Davis Commodities Limited Releases 2024 Chairwoman Letter to Shareholders

- None.

- None.

Insights

Given the global nature of the commodity trading industry, the consolidation of Davis Commodities' subsidiaries into a single operating company is a strategic move that is likely to enhance operational efficiency and market responsiveness. Streamlining operations can lead to reduced costs and improved margins, which are critical factors in an industry characterized by thin profit margins and high competition.

The growth projections for sugar, oil and rice markets in Asia, as reported by Frost & Sullivan, suggest a favorable environment for Davis Commodities' expansion plans. The anticipated rise in market sizes for these commodities in target markets like Indonesia, Singapore and Vietnam could translate into increased revenue streams for the company, provided they effectively capitalize on these opportunities. The company's focus on strategic partnerships and optimization of its business model could further strengthen its position in the market.

The successful initial public offering on the Nasdaq Capital Market is a significant event for Davis Commodities and its shareholders. Raising approximately $5 million, before expenses, provides the company with capital that can be directed towards its strategic growth initiatives. Investors will be interested in how this capital is allocated and the return on investment it generates.

Investors should also consider the risks associated with the commodity trading sector, including market volatility and economic uncertainty, which the company acknowledges. The resilience of Davis Commodities' financial performance in the face of such headwinds will be an important factor in assessing the company's long-term stability and growth prospects.

Commodity trading companies like Davis Commodities operate in a complex and volatile environment where factors such as global economic conditions, currency fluctuations and geopolitical events can have significant impacts on commodity prices and trade flows. The company's decision to restructure and consolidate operations could be a response to such challenges, aiming to create a more agile and competitive entity.

The company's plan to enhance the capabilities of its trading team and prioritize market and product development indicates a proactive approach to navigating the complexities of the commodities market. The ability to anticipate market trends and respond quickly to changes is crucial for success in this sector.

SINGAPORE, Jan. 29, 2024 (GLOBE NEWSWIRE) -- Davis Commodities Limited (Nasdaq: DTCK) (the "Company" or "Davis Commodities"), an agricultural commodity trading company that specializes in trading sugar, rice, and oil and fat products, today released the following letter to shareholders from Ms. Li Peng Leck, Executive Chairwoman and Executive Director of the Company.

Dear Shareholders,

Celebrating our 25th anniversary in 2024, Davis Commodities Limited has grown and prospered since its inception in 1999. This past year has marked a milestone in our global expansion, highlighted by our successful Nasdaq listing, a culmination of our dedicated efforts and remarkable achievements. Throughout the years, we have been greatly supported by our shareholders, and we are sincerely grateful for your enduring trust and attention.

We are proud of what we have achieved in 2023. Our financial performance has demonstrated strong resilience against headwinds, such as high market volatility and economic uncertainty. The restructuring of our business at the beginning of 2024 also heralds a year of gathering momentum for future growth. In 2024, we intend to continue to upgrade our business model to deliver greater value and remain committed to offering quality products to our customers.

We’re pleased to share with you our achievements over the past year and our outlook for 2024.

Our Achievements in 2023

Nasdaq Listing Marks a New Chapter in our Journey of Global Expansion

On September 21, 2023, we completed our initial public offering (the “Offering”) of 1,250,625 ordinary shares at a public offering price of

We believe the successful listing ushers in a new era of our global development, amplifying our growth potential in a global landscape. We expect to leverage the opportunity to pursue strategic partnerships and optimize our business in building up our competitiveness in the shifting international market.

Our Key Strategies and Initiatives in 2024

Strategic Consolidation to Streamline Operation and Bolster Growth

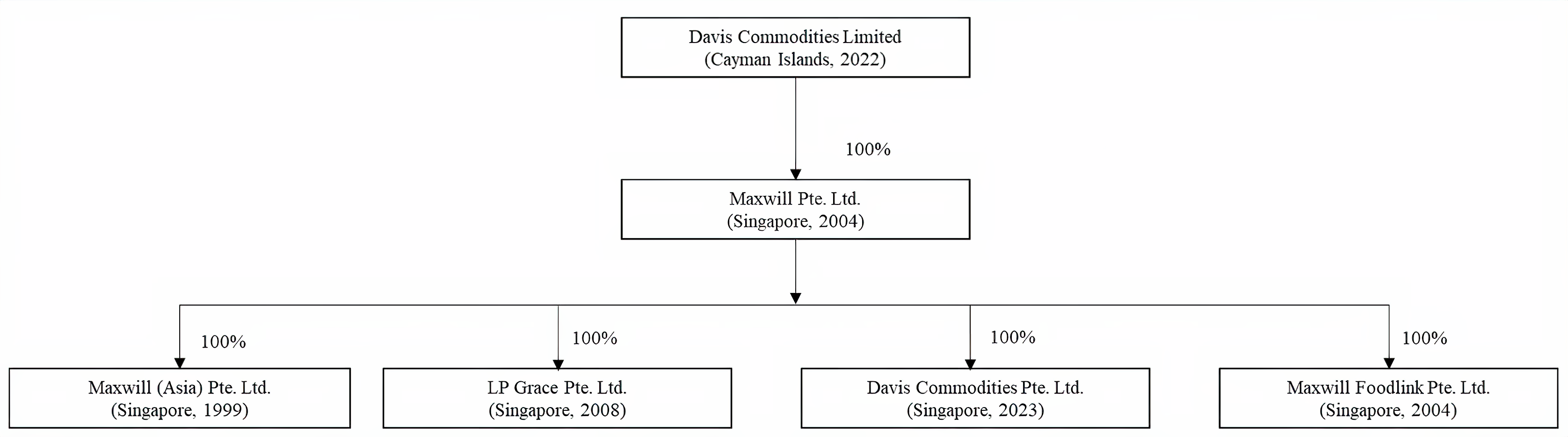

On September 15, 2023, Davis Commodities Pte. Ltd. was established as a wholly-owned subsidiary of Maxwill Pte. Ltd. We are in the process of shifting the current business operations of Maxwill (Asia) Pte. Ltd., LP Grace Pte. Ltd., and Maxwill Foodlink Pte. Ltd. to Davis Commodities Pte. Ltd. This strategic approach was conducted to enhance the operational efficiency, improve resource utilization, leverage synergies for growth, and increase market competitiveness. As of the date of this letter, our corporate structure is as follows:

Figure 1. The Corporate Structure of Davis Commodities Pte. Ltd.

After the consolidation, the business operations of Maxwill (Asia) Pte. Ltd., LP Grace Pte. Ltd., and Maxwill Foodlink Pte. Ltd. will be brought into one operating company, Davis Commodities Pte. Ltd.

The move is initiated to tap into our fully-integrated network and resources, and we expect to gear up for an accelerating growth pattern. The move also aims to streamline operational procedures to respond promptly to market changes and expedite the delivery of our products. The combined resources and anticipated agility are expected to elevate our service quality and boost our competitiveness.

Market Opportunities for Potential Growth

According to the industry report prepared by Frost & Sullivan Limited, the market size of sugar in our target markets is expected to grow steadily, driven by the expansion of food processing activities in Indonesia and Malaysia. The sugar market in Asia is projected to rise to

We believe that the coming year promises great growth opportunities, which we hope to seize upon through dedicated focus on our products and continued upgrades and expansion of our business. We are actively exploring growth opportunities that align closely with our strategic objectives. As part of our expansion initiatives, we plan to enhance the capabilities of our trading team, prioritizing market and product development.

Thank you again for your support for Davis Commodities Limited.

Ms. Li Peng Leck

Executive Chairwoman and Executive Director

Davis Commodities Limited

About Davis Commodities Limited

Based in Singapore, Davis Commodities Limited is an agricultural commodity trading company that specializes in trading sugar, rice, and oil and fat products in various markets, including Asia, Africa and the Middle East. The Company sources, markets, and distributes commodities under two main brands: Maxwill and Taffy in Singapore. The Company also provides customers of its commodity offerings with complementary and ancillary services, such as warehouse handling and storage and logistics services. The Company utilizes an established global network of third-party commodity suppliers and logistics service providers to distribute sugar, rice, and oil and fat products to customers in over 20 countries, as of the fiscal year ended December 31, 2022. For more information, please visit the Company’s website: ir.daviscl.com.

Forward-Looking Statements

Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can find many (but not all) of these statements by the use of words such as “approximates,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,” “would,” “should,” “could,” “may,” or other similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s registration statement and other filings with the SEC.

For more information, please contact:

Davis Commodities Limited

Investor Relations Department

Email: investors@daviscl.com

Ascent Investor Relations LLC

Tina Xiao

Phone: +1-646-932-7242

Email: investors@ascent-ir.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3d3796bb-bb73-41f6-956a-436c4647ed92