Electric Royalties Signs Rana Nickel Royalty Purchase Agreement

Electric Royalties Ltd. has signed a definitive purchase agreement to acquire a 1% net smelter revenue royalty on the Rana Nickel Project in Norway. This includes four exploration licenses covering 25 square kilometers, alongside cash consideration of $100,000. The Company will issue 2 million common shares, subject to a voluntary escrow lock-up. The Rana Nickel Project, which includes the former Bruvann Nickel mine, showcases historical estimates of 9.15 million tonnes of resources. The agreement facilitates further advancement of the project, aiming for updated resources within 12 to 24 months.

- Acquisition of a 1% net smelter revenue royalty may enhance long-term revenue potential.

- Rana Nickel Project has historical production and exploration data indicating a significant resource base.

- The project is strategically located with existing infrastructure and ice-free access year-round.

- Plans for resource updates within 12 to 24 months signal potential growth and development.

- None.

Insights

Analyzing...

VANCOUVER, BC / ACCESSWIRE / December 16, 2021 / Electric Royalties Ltd. (TSXV:ELEC)(OTCQB:ELECF) ("Electric Royalties" or the "Company") is pleased to announce the signature of the definitive purchase agreement of the previously announced Rana Nickel Royalty acquisition (see news release dated October 19, 2021) with Scandinavian Resource Holdings ("SRH") and Global Energy Metals Corp. (GEMC) to acquire a

Rana Nickel Royalty Acquisition Highlights

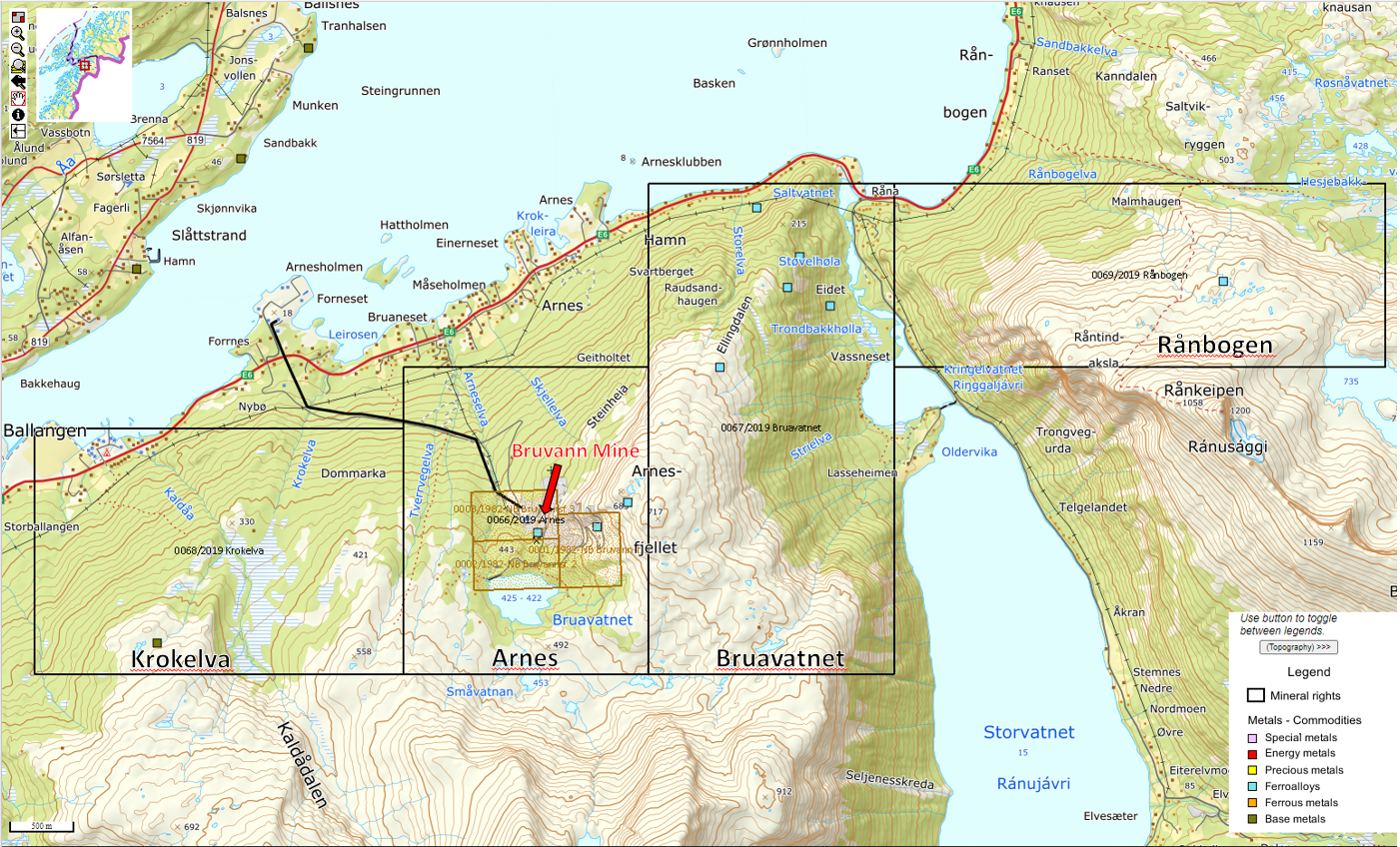

- The Rana Nickel Project is located on the Ofoten Fjord in Northern Norway which is ice-free year-round. The area is well serviced by the country's main highway and benefits from nearby international airport facilities.

- The project includes the past producing Bruvann Ni-Cu-Co mine which was in production from 1989 until 2002 and processed 8.2 million tonnes of ore at an average grade of

0.52% Ni,0.1% Cu and0.02% Co1. - A historical estimate of the remaining resource is 9.15 million tonnes at grades of

0.36% Ni,0.09% Cu and0.01% Co above a cut-off of0.3% Ni1. No classification of the estimate was reported. The estimate is historical in nature and does not qualify as mineral resources under CIM Definition standards and NI 43-101. A qualified person under has not done sufficient work to classify the estimate as current mineral resources and the Company is not treating it as current. - Available maintained mine infrastructure includes power, roads, and conveyor from mine site to existing port facilities.

- Large historical drill database of 3,845 holes which demonstrates compelling near mine exploration potential.

- Underexplored property with demonstrated exploration potential and near mine exploration potential with the mineralization reported to be open in several directions.

Rana Nickel Royalty Development Update

Electric Royalties is also pleased to announce that Metals One plc has signed a definitive term sheet to acquire

Metals One plc is an exciting new battery minerals exploration company focused on assets in the Scandinavian region and on the doorstep of the burgeoning European EV market. More detail on Metals One plc can be found at https://metals-one.com.

Rana Nickel Project Exploration Upside

All of the mineral occurrences within the 4 mining licenses at Råna are hosted in the 70km2 Råna mafic-ultramafic intrusion. The most significant of these occurrences is the formerly producing Bruvann Nickel Mine which was operated from 1989 to 2002 by Nickel og Olivin AS in association with Outokumpu OY.

Significant underground resources remain at Bruvann and it is the most important asset on the property. A report tabled by the NGU in 2007 stated that "…it is unlikely that the Bruvann mineralization is the richest in the complex." Recent exploration work guided primarily by geophysics elsewhere within the licenses has shown good potential to discover additional nickel-copper deposits.

Rana Nickel Project licenses, Bruvann Mine Location and mine access

Near Mine Exploration Potential

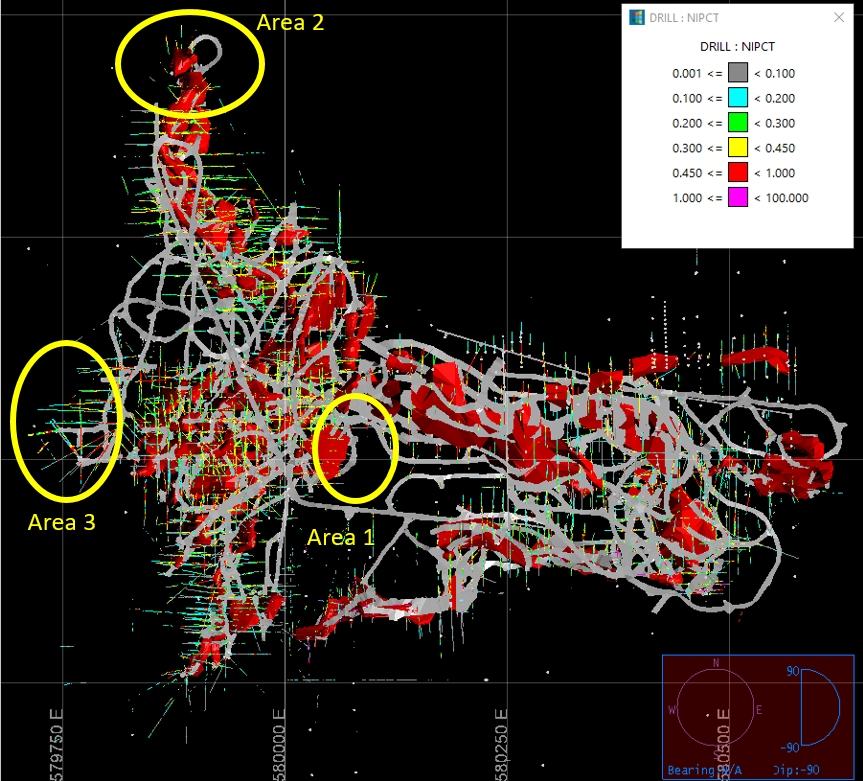

Several areas adjacent to mine workings offer good potential to discover additional resources. The most prospective of which are shown in the figures as Areas 1, 2, 3.

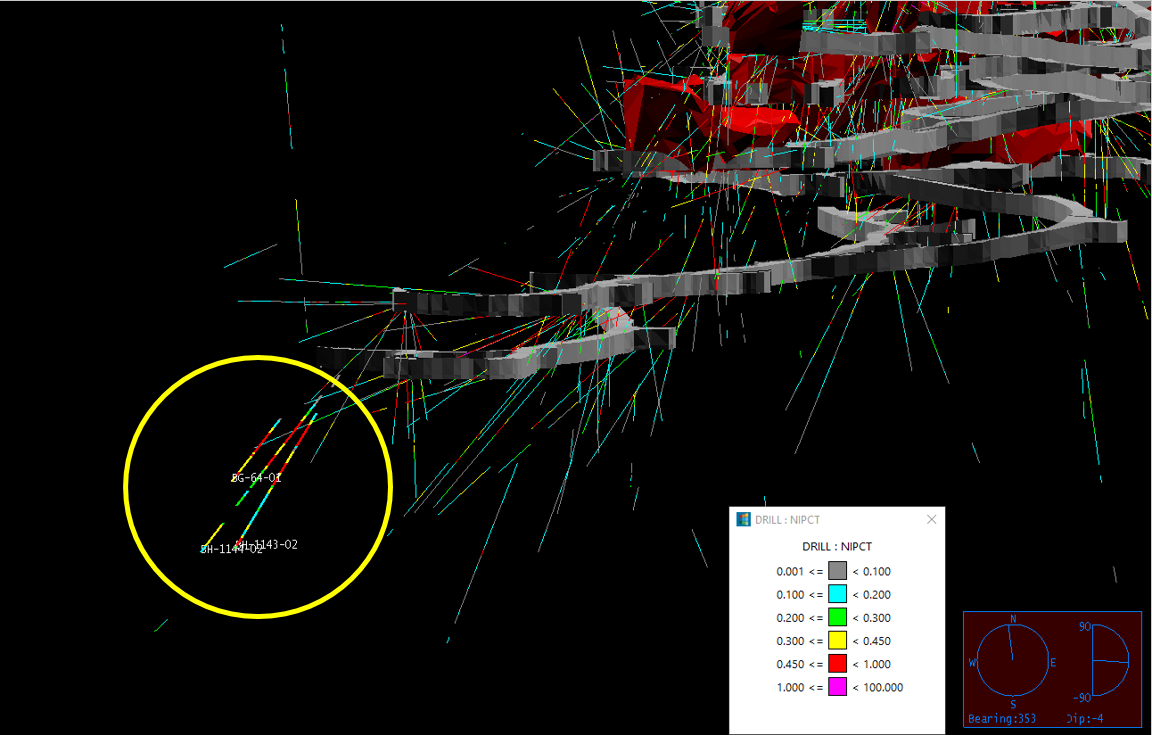

Plan view of the Bruvann mine showing stopes (red), ug development (grey), drilling, and areas of near mine exploration potential

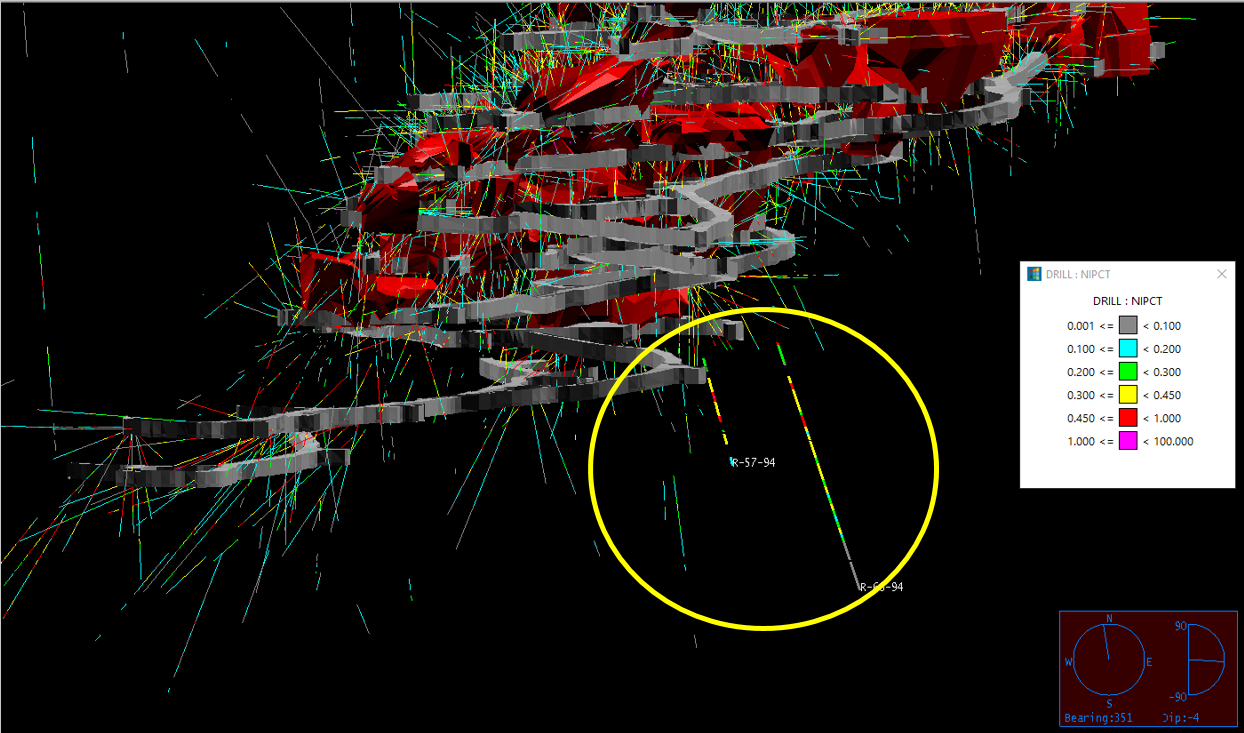

Area 1 occurs below existing workings in the central part of the deposit.

Showing Area 1 exploration potential

Area 2 is in the northern part of the deposit, where the mineralization is very poorly defined but where there are several drill holes which indicate the potential for a continuation of the mineralization. As in Area 1, this part of the deposit is well accessed by multiple mine levels facilitating access.

Showing Area 2 exploration potential

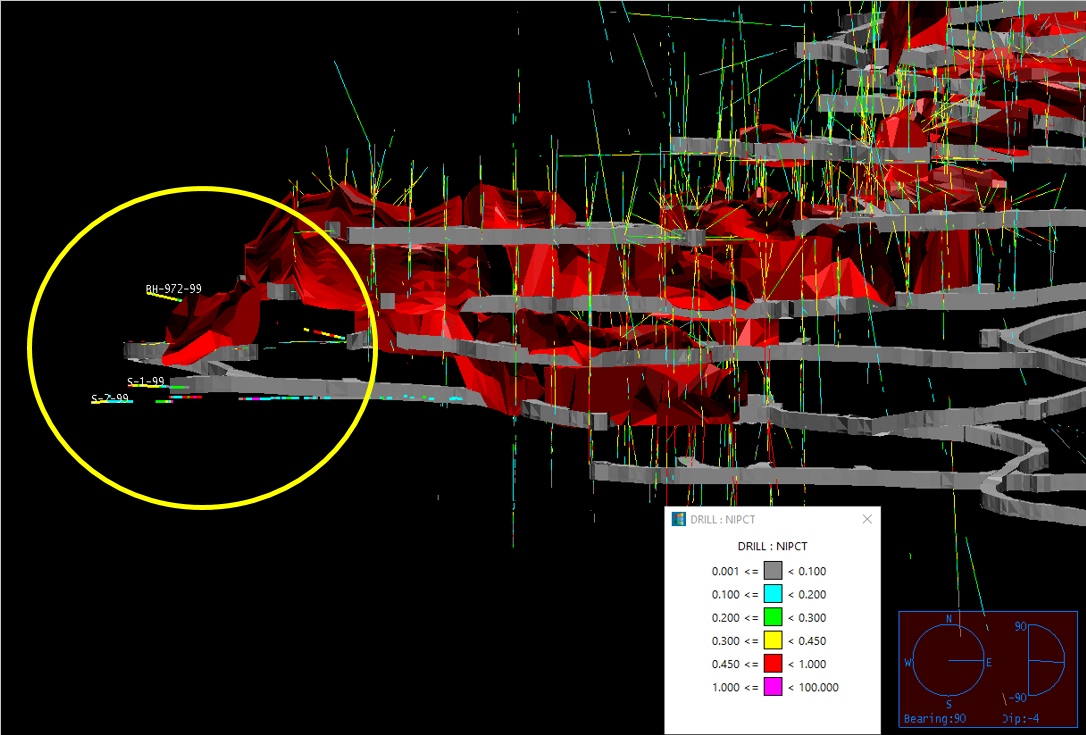

Area 3 lies on the west side of the deposit. As in Area 2, mining has occurred to a point, but drilling strongly indicates a continuation of the mineralization, and the area is accessible from several existing levels.

Showing Area 3 exploration potential

Brendan Yurik, CEO of Electric Royalties commented, "Underexplored historically producing nickel mines like Rana in tier 1 jurisdictions are an excellent place to search for future nickel supply to fill the looming supply / demand gap in an ESG friendly way and with less risk than greenfield projects.

More than

David Gaunt, P.Geo., a Qualified Person who is not independent of Electric Royalties, has reviewed and approved the technical information in this release.

About Electric Royalties Ltd.

Electric Royalties is a royalty company established to take advantage of the demand for a wide range of commodities (lithium, vanadium, manganese, tin, graphite, cobalt, nickel, zinc & copper) that will benefit from the drive toward electrification of a variety of consumer products: cars, rechargeable batteries, large scale energy storage, renewable energy generation and other applications.

Electric vehicle sales, battery production capacity and renewable energy generation are slated to increase significantly over the next several years and with it, the demand for these targeted commodities. This creates a unique opportunity to invest in and acquire royalties over the mines and projects that will supply the materials needed to feed the electric revolution.

Electric Royalties has a growing portfolio of 18 royalties, including one royalty that currently generates revenue. The Company is focused predominantly on acquiring royalties on advanced stage and operating projects to build a diversified portfolio located in jurisdictions with low geopolitical risk, which offers investors exposure to the clean energy transition via the underlying commodities required to rebuild the global infrastructure over the next several decades towards a decarbonized global economy.

For further information, please contact:

Brendan Yurik Tel: (604) 364‐3540

Brendan.yurik@electricroyalties.com

www.electricroyalties.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange), nor any other regulatory body or securities exchange platform, accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward-Looking Information and Other Company Information

This news release includes forward-looking information and forward-looking statements (collectively, "forward-looking information") with respect to the Company within the meaning of Canadian securities laws. Forward looking information is typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. This information represents predictions and actual events or results may differ materially. Forward-looking information may relate to the Company's future outlook and anticipated events and may include statements regarding the financial results, future financial position, expected growth of cash flows, business strategy, budgets, projected costs, projected capital expenditures, taxes, plans, objectives, industry trends and growth opportunities of the Company and the projects in which it holds royalty interests.

While management considers these assumptions to be reasonable, based on information available, they may prove to be incorrect. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company or these projects to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These risks, uncertainties and other factors include, but are not limited to risks associated with general economic conditions; adverse industry events; marketing costs; loss of markets; future legislative and regulatory developments involving the renewable energy industry; inability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favourable terms; the mining industry generally, the Covid-19 pandemic, recent market volatility, income tax and regulatory matters; the ability of the Company or the owners of these projects to implement their business strategies including expansion plans; competition; currency and interest rate fluctuations, and the other risks.

The reader is referred to the Company's most recent filings on SEDAR as well as other information filed with the OTC Markets for a more complete discussion of all applicable risk factors and their potential effects, copies of which may be accessed through the Company's profile page at www.sedar.com and at otcmarkets.com.

1 The past production and historical estimate for the Rana Project and the figures below are derived from the government report: Carl Olaf Mathiesen and Rognvald Boyd, 2017: History of exploration of the nickel resources of the Råna Intrusion, Nordland, Norway, NGU Report 2017.31, available at https://www.ngu.no/upload/Publikasjoner/Rapporter/2017/2017_031.pdf .

SOURCE: Electric Royalties Ltd.

View source version on accesswire.com:

https://www.accesswire.com/677977/Electric-Royalties-Signs-Rana-Nickel-Royalty-Purchase-Agreement