ECRID, the New Credit Bureau Files New IPO

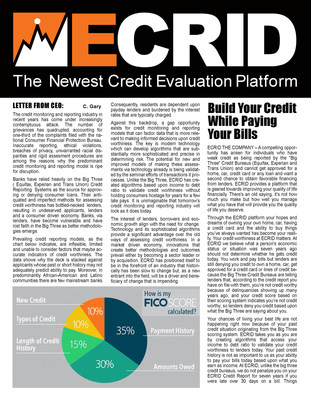

ECRID (OTC: ECDD), a new credit bureau, provides members with a personal ECRID Credit Report, starting with a Perfect 950 Credit Score. The platform aims to assist those with poor credit scores by allowing them to apply for loans (home, auto, personal) based on their ECRID report rather than traditional credit scores from Equifax or Experian. Launching in November 2021, ECRID also features an automated bill payment service that updates credit scores in real-time. Additionally, a referral program rewards members for bringing in new users, with a $75 incentive for each successful referral.

- Launch of a novel Fintech Credit Lending platform aimed at users with poor credit scores.

- Credit Report holders start with a perfect 950 credit score, enhancing initial borrower appeal.

- Automated bill payment system updates credit reports in real-time, providing lenders with validated payment histories.

- Referral program incentivizes user growth, offering $75 for each new member who creates an ECRID Credit Report.

- Potential risk of borrowers having their ECRID credit report pulled if 60 days past due, which could affect new lending opportunities.

- Requirement of a minimum of four ECRID credit profiles ($100) may deter some users from creating their reports.

STUART, Fla., Oct. 15, 2021 /PRNewswire/ -- ECRID (OTC: ECDD) is the New Credit Bureau (www.ECRID.com) that offers each member the opportunity to create their own personal ECRID Credit Report with conventional and unconventional creditors that they have paid on time to validate their credit worthiness (rental payments included) to lenders. Each Credit Report Holder starts out with a Perfect 950 Credit Score.

An ECRID executive said, "We're extremely excited and thrilled to prepare to launch one of the most exciting and novel Fintech Credit Lending platforms of its kind, at a time where a large percentage of adults have cash flow, but unfortunately deemed to have poor credit scores."

First, ECRID Bill Pay Service is second to none. ECRID Credit Report Holders will pay their monthly bills listed on their ECRID Credit Report, through an automated ECRID Electronic Payment System. Once payment is processed, the ECRID Credit Score and payment status will update in real time on the ECRID User's Credit Report. This process and method gives Lenders validation on how each ECRID Credit Report Holder pays their bills. Secondly, ECRID Credit Report Holders will be able to apply for loans (Home, Auto & Personal loans) inside their ECRID Business Center. Lenders will have access to sign up at www.ECRID.com to become a member and offer their services to the ECRID Credit Report Holders who are looking for financing. The goal is to start offering lending services in November 2021. ECRID Lenders will be asked not to pull an Equifax, Experion, or Transunion credit report, but instead, base their Novel Fintech Sector Lending on the actual individual user's ECRID Credit Report. This will give the ECRID User (borrower) a fresh start and a second chance at reestablishing themselves as credit-worthy borrowers. The company's (ECRID) primary objective is to base the lending decision on the user's (borrower) ECRID Credit Report along with the user's (borrower) income-to-debt ratio.

ECRID Credit Report Holders (Home, Auto & Personal loan) can apply for loans inside their ECRID Business Center. Lenders will have access to sign up at ECRID.com and become a member and offer their services to the ECRID Credit Report Holders who are looking for financing (Home, Car & Personal loan). The goal is to start offering this service in November of 2021. ECRID will ask lenders to not pull an Equifax, Experian or Trans Union credit report and will instead base their novel Fintech sector lending on the actual individual users ECRID Credit Report. This will give the borrower a second chance at reestablishing themselves as credit worthy borrowers. The lending decision will be based on your ECRID Credit Report and your Income to Debt Ratio. There could be an exception if the ECRID Credit Report Holder is 60 days past due on any creditor. There could also be some consideration made by the ECRID Credit Analysis team to pull all three Vantage scores and add

The ECRID Referral Program is an exciting and extremely lucrative novel tech platform that pays you, the new ECRID member,

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/ecrid-the-new-credit-bureau-files-new-ipo-301394486.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/ecrid-the-new-credit-bureau-files-new-ipo-301394486.html

SOURCE ECRID, inc.

FAQ

What is ECRID and its role in credit reporting?

When will ECRID start offering loans?

How does ECRID's credit scoring system differ from traditional scores?

What is the ECRID referral program?