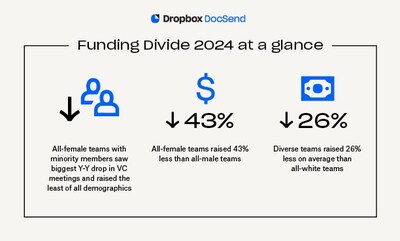

DocSend Report Shows Funding Gap Widens, Underrepresented Founders Hit Hardest by the Venture Slowdown

In 2023, funding for female and minority founders hit a significant low, according to DocSend's latest report. Underrepresented startups spent an average of 25 weeks fundraising, a 75% increase YoY, raising only $460K on average. The overall VC funding in 2023 was the lowest since 2018, with all demographics facing challenges, but minority female teams suffered the most, showing a 43% drop compared to the highest capital-earning group. VC pitch decks received an average review time of 2.5 minutes, with all-female and minority teams receiving more scrutiny. However, the business model slides of diverse teams received 29% less attention than those of all-white teams. Despite longer fundraising times, all-female teams with minority members raised the highest average dollars per meeting. The report underscores the increasing adversity faced by underrepresented founders in a tighter economy.

- All-female teams with minority members raised the highest average dollars per investor meeting, at $21.9K.

- Diverse all-male teams saw a slight increase in investor meetings from 48 to 50 YoY.

- Investors spent 66% more time on all-female team sections compared to all-male teams.

- All-male teams raised more money on average than all-female teams.

- All-male, non-minority teams spent the least time fundraising, at 17 weeks.

- Overall VC funding in 2023 was the lowest since 2018, affecting all demographics.

- Racially diverse, all-female teams spent the most time fundraising, averaging 25 weeks, a 75% increase YoY.

- All-female teams with minority members raised the least money, averaging $460K.

- All-female teams saw a 36% drop in investor meetings YoY.

- VCs spent 29% less time on diverse teams' business model sections than on all-white teams.

Insights

The venturing funding slowdown and its disparate impact on underrepresented founders have significant implications for retail investors. The report indicates that while fundraising became tougher for all startup demographics, female and minority founders faced the steepest challenges. Investors may need to be cautious about portfolio diversification concerning startups, as these disparities could affect the long-term growth potential of investments in diverse teams. The longer fundraising periods and reduced investment rounds may lead to liquidity issues that could hamper the scalability and market competitiveness of these startups.

Interestingly, while the total capital raised by underrepresented founders dropped, the average dollars per meeting for all-female minority teams were relatively higher, suggesting a higher efficiency in their pitches despite fewer meetings. This could imply a latent potential that might be overlooked due to biased investment practices.

The report sheds light on the changing dynamics within the venture capital landscape. It is important to note that investor attention, a key determinant of funding success, varied significantly by demographic. The disparity highlights a potential missed opportunity for investors who could be overlooking potentially lucrative ventures from diverse teams due to inherent biases. The increased scrutiny on fundraising goals for all-male teams and business models for all-white teams suggests a pattern-matching behavior that sidelines innovative and diverse ideas.

For retail investors, understanding these patterns can be valuable in making informed decisions about supporting diverse startups. It could also inform advocacy for more equitable investment practices within venture capital, which may, in turn, yield better returns in the long run by tapping into underutilized potential.

Female and minority founders spent the most time fundraising to raise the least amount of money

The fifth annual Funding Divide report, "Turned Down in the Downturn: Funding Gap Grows for Underrepresented Founders," measures and analyzes fundraising success and effort from startup founding teams of all demographics, and is published by DocSend, a secure document-sharing platform and Dropbox (NASDAQ: DBX) company.

All startups held fewer investor meetings over longer fundraising rounds to raise less money compared to 2022, during the slowest year for VC funding since 2018, but the losses suffered were disproportionate. All-female teams with minority members had the biggest drop in investor meetings YoY and earned

VC Deck Attention Shifts with Less Money to Go Around

Investor pitch deck total review time averages just 2.5 minutes. Slide-by-slide attention from investors varies greatly amongst teams of different demographics.

In 2023, VCs spent

"In 2021, underrepresented founders experienced a relative increase in funding and positive momentum in bridging the funding gap," said Justin Izzo, senior data and trends analyst at Dropbox DocSend. "But with less money overall to go around, this trend was short-lived. The pendulum swung even further back as VCs cautiously invested in decks that easily resonated. Investors are missing opportunities for outsized returns from underrepresented founders and less familiar ideas. Pattern matching as a form of de-risking has an opportunity cost."

The fundraising goals section stood out in 2023 for all genders as one of the most viewed sections. This section has not significantly held VC attention in the past, but in a tighter economy, investors are analyzing fundraising asks more closely when making decisions. VCs spent

Whether or not a team had minority team members, the business model slide was among the most scrutinized by investors. Still, diverse teams received

All-Female Teams Work Harder for Less

Fundraising times lengthened as investor meetings decreased in 2023. All-female teams with minorities spent the longest time fundraising at 25 weeks, followed by all-white female teams at 21 weeks. These increases are over

All-female teams with minority members had the biggest drop (-

"Fundraising is rarely a quick process, especially for underrepresented founders," said Victoria Yampolsky, president and founder of The Startup Station. "Despite increasing challenges, all-female teams continue to show unparalleled determination and resourcefulness. It's more than just fundraising, though: utilize your existing network while you build a new one, apply to an accelerator, enter a pitch contest and attend startup conferences. Above all, believe in yourself, your ability to raise money and your mission. Having an unwavering will to persevere, and open-mindedness to try all available resources can make the difference between success and failure."

Methodology

The report, The Funding Divide 2024, is the fifth annual analysis of how founder team demographics, like gender and race, can affect the productivity and success of their early-stage startup fundraising. DocSend gathered data by surveying over 200 startups at the pre-seed and seed stage and analyzed pitch decks slide-by-slide to understand how VCs scrutinized pitch decks across 2022. The team compositions covered in the analysis are:

- All-male, no minority

- All-female, no minority

- Mixed-gender, no minority

- All-male, has minority

- All-female, has minority

- Mixed-gender, no minority

About DocSend

DocSend enables companies to share business-critical documents with ease and get real-time actionable feedback. With DocSend's security and control, startup founders, investors, executives, and business development professionals can build business partnerships that have a lasting impact. Learn more at docsend.com.

About Dropbox

Dropbox is the one place to keep life organized and keep work moving. With more than 700 million registered users across 180 countries, we're on a mission to design a more enlightened way of working. Dropbox is headquartered in

Media Contact:

Carol Boyko

104 West for DocSend

carol.boyko@104west.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/docsend-report-shows-funding-gap-widens-underrepresented-founders-hit-hardest-by-the-venture-slowdown-302164287.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/docsend-report-shows-funding-gap-widens-underrepresented-founders-hit-hardest-by-the-venture-slowdown-302164287.html

SOURCE DocSend