Electrovaya Reports Third Quarter FY2024 Financial Results

Rhea-AI Summary

Electrovaya Inc. (NASDAQ:ELVA)(TSX:ELVA) reported its Q3 FY2024 financial results, showing revenue of $10.3 million and Adjusted EBITDA of $0.6 million. The company experienced continued gross margin growth, reaching 33.7% for the quarter. Electrovaya is making progress in meeting strategic financing objectives, including refinancing existing working capital facilities and negotiating with a US federal agency for financing its planned Jamestown, New York lithium-ion battery manufacturing facility. The company revised its revenue guidance for FY2024 to $45 million due to order delays. Electrovaya is focusing on new product development and business initiatives to support rapid growth in fiscal 2025 and beyond.

Positive

- Gross margin increased to 33.7% for Q3 FY2024, up from 30.5% in the prior year

- Adjusted EBITDA of $0.6 million for Q3 FY2024

- Trailing 12-month Adjusted EBITDA of $4.8 million on revenue of $49.4 million

- Purchase order backlog of $40.2 million as of August 12, 2024

- New supply agreement with Sumitomo Power & Mobility

- Launch of new Infinity Series Lithium-Ion Phosphate (LFP) based cell

Negative

- Revenue decreased slightly to $10.3 million, down 3% year-over-year

- Operating loss of $0.6 million compared to operating income of $0.9 million in the prior year quarter

- Revised revenue guidance for FY2024 to $45 million due to order delays

News Market Reaction 1 Alert

On the day this news was published, ELVA declined 4.37%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Continued gross margin growth, Revenue of

Progress in meeting strategic financing objectives including refinancing existing working capital facilities and in negotiations with a US federal agency with regards to financing planned Jamestown, New York lithium-ion battery manufacturing facility

TORONTO, ON / ACCESSWIRE / August 13, 2024 / Electrovaya Inc. ("Electrovaya" or the "Company") (NASDAQ:ELVA)(TSX:ELVA), a leading lithium-ion battery technology and manufacturing company, today reported its financial results for fiscal 2024 third quarter ended June 30, 2024 ("Q3 FY2024"). All dollar amounts are in U.S. dollars unless otherwise noted.

"We continue to strengthen our business through new product development, business development initiatives and in continuing to post consistent strong margins for our core material handling battery product lines," said Dr. Raj DasGupta, Electrovaya's CEO. "Our focus this fiscal year, and where we demonstrated significant progress in the current quarter, is to establish the foundations so that the business can continue with a rapid growth trajectory in fiscal 2025 and beyond. This not only includes the development of new product lines for current and new OEM partners, but also with respect to establishing financial partnerships to sustain our long-term growth objectives. While we continue to expect fiscal 2024 to be a strong year, we are experiencing an impact from the movement of orders to fiscal 2025 by our customers, particularly when the orders are related to new warehouse construction.

"In the current quarter, we had additional costs associated with new product development, including certification and third-party validation testing. These are part of large co-investments that we have been making over the course of the last year with respect to an OEM project that is scheduled to launch in fiscal year 2025. This is just one example of development programs we are currently engaged in that we expect will transform into significant revenue drivers in subsequent fiscal years.

"We have been making significant progress in achieving our strategic financing objectives for both our existing operations in the form of a lower cost and longer term refinancing with a major North American bank, and also with respect to financing our Jamestown lithium-ion battery manufacturing facility with a US federal agency. We are optimistic about closing both of these facilities in the current fiscal year."

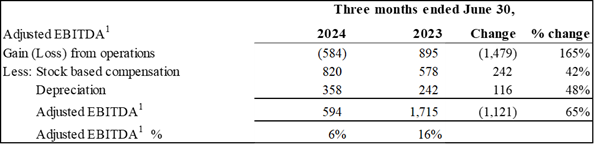

John Gibson, Electrovaya's CFO commented, "Q3 FY2024 demonstrated continued improvement in our margins leading to an adjusted EBITDA1 of

1 Non-IFRS Measure: Adjusted EBITDA is defined as profit/(loss) from operations, plus finance costs, stock-based compensation and depreciation. Adjusted EBITDA does not have a standardized meaning under IFRS. Therefore, it is unlikely to be comparable to similar measures presented by other issuers. Management believes that certain investors and analysts use adjusted EBITDA to measure the performance of the business and is an accepted measure of financial performance in our industry. It is not a measure of financial performance under IFRS and may not be defined and calculated in the same manner by other companies and should not be considered in isolation or as an alternative to Income (loss) from operations.

Financial Highlights:

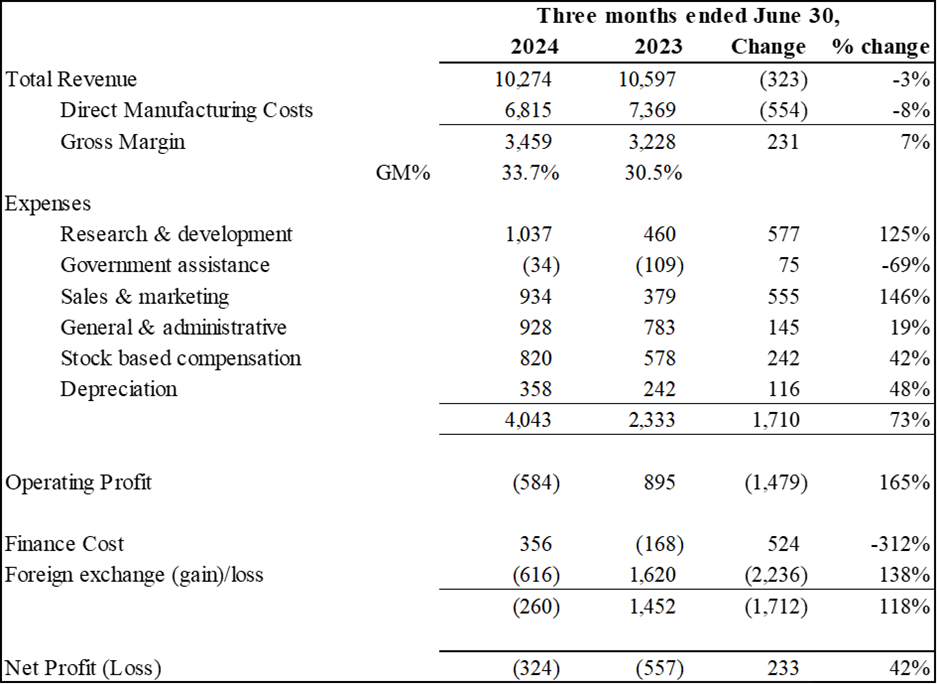

Revenue decreased slightly to

$10.3 million , compared to the restated$10.6 million for the quarters ended June 30, 2024 and 2023, respectively, a change of$0.3 million or3% .Gross margin increased to

$3.5 million , compared to$3.2 million for the quarter ended June 30, 2024 and 2023, respectively, an increase of$0.2 million or7% . Gross margin as a percentage of revenue was33.7% for the quarter ended June 30, 2024, compared to30.5% in the prior year. Gross margin for the nine months ended June 30, 2024 increased by$3.4 million to$10.7 million , an increase of46% . Gross margin as a percentage of revenue for the same period increased to32.4% from26.5% .Operating loss was

$(0.6) million compared to operating income of$0.9 million for the quarter embed June 30, 2024, a decrease of$1.5 million or165% . This loss was driven by one-off costs relating to ongoing engineering and development activities associated with a project in partnership with one of the Company's key OEM partners. Operating profit for the nine months ended June 30, 2024 was$0.02 million , compared to an operating loss of$0.6 million , an improvement of103% .For the quarter ended June 30, 2024, Adjusted EBITDA1 was

$0.6 million . Trailing 12 month Adjusted EBITDA1 was$4.8 million on revenue of$49.4 million , an EBITDA percentage of9.7% .As of August 12, 2024, the Company had a purchase order backlog of

$40.2 million to be delivered over the next 12 months.

Business Highlights:

On April 29, 2024, the Company announced that it had established a supply agreement with Sumitomo Corporation Power & Mobility (SCPM), a

100% owned subsidiary of Sumitomo Corporation. The supply agreement will initially cover the supply of battery modules to leading Japanese construction equipment manufacturers. The Company has thus far been selected by one major Japanese construction equipment manufacturer, which will be supplied through the SCPM supply agreement. First shipments to this OEM are expected in spring 2025.In May 2024, the Company signed a Contribution Agreement with a Canadian Federal Government funding agency, for C

$2 million in funding to support manufacturing improvements at its Mississauga production facility.On June 12, 2024, the Company announced the launch of its first Infinity Series Lithium-Ion Phosphate (LFP) based cell as its annual Battery Technology Day event. The newly developed EV-FP-44 cells, features LFP chemistry and retains the key competitive advantages of Electrovaya's Infinity technology with respect to enhanced cycle life and safety, while also providing lower costs.

On June 13, 2024, the Company announced an update to its solid-state battery program at its annual Battery Technology Day event. Updates included the following:

Development of a scalable and cost-effective lithium-ion conducting ceramic material

Development of a proprietary separator that uses Electrovaya's in-house ion conducting ceramic material.

Plans to ship samples to a leading European automaker later in the year

The Company is in late-stage negotiations with a major North American bank to refinance its working capital facilities. This refinance, if successful, is expected to lead to significantly lower debt servicing costs, provide the Company increased working capital availability and a new long term financial partner. The Company expects to close this refinancing by September 30, 2024.

The Company is in late-stage negotiations with a US federal government agency to provide financing for its Jamestown lithium-ion battery manufacturing facility. The targeted financing is over

$40 million with a targeted approval by September 30, 2024.

Positive Financial Outlook & Fiscal 2024 Guidance:

Due to previously announced risks associated with changes in delivery dates for battery system orders tied to new distribution center construction which have since transpired, the Company has revised its anticipated revenue guidance to approximately

Selected Annual Financial Information for the Quarter ended June 30, 2024 and 2023

Results of Operations

(Expressed in thousands of U.S. dollars)

Adjusted EBITDA1

(Expressed in thousands of U.S. dollars)

1 Non-IFRS Measure: Adjusted EBITDA is defined as loss from operations, plus finance costs, stock-based compensation costs and depreciation. Adjusted EBITDA does not have a standardized meaning under IFRS. We believe that certain investors and analysts use Adjusted EBITDA to measure the performance of the business and is an accepted measure of financial performance in our industry. It is not a measure of financial performance under IFRS, and may not be defined and calculated in the same manner by other companies and should not be considered in isolation or as an alternative to Income (loss) from operations.

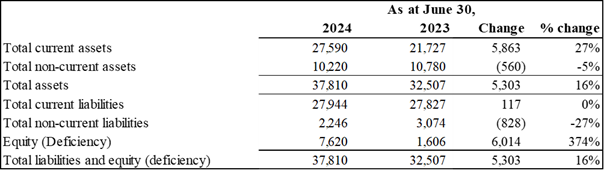

Summary Financial Position

(Expressed in thousands of U.S. dollars)

|

The Company's complete Financial Statements, Management Discussion and Analysis and Annual Information Form for the fourth quarter and fiscal year ended September 30, 2023 are available at www.sedarplus.ca or on the Company's website at www.electrovaya.com.

Conference Call details:

Date: Tuesday, August 13, 2024

Time: 5 pm Eastern Time (ET)

Toll Free: 877-545-0523

International: 973-528-0016

Participant Access Code: 302979

To help ensure that the conference begins in a timely manner, please dial in 10 minutes prior to the start of the call.

For those unable to participate in the conference call, a replay will be available for two weeks beginning on August 13, 2024 through August 27, 2024. To access the replay, the dial-in number is 877-481-4010 and 919-882-2331. The replay access ID is 51016.

Investor and Media Contact:

Jason Roy

VP, Corporate Development and Investor Relations

Electrovaya Inc.

jroy@electrovaya.com

905-855-4618

Brett Maas

Hayden IR

elva@haydenir.com

646-536-7331

About Electrovaya Inc.

Electrovaya Inc. (NASDAQ:ELVA) (TSX:ELVA) is a pioneering leader in the global energy transformation, focused on contributing to the prevention of climate change by supplying safe and long-lasting lithium-ion batteries. The Company has extensive IP and designs, develops and manufactures proprietary lithium-ion batteries and battery systems for energy storage and heavy duty electric vehicles based on its Infinity Battery Technology Platform. This technology offers enhanced safety and industry leading battery longevity. The Company is also developing next generation solid state battery technology at its Labs division. Headquartered in Ontario, Canada, Electrovaya has two operating sites in Canada and has acquired a 52-acre site with a 135,000 square foot manufacturing facility in New York state for its planned gigafactory. To learn more about Electrovaya, please explore www.electrovaya.com.

Forward-Looking Statements

This press release contains forward-looking statements including statements relating to FY 2024 and FY 2025 revenue and growth expectations, refinancing existing debt, the satisfaction of filing obligations in the United States, new product lines, new OEM partners, and an increased order backlog in FY 2024, business opportunities in 2025, US Government Agency debt approvals, ability to close on a major North American bank's lending facility, progress on the development of the Company's Jamestown assets, the deployment of the Company's products by the Company's customers and the timing for delivery thereof, and can generally be identified by the use of words such as "may", "will", "could", "should", "would", "likely", "possible", "expect", "intend", "estimate", "anticipate", "believe", "plan", "objective" and "continue" (or the negative thereof) and words and expressions of similar import. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, such statements involve risks and uncertainties, and undue reliance should not be placed on such statements. Certain material factors and assumptions are applied in making forward-looking statements, and actual results may differ materially from those expressed or implied in such statements. Without limitation, statements with respect to the FY2024 guidance, to the purchase and deployment of the Company's products by the Company's customers and users, and the timing for delivery thereof, customer delivery expectation changes, levels of expected sales and expected further purchases and demand growth, and development of facilities are based on an assumption that the Company's customers and users will deploy its products in accordance with communicated and contracted intentions and in accordance with trends observed by management, that the Company will be able to deliver the ordered products on a basis consistent with past deliveries, that future gross margins will reflect expected gross margins based on historical sales, the ability to increase prices to help maintain gross margins, ability to have production ramps of the Infinity Battery Technology Products in FY2024 and FY2025 to meet demand. Statements with respect to the ability to refinance debt are based on assumptions extrapolated from discussions with alternative lenders to the Company's existing lender. Important factors that could cause actual results to differ materially from expectations include but are not limited to macroeconomic effects on the Company and its business and on the Company's customers, economic conditions generally and their effect on consumer demand, labor shortages, inflation, supply chain constraints, and other factors which may cause disruptions in the Company's supply chain and Company's capability to deliver the products. Additional information about material factors that could cause actual results to differ materially from expectations and about material factors or assumptions applied in making forward-looking statements may be found in the Company's Annual Information Form for the year ended September 30, 2023 under "Risk Factors", and in the Company's most recent annual Management's Discussion and Analysis under "Qualitative And Quantitative Disclosures about Risk and Uncertainties" as well as in other public disclosure documents filed with Canadian securities regulatory authorities. The Company does not undertake any obligation to update publicly or to revise any of the forward-looking statements contained in this document, whether as a result of new information, future events or otherwise, except as required by law.

The expected revenue for FY 2024 described in this release constitutes future‐oriented financial information ("FOFI"), and is generally, without limitation, based on the assumptions and subject to the risks set out above under "Forward‐Looking Statements". Although management believes such assumptions to be reasonable, a number of such assumptions are beyond the Company's control and there can be no assurance that the assumptions made in preparing the FOFI will prove accurate. FOFI is provided for the purpose of providing information about management's current expectations and plans relating to the Company's future performance, and may not be appropriate for other purposes.

The FOFI does not purport to present the Company's financial condition in accordance with IFRS, and it is expected that there may be differences between expected results and actual results, and the differences may be material. The inclusion of the FOFI in this news release should not be regarded as an indication that the Company considers the FOFI to be a reliable prediction of future events, and the FOFI should not be relied upon as such.

SOURCE: Electrovaya, Inc.

View the original press release on accesswire.com