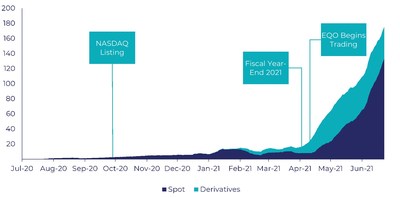

On June 24, 2021, EQONEX Group (Nasdaq: EQOS) announced that its cryptocurrency exchange surpassed US$5 billion in total spot and derivative trading volumes over the past 30 days. This reflects a significant increase, with June's average daily volumes reaching US$190 million, marking a 206% rise from April. The growth follows the successful launch of the EQO exchange token on April 8, 2021. CEO Richard Byworth emphasized the swift transition to revenue generation after the exchange's public launch, underscoring the company's commitment to fair markets and effective custody solutions.

- 30-day trading volume exceeded US$5 billion, indicating robust market activity.

- Average daily trading volumes rose to US$190 million, a 206% increase from April.

- Volumes increased over 12 times compared to pre-launch of EQO token.

- None.

Insights

Analyzing...

SINGAPORE, June 24, 2021 /PRNewswire/ -- Diginex Limited (Nasdaq: EQOS), recently rebranded as EQONEX Group (the "Company"), a digital assets financial services company, today announced that total spot and derivative trading volumes on EQONEX, its cryptocurrency exchange, exceeded US

Volumes in June have continued their recent strong upward trajectory, with average daily volumes in June month-to-date of US

The EQONEX exchange has transitioned from an early-stage strategy focused on building a highly competitive order book with tight spreads and deep liquidity, to one focused on driving revenue growth. Since early April 2021, the EQONEX exchange has seen a rapid expansion in fee-paying volume, driven in part by the launch of the EQO exchange token, which began trading on April 8, 2021.

This strategy has not only contributed to overall volume growth but has also driven fee-paying volume significantly higher, as highlighted in the attached table titled "30 Day Rolling Average Daily Fee-Paying Volume (US$m)."

Richard Byworth, CEO at EQONEX Group, said: "Our exchange has not only demonstrated rapid volume growth over recent months, but has also quickly embarked on a path to revenue after less than twelve months since its public launch into a competitive landscape. We have devoted substantial time and resources towards bootstrapping our volumes to a level where we could begin generating revenue. Reaching US

"Our commitment to fair and transparent markets combined with our institutional grade custody solution Digivault, our FCA-regulated digital asset custodian, is resonating well with customers."

About EQONEX

EQONEX is a digital assets financial services company focused on fairness, governance, and innovation. The group encompasses cryptocurrency exchange EQONEX as well as an over-the-counter trading platform. It also offers a front-to-back integrated trading platform, Access Trading, a securitization advisory service, EQONEX Capital, market leading hot and cold custodian Digivault and asset manager Bletchley Park.

For more information visit: https://www.group.eqonex.com

Follow Diginex on social media on Twitter @eqonex, on Facebook @eqonex, and on LinkedIn.

This press release is provided by Diginex Limited ("Eqonex") for information purposes only, is a summary only of certain key facts and plans of Eqonex and includes forward looking statements that involve risks and uncertainties. Without limitation, the press release does not constitute an offer or solicitation in relation to any securities or other regulated products or services or to make use of any services provided by Eqonex, and neither this press release nor anything contained in it will form the basis of any contract or commitment whatsoever. The contents of this press release have not been reviewed by any regulatory authority in any jurisdictions. Forward looking statements are statements that are not historical facts and are subject to risks and uncertainties, which could cause actual results or outcomes to differ materially from the forward-looking statements. Most of these factors are outside of Eqonex's control and are difficult to predict. Factors that may cause such differences include, but are not limited to: the ability to recognize the anticipated benefits of the business combination; the ability of Eqonex to grow and manage growth profitably; Eqonex's limited operating history and history of net losses; Eqonex's ability to execute its business plan; the inability to maintain the listing of Eqonex's shares on Nasdaq; Eqonex's estimates of the size of the markets for its products; the rate and degree of market acceptance of Eqonex's products; Eqonex's ability to identify and integrate acquisitions; potential litigation involving Eqonex or the validity or enforceability of Eqonex's intellectual property; general economic and market conditions impacting demand for Eqonex's products and services; and such other risks and uncertainties indicated in Eqonex's Shell Company Report on Form 20-F, including those under "Risk Factors" therein, and in Eqonex's other filings with the SEC, which are available on the SEC's website at www.sec.gov.

In addition, any forward-looking statements contained in this press release are based on assumptions that Eqonex believes to be reasonable as of this date. Eqonex undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this press release or to reflect new information or the occurrence of unanticipated events, except as required by law.

Other than those of Eqonex, all names, trademarks and logos in this press release and used in the materials herein belong to their respective owners. Nothing contained on this press release should be construed as granting, by implication, estoppel, or otherwise, any right or license to use any third-party names, trademarks, or logos displayed on the press release without the written permission of such third-parties.

Copyright (c) Diginex Limited 2021.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/eqonex-exchange-exceeds-us5-billion-in-30-day-volume-301319414.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/eqonex-exchange-exceeds-us5-billion-in-30-day-volume-301319414.html

SOURCE Diginex Limited