Elemental Altus to Sell Diba Gold Project in Mali to Allied Gold, Operator of the Adjacent Flagship Sadiola Gold Mine for Cash & NSR Royalty

- Elemental Altus sells subsidiary Legend Mali to Allied Gold Corporation for up to US$6 million in cash and a 3% NSR royalty on gold produced from the Diba Project. The sale will contribute to Allied's near-term production and generate new royalties for Elemental Altus.

- None.

Vancouver, British Columbia--(Newsfile Corp. - July 20, 2023) - Elemental Altus Royalties Corp. (TSXV: ELE) (OTCQX: ELEMF) ("Elemental Altus" or "the Company") announces that it has executed a Sale & Purchase Agreement ("SPA") with Allied Gold Corporation ("Allied") for the sale of the Company's

Highlights:

- The Diba Project is located 15 kilometres south of the processing plant of Allied's flagship Sadiola Gold Mine ("Sadiola") and is adjacent to the Sadiola Large Scale Mining Licence

- Existing shovel-ready resource at Korali-Sud Small Scale Mining Licence to be incorporated into Sadiola mine plan in 2024 and 2025, fast tracking royalty revenue and cash payments to Elemental Altus

- Sale will add new near-term production royalty to the Company, comprising:

3.0% on first 226,000 ounces of gold produced from within Korali-Sud2.0% on all future production in excess of defined 226,000 ounces from the Project

- Additional consideration of up to US

$6 million in cash, made up of:- US

$1 million on Closing - US

$1 million 90 days after commercial production with a long-stop date of 2025 - US

$2 million within 90 days of production of 100,000 ounces from within Korali-Sud - US

$1 million within 90 days of production of 150,000 ounces from within Korali-Sud - US

$1 million within 90 days of production of 200,000 ounces from within Korali-Sud

- US

- Diba hosts a NI 43-101 compliant Preliminary Economic Assessment1 ("PEA") which confirmed a Mineral Resource Estimate of:

- 312,000 ounces of gold with a grade of 1.24 g/t in the Indicated Category, including 199,000 ounces of gold in oxides with an average grade of 1.52 g/t; and

- 362,000 ounces of gold at 0.88 g/t in the Inferred Category

- Allied plans to commence an infill drilling campaign to refine and expand the potential contribution of Diba to Sadiola's near term production profile

- Additional excellent potential exists for further expansion beyond the existing Resource based on the 107 square km Project area in the same geological district as Sadiola with historical drill results including:

- 4.78 g/t over 12m from Diba NW prospect

- 1.23 g/t Au over 127m at Lakanfla Central prospect

- Potential for 'Yatela type' carbonate-hosted karst targets at Lakanfla

- Deal demonstrates Company's ability to generate new and high impact royalties

Frederick Bell, CEO of Elemental Altus, commented:

"We are delighted to enter this sale and royalty transaction with Allied Gold on our Diba Gold Project in western Mali. After a competitive process, we selected Allied as the successful bidder given the incredibly compelling operational synergies with their adjacent Sadiola Gold mine complex, which is one of the largest and longest operating multi open-pit gold mines in Mali. Oxide material from the Project is expected to be fast-tracked to production at Sadiola, greatly accelerating the time to first royalty cashflows, while also mitigating risks associated with the construction of a new mine.

The Consideration is a tiered NSR royalty of

Based on our work to-date, we are confident that the Diba Project has significant exploration upside potential, being adjacent to and along strike from a historical resource of over 10 million ounces. We believe Allied's team have the technical capability to unlock the potential and deliver considerable future value to the Company through the uncapped life of mine royalty."

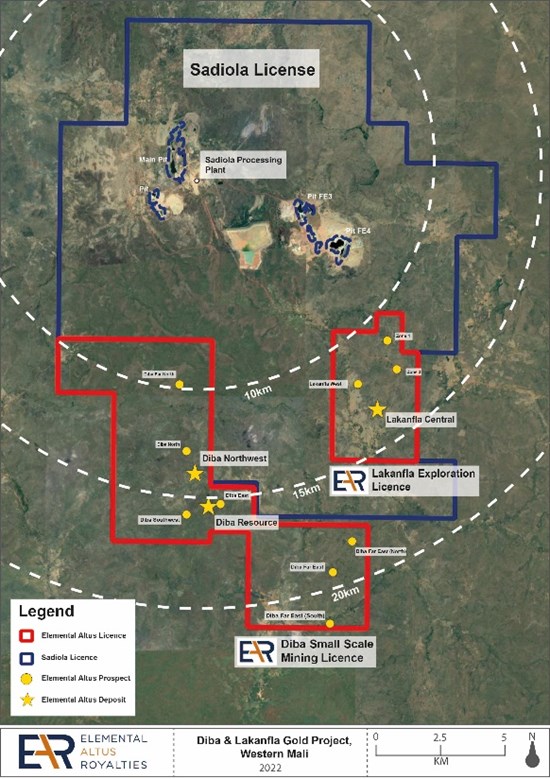

Diba Gold Project: Location

The 107km2 Korali Sud Small Scale Mining Licence and Lakanfla Exploration Licence are located 5km apart in the Kayes region of western Mali along the Senegal-Mali shear zone, approximately 450km northwest of the capital city of Bamako (see Map 1). The Project is contiguous with the multi-million ounce Sadiola gold mine licence acquired by Allied Gold Corporation from the previous operators AngloGold Ashanti and IAMGOLD Corporation, and 35km south of the multi-million ounce Yatela former gold mine.

Map 1. Location of the Diba Gold Project and Sadiola Gold Mine

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8358/174207_47f21b9a34055a02_001full.jpg

Diba Gold Project: Geology and Mineralisation

Diba Small Scale Mining Licence

Mineralisation at the Diba deposit is sediment-hosted within a series of stacked quartz lenses, typically between 20m and 40m thick (see Map 2). The lenses are shallow-dipping at approximately 30 degrees angled to the east/east-southeast. The Diba deposit is considered to be controlled by a number of northwest and northeast orientated structures, with gold occurring as fine-grained disseminations in localised high-grade, calcite-quartz veinlets. Alteration at the Diba deposit is typically albite-hematite+/-pyrite, although pyrite content is generally very low (<

Lakanfla Licence

The Lakanfla licence hosts a significant number of active and historic artisanal gold workings coincident with significant geochemical and gravity anomalies. The workings surround the Kantela granodiorite intrusion and cover an area of approximately 900m x 500m. The gold mineralisation at Lakanfla is typically hosted within breccia zones which cut the granodiorite and surrounding carbonate metasediments. Drilling by the Company has intersected 1.23 g/t Au over 127m at the Lakanfla Central prospect, while historical intersections by previous operators include 9.78 g/t Au over 12m and 5.20 g/t Au over 16m as well as having intersected voids and unconsolidated sand from 165-171m depth. The Company has not verified the historic drilling data at the Lakanfla licence.

Map 2: Cross section of the Diba Gold Deposit

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8358/174207_47f21b9a34055a02_002full.jpg

SPA Terms and Advisors

The Company has entered into an agreement to sell its

The consideration is comprised of a

Elemental Altus' financial advisor for the transaction is National Bank Financial.

On behalf of Elemental Altus Royalties Corp.

Frederick Bell

CEO and Director

Corporate & Media Inquiries:

Jacy Zerb, VP Investor Relations

Direct: +1 604-243-6511 ext. 2700

j.zerb@elementalaltus.com

Elemental Altus is a proud member of Discovery Group. For more information please visit: www.discoverygroup.ca or contact 604-653-9464.

TSX.V: ELE | OTCQX: ELEMF | ISIN: CA28619K1093 | CUSIP: 28619K109

About Elemental Altus Royalties Corp.

Elemental Altus is an income generating precious metals royalty company with 10 producing royalties and a diversified portfolio of pre-production and discovery stage assets. The Company is focused on acquiring uncapped royalties and streams over producing, or near-producing, mines operated by established counterparties, as well as generating royalties on new discoveries. The vision of Elemental Altus is to build a global gold royalty company, offering investors superior exposure to gold with reduced risk and a strong growth profile.

About Allied Gold Corp Limited

Allied is a private company focused on gold mining asset transformation in Africa. Allied has three mines and several development and exploration projects in Africa where it has significant operating experience. Operations are located in Côte d'Ivoire, Mali, Ethiopia and Egypt. Led by a team of mine developers with proven success in adding value to tier one assets, AGC aspires to become a mid-tier next generation gold producer in Africa and ultimately a leading senior global gold producer.

1 The Project Mineral Resource and Mineral Reserve Estimates quoted are those published in Altus Strategies 2022 NI 43-101 report: "Altus Strategies: Diba & Lakanfla Project Heap Leach Preliminary Economic Assessment (NI43-101), Mali" dated 1 August, 2022, effective as at 1 August 2022; Report author: Matthew Field, BSc, BSc Hons, MSc, PhD as Principal Consulting Geologist with Mining Plus UK Ltd

Qualified Person

Steven Poulton, Executive Chairman for Elemental Altus, and a qualified person under National Instrument 43-101 - Standards of Disclosure for Mineral Projects, has reviewed and approved the scientific and technical disclosure contained in this press release.

Neither the TSX-V nor its Regulation Service Provider (as that term is defined in the policies of the TSX-V.) accepts responsibility for the adequacy or accuracy of this press release.

Cautionary note regarding forward-looking statements

This news release contains certain "forward looking statements" and certain "forward-looking information" as defined under applicable Canadian securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "intend", "estimate", "anticipate", "believe", "continue", "plans" or similar terminology.

Forward-looking statements and information include, but are not limited to, statements with respect to the date that the name change is expected to become effective, whether shareholders will be required by their broker to exchange their issued certificate for a new certificate or take any other action in connection to the name change, the Company's ability to deliver a materially increased revenue profile with a lower cost of capital, the future growth, development and focus of the Company, and the acquisition of new royalties and streams. Forward-looking statements and information are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that, while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties and contingencies.

All of the results of the PEA on the Project constitute forward-looking information, including estimates of internal rates of return, net present value, future production, estimates of cash cost, assumed long term price for gold of US

Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of Elemental Altus to control or predict, that may cause Elemental Altus' actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including but not limited to: the impact of general business and economic conditions, the absence of control over the mining operations from which Elemental Altus will receive royalties, risks related to international operations, government relations and environmental regulation, the inherent risks involved in the exploration and development of mineral properties; the uncertainties involved in interpreting exploration data; the potential for delays in exploration or development activities; the geology, grade and continuity of mineral deposits; the impact of the COVID-19 pandemic; the possibility that future exploration, development or mining results will not be consistent with Elemental Altus' expectations; accidents, equipment breakdowns, title matters, labour disputes or other unanticipated difficulties or interruptions in operations; fluctuating metal prices; unanticipated costs and expenses; uncertainties relating to the availability and costs of financing needed in the future; the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses, commodity price fluctuations; currency fluctuations; regulatory restrictions, including environmental regulatory restrictions; liability, competition, loss of key employees and other related risks and uncertainties. For a discussion of important factors which could cause actual results to differ from forward-looking statements, refer to the annual information form of the Company for the year ended 31 December 2022. Elemental Altus undertakes no obligation to update forward-looking statements and information except as required by applicable law. Such forward-looking statements and information represents management's best judgment based on information currently available. No forward-looking statement or information can be guaranteed, and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/174207

FAQ

What is the sale price of the subsidiary Legend Mali?

What is the royalty agreement for the Diba Project?

How will the sale affect Elemental Altus?