Emgold Provides Exploration Update For its New York Canyon Property, NV

Emgold Mining Corporation (OTCQB: EGMCF) announced significant assay results from its New York Canyon Property in Nevada. Key findings include drill hole NYCN0010 with 16.6 m of 0.263% CuEq. Kennecott Exploration Company (KEX), a Rio Tinto subsidiary, completed 4,481 m of drilling in 2021, surpassing their initial plan. KEX has spent US$5.0 million on exploration, positioning them to exercise a 55% interest option in the property within five years of the February 2020 agreement. The property consists of 417 claims covering approximately 8,700 acres.

- Significant assay results from NYCN0010, including 16.6 m of 0.263% CuEq.

- KEX completed 4,481 m of drilling, doubling the originally planned scope.

- KEX spent US$5.0 million in exploration expenditures, meeting the required investment to exercise their First Option.

- None.

VANCOUVER, BC / ACCESSWIRE / March 7, 2022 / Emgold Mining Corporation (TSXV:EMR)(OTCQB:EGMCF)(FRA:EMLM)(BSE:EMLM) ("Emgold" or the "Company") announces assay results from the final three exploration diamond core holes drilled at its New York Canyon Property, NV (the "Property") in 2021. Exploration activities are being carried out by Kennecott Exploration Company ("KEX"), a subsidiary of Rio Tinto plc, in connection with KEX's earn-in obligations under the Earn-In with Option to Joint Venture Agreement (the "Agreement") between Emgold and KEX first announced by press release on February 11, 2020.

Key exploration results include:

- Hole NYCN0010 intersected 16.6 m of

0.263% CuEq, 14.9 m of0.131% CuEq, and 31.47 m of0.108% CuEq as shown in Table 3 below; - KEX completed 4,481 m (14,701 ft) of drilling in 10 core holes in 2021;

- Results of a passive seismic geophysical survey completed by KEX indicates potential to expand the three main exploration targets on the Property, the Copper Queen, Champion, and Longshot Ridge Targets, to the southeast; and

- KEX has now completed US

$5.0 million in exploration expenditures on the Property, including US$1.0 million that was required to be spent within 18 months of signing the Agreement. They are now in a position to exercise their First Option, as described further below, to earn a55% interest in the Property. They have five years from February 7, 2020, the date of the Agreement, to exercise this First Option.

David Watkinson, President and CEO of Emgold, stated, "KEX has wrapped up its 2021 exploration field work at New York Canyon and made significant progress, doubling the scope of their originally planned drill program and associated expenditures. They are currently analyzing the results of this work and completing a 3-D exploration model for the Property. It is expected the model will be completed in the first half of 2022, after which they plan to continue their field exploration efforts at New York Canyon."

This press release should be read in conjunction with Emgold's April 8, July 22, and October 4, 2021, press releases as well as Emgold's January 26, 2022, press release, all of which provide information on the 2021 exploration program and results at New York Canyon.

About the New York Canyon Property

The Property currently consists of 417 unpatented claims and twenty-one patented claims totaling approximately 8,700 acres. It is located in the Santa Fe Mining District, Mineral County, west-central Nevada, and about 30 mi. (48 km) east of the town of Hawthorne. KEX is exploring the Property to expand the copper skarn and copper porphyry mineralization. Total historic drilling on the Property, prior to the current drill program, is 234 holes totaling about 43,000 m (139,000 ft). KEX completed an additional 4,481 m (14,701 ft) of core drilling in 2021.

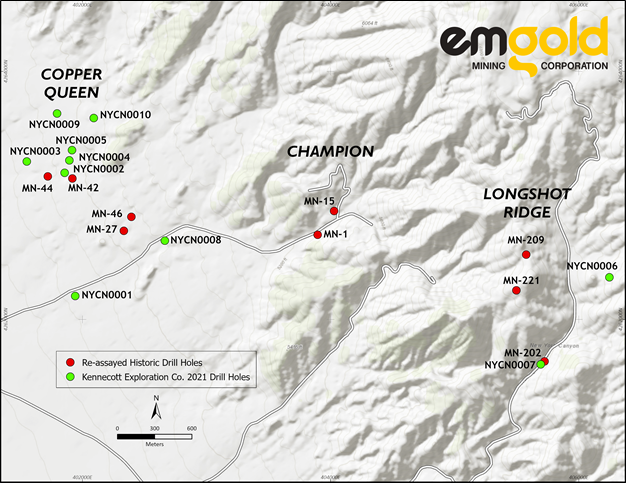

The Property is an advanced stage exploration project consisting of three main copper targets which were first explored in the mid-1960's, with the last historic drilling completed in 2006. These historic targets, situated west to east respectively, are called Copper Queen, Champion, and Longshot Ridge. A claim map showing the location of these targets is shown in Figure 1.

The Property is subject to an Earn-In with Option to Joint Venture Agreement (the "Agreement") between Emgold and KEX first announced by press release on February 11, 2020. KEX can earn up to a

Figure 1

New York Canyon Property

Claim Map and Exploration Target Areas

Claim map excludes a block of 27 non-contiguous claims to the north that make up part of the property (the North Block).

Historic Exploration on the Property

From the Copper Queen Target on the west side of the Property to Longshot Ridge Target on the east side, is a length of 6.4 km (4.0 miles). The average width of the known mineralization is 3.2 km (2.0 miles). Copper mineralization, including skarn and porphyry types, is found in all three deposits.

Copper Queen Target

Historic exploration by Conoco in the 1970's and 1980's defined copper sulfide skarn and porphyry mineralization at the Copper Queen Target. Drilling reported in a May 10, 1979, internal report included a significant interval of chalcopyrite and molybdenite mineralization in drill-hole MN-42, drilled in 1977. MN-42 intersected 1,020 ft (310.9m) of

KEX re-assayed MN-42, with assay results summarized in the October 4, 2021, press release. The re-assay results included 1,310 ft (399.3 m) of

Champion Target

The Champion Target was explored from the late 1960s through the 1970s, but to a lesser extent than Copper Queen and Longshot Ridge. Historic core drilling intersected oxide and sulfide copper skarn mineralization, but historical mineral resources were not delineated.

Longshot Ridge Target

Oxide skarn mineralization has been drilled at the Longshot Ridge Target by various operators since the 1960's. Most recently, Searchlight Resources Inc. (TSXV: SCLT) (formerly known as Canyon Copper Corporation and Aberdene Mines Limited) drilled the Property between 2004 and 2006 and completed a 2010 Technical Report. Searchlight defined an indicated resource of 16.3 million tons (14.8 million tonnes) of

2021 Drilling Program to Date by KEX

Kennecott drilled ten core holes at the Property in 2021. Assays have now been received for all 10 holes, as shown in Table 1. Seven holes were drilled in the Copper Queen Target. Two holes were drilled in the Longshot Ridge Target. No holes were drilled in the Champion Target. A geophysical anomaly, called Ideal, was targeted with one drillhole, and is located to the south of the Copper Queen Target. The location of the ten drill holes drilled to date and ten historic drill holes re-assayed by KEX (discussed in previous press releases) are shown in Figure 2.

Detailed information about the ten KEX drill holes drilled in 2021 is shown in Table 2. Assay results from seven of the ten holes was previously released by Emgold. The assay results from the three remaining holes, NYCN0007, NYCN0009, and NYCN0010 are shown in Table 3. NYCN00010 showed intercepts greater than or equal to

Table 1

New York Canyon Property

2021 Drill Program Status

Hole or | Target | Depth or Planned | Drilling | Logging | Samples | Assays | Assays Tabulated |

| NYCN0001 | Ideal | 347.78 | Complete | Complete | Yes | Yes | Yes |

| NYCN0002 | Copper Queen | 716.28 | Complete | Complete | Yes | Yes | Yes |

| NYCN0003 | Copper Queen | 390.14 | Complete | Complete | Yes | Yes | Yes |

| NYCN0004 | Copper Queen | 348.00 | Complete | Complete | Yes | Yes | Yes |

| NYCN0005 | Copper Queen | 318.52 | Complete | Complete | Yes | Yes | Yes |

| NYCN0006 | Longshot | 503.53 | Complete | Complete | Yes | Yes | Yes |

| NYCN0007 | Longshot | 421.38 | Complete | Complete | Yes | Yes | Yes |

| NYCN0008 | Copper Queen | 410.56 | Complete | Complete | Yes | Yes | Yes |

| NYCN0009 | Copper Queen | 473.81 | Complete | Complete | Yes | Yes | Yes |

| NYCN0010 | Copper Queen | 550.47 | Complete | Complete | Yes | Yes | Yes |

Figure 2

New York Canyon Property

Location of KEX 2021 Drill Holes and Re-Assayed Drill Holes

Table 2

New York Canyon Property

Drill Hole Information

Drill Hole | Easting | Northing | Elevation | Azimuth | Dip | Target Depth | Actual Depth | |

NYCN0001 | 401942 | 4262189 | 1,421.1 | 142 | -80 | 400 | 347.8 | |

NYCN0002 | 401856 | 4263182 | 1,444.8 | 30 | -85 | 700 | 716.3 | |

NYCN0003 | 401552 | 4263273 | 1,419.3 | 360 | -90 | 700 | 390.1 | |

NYCN0004 | 401894 | 4263282 | 1,449.6 | 360 | -90 | 700 | 348.4 | |

NYCN0005 | 401915 | 4263365 | 1,445.0 | 360 | -90 | 700 | 318.5 | |

NYCN0006 | 406247 | 4262339 | 1,924.1 | 70 | -85 | 500 | 503.5 | |

NYCN0007 | 405693 | 4261637 | 1,901.2 | 340 | -70 | 750 | 421.4 | |

NYCN0008 | 402663 | 4262635 | 1,493.9 | 300 | -70 | 400 | 410.6 | |

NYCN0009 | 401795 | 4263750 | 1,438.0 | 360 | -90 | 700 | 473.81 | |

NYCN0010 | 402091 | 4263624 | 1,480.9 | 195 | -70 | 500 | 550.47 |

Table 3

New York Canyon Property

Drilling Results

Drill Intercepts Greater than

Drill Holes NYCN0007, NYCN0009 to NYCN0010

Hole ID | From | To | Length | Cu | Mo | Ag | Au | CuEq |

(m) | (m) | (m) | % | % | g/t | g/t | % | |

| NYCN0007 | 103.00 | 106.00 | 3.00 | 0.020 | 0.000 | 29.980 | 0.010 | 0.312 |

| and | 333.00 | 336.21 | 3.21 | 0.005 | 0.011 | 7.430 | 0.009 | 0.114 |

| NYCN0009 | 270.40 | 273.40 | 3.00 | 0.150 | 0.000 | 2.380 | 0.001 | 0.173 |

| and | 344.12 | 348.34 | 4.22 | 0.332 | 0.001 | 4.947 | 0.011 | 0.382 |

| and | 396.05 | 399.00 | 2.95 | 0.098 | 0.000 | 1.115 | 0.003 | 0.110 |

| and | 412.85 | 416.34 | 3.49 | 0.683 | 0.000 | 10.081 | 0.012 | 0.783 |

| NYCN0010 | 44.50 | 61.10 | 16.60 | 0.181 | 0.007 | 5.969 | 0.006 | 0.263 |

| and | 68.50 | 83.40 | 14.90 | 0.019 | 0.031 | 0.810 | 0.005 | 0.131 |

| and | 519.00 | 550.47 | 31.47 | 0.054 | 0.014 | 0.775 | 0.006 | 0.108 |

- True widths unknown.

- Copper equivalent grades are calculated based on US

$3.00 per lb Cu, US$10.00 per lb Mo, US$19.00 per oz Ag, and US$1,750 per oz Au approximating average prices for those metals over the previous three years. No adjustment has been made for recovery.

Significant assays, defined in this press release as intervals greater than

- 16.60 m of

0.263% CuEq in NYCN0010 from 44.50 m to 61.10 m; - 14.90 m of

0.131% CuEq in NYCN0010 from 68.50 m to 83.40 m; and - 31.47 m of

0.108% CuEq in NYC0010 from 519.00 m to 500.47 m (bottom of hole)

Other Work Completed by KEX as Part of the 2021 Exploration Program

Other work completed as part of its 2021 Exploration Program includes:

- Geologic, structural, and alteration mapping;

- Re-assaying of selected intervals of 10 historic core holes;

- Surface rock chip sampling;

- A UAV drone magnetic geophysics and DEM survey was completed by MWH Geo-Surveys over the majority of the Property and over the northwest corner of the claims;

- A passive seismic geophysics survey completed by Magee Geophysical Services LLC and IM Seismology; and

- Carbon-oxygen isotope analysis was competed for historic holes MN-202 and MN-221.

The passive seismic geophysics survey is new technology that has been useful to map pediment-bedrock contacts and contrasting lithologies, including skarns, at New York Canyon. The survey recorded data for 25 days at 407 stations. Preliminary results indicated that there is potential to expand the Copper Queen, Champion, and Longshot Ridge deposits to the southeast into areas that received little exploration attention historically. This will initially involve field mapping of lithologies and alteration, and ultimately, drilling if warranted.

KEX Plans for 2022

KEX is currently analyzing results from the 2021 exploration program. They plan to complete a 3-D geologic model for the Property using Leapfrog software in early 2022, to do additional geologic and mapping, and plan to subsequently assess potential for additional drill targets. The scope and timing of any future drilling remains undefined at this time, pending completion of the above work. Note that work continues to be impacted by Covid-19.

QA/QC Methods

The drill used was a Boart Longyear LF-160. In the three holes, a PWT size casing was installed from the surface to varying depths, with the maximum depth being 110 m. In hole NYCN0007, PQ coring was completed from 6.1 m to a depth of 216.1 m, followed by HQ size to 369.1 m. Core was then reduced to NQ size to a depth of 421.4 m. In NYCN0009, the core size was PQ from 109.7 to 260.6 m, and then reduced to HQ size to a depth of 473.8 m. In hole NYCN0010, the core size was PQ from 83.8 m to 225.6 m and was then reduced to HQ to a depth of 550.5 m.

Drill core was initially taken to a field core logging facility on the Property and scanned with an XRF device and quick-logged by the field geologist. Core samples were then shipped to KEX's core logging facility in Salt Lake City, where they were photographed and logged in detail. Detailed logging includes rock types, alteration, and structures. Core was sawed in half, and samples prepared, labeled, and shipped to ALS Laboratories ("ALS") in Elko Nevada. In the three holes, core samples were typically 1.5 m in length while drilling with PQ core, and approximately 3.0 m in length when drilling with HQ and NQ size.

ALS is an ISO/IEC 17025:2017 accredited laboratory. ALS prepared the samples and analyzed them using ME-MS61L. If certain elements, including copper, exceeded certain values, additional analyses were done using ME-OG62. Gold was also analyzed using method Au-ICP21. The lab inserted standards and duplicates as part of its internal QA/QC program. ALS is independent from both KEX and Emgold.

KEX follows strict QA/QC measures. As part of the KEX QA/QC program, independently certified control samples (standards, blanks, and duplicate samples) were inserted into the sample stream for each analytical batch. In general, a blank was inserted at the start of each stream and then every 10th sample was a QA/QC sample, alternating between blanks, standards, and duplicates. Standards were inserted with every submitted batch of samples, and to match the level of mineralization as much as possible. Additional blanks were sometimes included before visibly mineralized intervals. Duplicate samples were systematically included. Drill core duplicates are one-quarter core samples. Finally, KEX evaluates the QA/QC results to determine if they meet specifications to ensure proper QA/QC. All holes passed QA/QC in this report.

Qualified Person

Technical aspects of this press release have been reviewed and approved by Robert Pease, P.Geo., CPG., the designated Qualified Person (QP) under National Instrument 43-101.

About Emgold

Emgold is a gold and base metal exploration company focused on Nevada and Quebec. The Company's strategy is to look for quality acquisitions, add value to these assets through exploration, and monetize them through sale, joint ventures, option, royalty, and other transactions to create value for our shareholders (acquisition and divestiture (A&D) business model).

In Nevada, Emgold's Golden Arrow Property, the core asset of the Company, is an advanced stage gold and silver property with a well-defined measured and indicated resource. New York Canyon is a base metal property subject to an Earn-in with Option to Joint Venture Agreement with Kennecott Exploration, a subsidiary of Rio Tinto Plc (NYSE:RIO). The Mindora Property is a gold, silver, and base metal property located twelve miles from New York Canyon. Buckskin Rawhide East is a gold and silver property leased to Rawhide Mining LLC, operators of the adjacent Rawhide Mine.

In Quebec, the Casa South Property, is an early-stage gold property adjacent to Hecla Mining Corporation's (NYSE:HL) operating Casa Berardi Mine. The East-West Property is a gold property adjacent to and on strike with Wesdome Gold Mine Ltd.'s (TSX:WDO) Kiena Complex and O3 Mining Corporation's (TSX:OIII) Malarctic Property (Marban Project). The Trecesson Property is located about 50 km north of the Val d'Or mining camp. Emgold also has a

Note that the location of Emgold's properties adjacent to producing or past producing mines does not guarantee exploration success at Emgold's properties or that mineral resources or reserves will be delineated. For more information on the Company, investors should review the Company's website at www.emgold.com or view the Company's filings available at www.sedar.com.

On behalf of the Board of Directors

David G. Watkinson, P.Eng.

President & CEO

For further information, please contact:

David G. Watkinson, P.Eng.

Tel: 530-271-0679 Ext 101

Email: info@emgold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as the term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note on Forward-Looking Statements

Certain statements made and information contained herein may constitute "forward looking information" and "forward looking statements" within the meaning of applicable Canadian and United States securities legislation. These statements and information are based on facts currently available to the Company and there is no assurance that actual results will meet management's expectations. Forward-looking statements and information may be identified by such terms as "anticipates", "believes", "targets", "estimates", "plans", "expects", "may", "will", "could" or "would". Forward-looking statements and information contained herein are based on certain factors and assumptions regarding, among other things, the estimation of mineral resources and reserves, the realization of resource and reserve estimates, metal prices, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes and other matters. While the Company considers its assumptions to be reasonable as of the date hereof, forward-looking statements and information are not guarantees of future performance and readers should not place undue importance on such statements as actual events and results may differ materially from those described herein. The Company does not undertake to update any forward-looking statements or information except as may be required by applicable securities laws. The Company's Canadian public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials, including any technical reports filed with respect to the Company's mineral properties.

SOURCE: Emgold Mining Corporation

View source version on accesswire.com:

https://www.accesswire.com/691706/Emgold-Provides-Exploration-Update-For-its-New-York-Canyon-Property-NV

FAQ

What are the latest assay results from Emgold Mining Corporation's New York Canyon Property?

How much has Kennecott Exploration spent on the New York Canyon Property?

What are the key targets at the New York Canyon Property?

When can Kennecott Exploration exercise their option to earn a 55% interest in the property?