Electric Metals (USA) Limited Receives Expanded Mineral Resource Estimate for the Emily Manganese Project, Minnesota. The Highest-grade Manganese Deposit in North America

- None.

- None.

20.9% increase in total Indicated Resources to 6.2 million tonnes with average manganese grade of19.27% and596.5% increase in Inferred Resource to 4.9 million tonnes with average manganese grade of17.50% , using a10% cutoff grade64.2% increase in total Indicated Resources to 14.5 million tonnes with average manganese grade of12.06% and800.1% increase in Inferred Resource to 9.6 million tonnes with average manganese grade of12.11% , using a5% cutoff grade- Three primary zones of manganese mineralization modeled

- Large tonnage expansion associated with initial drilling of the central zone of the deposit

- Eastern in-fill drilling and central step-out drill holes undertaken at approximately 100m spacing

- Western zone of the deposit open and recommended for future expansion

TORONTO, ON / ACCESSWIRE / April 9, 2024 / Electric Metals (USA) Limited ("EML" or the "Company") (TSXV:EML)(OTCQB:EMUSF) is pleased to announce the receipt of the expanded Mineral Resource Estimate for the

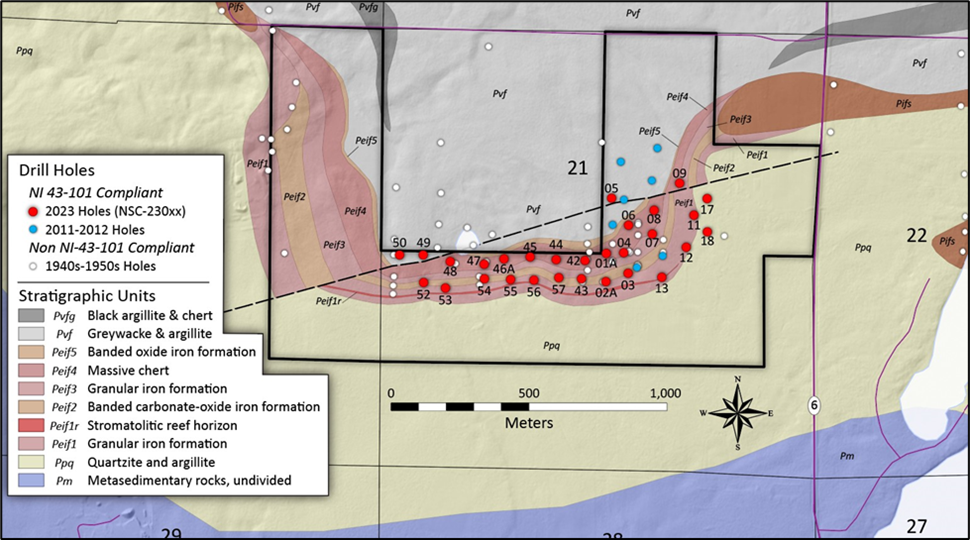

The Mineral Resource Estimate is based on a geological model incorporating data from 29 diamond core holes drilled by Electric Metals in 2023 in the eastern and central portion of the Emily Manganese Deposit, and historical drilling data from 7 diamond core holes drilled in 2011 and 2012 in the eastern portion of the deposit. The drilling overlays a planned, but not executed, former U.S. Steel iron ore - manganese mine proposed in 1959. The current estimate confirms and expands the previous Mineral Resources. The current estimate is based on the most detailed geological model of the Emily Manganese deposit to date, which significantly enhances the understanding of grades and zonation within the deposit.

The Emily Manganese Deposit is in the northern portion of Minnesota's Cuyuna Iron Range in Crow Wing County, near the town of Emily. The Emily Deposit, a sedimentary iron deposit, is hosted by rocks of the Paleoproterozoic Animikie Basin, an early Proterozoic geologic terrane, which occupies much of east central Minnesota. The stratigraphy, structure, and high-grade manganese mineralization within these rocks is the result of long periods of sedimentation, deformation, and erosion along the ancestral southern margin of the Superior Craton. The Cuyuna Iron Range is traditionally divided into three districts, the Emily District, the North Range, and the South Range. While mined principally for iron ore, large quantities of manganese were extracted as manganiferous iron ores from several mines in the Cuyuna Iron Range from 1911 to 1967.

Further details supporting the geological model and the resource model estimation procedure will be available in an NI 43‐101 Technical Report disclosing the results of the Resource Estimate which will be posted under the Company's profile at www.sedar.com within 45 days.

Brian Savage, CEO, Electric Metals, commented "We're thrilled to announce the expanded Mineral Resource Estimate for our Emily Manganese Project in Minnesota, solidifying our position as a key player in North America's manganese market. This significant increase in both Indicated and Inferred Resources underscores our dedication to maximizing the potential of the deposit. Our next objectives include conducting further drilling to progress these resources into a mineable reserve and conducting additional metallurgical testing to refine and optimize the flow sheet."

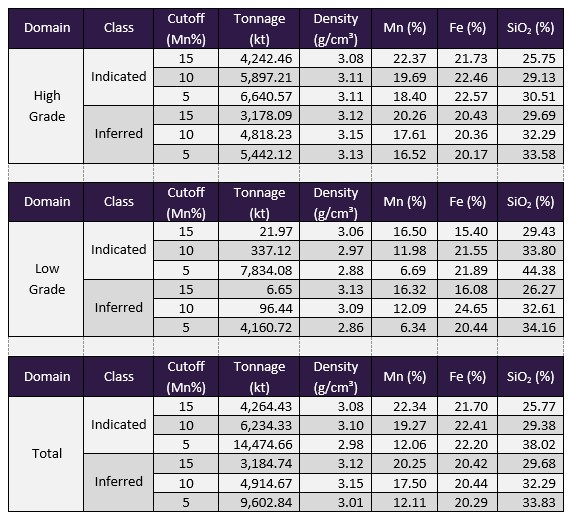

Results of the current Mineral Resource Estimate (Table 1) are as follows:

Table 1: NSM Emily Classified Mineral Resource Estimate (k metric tonnes)

Notes:

- CIM Definition Standards (2014) were used for reporting the Mineral Resource Estimate.

- The effective date of the estimate is December 31, 2023.

- The Qualified Persons associated with this Mineral Resource Estimate are:

- Ms. Amanda Irons, CPG & Senior Resource Geologist, Forte Dynamics,

- Mr. Donald H. Hulse, PE & Director of Mining Resources, Forte Dynamics, and

- Dr. Deepak Malhotra, SME-RM & Director of Metallurgy, Forte Dynamics.

- All resources were considered potentially extractable via underground mining scenarios.

- A three-dimensional geological model was produced in LeapFrog Geo.

- The Emily Iron Formation (Peif) is separated into six subunits (Peif1-Peif5, and Peif1r), with zones in four subunits (Peif1-3, Peif1r) used the Resource Estimate.

- Mineralization occurred in two domains withing Peif 1 and Peif 3 which were estimated as separate domains using 3 dimensional cutoff shells based on

10% Mn to segregate as high-grade and low-grade populations. - A total of 730 specific gravity measurements were taken, and specific gravity was estimated on Peif subunits, averaging 2.88 for low-grade and 3.11 for high-grade.

- Resource estimation used a 4m x 2m x 1.5m, orthogonal, non-rotated block model using LeapFrog Edge software.

- Grade estimates use inverse distance to the second power (ID2), within each domain.

- Capping was applied per Peif subunit by high and low grade domains, with Peif1-1r HG at

47% Mn and36% Fe, Peif1-1r LG at16% Mn and36% Fe, Peif2 at20% Mn and36% Fe, Peif3 HG at30% Mn and50% Fe, and Peif3 LG at16% Mn and50% Fe. - For the high-grade combined Mn domains, a distance limit of 80 meters was used to classify indicated and inferred material. Indicated and inferred for the combined low-grade domains uses an average distance limit of 100 meters.

- For potential economic extraction, the mineral resource reported was limited to an area with a Mn grade greater than

5% and thickness greater than 4 meters, representing the minimum thickness assumed for effective mining. - Manganese recovery was estimated at

95% , based on the current metallurgical tests. - Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- The quantity and grade, or quality is an estimate and is rounded. Quantities may not sum due to rounding.

Figure 1 represents the recent drilling campaigns and property boundary.

Figure 1. Map of Drillholes and Emily Property Boundary

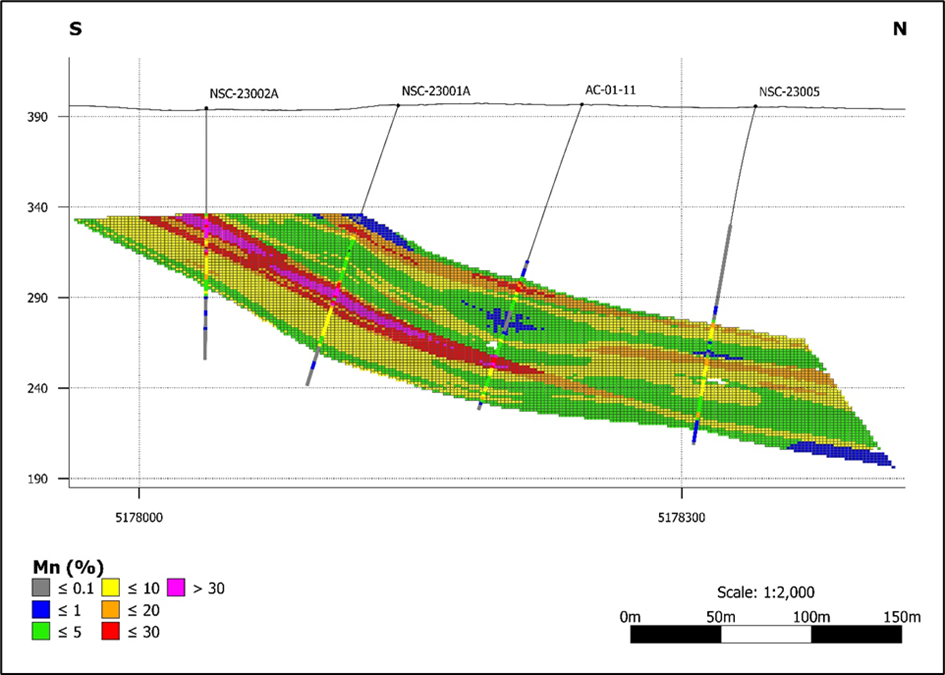

Block Model

The block model used for resource estimation is a 4m x 2m x 1.5m, orthogonal, non-rotated block model. Block grade estimation was completed using LeapFrog Edge software. Grade estimates use inverse distance to the second power (ID2), within each domain. Blocks were estimated with a single pass search at about 1.5 variogram ranges for the Mn domains, and 1.5 of the variogram ranges for the Fe and SiO2 domains.

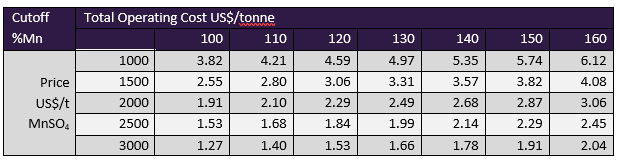

Potential cutoff grades for the models were estimated using U.S.

Based on these ranges the QP estimated potential cutoff grades in percent contained manganese and the sensitivity is shown in Table 2. This shows a range of cutoff grades from

Table 2: Cutoff Grade Sensitivity

Notes:

- Variable operating costs were utilized in the models, from U.S.

$100 -$160 /tonne for mining, processing, and administrative costs. - Value was only attributed to manganese, with variable product pricing from U.S.

$1,000 -$3,000 /tonne for battery grade manganese sulphate monohydrate (MnSO4).

A visual review of the block model shows good agreement between block and composite grades.

Figure 2. Cross Section of Block Model looking West

Qualified Person

The scientific and technical data contained in this news release was reviewed and approved by Mr. Donald E. Hulse, who is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

About Electric Metals (USA) Limited

Electric Metals (USA) Limited (TSXV:EML)(OTCQB:EMUSF) is a U.S.-based mineral development company with manganese and silver projects geared to supporting the transition to clean energy. The Company's principal asset is the Emily Manganese Project in Minnesota, which has been the subject of considerable technical studies, including a National Instrument 43-101 Technical Report - Resource Estimate, with over US

For further information please contact

Brian Savage

CEO and Director

(303) 656-9197

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words "believes," "may," "plans," "will," "anticipates," "intends," "could", "estimates", "expects", "forecasts", "projects" and similar expressions, and the negative of such expressions.

Forward-looking statements in this news release include, but are not limited to, statements with respect to the announcement of an updated mineral resource and the ability of Electrical Metals to produce battery grade high purity manganese sulphate monohydrate (HPMSM) and other high-grade manganese products from the Emily Manganese Project ore.

These statements address future events and conditions and so involve inherent risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such risks include, but are not limited to, the failure to obtain all necessary stock exchange and regulatory approvals. Forward-looking information is based on the reasonable assumptions, estimates, analysis and opinions of management made in light of its experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances at the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information.

All forward-looking information herein is qualified in its entirety by this cautionary statement, and the Company disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events, or developments, except as required by law.

SOURCE: Electric Metals (USA) Limited

View the original press release on accesswire.com