Electrovaya Reports Q1 Fiscal Year 2025 Results

Electrovaya (NASDAQ:ELVA) reported Q1 2025 financial results with revenue of $11.2 million, slightly down from $12.1 million in Q1 2024. The company achieved a gross margin of 30.5%, improving by 130 basis points year-over-year, and marked its seventh consecutive quarter of positive Adjusted EBITDA at $0.6 million.

Key developments include securing a $50.8 million EXIM direct loan approval for U.S. manufacturing expansion in Jamestown, New York, and completing a $12.8 million equity offering. The company strengthened its balance sheet with working capital of $12.6 million and cash position of $8.2 million.

Electrovaya plans to commence commercial operations at its Jamestown facility in April 2025 and reaffirmed its fiscal 2025 revenue guidance exceeding $60 million, supported by strong demand from material handling customers and OEM partners.

Electrovaya (NASDAQ:ELVA) ha riportato i risultati finanziari del primo trimestre 2025 con un fatturato di 11,2 milioni di dollari, leggermente in calo rispetto ai 12,1 milioni di dollari nel primo trimestre 2024. L'azienda ha raggiunto un margine lordo del 30,5%, migliorando di 130 punti base rispetto all'anno precedente, e ha segnato il suo settimo trimestre consecutivo di EBITDA rettificato positivo a 0,6 milioni di dollari.

Le principali novità includono l'approvazione di un prestito diretto EXIM di 50,8 milioni di dollari per l'espansione della produzione negli Stati Uniti a Jamestown, New York, e il completamento di un

Electrovaya prevede di avviare le operazioni commerciali presso il suo stabilimento di Jamestown nell'aprile 2025 e ha confermato la sua previsione di fatturato per l'anno fiscale 2025 superiore ai 60 milioni di dollari, supportata da una forte domanda da parte dei clienti nel settore della movimentazione dei materiali e dei partner OEM.

Electrovaya (NASDAQ:ELVA) reportó los resultados financieros del primer trimestre de 2025 con ingresos de 11.2 millones de dólares, ligeramente por debajo de los 12.1 millones de dólares del primer trimestre de 2024. La compañía logró un margen bruto del 30.5%, mejorando en 130 puntos básicos interanuales, y marcó su séptimo trimestre consecutivo de EBITDA ajustado positivo de 0.6 millones de dólares.

Los desarrollos clave incluyen la obtención de una aprobación de préstamo directo EXIM de 50.8 millones de dólares para la expansión de fabricación en Jamestown, Nueva York, y la finalización de una oferta de capital de 12.8 millones de dólares. La compañía fortaleció su balance con un capital de trabajo de 12.6 millones de dólares y una posición de efectivo de 8.2 millones de dólares.

Electrovaya planea comenzar operaciones comerciales en su instalación de Jamestown en abril de 2025 y reafirmó su guía de ingresos fiscales 2025 superando los 60 millones de dólares, respaldada por una fuerte demanda de clientes de manejo de materiales y socios OEM.

Electrovaya (NASDAQ:ELVA)는 2025년 1분기 재무 결과를 보고하며 매출이 1,120만 달러로, 2024년 1분기 1,210만 달러에서 약간 감소했다고 발표했습니다. 이 회사는 총 마진 30.5%를 달성했으며, 전년 대비 130베이시스 포인트 개선되었고, 0.6백만 달러의 긍정적인 조정 EBITDA를 기록하며 7분기 연속 성과를 냈습니다.

주요 개발 사항으로는 뉴욕 주 잼스타운에서의 미국 제조 확장을 위한 5080만 달러 EXIM 직접 대출 승인을 확보하고, 1280만 달러의 자본 제안을 완료한 것입니다. 이 회사는 1260만 달러의 운전 자본과 820만 달러의 현금 위치로 재무 상태를 강화했습니다.

Electrovaya는 2025년 4월 잼스타운 시설에서 상업 운영을 시작할 계획이며, 2025 회계 연도 매출 가이던스가 6천만 달러를 초과할 것임을 재확인했습니다, 이는 자재 취급 고객과 OEM 파트너로부터의 강력한 수요에 의해 지원됩니다.

Electrovaya (NASDAQ:ELVA) a publié les résultats financiers du premier trimestre 2025, avec un chiffre d'affaires de 11,2 millions de dollars, légèrement en baisse par rapport à 12,1 millions de dollars au premier trimestre 2024. La société a réalisé une marge brute de 30,5%, améliorée de 130 points de base d'une année sur l'autre, et a marqué son septième trimestre consécutif d'EBITDA ajusté positif à 0,6 million de dollars.

Parmi les développements clés, on note l'obtention d'une approbation de prêt direct EXIM de 50,8 millions de dollars pour l'expansion de la fabrication aux États-Unis à Jamestown, New York, et la réalisation d'une offre de capitaux de 12,8 millions de dollars. L'entreprise a renforcé son bilan avec un fonds de roulement de 12,6 millions de dollars et une position de liquidités de 8,2 millions de dollars.

Electrovaya prévoit de commencer ses opérations commerciales dans son établissement de Jamestown en avril 2025 et a réaffirmé ses prévisions de revenus pour l'exercice 2025 dépassant les 60 millions de dollars, soutenues par une forte demande de la part des clients en manutention de matériaux et des partenaires OEM.

Electrovaya (NASDAQ:ELVA) hat die finanziellen Ergebnisse für das erste Quartal 2025 veröffentlicht, mit einem Umsatz von 11,2 Millionen Dollar, leicht rückläufig von 12,1 Millionen Dollar im ersten Quartal 2024. Das Unternehmen erzielte eine Bruttomarge von 30,5%, was einer Verbesserung um 130 Basispunkte im Jahresvergleich entspricht, und verzeichnete das siebte aufeinanderfolgende Quartal mit positivem bereinigtem EBITDA von 0,6 Millionen Dollar.

Wichtige Entwicklungen umfassen die Sicherstellung einer Genehmigung für ein EXIM-Direktdarlehen in Höhe von 50,8 Millionen Dollar für die Expansion der Produktion in Jamestown, New York, sowie den Abschluss eines Eigenkapitalangebots in Höhe von 12,8 Millionen Dollar. Das Unternehmen stärkte seine Bilanz mit einem Working Capital von 12,6 Millionen Dollar und einer liquiden Mittelposition von 8,2 Millionen Dollar.

Electrovaya plant, im April 2025 den kommerziellen Betrieb in seiner Einrichtung in Jamestown aufzunehmen und bestätigte seine Umsatzprognose für das Geschäftsjahr 2025 von über 60 Millionen Dollar, unterstützt durch eine starke Nachfrage von Materialhandelskunden und OEM-Partnern.

- Seventh consecutive quarter of positive Adjusted EBITDA ($0.6M)

- Improved gross margin to 30.5% (up 130 basis points YoY)

- Secured $50.8M EXIM loan approval for manufacturing expansion

- Strengthened balance sheet with $12.6M working capital (vs -$0.4M in Q1 2024)

- Increased cash position to $8.2M (vs $0.6M in Q1 2024)

- Successfully raised $12.8M through equity offering

- Revenue declined to $11.2M from $12.1M in Q1 2024

- Dilution of shareholders through 5.95M share public offering

Insights

The Q1 2025 results reveal Electrovaya's strengthening financial foundation and execution capabilities in the lithium-ion battery sector. The 30.5% gross margin, improving by 130 basis points year-over-year, demonstrates robust pricing power and operational efficiency in a competitive market. The sustained battery system margins of 30.8% suggest strong product differentiation and cost management.

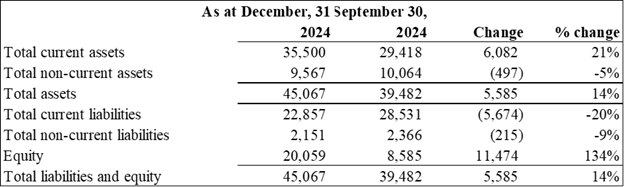

The transformation from negative $0.4M to positive $12.6M working capital represents a important inflection point, providing operational flexibility and reducing reliance on external financing for day-to-day operations. The $8.2M cash position, significantly up from $0.6M last year, creates a solid buffer for expansion initiatives.

The strategic significance of the $50.8M EXIM loan approval extends beyond mere financing - it validates the company's technology and business model while supporting domestic manufacturing capabilities. The accelerated timeline for the Jamestown facility, with operations starting in April 2025, positions Electrovaya to capitalize on potential reshoring trends and trade-related advantages.

The introduction of a leasing program with OEM partners represents a strategic shift toward recurring revenue streams, potentially improving customer acquisition and lifetime value. The renewed demand from Fortune 100 retail customers suggests strong product validation in mission-critical applications.

The $60M+ revenue guidance for FY2025 appears well-supported by:

- Existing purchase orders and pipeline visibility

- Expanding production capacity in Jamestown

- Growing demand from established customers

- Strategic financing secured for expansion

Revenue of

Strengthened Balance Sheet and improved financial position

Significant Progress in Closing EXIM and Bank Financing to support US Manufacturing Expansion and Overall Growth Plans

Reaffirms Fiscal 2025 Revenue Guidance Exceeding

TORONTO, ONTARIO / ACCESS Newswire / February 13, 2025 / Electrovaya Inc. ("Electrovaya" or the "Company") (NASDAQ:ELVA)(TSX:ELVA), a leading lithium-ion battery technology and manufacturing company, today reported its financial results for the first quarter of the fiscal year ending September 30, 2025 ("Q1 2025"). All dollar amounts are in U.S. dollars unless otherwise noted.

Financial Highlights:

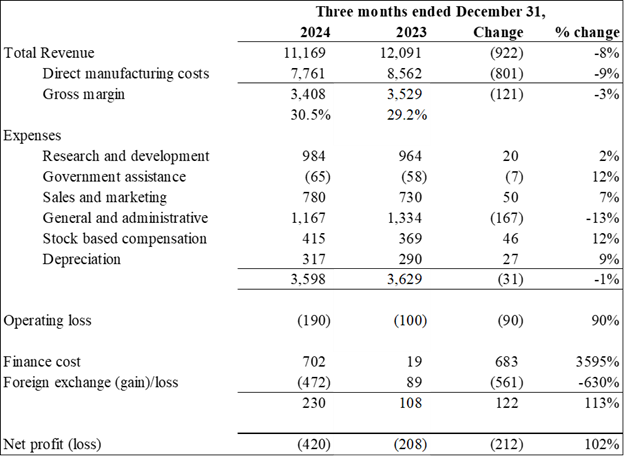

Revenue for Q1 2025 was

$11.2 million , compared to$12.1 million in the fiscal year ended December 31, 2023 ("Q1 2024").Gross margin was

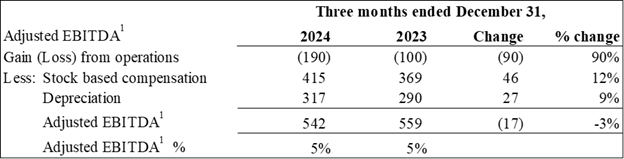

30.5% in Q1 2025, an improvement of 130 basis points compared to Q1 2024. Battery system margins remained strong at30.8% for the quarter.Adjusted EBITDA1 was

$0.6 million . Q1 2025 was the Company's seventh consecutive quarter of positive Adjusted EBITDA1.The Company had positive working capital of

$12.6 million for Q1 2025 compared to negative working capital of$0.4 million in Q1 2024.Cash in hand was

$8.2 million at the end of Q1 2025 compared to$0.6 million for Q1 2024.The Company paid off all debts associated with its property in Jamestown, New York, including the existing mortgage and promissory notes.

Key Operational and Strategic Highlights - Q1 2025

Received Direct Loan Approval from Export-Import Bank of the United States: On November 14, 2024, the Company announced that it had secured approval for a direct loan in the amount of US

$50.8 million from the Export-Import Bank of the United States ("EXIM") under the bank's "Make More in America" initiative. This financing is expected to fund Electrovaya's battery manufacturing buildout in Jamestown, New York including equipment, engineering and setup costs for the facility.Completed an Equity Offering with Gross Proceeds of

$12.8 million : On December 18, 2024, the Company, after giving effect to the full exercise of the Over-Allotment Option, sold 5,951,250 Common Shares under a public offering, for aggregate gross proceeds of US$12,795,188.00 . The Company intends to use the net proceeds from the Offering to satisfy conditions associated with the loan approved by EXIM, repayment of amounts under the Company's existing working capital facility in advance of proposed bank refinancing and for the costs of such financing, and satisfaction of certain outstanding amounts in connection with the purchase of the Company's Jamestown, New York manufacturing facility.Continued Growth from OEM Partners & Leading End-Customers: The Company continues to see good momentum from its key OEM partners and end customers of its material handling products. A recently introduced leasing program with one of the Company's OEM partners has demonstrated high sales interest and has already led to encouraging order traction. Furthermore, the Company has seen momentum growing from one of its key end customers for repowering existing warehouse infrastructure with Electrovaya batteries. Finally, the Company's current largest operator of battery equipment, a Fortune 100 retailer, has indicated renewed demand for Electrovaya's products.

Accelerated Battery Assembly Plans in Jamestown, New York: The Company has accelerated its plans for battery system assembly operations at its Jamestown facility. Assembly equipment that is used at its existing Ontario facility has been procured and hiring key personnel is underway. The Company anticipates being able to commence commercial operations in April 2025, however has capability to further accelerate if necessary. The start of assembly in Jamestown will help support ramp up in overall production while also supporting the Company's mitigation strategy with respect to potential trade barriers.

Progress in Closing EXIM & Bank Financing: Electrovaya is currently in the process of finalizing loan documentation with both EXIM and a leading North American bank for their respective financing packages to support both the Jamestown expansion as well as improve the Company's overall working capital position. The anticipated closing and funding date is in the current quarter, Q2 FY 2025.

Management Commentary:

"Q1 2025 was a successful and pivotal quarter for the Company, marked by significant financial and operational progress." stated Dr. Raj DasGupta, Electrovya's CEO. "This included receiving approval from EXIM for a

"Despite the typical weaker seasonality of Q1, we delivered strong financial performance, achieving over

Positive Financial Outlook & Fiscal 2025 Guidance:

The Company anticipates strong growth into FY 2025 with estimated revenues to exceed

Selected Financial Information for the quarters ended December 31, 2024 and 2023:

Results of Operations

(Expressed in thousands of U.S. dollars)

Adjusted EBITDA1

(Expressed in thousands of U.S. dollars)

1 Non-IFRS Measure: Adjusted EBITDA is defined as income/(loss) from operations, plus stock-based compensation costs and depreciation and amortization costs. Adjusted EBITDA does not have a standardized meaning under IFRS. Therefore it is unlikely to be comparable to similar measures presented by other issuers. Management believes that certain investors and analysts use adjusted EBITDA to measure the performance of the business and is an accepted measure of financial performance in our industry. It is not a measure of financial performance under IFRS, and may not be defined and calculated in the same manner by other companies and should not be considered in isolation or as an alternative to IFRS measures. The most directly comparable measure to Adjusted EBITDA calculated in accordance with IFRS is income (loss) from operations.

Summary Financial Position|

(Expressed in thousands of U.S. dollars)

The Company's complete Financial Statements and Management Discussion and Analysis for the quarter ended December 31, 2024 are available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov, as well as on the Company's website at www.electrovaya.com.

Conference Call details:

Date: Thursday, February 13, 2025

Time: 5:00 pm. Eastern Time (ET)

Toll Free: 888-506-0062

International: 973-528-0011

Participant Access Code: 253979

To help ensure that the conference begins in a timely manner, please dial in 10 minutes prior to the start of the call.

For those unable to participate in the conference call, a replay will be available for two weeks beginning on February 13, 2025 through February 27, 2025. To access the replay, the dial-in number is 877-481-4010 and 919-882-2331. The replay passcode is 51997.

Investor and Media Contact:

Jason Roy

VP, Corporate Development and Investor Relations=

Electrovaya Inc.

jroy@electrovaya.com

905-855-4618

About Electrovaya Inc.

Electrovaya Inc. (NASDAQ:ELVA) (TSX:ELVA) is a pioneering leader in the global energy transformation, focused on contributing to the prevention of climate change by supplying safe and long-lasting lithium-ion batteries without compromising energy and power. The Company has extensive IP and designs, develops and manufactures proprietary lithium-ion batteries, battery systems, and battery-related products for energy storage, clean electric transportation, and other specialized applications.Electrovaya has two operating sites in Canada and a 52-acre site with a 135,000 square foot manufacturing facility in Jamestown New York state for its planned gigafactory. To learn more about how Electrovaya is powering mobility and energy storage, please explore www.electrovaya.com.

Forward-Looking Statements

This press release contains forward-looking statements, including statements that relate to, among other things, revenue growth and revenue guidance of approximately

Revenue guidance for FY2025 described herein constitutes future‐oriented financial information and financial outlooks (collectively, "FOFI"), and generally, is, without limitation, based on the assumptions and subject to the risks set out above under "Forward‐Looking Statements". Although management believes such assumptions to be reasonable, a number of such assumptions are beyond the Company's control and there can be no assurance that the assumptions made in preparing the FOFI will prove accurate. FOFI is provided for the purpose of providing information about management's current expectations and plans relating to the Company's future performance, and may not be appropriate for other purposes.

The FOFI does not purport to present the Company's financial condition in accordance with IFRS, and it is expected that there may be differences between audited results and preliminary results, and the differences may be material. The inclusion of the FOFI in this news release disclosure should not be regarded as an indication that the Company considers the FOFI to be a reliable prediction of future events, and the FOFI should not be relied upon as such.

Contact Information

Jason Roy

VP, Corporate Development and Investor Relations

jroy@electrovaya.com

905-855-4618

SOURCE: Electrovaya, Inc.

View the original press release on ACCESS Newswire