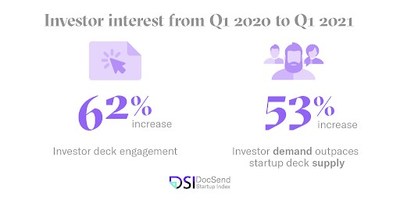

VC Interest In Pitch Decks Up 62% In Q1, According To 2021 DocSend Startup Index

SAN FRANCISCO, April 8, 2021 /PRNewswire/ -- Dropbox (NASDAQ: DBX) today announced that DocSend, a secure document sharing platform, released quarterly data based on its Pitch Deck Interest metrics that show venture capital investor interest and engagement (demand) with startup pitch decks (supply) were up

"Accounting for the accelerating national vaccine rollout, we knew the first quarter would represent the beginning of a rebound, but I don't think anyone expected VC and startup activity to be this high; investor confidence is booming and beginning to outpace the supply of startups seeking fundraising," said Russ Heddleston, DocSend co-founder and CEO.

In High Demand, Startup Founders Seek Investor Attention to Raise Capital En Masse

Q1 saw a

When founders share their pitch decks with VCs using DocSend, they tend to create a new unique link each time to tailor their pitch decks to the specific investor. Therefore, more link creation means founders are sharing their decks more widely with more VCs and suggests they are less intimidated by the economic uncertainty of the pandemic.

One explanation for the unprecedented surge could be that startups conceived during the depths of the pandemic are now seeking funding in full force, and they are confident in their chances of securing term sheets.

Additionally, the wave of activity could also represent the pent-up demand from more conservative founders who were waiting for positive signs of economic recovery before taking their startups to the next stage.

Along with the dramatic year-over-year increase, links created per founder in Q1 were substantially higher than Q4 of 2020 — 7.4 versus 8.79, a

Investor Attention: A Valuable, Increasingly Scarce Commodity

With more supply comes greater demand on VCs' time — the average time investors spent reviewing decks was down

This means when investors chose to review a pitch deck, they spent less time scrutinizing the information and came to a conclusion on whether they wanted to meet with founders more quickly. Also, this may be a side-effect of investors continuing to more easily agree to virtual meetings than face-to-face meetings.

"In the last year, due to the virtual nature of fundraising, I have met with more founders than ever before. These virtual meetings are now much quicker — from an hour, down to 30 minutes, usually. The pitch deck is what gets founders a foot in the door, but they also must utilize their time wisely when in these shortened meetings," said DocSend board member and general partner at DCM, Kyle Lui.

Both in virtual meetings and when reviewing decks, every second of investors' attention is becoming a premium.

"If you break it down by section in a pitch deck, you can appreciate just how much is on the line once you get a VC to open your deck," Heddleston said. "If you take a make-or-break section like 'competitive landscape' (35 seconds of review on average) in the pre-seed round, for example, and compare it to the average amount raised, you're looking at roughly

Key Leading Indicators of VC Fundraising Activity

The Pitch Deck Interest metrics are part of the DocSend Startup Index (DSI) and measure activity via three key indicators of founder and investor engagement. The insights help startup founders better understand fundraising conditions, especially in the recovering yet still volatile COVID-19 landscape. The DSI anonymizes, aggregates and compiles Pitch Deck Interest metrics in real-time and reports on changes on a weekly basis and are a leading indicator of future deal flow and fundings.

There are three core metrics. First, a "link" refers to the unique URL a founder creates with DocSend to share their pitch deck with investors. Each investor should get a unique presentation with the most pertinent and up-to-date information, so every time a founder sends a new pitch, they generate a new link.

- Investor deck interactions - the average number of investor interactions for each pitch deck link created by founders on the DocSend platform, which can serve as a proxy for demand for investments. The higher the interaction metric, the more often decks are being viewed, shared, and revisited by potential investors.

- Founder links created - the average number of pitch deck links each founder is creating on the DocSend platform, which serves as a proxy for supply of startups seeking funding. A "link" refers to the unique URL a founder creates with DocSend to share their pitch deck with investors. Each investor should get a unique presentation with the most pertinent and up-to-date information. When the average number of links increases, it means that founders are sending their decks out to more investors.

- Investor time spent - the average time spent per pitch deck by potential investors. This metric offers a look at how long VCs are spending reviewing deals. More time spent per deck could mean investors are more closely scrutinizing deals.

DocSend continuously releases quarterly reports via the DocSend Startup Index to track and predict the investment landscape and better inform founders about the volatility/stability of the venture capital environment.

Follow Russ Heddleston on Twitter for a synopsis of each week's fundraising data.

About DocSend

DocSend enables companies to share business-critical documents with ease and get real-time actionable feedback. With DocSend's security and control, startup founders, investors, executives, and business development professionals can build business partnerships that have a lasting impact. Over 18,000 customers of all sizes use DocSend today. Learn more at docsend.com.

Media Contact:

Laura Kubitz

104 West for DocSend

laura.kubitz@104west.com

1 Source: https://news.crunchbase.com/news/q3-2020-global-venture-report/

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/vc-interest-in-pitch-decks-up-62-in-q1-according-to-2021-docsend-startup-index-301264609.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/vc-interest-in-pitch-decks-up-62-in-q1-according-to-2021-docsend-startup-index-301264609.html

SOURCE DocSend