Show Us the Momentum: New DocSend Report Reveals VCs Pushing Seed Startups on Business Model, Traction and Financials

DocSend, a Dropbox company, released a report highlighting critical aspects for startups in the seed fundraising market. It emphasizes the importance of demonstrating a solid business model, market traction, and financial viability. The report notes that investors spend an average of 31 seconds on the business model section of successful pitch decks, potentially impacting funding by approximately $150,000. The average seed funding in H1 2021 rose to $2.5M, a 47% increase from 2020, indicating a competitive environment for startups.

- Average seed funding in H1 2021 was $2.5M, a 47% increase from 2020's $1.7M.

- Investors spent 236% longer on financial sections in successful pitch decks compared to unsuccessful ones.

- None.

Insights

Analyzing...

SAN FRANCISCO, Sept. 22, 2021 /PRNewswire/ -- DocSend, a secure document sharing platform and Dropbox (NASDAQ: DBX) company, released a new report detailing critical factors for startups raising money in the increasingly competitive seed round. The report shows that seed pitch decks have to demonstrate clear momentum in the market by articulating a sound, repeatable business model, market traction and financial viability. The report is part of the DocSend Startup Index which provides data-driven insights about founder actions and investor reactions throughout the process of successful and unsuccessful pitches.

The new report, The Seed Round in 2020-21: Make or Break Moment for Founders, analyzed seed round fundraising in 2020 and the first half of 2021, one of the most active fundraising markets in recent years. It found that the seed round has new competitive stakes that can impact a successful raise. According to the report, investors spend on average 31 seconds scrutinizing the business model section of a successful pitch deck. Based on average seed funding, this added scrutiny alone could equate to approximately

So far, 2021 has been a record year for deals and funds raised: the average seed funding amount in H1 2021 was

With an increased volume of funding activity across the board, VCs have become continuously more efficient when evaluating pitch decks, spending just 3 minutes, 18 seconds on average per seed deck. Investors paid more attention to decks they ultimately went on to fund, (3 minutes, 20 seconds), which is

"The market is red hot right now, and while VCs are competing with each other to court earlier-stage startups, seed stage startups still have to work hard to pitch their business and raise money," explained Russ Heddleston, DocSend Co-Founder and Head of Commercial, DocSend at Dropbox. "Startups are reaching out to more investors than ever before and are under pressure to demonstrate clear progress of their business. And despite businesses returning to some in-person meetings, the virtual process of fundraising is here to stay, keeping the pitch deck front and center."

From Business Idea to a Business That Endures

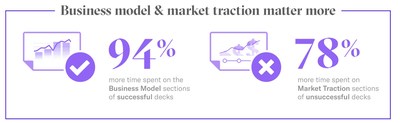

The seed pitch deck sections that held the most weight in the minds of discerning investors were the business model and market traction slides. VCs spent

"When you are in fundraising mode, you are constantly hustling to prove yourself and your business," said Nyasha-Harmony Gutsa, CEO of Billy and member of DocSend's Fundraising Network. "There are many hurdles in fundraising, and knowing what makes a successful pitch deck, from financials to product readiness, can help make the process smoother and more successful."

Show Them The Money, Get the Money Faster

The research shows that the financial section is not always included in seed stage decks, but if there are viable financials to share, investors will look. In 2020/21, investors spent

Additional Insights

The report includes additional findings and data cuts such as founding team makeup, exploring gender and race from a fundraising perspective and geographical considerations and funding duration, including number of VC meetings, and average equity costs at the seed stage. It also breaks down the typical seed pitch providing insights into deck length and successful slide order.

As 2021 continues to break records, DocSend will analyze the startup fundraising market and release weekly metrics and analysis to the DocSend Startup Index.

About DocSend

DocSend enables companies to share business-critical documents with ease and get real-time actionable feedback. With DocSend's security and control, startup founders, investors, executives, and business development professionals can build business partnerships that have a lasting impact. Over 21,000 customers of all sizes use DocSend today. Learn more at docsend.com.

About Dropbox

Dropbox is the one place to keep life organized and keep work moving. With more than 700 million registered users across 180 countries, we're on a mission to design a more enlightened way of working. Dropbox is headquartered in San Francisco, CA, and has offices around the world. For more information on our mission and products, visit http://dropbox.com.

CONTACT:

Carol Boyko

104 West for DocSend

carol.boyko@104west.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/show-us-the-momentum-new-docsend-report-reveals-vcs-pushing-seed-startups-on-business-model-traction-and-financials-301382159.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/show-us-the-momentum-new-docsend-report-reveals-vcs-pushing-seed-startups-on-business-model-traction-and-financials-301382159.html

SOURCE DocSend