Emgold Provides Exploration Update For its New York Canyon Property, NV

Emgold Mining Corporation (OTC PINK: EGMCF) announced assay results from four diamond core holes and re-assays from nine historic holes at its New York Canyon Property in Nevada. The ongoing exploration, conducted by Kennecott Exploration Company, highlights three main copper targets: Copper Queen, Champion, and Longshot Ridge. KEX can earn a 75% interest by spending up to US$22.5 million. Significant intercepts were reported, including 94.35 m of 0.333% CuEq. The property spans approximately 8,700 acres, with historic drilling totaling about 43,000 m.

- Significant drill intercept of 94.35 m at 0.333% CuEq from NYCN0002.

- Kennecott Exploration is doubling the drilling program from five to at least ten holes.

- Exploration suggests potential for a larger copper skarn and porphyry system.

- None.

VANCOUVER, BC / ACCESSWIRE / October 4, 2021 / Emgold Mining Corporation (TSXV:EMR)(OTC PINK:EGMCF)(FRA:EMLM)(BSE:EMLM) ("Emgold" or the "Company") is pleased to announce assay results from four exploration diamond core holes and re-assay results from nine historic diamond core holes drilled at its New York Canyon Property, NV (the "Property"). Exploration activities are being carried out by the Company's partner, Kennecott Exploration Company ("KEX"), a subsidiary of Rio Tinto plc (RIO).

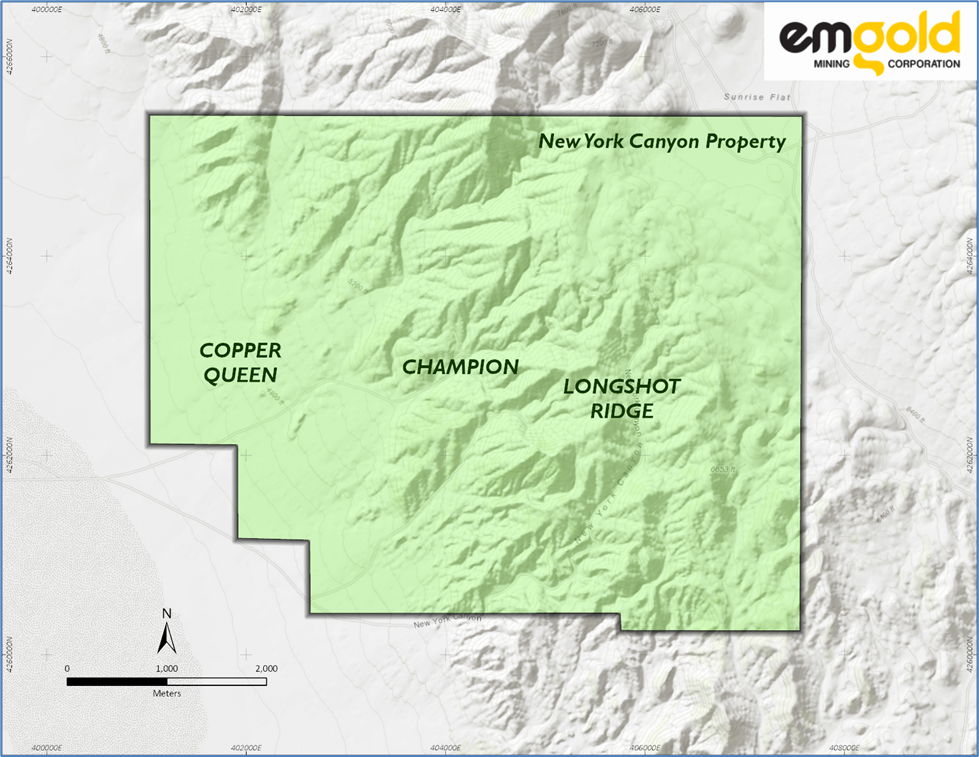

The Property is an advanced stage exploration project consisting of three main copper targets which were first explored in the mid-1960's, with the last historic drilling completed in 2006. These historic targets, situated west to east respectively, are called Copper Queen, Champion, and Longshot Ridge.

The Property is subject to an Earn-In with Option to Joint Venture Agreement (the "Agreement") between Emgold and KEX first announced by press release on February 11, 2020. KEX can earn up to a

Significant intercepts from the first four of 10 currently planned drill holes for 2021 on the Property are summarized in Table 1.

Table 1

New York Canyon Property

Significant Drill Intercepts for Drill Holes NYCN0001 to NYCN0004

(Assay intervals greater than or equal to

Hole ID | From | To | Length (1) | CuEq (2) |

NYCN0002 | 110.03 | 204.38 | 94.35 | 0.333 |

and | 457.60 | 506.94 | 49.34 | 0.273 |

and | 544.00 | 716.28 | 172.28 | 0.169 |

NYCN003 | 123.50 | 134.00 | 10.50 | 0.163 |

and | 161.00 | 200.00 | 39.00 | 0.312 |

and | 344.00 | 362.00 | 18.00 | 0.168 |

- True widths unknown.

- Copper equivalent grades are calculated based on US

$3.00 per lb Cu, US$10.00 per lb Mo, US$19.00 per oz Ag, and US$1,750 per oz Au approximating average prices for those metals over the previous three years. No adjustment has been made for recovery.

In addition, KEX has re-assayed core from nine historic drill holes stored on the Property. Significant intercepts from six of these re-assayed drill holes received to date are shown in Table 2.

Table 2

New York Canyon Property

Significant Drill Intercepts from Re-Assayed Historic Drill Holes

(Assay intervals greater than or equal to

Hole ID | From | To | Length (1) | CuEq (2) |

MN-1 | 15.24 | 73.15 | 57.91 | 0.686 |

MN-15 | 166.42 | 192.02 | 25.60 | 0.185 |

MN-42 | 106.68 | 505.97 | 399.29 | 0.443 |

MN-44 | 45.72 | 57.91 | 12.19 | 0.374 |

and | 112.78 | 158.50 | 45.72 | 0.220 |

and | 173.74 | 192.02 | 18.28 | 0.159 |

MM-46 | 45.72 | 57.91 | 12.19 | 0.107 |

and | 112.78 | 158.50 | 45.72 | 0.413 |

and | 173.74 | 192.02 | 18.28 | 0.303 |

MN-209 | 0.00 | 45.72 | 45.72 | 0.183 |

and | 176.78 | 240.79 | 64.01 | 0.263 |

- True widths unknown.

- Copper equivalent grades are calculated based on US

$3.00 per lb Cu, US$10.00 per lb Mo, US$19.00 per oz Ag, and US$1,750 per oz Au approximating average prices for those metals over the previous three years. No adjustment has been made for recovery.

Details on the 2021 exploration program, to date, are outlined below. David Watkinson, President and CEO of Emgold, stated, "We are grateful to have KEX as a partner to explore the New York Canyon Property and are excited by the results to date that indicate the potential for a larger copper skarn and porphyry system on the Property. KEX is taking a systematic approach to exploring the Property, including geologic and structural mapping, geophysics, drilling, and other exploration work. KEX has doubled the size of its initial planned drilling program from five hole in 2021 and is now expected to complete at least 10 holes prior to year-end. We look forward to receiving and releasing additional exploration results in the near-future."

About the Property

The Property currently consists of 417 unpatented claims and 21 patented claims totaling approximately 8,700 acres. It is located in the Santa Fe Mining District, Mineral County, west-central Nevada, and about 30 mi. (48 km) east of the town of Hawthorne. KEX is exploring the Property to expand the copper skarn and copper porphyry mineralization. Total historic drilling on the Property, prior to the current drill program, is 234 holes totaling about 43,000 m (139,000 ft).

The Property is an advanced stage exploration project consisting of three main copper targets which were first explored in the mid-1960's, with the last historic drilling done completed in 2006. These historic targets, situated west to east respectively, are called Copper Queen, Champion, and Longshot Ridge. A claim map showing the location of these targets is shown in Figure 1.

Figure 1

New York Canyon Property

Claim Map and Exploration Target Areas

Claim map excludes a block of 27 non-contiguous claims to the north that make up part of the property (the North Block).

Historic Exploration on the Property

From Copper Queen on the west side of the Property to Longshot Ridge on the east side, is a length of 6.4 km (4.0 miles). The average width of the known mineralization is 3.2 km (2.0 miles). Copper mineralization, including skarn and porphyry, has been found in all three deposits.

Copper Queen Target

Historic exploration by Conoco in the 1970's and 1980's defined copper sulfide skarn and porphyry mineralization at the Copper Queen prospect. Drilling reported in a May 10, 1979 internal report included a significant interval of chalcopyrite and molybdenite mineralization in drill-hole MN-42, drilled in 1977. MN-42 intersected 1,020 ft (310.9m) of

Champion

The Champion prospect was explored from the late 1960s through the 1970s, although apparently to a lesser extent than Copper Queen and Longshot Ridge. Historic core drilling intersected oxide and sulfide copper skarn mineralization, but historical mineral resources were not delineated.

Longshot Ridge

Oxide skarn mineralization has been drilled at the Longshot Ridge target by various operators since the 1960's. Most recently, Searchlight Resources Inc. (SCLT) (formerly known as Canyon Copper Corporation and Aberdene Mines Limited) drilled the property between 2004 and 2006 and completed a 2010 Technical Report. Searchlight defined an indicated resource of 16.3 million tons (14.8 million tonnes) of

Other Targets

The Ideal target is located south of Copper Queen and underlies alluvium. The actual date of its discovery is unknown at this time, although it appears in a 1997 report and map. Ideal appears to be a previously untested geophysical anomaly. Kennecott drilled hole one hole (NYCN0001) into this target and assay samples from this hole did not encounter significant copper values.

2021 Drilling Program to Date by KEX

Kennecott's current plans (as of this press release) are to drill 10 core holes at the Property in 2021 (subject to adjustment). A total of nine holes have been completed to date and drilling of a tenth hole is in progress. Assays have been received for four holes. The status of the current drilling program is shown in Table 3.

Table 3

New York Canyon Property

Drill Program Status

Hole or Planned Hole | Target | Depth or Planned Depth in Meters | Drilling Status | Logging Status | Samples Sent to Lab | Assays Back from Lab | Assays Tabulated & Analyzed |

NYCN0001 | Ideal | 347.78 | Complete | Complete | Yes | Yes | Yes |

NYCN0002 | Copper Queen | 716.28 | Complete | Complete | Yes | Yes | Yes |

NYCN0003 | Copper Queen | 390.14 | Complete | Complete | Yes | Yes | Yes |

NYCN0004 | Copper Queen | 348.00 | Complete | Complete | Yes | Yes | Yes |

NYCN0005 | Copper Queen | 318.52 | Complete | Complete | Yes | No | |

NYCN0006 | Longshot | 503.53 | Complete | In Progress | 0-132m | No | |

NYCN0007 | Longshot | 421.38 | Complete | In Progress | No | No | |

NYCN0008 | Copper Queen | 410.56 | Complete | In Progress | No | ||

NYCN0009 | Copper Queen | 473.81 | Complete | Not Started | |||

NYCN0010 | Copper Queen | 550.00 (1) | In Progress | Not Started |

- Planned depth

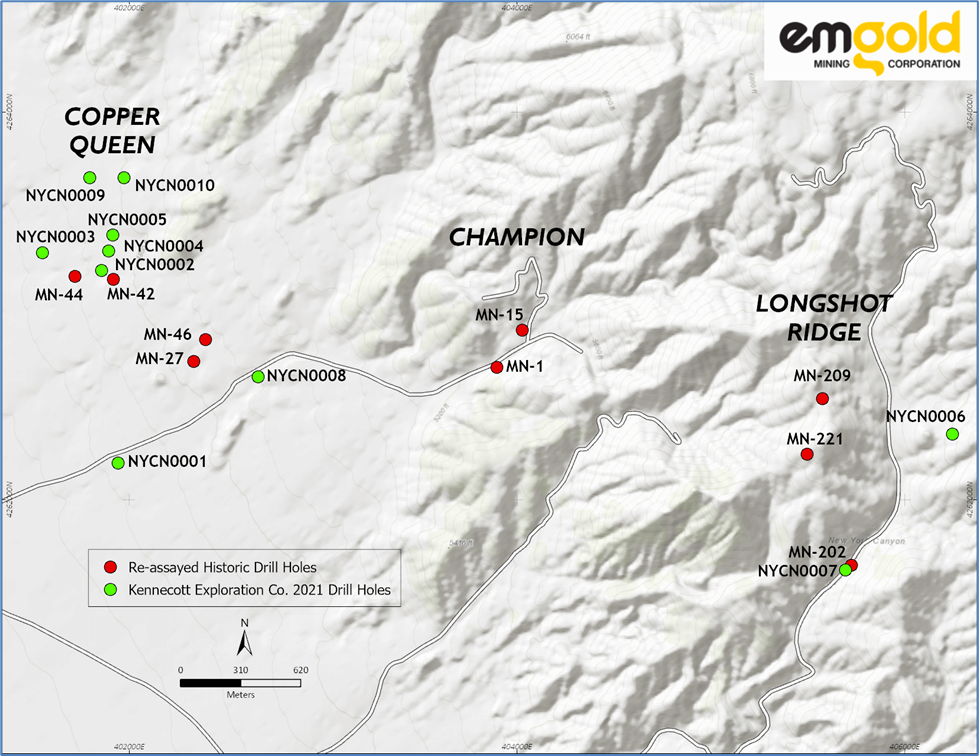

Seven holes have targeted the Copper Queen area. Two holes have targeted the Longshot Ridge area. No holes were drilled in the Champion area. A geophysical anomaly, called Ideal, was targeted with one drill hole and is located to the south of the Copper Queen area. The location of the nine drill holes drilled to date and ten drill holes re-assayed by KEX (discussed below in this press release) are shown in Figure 2.

Figure 2

New York Canyon Property

Location of KEX 2021 Drill Holes and Re-Assayed Drill Holes

Detailed information about the drill holes is shown in Table 4.

Table 4

New York Canyon Property

Drill Hole Information

Drill Hole | Easting | Northing | Elevation | Azimuth | Dip | Target Depth | Actual Depth | |

NYCN0001 | 401942 | 4262189 | 1,421.1 | 142 | -80 | 400 | 347.8 | |

NYCN0002 | 401856 | 4263182 | 1,444.8 | 212 | -80 | 700 | 716.3 | |

NYCN0003 | 401552 | 4263273 | 1,419.3 | 119 | -80 | 700 | 390.1 | |

NYCN0004 | 401894 | 4263282 | 1,449.6 | 360 | 0 | 700 | 348.4 | |

NYCN0005 | 401915 | 4263365 | 1,445.0 | 360 | 0 | 700 | 318.5 | |

NYCN0006 | 406247 | 4262339 | 1,924.1 | 70 | -85 | 500 | 503.5 | |

NYCN0007 | 405693 | 4261637 | 1,901.2 | 340 | -70 | 750 | 421.4 | |

NYCN0008 | 402663 | 4262635 | 1,493.9 | 300 | -70 | 400 | 410.6 | |

NYCN0009 | 401795 | 4263750 | 1,438.0 | 360 | 0 | 700 | 473.81 | |

NYCN0010 | 401974 | 4263660 | 1,469.0 | 200 | -70 | 550 | In progress |

Results from the drilling are shown in Table 5. NYCN0001 drilled into the Ideal geophysical target intersected a magnetic anomaly with no significant copper mineralization. NYCN0002 was a step-out hole from historic hole MN-42 and showed several long-mineralized skarn intercepts including 94.35 m of

Table 5

New York Canyon Property

Drilling Results

Drill Intercepts Greater than

Drill Holes NYCN0001 to NYCN0004

Hole ID | From | To | Length (1) | Cu | Mo | Ag | Au | CuEq(2) |

NYCN0001 | No Significant Intercepts | |||||||

NYCN0002 | 59.00 | 59.80 | 0.80 | 0.134 | 0.001 | 0.535 | 0.005 | 0.144 |

and | 62.61 | 67.15 | 4.54 | 0.206 | 0.002 | 0.045 | 0.011 | 0.218 |

and | 96.57 | 101.37 | 4.80 | 0.207 | 0.000 | 0.043 | 0.012 | 0.211 |

and | 110.03 | 204.38 | 94.35 | 0.288 | 0.007 | 2.378 | 0.019 | 0.333 |

and | 243.00 | 244.29 | 1.29 | 0.132 | 0.002 | 0.917 | 0.008 | 0.148 |

and | 420.37 | 422.00 | 1.63 | 0.013 | 0.028 | 0.528 | 0.002 | 0.110 |

and | 457.60 | 506.94 | 49.34 | 0.234 | 0.006 | 1.893 | 0.020 | 0.273 |

and | 519.29 | 521.42 | 2.13 | 0.198 | 0.003 | 1.000 | 0.009 | 0.216 |

and | 533.28 | 535.30 | 2.02 | 0.235 | 0.005 | 1.121 | 0.008 | 0.263 |

and | 544.00 | 716.28 | 172.28 | 0.116 | 0.012 | 1.175 | 0.003 | 0.169 |

NYCN0003 | 100.50 | 104.00 | 3.50 | 0.234 | 0.005 | 1.412 | 0.015 | 0.265 |

and | 116.00 | 117.50 | 1.50 | 0.092 | 0.005 | 0.799 | 0.004 | 0.118 |

and | 123.50 | 134.00 | 10.50 | 0.134 | 0.006 | 1.103 | 0.011 | 0.163 |

and | 140.00 | 141.50 | 1.50 | 0.081 | 0.005 | 0.826 | 0.004 | 0.107 |

and | 155.00 | 156.50 | 1.50 | 0.113 | 0.002 | 1.405 | 0.006 | 0.134 |

and | 161.00 | 200.00 | 39.00 | 0.276 | 0.004 | 2.241 | 0.013 | 0.312 |

and | 245.00 | 247.00 | 2.00 | 0.016 | 0.032 | 0.382 | 0.004 | 0.125 |

and | 323.00 | 325.00 | 2.00 | 0.025 | 0.021 | 0.669 | 0.005 | 0.102 |

and | 344.00 | 362.00 | 18.00 | 0.056 | 0.030 | 1.183 | 0.005 | 0.168 |

NYCN0004 | 50.00 | 56.00 | 6.00 | 0.114 | 0.005 | 2.534 | 0.005 | 0.155 |

and | 81.50 | 83.00 | 1.50 | 0.119 | 0.004 | 0.680 | 0.003 | 0.138 |

and | 86.00 | 95.50 | 9.50 | 0.172 | 0.002 | 1.861 | 0.011 | 0.198 |

and | 109.81 | 114.03 | 4.22 | 0.240 | 0.002 | 2.238 | 0.017 | 0.269 |

and | 129.22 | 133.30 | 4.08 | 0.156 | 0.004 | 1.101 | 0.011 | 0.181 |

and | 140.92 | 147.02 | 6.10 | 0.382 | 0.005 | 2.533 | 0.015 | 0.423 |

and | 309.00 | 312.00 | 3.00 | 0.013 | 0.001 | 14.550 | 0.001 | 0.157 |

and | 347.00 | 348.38 | 1.38 | 0.086 | 0.008 | 0.803 | 0.009 | 0.120 |

- True widths unknown.

- Copper equivalent grades are calculated based on US

$3.00 per lb Cu, US$10.00 per lb Mo, US$19.00 per oz Ag, and US$1,750 per oz Au approximating average prices for those metals over the previous three years. No adjustment has been made for recovery.

2021 Re-Assay Program by KEX

Historic drill core from past drilling programs is stored on the Property. KEX re-assayed selected holes and in some cases selected core intervals of the historic drill core. Table 6 shows details of the original drill holes that were re-assayed by KEX.

Table 6

New York Canyon Property

Re-Assay Drill Hole Information

Drill Hole | Easting | Northing | Elevation | Azimuth | Dip | Total Depth | Date Drilled |

MN-1 | 402200.7 | 4262251.0 | 1,606.5 | 360 | -90 | 79.9 | 1972 |

MN-15 | 402469.7 | 4264236.8 | 1,634.3 | 360 | -90 | 732.1 | 1972 |

MN-27 | 398967.1 | 4262313.1 | 1,470.4 | 360 | -90 | 717.5 | 1972 |

MN-42 | 398095.8 | 4266557.6 | 1,484.4 | 360 | -90 | 600.6 | 1977 |

MN-44 | 397684.4 | 4266680.7 | 1,435.0 | 360 | -90 | 609.9 | 1979 |

MN-46 | 399090.8 | 4263465.6 | 1,481.0 | 360 | -90 | 200.6 | 1980 |

MN-202 | 406021.4 | 4252144.3 | 1,810.5 | 360 | -90 | 274.3 | 1979 |

MN-209 | 405685.4 | 4262326.0 | 1,981.6 | 360 | -90 | 422.1 | 1979 |

MN-221 | 405531.5 | 4262038.0 | 1,976.2 | 360 | -90 | 824.5 | 1979 |

Table 7 shows the selected intervals that were re-assayed by KEX. Note that MN-202 and MN-221 were selectively sampled with representative 0.2 m long core samples taken at selected intervals which were re-assayed and used for isotope testing.

Table 8 shows the status of the re-assay program. Re-assay information has been received from all holes except MN-27 to date.

Table 9 includes assay results from the re-assay program. Of particular note is the re-assay of MN-42, drilled in 1977, which was reported as intersecting 1,020 ft (310.9 m) of

Note that re-assay intervals tried to copy historic assay intervals from work done in the 1970's. In addition, lab detection limits for gold and silver used today are much lower. However, internal analysis shows that where selective assay intervals could be compared with historic intervals on a footage-to-footage basis, the results were comparable.

Table 7

New York Canyon Property

Re-Assay Intervals from Selected Drill Holes

Hole ID | From (m) | To (m) | Length (m) |

MN-1 | 7.9 | 73.2 | 65.3 |

MN-15 | 166.4 | 210.9 | 44.5 |

MN-42 | 97.5 | 600.6 | 503.1 |

MN-44 | 105.8 | 609.6 | 503.8 |

MN-46 | 6.4 | 24.7 | 18.3 |

and | 39.9 | 200.6 | 160.7 |

MN-202 | 7.0 | 7.2 | 0.2 |

and | 51.2 | 51.4 | 0.2 |

and | 110.9 | 111.1 | 0.2 |

and | 134.4 | 134.6 | 0.2 |

and | 163.1 | 163.3 | 0.2 |

and | 208.2 | 208.4 | 0.2 |

and | 245.4 | 245.6 | 0.2 |

and | 270.4 | 270.6 | 0.2 |

MN-209 | 0 | 269.1 | 269.1 |

MN-221 | 57.3 | 57.5 | 0.2 |

and | 91.4 | 91.6 | 0.2 |

and | 110.6 | 110.8 | 0.2 |

and | 111.6 | 111.8 | 0.2 |

and | 126.8 | 127.0 | 0.2 |

and | 128.9 | 129.1 | 0.2 |

and | 133.2 | 133.4 | 0.2 |

and | 142.3 | 142.5 | 0.2 |

and | 248.1 | 248.3 | 0.2 |

Table 8

New York Canyon Property

Re-Assay Program Status

Hole ID | Target | Depth | Logging | Samples | Assay | Tabulated |

MN-1 | Champion | 79.9 | Not re-logged | Yes | Yes | Yes |

MN-15 | Champion | 732.1 | Complete | Yes | Yes | Yes |

MN-27 | Copper Queen | 717.5 | Not re-logged | No | No | No |

MN-42 | Copper Queen | 600.6 | Complete | Yes | Yes | Yes |

MN-44 | Copper Queen | 609.9 | Not re-logged | Yes | Yes | Yes |

MN-46 | Copper Queen | 200.6 | Not re-logged | Yes | Yes | Yes |

MN-202 | Copper Queen | 274.3 | Complete | Yes | Yes | Yes |

MN-209 | Longshot Ridge | 422.1 | Complete | Yes | Yes | Yes |

MN-221 | Longshot Ridge | 824.5 | Complete | Yes | Yes | Yes |

Table 9

New York Canyon Property

Re-Assay Results

Drill Intercepts Greater than

Drill Holes MN-1, 15, 42, 44, 46, 209, 211, and 221

Hole ID | From | To | Length (1) | Cu | Mo | Ag | Au | CuEq(2) |

MN-1 | 15.24 | 73.15 | 57.91 | 0.541 | 0.011 | 7.819 | 0.036 | 0.686 |

MN-15 | 166.42 | 192.02 | 25.60 | 0.130 | 0.012 | 1.154 | 0.004 | 0.185 |

MN-42 | 106.68 | 505.97 | 399.29 | 0.341 | 0.012 | 3.301 | 0.034 | 0.443 |

and | 515.11 | 518.16 | 3.05 | 0.114 | 0.008 | 1.250 | 0.002 | 0.156 |

and | 524.26 | 527.30 | 3.05 | 0.083 | 0.004 | 1.125 | 0.003 | 0.110 |

and | 569.98 | 576.07 | 6.10 | 0.122 | 0.007 | 1.516 | 0.004 | 0.163 |

MN-44 | 124.97 | 234.70 | 109.73 | 0.313 | 0.004 | 2.918 | 0.021 | 0.374 |

and | 316.99 | 432.82 | 115.83 | 0.105 | 0.031 | 0.942 | 0.005 | 0.220 |

and | 493.78 | 505.97 | 12.19 | 0.093 | 0.000 | 4.892 | 0.021 | 0.159 |

and | 515.11 | 521.21 | 6.10 | 0.211 | 0.002 | 2.008 | 0.005 | 0.240 |

and | 554.74 | 557.78 | 3.04 | 0.067 | 0.011 | 1.050 | 0.002 | 0.115 |

and | 569.98 | 573.02 | 3.04 | 0.078 | 0.002 | 1.775 | 0.002 | 0.103 |

MN-46 | 6.40 | 9.14 | 2.74 | 0.099 | 0.002 | 1.090 | 0.006 | 0.121 |

and | 45.72 | 57.91 | 12.19 | 0.092 | 0.001 | 0.809 | 0.007 | 0.107 |

and | 85.34 | 88.39 | 3.05 | 0.098 | 0.001 | 0.273 | 0.003 | 0.105 |

and | 97.54 | 100.58 | 3.04 | 0.100 | 0.001 | 0.611 | 0.004 | 0.112 |

and | 112.78 | 158.50 | 45.72 | 0.333 | 0.007 | 3.557 | 0.028 | 0.413 |

and | 173.74 | 192.02 | 18.28 | 0.223 | 0.013 | 2.828 | 0.011 | 0.303 |

MN-209 | 0.00 | 45.72 | 45.72 | 0.154 | 0.003 | 1.646 | 0.005 | 0.183 |

and | 54.86 | 57.91 | 3.05 | 0.103 | 0.001 | 0.922 | 0.003 | 0.117 |

and | 64.01 | 67.06 | 3.05 | 0.221 | 0.002 | 6.280 | 0.010 | 0.296 |

and | 76.20 | 79.25 | 3.05 | 0.074 | 0.008 | 1.805 | 0.006 | 0.123 |

and | 161.54 | 164.59 | 3.05 | 0.135 | 0.002 | 2.950 | 0.010 | 0.178 |

and | 176.78 | 240.79 | 64.01 | 0.145 | 0.030 | 1.246 | 0.005 | 0.263 |

and | 255.12 | 259.08 | 3.96 | 0.243 | 0.001 | 0.831 | 0.003 | 0.257 |

MN-211 | No Significant Assays | |||||||

MN-221 | 142.34 | 142.54 | 0.20 | 0.211 | 0.003 | 1.850 | 0.006 | 0.245 |

(1) True widths unknown.

(2) Copper equivalent grades are calculated based on US

Other Work Completed by KEX as Part of the 2021 Exploration Program

Other work completed as part of its 2021 Exploration Program includes:

- Geologic, structural, and alteration mapping.

- Surface rock chip sampling.

- A UAV drone magnetic geophysics and DEM survey was completed by MWH Geo-Surveys over the majority of the Property and over the northwest corner of the claims.

- A passive seismic reflection geophysics survey completed by Magee Geophysical Services LLC and IM Seismology with results pending.

- Carbon-oxygen isotope analysis was competed for historic holes MN-202 and MN-221.

QA/QC Methods

Drilling Program

The drill being used is a Boart LF-160. Core is typically PQ in size at the top of the holes, reduced to HQ around 200 to 300 m depth, and further reduced to NQ if needed.

Drill core is initially taken to a field core logging facility on the Property and scanned with an XRF device and quick-logged by the field geologist. Core samples are then shipped to KEX's core logging facility in Salt Lake City, where they are photographed and logged in detail. Detailed logging includes rock types, alteration, and structures. Core is sawn in half, and samples prepared, labeled, and shipped to ALS Laboratories ("ALS") in Elko Nevada. Typically core samples were 1.0 to 3.0 m in length, except for hole NYCN0001 where 10 m composite samples were taken.

ALS is an ISO/IEC 17025:2017 accredited laboratory. ALS prepared the samples and analyzed them using ME-MS61L. If certain elements, including copper, exceeded certain values, additional analyses were done using ME-OG62. Gold, in some cases, was analyzed using method Au-ICP21. The lab inserted standards and duplicates as par of its internal QA/QC program. ALS is independent from both KEX and Emgold.

KEX follows strict QA/QC measures. As part of the KEX QA/QC program, independently certified control samples (standards, blanks, and duplicate samples) were also inserted into the sample stream for each analytical batch. In general, a blank is inserted at the start of each stream and then every 10th sample is a QA/QC sample, alternating between blanks, standards, and duplicates. Standards are inserted with every submitted batch of samples, and to match the level of mineralization as much as possible. Additional blanks are sometimes included before visibly mineralized intervals. Duplicate samples were systematically included. Drill core duplicates are one-quarter core samples. Finally, KEX evaluates the QA/QC results to determine if they meet the company's specifications to ensure proper QA/QC. All holes passed QA/QC in this report.

Re-assaying Program

Historic core samples selected from storage on the Property were shipped to KEX's core logging facility in Salt Lake City, where they are photographed. Of the nine historic holes re-assayed, five holes were relogged. Half core, remaining from historic drilling, was sawed in half (i.e. quartered), and samples were prepared, labeled, and shipped to ALS Laboratories ("ALS") in Elko Nevada. Sample lengths were typically 3.0 m long, except for holes MN-202 and MN-221. In those holes, a 20 cm sample was taken at the beginning at various depths to get representative samples of longer core intervals.

ALS is an ISO/IEC 17025:2017 accredited laboratory. ALS analyzed the samples using the method ME-MS61L. If certain elements, including copper, exceeded certain values, additional analyses were done using ME-OG62. Gold, in some cases, was analyzed using method Au-ICP21. The lab inserted standards and completed duplicates as part of its internal QA/QC program. ALS is independent from both KEX and Emgold.

KEX follows very strict QA/QC measures. As part of the KEX QA/QC program, independently certified control samples (standards, blanks, and duplicate samples) were also inserted into the sample stream for each analytical batch. In general, a blank is inserted at the start of each stream and then every 10th sample is a QA/QC sample, alternating between blanks, standards, and duplicates. Standards are inserted to match the level of mineralization ad much as possible. Duplicate samples were systematically included. As previously noted, KEX evaluates the QA/QC results to determine if they meet the company's specifications

and to ensure proper QA/QC. All historical holes passed QA/QC in this report.

Qualified Person

Technical aspects of this press release have been revied and approved by Robert Pease, P.Geo., CPG., the designated Qualified Person (QP) under National Instrument 43-101.

About Emgold

Emgold is a gold and base metal exploration company focused on Nevada and Quebec. The Company's strategy is to look for quality acquisitions, add value to these assets through exploration, and monetize them through sale, joint ventures, option, royalty, and other transactions to create value for our shareholders (acquisition and divestiture (A&D) business model).

In Nevada, Emgold's Golden Arrow Property, the core asset of the Company, is an advanced stage gold and silver property with a well-defined measured and indicated resource. New York Canyon is a base metal property subject to an Earn-in with Option to Joint Venture Agreement with Kennecott Exploration, a subsidiary of Rio Tinto Plc (RIO). The Mindora Property is a gold, silver, and base metal property located 12 miles from New York Canyon. Buckskin Rawhide East is a gold and silver property leased to Rawhide Mining LLC, operators of the adjacent Rawhide Mine.

In Quebec, the Casa South Property, is an early-stage gold property adjacent to Hecla Mining Corporation's (HL) operating Casa Berardi Mine. The East-West Property is a gold property adjacent to and on strike with Wesdome Gold Mine Ltd.'s (WDO) Kiena Complex and O3 Mining Corporation's (OIII) Malarctic Property (Marban Project). Emgold also has a

Note that the location of Emgold's properties adjacent to producing or past producing mines does not guarantee exploration success at Emgold's properties or that mineral resources or reserves will be delineated. For more information on the Company, investors should review the Company's website at www.emgold.com or view the Company's filings available at www.sedar.com .

On behalf of the Board of Directors

David G. Watkinson, P.Eng.

President & CEO

For further information, please contact:

David G. Watkinson, P.Eng.

Tel: 530-271-0679 Ext 101

Email: info@emgold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as the term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note on Forward-Looking Statements

Certain statements made and information contained herein may constitute "forward looking information" and "forward looking statements" within the meaning of applicable Canadian and United States securities legislation. These statements and information are based on facts currently available to the Company and there is no assurance that actual results will meet management's expectations. Forward-looking statements and information may be identified by such terms as "anticipates", "believes", "targets", "estimates", "plans", "expects", "may", "will", "could" or "would". Forward-looking statements and information contained herein are based on certain factors and assumptions regarding, among other things, the estimation of mineral resources and reserves, the realization of resource and reserve estimates, metal prices, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes and other matters. While the Company considers its assumptions to be reasonable as of the date hereof, forward-looking statements and information are not guarantees of future performance and readers should not place undue importance on such statements as actual events and results may differ materially from those described herein. The Company does not undertake to update any forward-looking statements or information except as may be required by applicable securities laws. The Company's Canadian public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials, including any technical reports filed with respect to the Company's mineral properties.

SOURCE: Emgold Mining Corporation

View source version on accesswire.com:

https://www.accesswire.com/666568/Emgold-Provides-Exploration-Update-For-its-New-York-Canyon-Property-NV

FAQ

What are the latest assay results for EGMCF at the New York Canyon Property?

Who is conducting the exploration at the New York Canyon Property for EGMCF?

What is Emgold Mining Corporation's (EGMCF) strategy for the New York Canyon Property?

How many drill holes are planned at the New York Canyon Property for 2021?