DocSend Mid-Year 2023 Pitch Deck Interest Analysis Indicates Growing Gap in Founder and Investor Activity

- None.

- None.

Insights

Analyzing...

Founders seeking capital see limited opportunities as investors take their time – and their summer vacations

Early Summer Slowdown Keeps Investors in Control

Seasonality, which refers to the typical slowdown in activity during the summer months and other holiday time frames, may already be impacting the early-stage fundraising marketplace.

QoQ analysis shows that founder activity, which serves as a gauge for fundraising market supply, increased

Year-to-date (YTD) data shows that this trend has been a constant in the first half of 2023. Founder activity decreased less than

Additionally, while investors are reviewing fewer pitch decks from founders, they are spending less time reviewing them when they do. In Q2, investor time spent reviewing pitch decks decreased

"All three of DocSend's historical metrics point clearly to an investor-friendly marketplace at this time," said Justin Izzo, data and trends analyst at Dropbox DocSend. "Due to continued macro concerns as well as the usual seasonal lull, fundraising dollars may be challenging for fundraising founders to come across in the near future."

2023 vs. 2021 Analysis Reveals Uphill Battle for Founders

In venture capital, 2021 is a year that has been hailed as one of the most founder-friendly climates in recent history. 2023 is clearly a different picture, but analyzing these two years shows that founders have continued to aggressively pursue fundraising, but in two entirely different climates.

When comparing the percentage change from Q2 2021 to Q2 2023, founder activity increased by

In Q1 of 2023, VC investment in early stage companies totaled

"Since 2021, there has been a consistent shift in valuations and some founders and investors aren't seeing eye-to-eye on company valuations," said Winter Mead, founder and Chief Executive Officer at Coolwater Capital. "Private markets usually take a few quarters to catch up to the public markets. The price correction can take a little longer to reach early-stage than late-stage and these dynamics are currently playing out in the market today."

DocSend releases quarterly data analyses via the Pitch Deck Interest metrics to track and predict the investment landscape, informing founders of volatility or stability in the venture capital environment.

Key Leading Indicators of Fundraising Activity

There are three core metrics unique to DocSend for tracking investors' hunger for deals and founders' quest for capital.

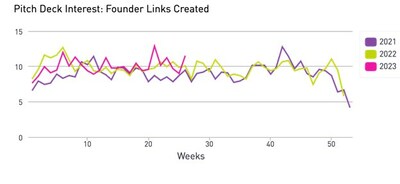

- Founder links created - the average number of pitch deck links each founder is creating via DocSend. This serves as a proxy for the supply of startups seeking funding. A "link" refers to the unique URL a founder creates using DocSend to share their pitch deck with investors. When the average number of links increases, it means that founders are sending their decks out to more investors.

- Investor deck interactions - the average number of investor interactions for each pitch deck link. This serves as a proxy for demand for investments. The higher the interaction metric, the more often decks are viewed, shared, and revisited by potential investors.

- Investor time spent - the average time spent per pitch deck by potential investors. This metric offers a look at how long VCs are spending reviewing deals. More time spent per deck could mean investors are more closely scrutinizing deals.

About DocSend

DocSend enables companies to share business-critical documents with ease and get real-time actionable feedback. With DocSend's security and control, startup founders, investors, executives, and business development professionals can build business partnerships that have a lasting impact. Over 30,000 customers of all sizes use DocSend today. Learn more at docsend.com.

About Dropbox

Dropbox is one place to keep life organized and keep work moving. With more than 700 million registered users across 180 countries, we're on a mission to design a more enlightened way of working. Dropbox is headquartered in

Media Contact:

Carol Boyko

104 West for DocSend

carol.boyko@104west.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/docsend-mid-year-2023-pitch-deck-interest-analysis-indicates-growing-gap-in-founder-and-investor-activity-301876133.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/docsend-mid-year-2023-pitch-deck-interest-analysis-indicates-growing-gap-in-founder-and-investor-activity-301876133.html

SOURCE DocSend